Concept explainers

Determining Actual,

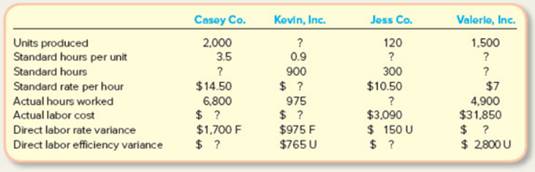

For each of the following independent cases, fill in the missing amounts:

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The missing values for direct labor variances.

Answer to Problem 18E

| Particulars | Casey Co. | Kevin Inc. | Jess Co. | Valerie Inc. |

| Unit produced | ||||

| Standard hours per unit | ||||

| Standard hours | ||||

| Standard rate per hour | ||||

| Actual hours worked | ||||

| Actual labor cost | ||||

| Direct labor rate variance | ||||

| Direct labor efficiency variance |

Explanation of Solution

Casey Co.

Calculation of standard hours

Unit produced

Standard hours per unit

Standard hours

Calculation of direct labour efficiency variance:

Standard hours

Actual hours

Standard rate per hour

Calculation of Actual Labour cost:

Labour rate per hour is

Where,

Kevin Inc.

Calculation of units produced

Standard hours

Standard hours per unit

Unit produced

Calculation of standard rate per hour

Standard hours

Actual hours

Direct labour efficiency variance

Let standard rate per hour = X

Calculation of Actual Labour cost:

Actual hours

Standard rate per hour

Direct labour rate variance

Let actual rate per hr be X

Labour rate per hour is

Where,

Jess co.

Calculation of standard hour per unit:

Units produced

Standard hours

Calculation of actual hours worked:

Direct labour rate variance

Actual labour cost

Standard rate per hour

Actual hours

So, Actual hour is

Calculation of direct labour efficiency variance:

Standard hours

Actual hours

Standard rate per hour

So, direct labour efficiency variance is

Valerie Inc.

Calculation of standard hours:

Actual hours

Standard rate per hour

Direct labour efficiency variance

Standard hours = X

So, Standard hour is

Calculation of standard hour per unit:

Units produced

Standard hours

So, Standard hour per unit is

Calculation of direct labour rate variance:

Actual hours

Standard rate per hour

Actual rate per hour

So, Direct labour rate variance is

Want to see more full solutions like this?

Chapter 9 Solutions

WHITECOTTON MGRL ACCTG (LL)

- What two factors must be considered when breaking down a variance into its components?arrow_forwardAcme Inc. has the following information available: A. Compute the material price and quantity, and the labor rate and efficiency variances. B. Describe the possible causes for this combination of favorable and unfavorable variances.arrow_forwardIdentify several causes of a favorable material quantity variance.arrow_forward

- The variable overhead rate variance is caused by the sum between which of the following? A. actual and standard allocation base B. actual and standard overhead rates C. actual and budgeted units D. actual units and actual overhead ratesarrow_forwardWhat are the two variances between the actual cost and the standard cost for direct materials?arrow_forwardUse the information provided to answer the questions. All material purchased was used in production. A. What is the standard price paid for materials? B. What is the direct materials quantity variance? C. What is the total direct materials cost variance? D. If the direct materials price variance was unfavorable, what would be the standard price?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning