Concept explainers

Calculating Direct Materials and Direct Labor Variances

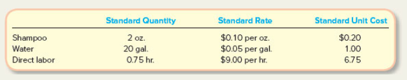

Suds & Cuts is a local pet grooming shop owned by Collin Bark. CoIlin has prepared the following

During the month of July, CoIlin's employees gave 360 baths. The actual results ware 725 ounces of shampoo used (cost of $116). 6,500 gallons of water used (cost of $455), and labor costs for 230 hours (cost of $2.300).

Required:

- Calculate Suds & Cuts direct materials variances for both shampoo and water for the month of July.

(a)

Concept introduction:

Price variance:

It is the difference between price per unit in standard and actual price of product and multiplying that with quantity purchased in actual.

Quantity variance:

It is referred to the amount which is computed by multiplying the standard price per unit with the difference between quantity in actual term and standard term of product.

Direct Material spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The direct material variances for shampoo and water for the month of July.

Answer to Problem 4E

Direct material variances for Shampoo:

Direct material price variance

Direct material quantity variance

Direct material spending variance

Direct material variances for water:

Direct material price variance

Direct material quantity variance

Direct material spending variance

Explanation of Solution

Direct material variances for Shampoo:

Number of baths

Standard quantity of shampoo used

Standard rate

Actual quantity of shampoo used

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material spending variance is as follows:

Direct material variances for water:

Number of baths

Standard quantity of water used

Standard rate

Actual quantity of crystal used

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material spending variance is as follows:

(b)

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

To compute:

The direct labor variances for the month of January.

Answer to Problem 4E

Direct labor rate variance

Direct labor efficiency variance

Direct labor spending variance

Explanation of Solution

Standard hours

Standard rate

Actual hours used

Computation of Direct labor rate variance is as follows:

Computation of Direct labor efficiency variance is as follows:

Computation of Direct laborspending variance is as follows:

(c)

Concept introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:

It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour spending variance:

This is calculated by combining material price variance and material quantity variance.

The possible causes of each variance.

Answer to Problem 4E

The possible cause of the variances is the difference between the actual and standard or budgeted figures.

Explanation of Solution

The direct material price variance of shampoo is unfavorable, which means the price paid in actual is more than the standard price. The direct material quantity variance of shampoo is also unfavorable which means the quantity used in actual is more than the standard quantity.

The direct material price variance of water is unfavorable which means the price paid in actual is more than the standard price. The direct material quantity variance of water is favorable which means the quantity used in actual is less than the standard quantity.

The direct labor rate variance is unfavorable which means the rate paid in actual is more than the standard rate. The direct labor time variance is favorable which means the hours used in actual is less than the standard hours.

Want to see more full solutions like this?

Chapter 9 Solutions

WHITECOTTON MGRL ACCTG (LL)

- Materials and labor variances Branca Inspections Inc. specializes in determining whether a building or houses drainpipes are properly tied into the citys sewer system. The company pours colored chemical through the pipes and collects an inspection sample from each outlet, which is then analyzed. Each job should take 15 hours for each of four inspectors, at a standard rate of 18 per hour. Each job requires a standard quantity of 5 gallons of Glow (a colored chemical), which should cost 25 per gallon. Data from the companys most recent job (a building) follow: Required: Compute the following variances, using the formulas on pages 421422 and 424: 1. Materials price and quantity variances. 2. Labor rate and efficiency variances.arrow_forwardUse the following information to complete Brief Exercises 10-25 and 10-26: Tico Inc. produces plastic bottles. Each bottle has a standard labor requirement of 0.03 hour. During the month of April, 900,000 bottles were produced using 25,200 labor hours @ 15.00. The standard wage rate is 13.50 per hour. 10-26 Labor Rate and Efficiency Variances Refer to the information above for Tico Inc. on the previous page Required: Calculate the labor rate and efficiency variances using the columnar and formula approaches.arrow_forwardDirect materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forward

- Carlo Lee Corp. has established the following standard cost per unit: Although 10,000 units were budgeted, only 8,800 units were produced. The purchasing department bought 55,000 lb of materials at a cost of $123,750. Actual pounds of materials used were 54,305. Direct labor cost was $186,550 for 18,200 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forwardUse the following information to complete Brief Exercises 10-25 and 10-26: Tico Inc. produces plastic bottles. Each bottle has a standard labor requirement of 0.03 hour. During the month of April, 900,000 bottles were produced using 25,200 labor hours @ 15.00. The standard wage rate is 13.50 per hour. 10-25 Total Labor Variance Refer to the information for Tico Inc. on the previous page. Required: Calculate the total variance for production labor for the month of April.arrow_forwardCalculation of materials and labor variances Fritz Corp. manufactures and sells a single product. The company uses a standard cost system. The standard cost per unit of product follows: The charges to the manufacturing department for November, when 5,000 units were produced, follow: The Purchasing department normally buys about the same quantity as is used in production during a month. In November, 5,500 lb were purchased at a price of $2.90 per pound. Required: Calculate the following from standard costs for the data given, using the formulas on pages 421–422 and 424: Materials quantity variance. Materials purchase price variance (at time of purchase). Labor efficiency variance. Labor rate variance. Give some reasons as to why both the materials quantity variance and labor efficiency variance might be unfavorable.arrow_forward

- Control Limits During the last 6 weeks, the actual costs of labor for Solsana Company were as follows: The standard materials cost for each week was 40,000 with an allowable deviation of 5,000. Required: Plot the actual costs over time against the upper and lower limits. Comment on whether or not there is a need to investigate any of the variances. Use the following information to complete Brief Exercises 10-34 and 10-35: Young Inc. produces plastic bottles. Production of 16-ounce bottles has a standard unit quantity of 0.45 ounce of plastic per bottle. During the month of June, 240,000 bottles were produced using 110,000 ounces of plastic. The actual cost of plastic was 0,042 per ounce, and the standard price was 0,045 per ounce. There is no beginning or ending inventories of plastic.arrow_forwardCorolla Manufacturing has a standard cost for steel of $20 per pound for a product that uses 4 pounds of steel. During September, Corolla purchased and used 4,200 pounds of steel to make 1,040 units. They paid $20.75 per pound for the steel. Compute the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance for the month of September. What would change if Corolla had made 2,200 units?arrow_forwardUse the following information to complete Brief Exercises 10-36 and 10-37: Ambient Inc. produces aluminum cans. Each can has a standard labor requirement of 0.03 hour. During the month of May, 500,000 cans were produced using 14,000 labor hours @ 15.00. The standard wage rate is 14.50 per hour. 10-37 Labor Rate and Efficiency Variances Refer to the information for Ambient Inc. above. Required: Calculate the labor rate and efficiency variances using the columnar and formula approaches.arrow_forward

- Use the following information to complete Brief Exercises 10-36 and 10-37: Ambient Inc. produces aluminum cans. Each can has a standard labor requirement of 0.03 hour. During the month of May, 500,000 cans were produced using 14,000 labor hours @ 15.00. The standard wage rate is 14.50 per hour. 10-36 Total Labor Variance Refer to the information for Ambient Inc. above. Required: Calculate the total variance for production labor for the month of May.arrow_forwardCase made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forwardFactory overhead cost variance report Tannin Products Inc. prepared the following factory overhead cost budget for the Trim Department for July of the current year, during which it expected to use 20,000 hours for production: Tannin has available 25,000 hours of monthly productive capacity in the Trim Department under normal business conditions. During July, the Trim Department actually used 22,000 hours for production. The actual fixed costs were as budgeted. The actual variable overhead for July was as follows: Construct a factory overhead cost variance report for the Trim Department for July.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning