Concept explainers

Sales and Purchases

Ms. Valli of All About You Spa has decided to expand her business by adding two lines of merchandise—a selection of products used in the salon for the body, the feet, and the face, as well as logo mugs, T-shirts, and baseball caps that can provide advertising benefits. She believes she will be able to increase her profits significantly.

July

So that you can complete the journal entries for the month of July, Ms. Valli has also left the information you will need and directions on how to proceed.

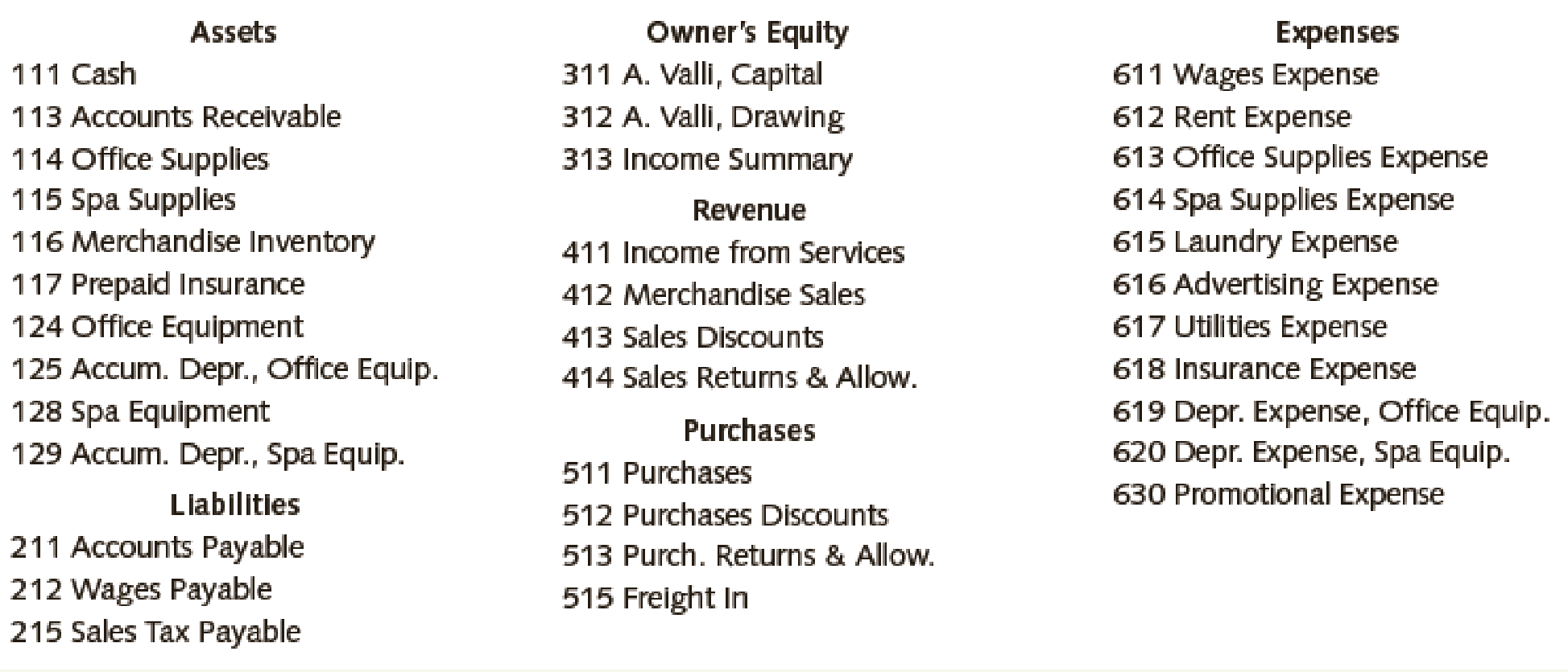

Note that with the expansion of the business into merchandising, new accounts have been added to the chart of accounts. For example, an additional revenue account, Merchandise Sales, is needed. Because All About You Spa now needs a Purchases account, the chart of accounts needs to be modified as follows: The 500–599 range is used for the purchase-related accounts (for example, Purchases 511 and Freight In 515). Your new chart of accounts is as follows:

CHART OF ACCOUNTS FOR ALL ABOUT YOU SPA

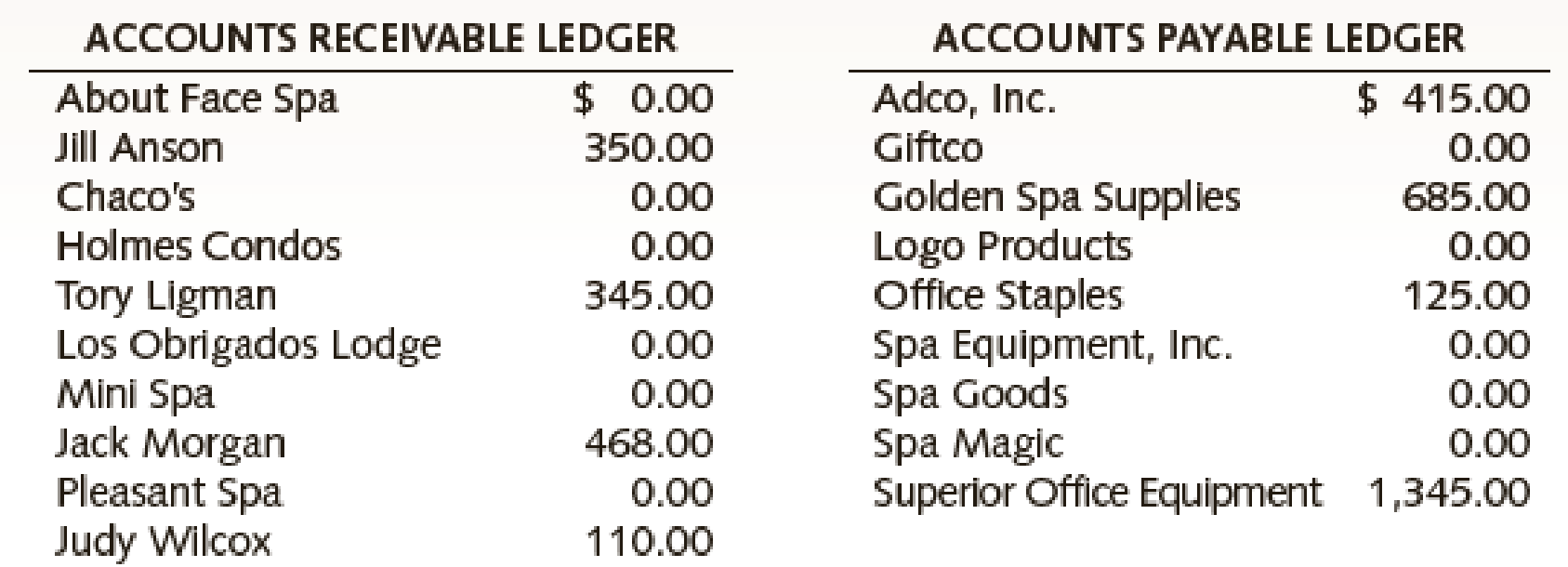

Also note that because you will be making purchases on account and sales on account, subsidiary ledgers will be needed to track what is due from individual customers and owed to individual vendors. A listing of customers and vendors with current balances are as follows:

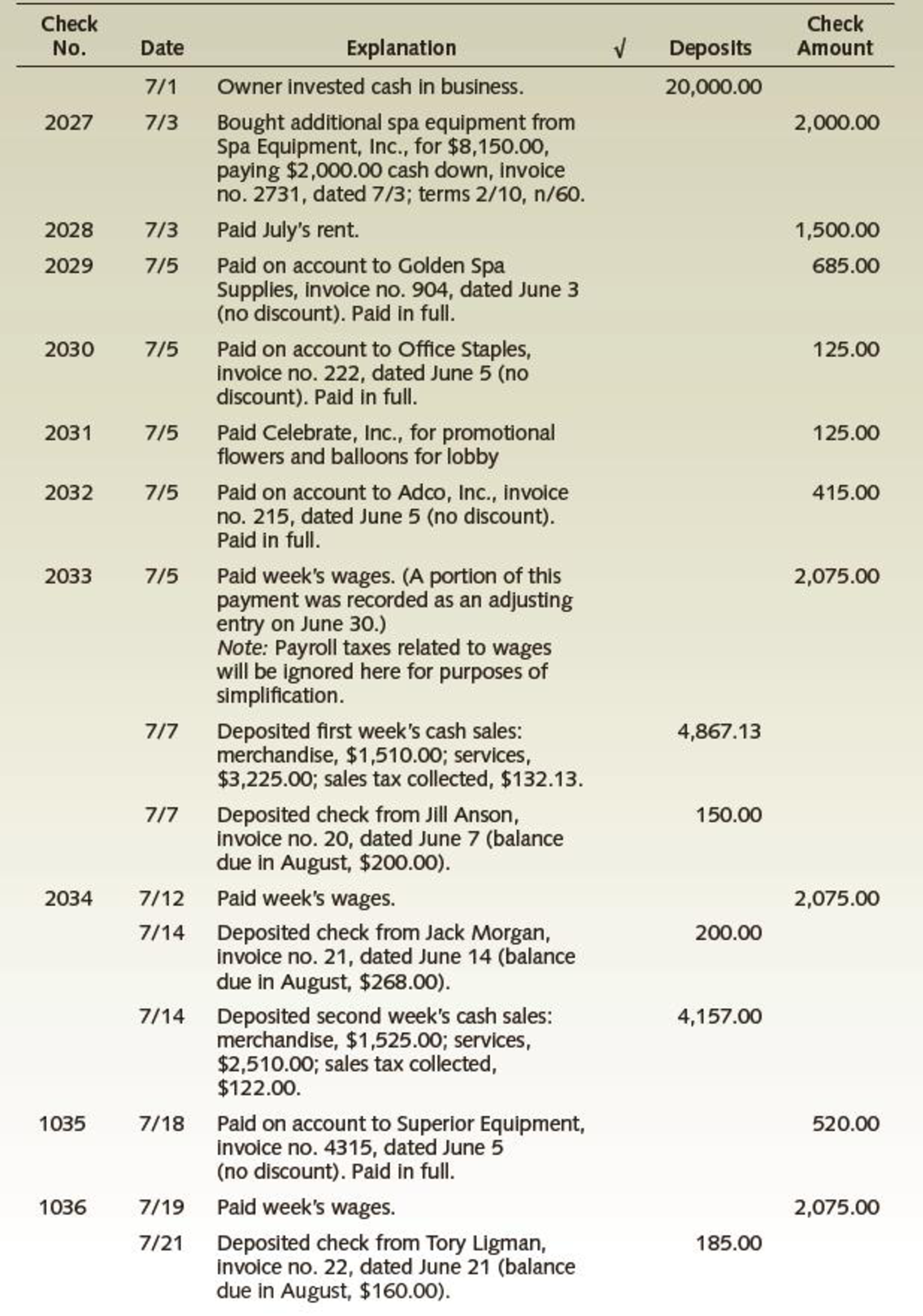

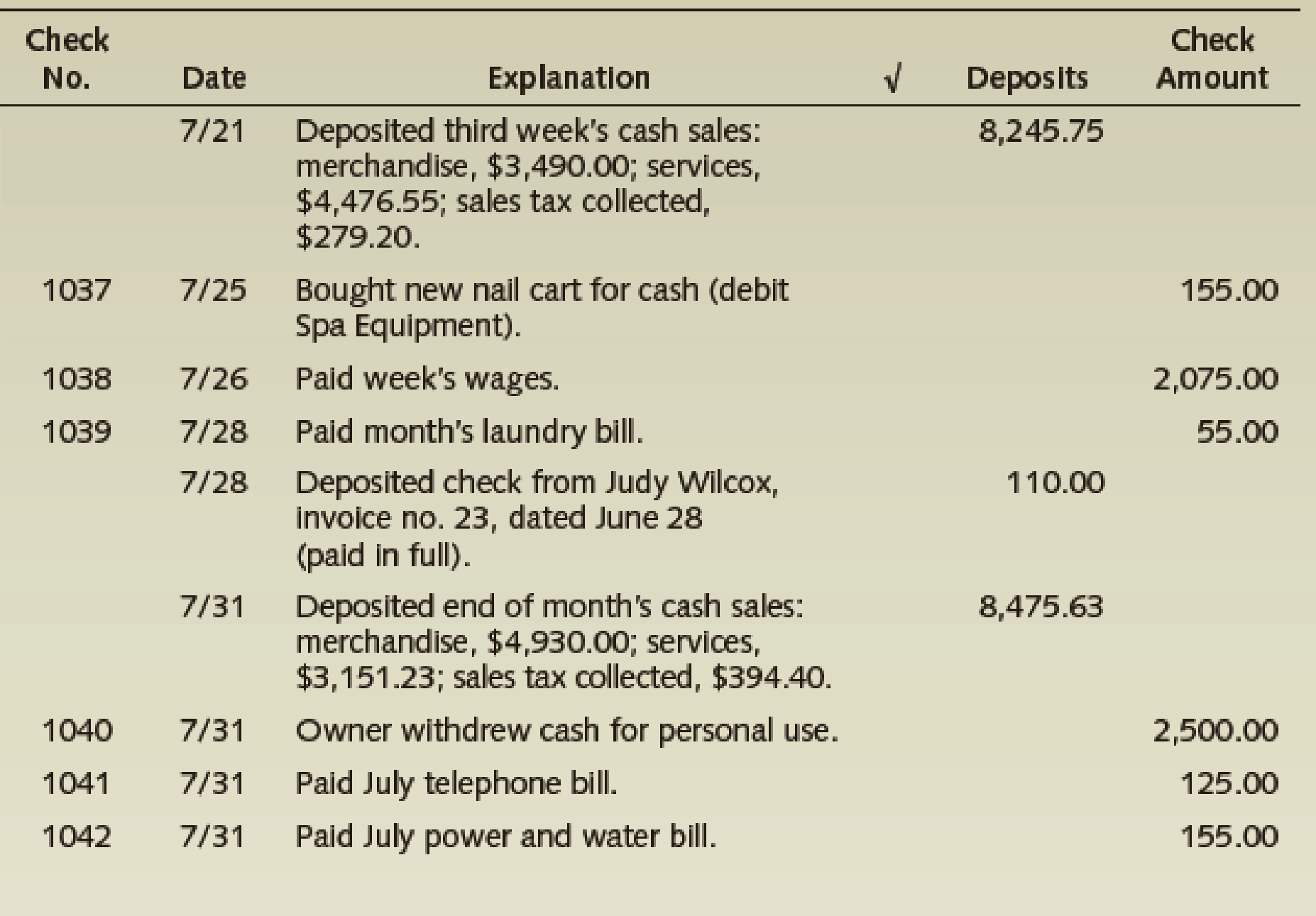

Checkbook Register

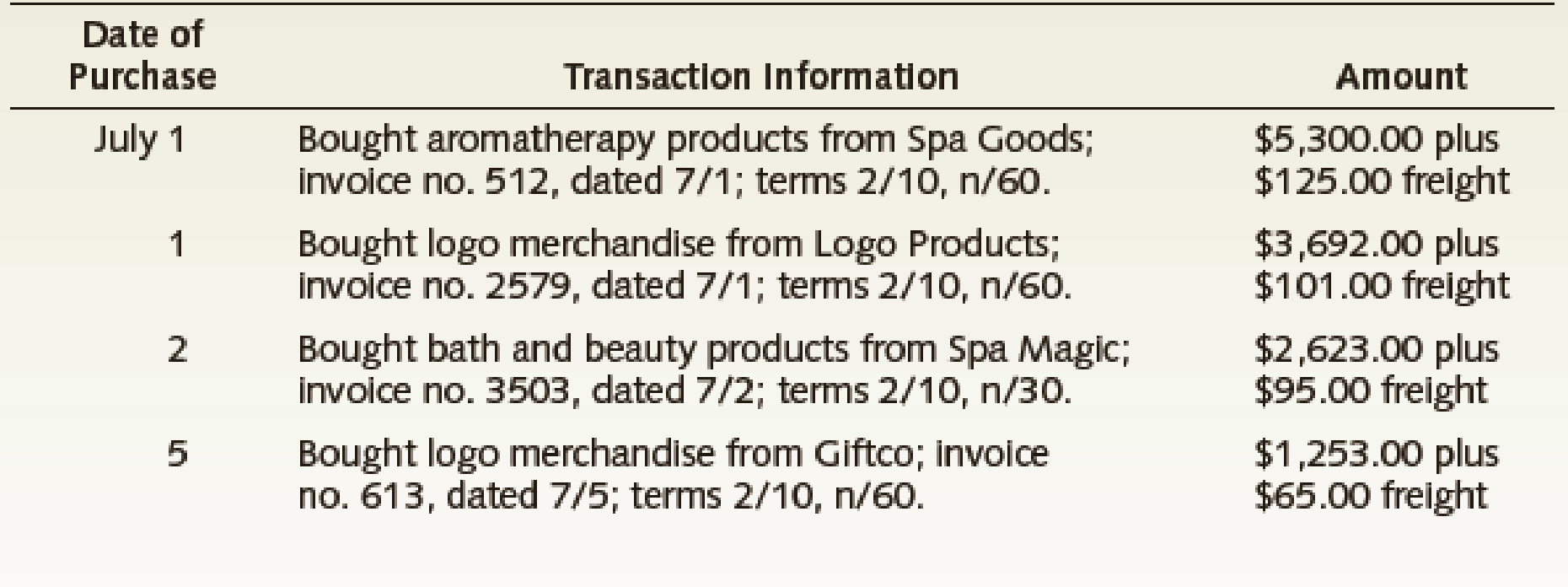

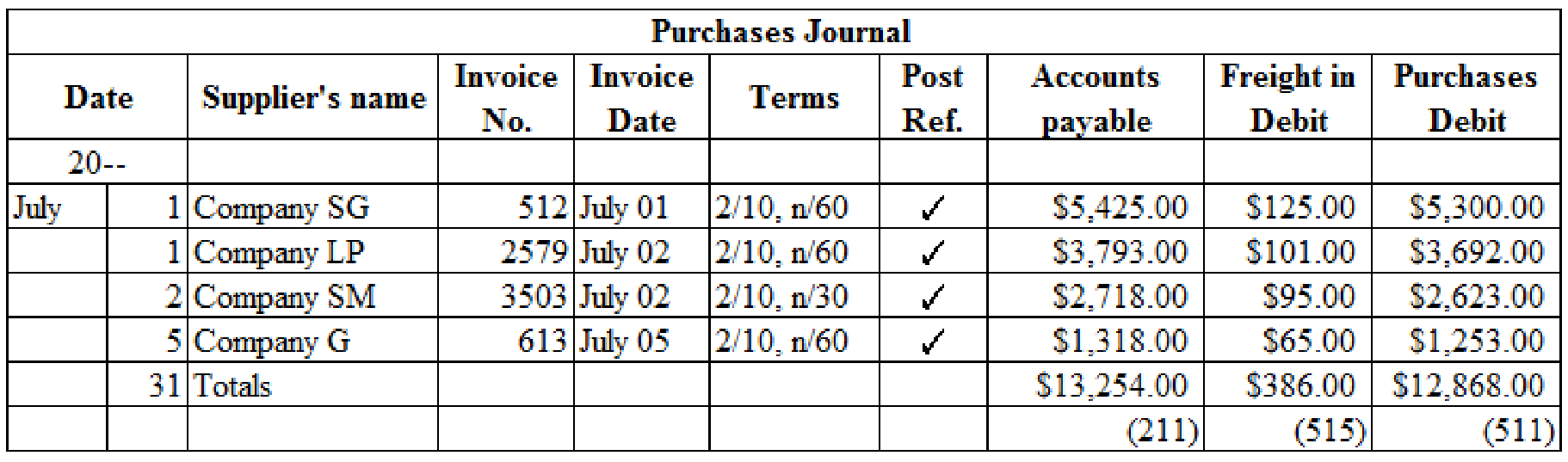

Purchases Invoices for Merchandise Bought on Account During July

All About You Spa will pay all freight costs associated with purchases of merchandise to the supplier. Use the new accounts Purchases 511 and Freight In 515.

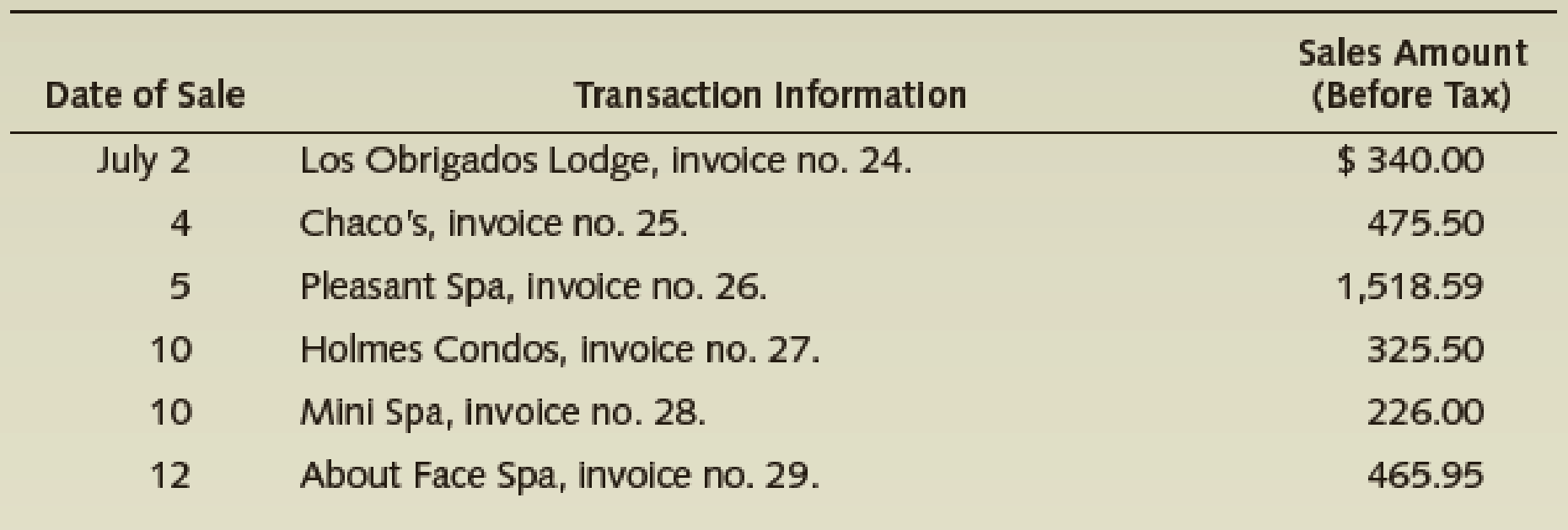

Sales Invoices for Gift Certificates Sold on Account During July

All About You Spa is responsible for collecting and paying the sales tax on merchandise that it sells. The sales tax rate where All About You Spa does business is 8 percent of each sale (for example, $340.00 × 0.08 = $27.20).

Note: All gift certificates were redeemed for merchandise by the end of the month.

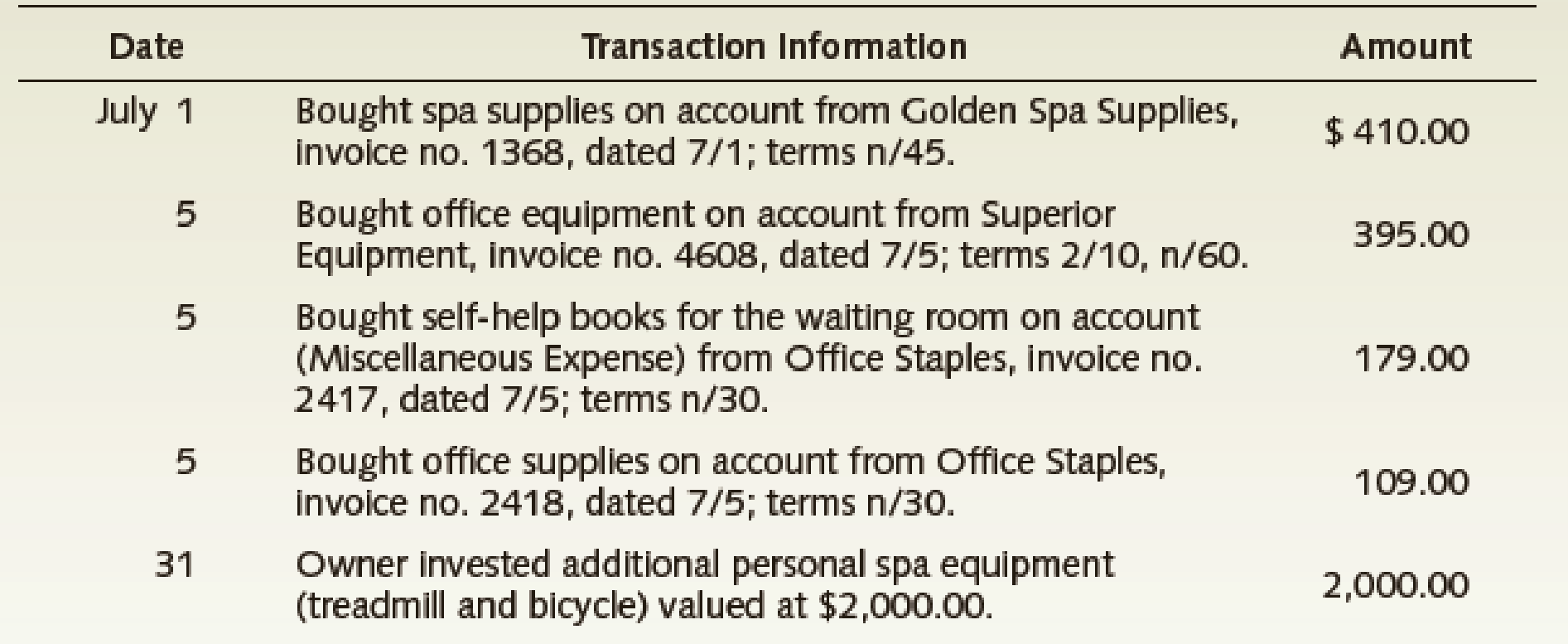

Other July Transactions

There were five other transactions in July. None involved cash.

Required

- 1. Journalize the transactions for July (in date order). Ask your instructor whether you should use the special journals or the general journal for this problem.

- If you are preparing the journal entries using Working Papers, enter your transactions beginning on page 6.

- 2.

Post the entries to theaccounts receivable , accounts payable, and general ledgers.- Ignore this step if you are using CLGL.

- 3. Prepare a

trial balance as of July 31, 20--. - 4. Prepare a schedule of accounts receivable as of July 31, 20--.

- 5. Prepare a schedule of accounts payable as of July 31, 20--.

1.

Journalize the transactions for the month of July.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Rules of Debit and Credit: Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journalize the transactions for the month of July:

| Date | Account title and explanation | Post Ref. | Amount | ||

| Debit | Credit | ||||

| 20-- | |||||

| July | 1 | Cash | 111 | $20,000 | |

| Person AV's Capital | 311 | $20,000 | |||

| 1 | Spa Supplies | 115 | $410 | ||

| Accounts Payable - Company GSS | 211/✓ | $410 | |||

| 1 | Purchases | 511 | $5,300 | ||

| Freight In | 515 | $125 | |||

| Accounts Payable - Company SG | 211/✓ | $5,425 | |||

| 1 | Purchases | 511 | $3,692 | ||

| Freight In | 515 | $101 | |||

| Accounts Payable – Company LP | 211/✓ | $3,793 | |||

| 2 | Purchases | 511 | $2,623 | ||

| Freight In | 515 | $95 | |||

| Accounts Payable - Company SM | 211/✓ | $2,718 | |||

| 2 | Accounts receivable - Company LO | 113/✓ | $367 | ||

| Merchandise Sales | 412 | $340 | |||

| Sales Tax Payable | 215 | $27 | |||

| 3 | Spa Equipment | 128 | $8,150 | ||

| Accounts Payable -Incorporation SE | 211/✓ | $6,150 | |||

| Cash | 111 | $2,000 | |||

| 3 | Rent Expense | 612 | $1,500 | ||

| Cash | 111 | $1,500 | |||

| 4 | Accounts Receivable- Company C | 113/✓ | $514 | ||

| Merchandise Sales | 412 | $476 | |||

| Sales Tax Payable | 215 | $38 | |||

| 5 | Accounts Payable - Company GSS | 211/✓ | $685 | ||

| Cash | 111 | $685 | |||

| 5 | Accounts Payable - Company OS | 211/✓ | $125 | ||

| Cash | 111 | $125 | |||

| 5 | Promotional Expense | 630 | $125 | ||

| Cash | 111 | $125 | |||

| 5 | Accounts Payable - Incorporation A | 211/✓ | $415 | ||

| Cash | 111 | $415 | |||

| 5 | Wages Payable | 212 | $415 | ||

| Wages Expense | 611 | $1,660 | |||

| Cash | 111 | $2,075 | |||

| 5 | Office Equipment | 124 | $395 | ||

| Accounts Payable - Company SE | 211/✓ | $395 | |||

| 5 | Promotion Expense | 630 | $179 | ||

| Accounts Payable - Company OS | 211/✓ | $179 | |||

| 5 | Office Supplies | 114 | $109 | ||

| Accounts Payable -Company OS | 211/✓ | $109 | |||

| 5 | Purchases | 511 | $1,253 | ||

| Freight In | 515 | $65 | |||

| Accounts Payable - Company G | 211/✓ | $1,318 | |||

| 5 | Accounts receivable - Company PS | 113/✓ | $1,640 | ||

| Merchandise Sales | 412 | $1,519 | |||

| Sales Tax Payable | 215 | $121 | |||

| 7 | Cash | 111 | $4,867 | ||

| Merchandise Sales | 412 | $1,510 | |||

| Income from Services | 411 | $3,225 | |||

| Sales Tax Payable | 215 | $132 | |||

| 7 | Cash | 111 | $150 | ||

| Accounts Receivable - Company JA | 113/✓ | $150 | |||

| 10 | Accounts Receivable - Company HC | 113/✓ | $352 | ||

| Merchandise Sales | 412 | $326 | |||

| Sales Tax Payable | 215 | $26 | |||

| 10 | Accounts Receivable - Company MS | 113/✓ | $244 | ||

| Merchandise Sales | 412 | $226 | |||

| Sales Tax Payable | 215 | $18 | |||

| 12 | Wages Expense | 611 | $2,075 | ||

| Cash | 111 | $2,075 | |||

| 12 | Accounts Receivable - Company AFS | 113/✓ | $503 | ||

| Merchandise Sales | 412 | $466 | |||

| Sales Tax Payable | 215 | $37 | |||

| 14 | Cash | 111 | $200 | ||

| Accounts Receivable - Company JM | 113/✓ | $200 | |||

| 14 | Cash | 111 | $4,157 | ||

| Merchandise Sales | 412 | $1,525 | |||

| Income from Services | 411 | $2,510 | |||

| Sales Tax Payable | 215 | $122 | |||

| 18 | Accounts Payable - Company SE | 211/✓ | $520 | ||

| Cash | 111 | $520 | |||

| 19 | Wages Expense | 611 | $2,075 | ||

| Cash | 111 | $2,075 | |||

| 21 | Cash | 111 | $185 | ||

| Accounts Receivable - Company TL | 113/✓ | $185 | |||

| 21 | Cash | 111 | $8,246 | ||

| Merchandise Sales | 412 | $3,490 | |||

| Income from Services | 411 | $4,477 | |||

| Sales Tax Payable | 215 | $279 | |||

| 25 | Spa Equipment | 128 | $155 | ||

| Cash | 111 | $155 | |||

| 26 | Wages Expense | 611 | $2,075 | ||

| Cash | 111 | $2,075 | |||

| 28 | Laundry Expense | 615 | $55 | ||

| Cash | 111 | $55 | |||

| 28 | Cash | 111 | $110 | ||

| Accounts Receivable - Company JW | 113/✓ | $110 | |||

| 31 | Cash | 111 | $8,476 | ||

| Merchandise Sales | 412 | $4,930 | |||

| Income from Services | 411 | $3,151 | |||

| Sales Tax Payable | 215 | $394 | |||

| 31 | Person AV's Drawing | 312 | $2,500 | ||

| Cash | 111 | $2,500 | |||

| 31 | Utilities Expense | 617 | $125 | ||

| Cash | 111 | $125 | |||

| 31 | Utilities Expense | 617 | $155 | ||

| Cash | 111 | $155 | |||

| 31 | Spa Equipment | 128 | $2,000 | ||

| Person AV's Capital | 311 | $2,000 | |||

Table (1)

2.

Post the entries to the accounts receivable, accounts payable and general ledger.

Explanation of Solution

Post the entries to the accounts receivable, accounts payable and general ledger:

General Ledger:

| Sales journal | |||||||

| Date | Invoice No. | Customer's name | Post Ref. | Accounts Receivable debit | Sales tax payable credit | Merchandise sales credit | |

| 20-- | |||||||

| July | 2 | 24 | Company LO | 367.20 | 27.20 | 340.00 | |

| 4 | 25 | Company C | 513.54 | 38.04 | 475.50 | ||

| 5 | 26 | Company PS | 1,640.08 | 121.49 | 1,518.59 | ||

| 10 | 27 | Company HC | 351.54 | 26.04 | 325.50 | ||

| 10 | 28 | Company MS | 244.08 | 18.08 | 226.00 | ||

| 12 | 29 | Company AFS | 503.23 | 37.28 | 465.95 | ||

| 31 | Totals | 3,619.67 | 268.13 | 3,351.54 | |||

| (113) | (215) | (412) | |||||

Table (2)

Table (3)

| Account: Cash | Account No. 111 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $24,597.00 | |||

| 1 | J6 | $20,000.00 | $44,597.00 | ||||

| 3 | J6 | $2,000.00 | $42,597.00 | ||||

| 3 | J6 | $1,500.00 | $41,097.00 | ||||

| 5 | J7 | $685.00 | $40,412.00 | ||||

| 5 | J7 | $125.00 | $40,287.00 | ||||

| 5 | J7 | $125.00 | $40,162.00 | ||||

| 5 | J7 | $415.00 | $39,747.00 | ||||

| 5 | J7 | $2,075.00 | $37,672.00 | ||||

| 7 | J8 | $4,867.13 | $42,539.13 | ||||

| 7 | J8 | $150.00 | $42,689.13 | ||||

| 12 | J8 | $2,075.00 | $40,614.13 | ||||

| 14 | J8 | $200.00 | $40,814.13 | ||||

| 14 | J9 | $4,157.00 | $44,971.13 | ||||

| 18 | J9 | $520.00 | $44,451.13 | ||||

| 19 | J9 | $2,075.00 | $42,376.13 | ||||

| 21 | J9 | $185.00 | $42,561.13 | ||||

| 21 | J9 | $8,245.75 | $50,806.88 | ||||

| 25 | J9 | $155.00 | $50,651.88 | ||||

| 26 | J9 | $2,075.00 | $48,576.88 | ||||

| 28 | J9 | $55.00 | $48,521.88 | ||||

| 28 | J9 | $110.00 | $48,631.88 | ||||

| 31 | J9 | $8,475.63 | $57,107.51 | ||||

| 31 | J10 | $2,500.00 | $54,607.51 | ||||

| 31 | J10 | $125.00 | $54,482.51 | ||||

| 31 | J10 | $155.00 | $54,327.51 | ||||

Table (4)

| Account: Accounts receivable | Account No. 113 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,273.00 | |||

| 2 | J6 | $367.20 | $1,640.20 | ||||

| 4 | J7 | $513.54 | $2,153.74 | ||||

| 5 | J8 | $1,639.39 | $3,793.82 | ||||

| 7 | J8 | $150.00 | $3,643.82 | ||||

| 10 | J8 | $351.54 | $3,995.36 | ||||

| 10 | J8 | $244.08 | $4,239.44 | ||||

| 12 | J8 | $503.23 | $4,742.67 | ||||

| 14 | J8 | $200.00 | $4,542.67 | ||||

| 21 | J9 | $185.00 | $4,357.67 | ||||

| 28 | J9 | $110.00 | $4,247.67 | ||||

Table (5)

| Account: Office supplies | Account No. 114 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,273.00 | |||

| 2 | J6 | $367.20 | $1,640.20 | ||||

Table (6)

| Account: Spa supplies | Account No. 115 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $255.00 | |||

| 5 | J7 | $410.00 | $665.00 | ||||

Table (7)

| Account: Prepaid insurance | Account No. 117 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $700.00 | |||

Table (8)

| Account: Office equipment | Account No. 124 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $1,345.00 | |||

| 5 | J7 | $395.00 | $1,740.00 | ||||

Table (9)

| Account: Accumulated Depreciation, Office equipment | Account No. 125 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $13.25 | |||

Table (10)

| Account: Spa equipment | Account No. 128 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $9,125.00 | |||

| 3 | J6 | $8,150.00 | $17,275.00 | ||||

| 25 | J9 | $155.00 | $17,430.00 | ||||

| 31 | J10 | $2,000.00 | $19,430.00 | ||||

Table (11)

| Account: Accumulated Depreciation, Spa equipment | Account No. 129 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $150.00 | |||

Table (12)

| Account: Accounts payable | Account No. 211 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $2,570.00 | |||

| 1 | J6 | $410.00 | $2,980.00 | ||||

| 1 | J6 | $5,425.00 | $8,405.00 | ||||

| 1 | J6 | $3,793.00 | $12,198.00 | ||||

| 2 | J6 | $2,718.00 | $14,916.00 | ||||

| 3 | J6 | $6,150.00 | $21,066.00 | ||||

| 5 | J7 | $685.00 | $20,381.00 | ||||

| 5 | J7 | $125.00 | $20,236.00 | ||||

| 5 | J7 | $415.00 | $19,841.00 | ||||

| 5 | J7 | $395.00 | $20,236.00 | ||||

| 5 | J7 | $179.00 | $20,415.00 | ||||

| 5 | J7 | $109.00 | $20,524.00 | ||||

| 5 | J8 | $1,318.00 | $21,842.00 | ||||

| 18 | J9 | $520.00 | $21,322.00 | ||||

Table (13)

| Account: Wages payable | Account No. 212 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $415.00 | |||

| 5 | J7 | $415.00 | |||||

Table (14)

| Account: Sales tax payable | Account No. 215 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $27.20 | $27.20 | |||

| 4 | J7 | $38.04 | $65.24 | ||||

| 5 | J8 | $121.49 | $186.73 | ||||

| 7 | J8 | $132.13 | $318.86 | ||||

| 10 | J8 | $26.04 | $344.90 | ||||

| 10 | J8 | $18.08 | $362.98 | ||||

| 12 | J8 | $37.28 | $400.26 | ||||

| 14 | J9 | $122.00 | $522.26 | ||||

| 21 | J9 | $279.20 | $801.46 | ||||

| 31 | J9 | $394.40 | $1,195.86 | ||||

Table (15)

| Account: Person AV, Capital | Account No. 311 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | Balance | ✓ | $34,271.75 | |||

| 1 | J6 | $20,000.00 | 54,271.75 | ||||

| 31 | J10 | $2,000.00 | 56,271.75 | ||||

Table (16)

| Account: Person AV, Drawing | Account No. 312 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $2,500.00 | $2,500.00 | |||

Table (17)

| Account: Income summary | Account No. 313 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (18)

| Account: Income from services | Account No. 411 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 7 | J8 | $3,225.00 | $3,225.00 | |||

| 14 | J9 | $2,510.00 | $5,735.00 | ||||

| 21 | J9 | $4,476.55 | $10,211.55 | ||||

| 31 | J9 | $3,151.23 | $13,362.78 | ||||

Table (19)

| Account: Merchandise sales | Account No. 412 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 2 | J6 | $340.00 | $340.00 | |||

| 4 | J7 | $475.50 | $815.50 | ||||

| 5 | J8 | $1,518.59 | $2,334.09 | ||||

| 7 | J8 | $1,510.00 | $3,844.09 | ||||

| 10 | J8 | $325.50 | $4,169.59 | ||||

| 10 | J8 | $226.00 | $4,395.59 | ||||

| 12 | J8 | $465.95 | $4,861.54 | ||||

| 14 | J9 | $1,525.00 | $6,386.54 | ||||

| 21 | J9 | $3,490.00 | $9,876.54 | ||||

| 31 | J9 | $4,930.00 | $14,806.54 | ||||

Table (20)

| Account: Purchases | Account No. 511 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $5,300.00 | $5,300.00 | |||

| 1 | J6 | $3,692.00 | $8,992.00 | ||||

| 2 | J6 | $2,623.00 | $11,615.00 | ||||

| 5 | J8 | $1,253.00 | $12,868.00 | ||||

Table (21)

| Account: Freight In | Account No. 515 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 1 | J6 | $125.00 | $125.00 | |||

| 1 | J6 | $101.00 | $226.00 | ||||

| 2 | J6 | $95.00 | $321.00 | ||||

| 5 | J8 | $65.00 | $386.00 | ||||

Table (22)

| Account: Wages expense | Account No. 611 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $1,660.00 | $1,660.00 | |||

| 12 | J8 | $2,075.00 | $2,075.00 | ||||

| 19 | J9 | $2,075.00 | $5,810.00 | ||||

| 26 | J9 | $2,075.00 | $7,885.00 | ||||

Table (23)

| Account: Rent expense | Account No. 612 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 3 | J6 | $1,500.00 | $1,500.00 | |||

Table (24)

| Account: Office supplies expense | Account No. 613 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (25)

| Account: Spa supplies expense | Account No. 614 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (26)

| Account: Laundry expense | Account No. 615 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 28 | J9 | $55.00 | $55.00 | |||

Table (27)

| Account: Advertising expense | Account No. 616 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (28)

| Account: Utilities expense | Account No. 617 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 31 | J10 | $125.00 | $125.00 | |||

| 31 | J10 | $155.00 | $280.00 | ||||

Table (29)

| Account: Insurance expense | Account No. 618 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (30)

| Account: Depreciation expense, Office equipment | Account No. 619 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (31)

| Account: Depreciation expense, Spa equipment | Account No. 620 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

Table (32)

| Account: Promotional expense | Account No. 630 | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | ||

| Debit | Credit | ||||||

| 20-- | |||||||

| July | 5 | J7 | $125.00 | $125.00 | |||

| $179.00 | $179.00 | ||||||

Table (33)

Accounts receivable ledger:

| Accounts receivable ledger | ||||||

| Name : Company AFS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 12 | J8 | $503.23 | $503.23 | ||

Table (34)

| Accounts receivable ledger | ||||||

| Name : Company JA | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $350.00 | |||

| 7 | J8 | $150.00 | $200.00 | |||

Table (35)

| Accounts receivable ledger | ||||||

| Name : Company C | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 4 | J7 | $513.54 | $513.54 | ||

Table (36)

| Accounts receivable ledger | ||||||

| Name : Company HC | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $351.54 | $351.54 | ||

Table (37)

| Accounts receivable ledger | ||||||

| Name : Company TL | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $345.00 | ||

| 21 | J9 | $185.00 | $160.00 | |||

Table (38)

| Accounts receivable ledger | ||||||

| Name : Company LO | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $367.20 | $367.20 | ||

Table (39)

| Accounts receivable ledger | ||||||

| Name : Company MS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 10 | J8 | $244.08 | $244.08 | ||

Table (40)

| Accounts receivable ledger | ||||||

| Name : Company JM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | ✓ | $468.00 | |||

| 14 | J8 | $200.00 | $268.00 | |||

Table (41)

| Accounts receivable ledger | ||||||

| Name : Company PS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,640.08 | $1,640.08 | ||

Table (42)

| Accounts receivable ledger | ||||||

| Name : Company JW | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $110.00 | ||

| 28 | J8 | $110.00 | $110.00 | |||

Table (43)

Accounts payable ledger:

| Accounts payable ledger | ||||||

| Name : Incorporation A | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $415.00 | ||

| August | 5 | $415.00 | ||||

Table (44)

| Accounts payable ledger | ||||||

| Name : Company G | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 5 | J8 | $1,318.00 | $1,318.00 | ||

Table (45)

| Accounts payable ledger | ||||||

| Name : Company GSS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $685.00 | ||

| 1 | J6 | $410.00 | $1,095.00 | |||

| 5 | J7 | $685.00 | $410.00 | |||

Table (46)

| Accounts payable ledger | ||||||

| Name : Company LP | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | J6 | $3,793.00 | $3,793.00 | |

Table (47)

| Accounts payable ledger | ||||||

| Name : Company OS | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $125.00 | ||

| 5 | J7 | $125.00 | ||||

| 5 | J7 | $179.00 | $179.00 | |||

| 5 | J7 | $109.00 | $288.00 | |||

Table (48)

| Accounts payable ledger | ||||||

| Name : Incorporation SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | |||

| 3 | J6 | $6,150.00 | $6,150.00 | |||

Table (49)

| Accounts payable ledger | ||||||

| Name : Company SG | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | J6 | $5,425.00 | $5,425.00 | ||

Table (50)

| Accounts payable ledger | ||||||

| Name : Company SM | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 2 | J6 | $2,718.00 | $2,718.00 | ||

Table (51)

| Accounts payable ledger | ||||||

| Name : Company SE | ||||||

| Date | Item | Post Ref. | Debit | Credit | Balance | |

| 20-- | ||||||

| July | 1 | Balance | ✓ | $1,345.00 | ||

| 5 | J7 | 395 | $1,740.00 | |||

| 18 | J9 | 520 | $1,220.00 | |||

Table (52)

3.

Prepare trial balance as of July 31.

Explanation of Solution

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare the trial balance.

| Company AAY | ||

| Trial balance | ||

| As on July 31, 20-- | ||

| Account name | Debit | Credit |

| Cash | $54,327.51 | |

| Accounts Receivable | $4,247.67 | |

| Office Supplies | $234.00 | |

| Spa Supplies | $665.00 | |

| Prepaid Insurance | $700.00 | |

| Office Equipment | $1,740.00 | |

| Accumulated Depreciation, Office Equipment | $13.25 | |

| Spa Equipment | $19,430.00 | |

| Accumulated Depreciation, Spa Equipment | $150.00 | |

| Accounts Payable | $21,322.00 | |

| Sales Tax Payable | $1,195.86 | |

| Person AV, Capital | $56,271.75 | |

| Person AV, Drawing | $2,500.00 | |

| Income from Services | $13,362.78 | |

| Merchandise Sales | $14,806.54 | |

| Purchases | $12,868.00 | |

| Freight In | $386.00 | |

| Wages Expense | $7,885.00 | |

| Rent Expense | $1,500.00 | |

| Laundry Expense | $55.00 | |

| Utilities Expense | $280.00 | |

| Miscellaneous Expense | $304.00 | |

| Total | $107,122.18 | $107,122.18 |

Table (53)

Thus, the total of trial balance of Company AAY is $107,122.18.

4.

Prepare a schedule of accounts receivable.

Explanation of Solution

Schedule of accounts receivable: A schedule of accounts receivable is a subsidiary ledger that list out the accounts of credit customers individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of accounts receivable:

| Company AAY | |

| Schedule of Accounts receivable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company AFS | $503.23 |

| Company JA | $200.00 |

| Company C | $513.54 |

| Company HC | $351.54 |

| Incorporation TL | $160.00 |

| Company LO | $367.20 |

| Company MS | $244.08 |

| Company JM | $268.00 |

| Company PS | 1,640.08 |

| Total Accounts receivable | $4,247.67 |

Table (54)

5.

Prepare a schedule of Accounts payable.

Explanation of Solution

Schedule of accounts payable: A schedule of accounts payable lists is a subsidiary ledger that list out the accounts of creditors (vendors/suppliers) individually in alphabetical or numeric order with their respective balances.

Prepare a schedule of Accounts payable:

| Company AAY | |

| Schedule of Accounts payable | |

| July 31, 20-- | |

| Particulars | Amount |

| Company G | $1,318.00 |

| Company GSS | $410.00 |

| Company LP | $3,793.00 |

| Company OS | $288.00 |

| Incorporation SE | $6,150.00 |

| Company SG | $5,425.00 |

| Company SM | $2,718.00 |

| Company SE | $1,220.00 |

| Total Accounts payable | $21,322.00 |

Table (55)

Want to see more full solutions like this?

Chapter 9 Solutions

College Accounting (Book Only): A Career Approach

Additional Business Textbook Solutions

Managerial Accounting (4th Edition)

Financial Accounting

Managerial Accounting: Tools for Business Decision Making

Financial Accounting: Tools for Business Decision Making, 8th Edition

FINANCIAL ACCT.FUND.(LOOSELEAF)

Fundamentals Of Financial Accounting

- Communication Golden Eagle Company began operations on April 1 by selling a single product. Data on purchases and sales for the year are as follows: Purchases: Sales: The president of the company, Connie Kilmer, has asked for your advice on which inventory cost flow method should be used for the 32,000-unit physical inventory that was taken on December 31. The company plans to expand its product line in the future and uses the periodic inventory system. Write a brief memo to Ms. Kilmer comparing and contrasting the LIFO and FIFO inventory cost flow methods and their potential impacts on the companys financial statements.arrow_forwardJournalize the transactions in a merchandising business in general journal - purchase and sales. See the template below for general journal, purchase journal, and sales journal. (This is the correct template please be guided)Write your answer on a columnar sheet. On January 15, Aeron Trading purchased from Victoria Merchandising goods amounting to ₱30,000on term 50% down, balance 2/10, n/30. The next day, Aeron Trading issued a ₱2,000 debitmemorandum to Victoria Merchandising for the return of defective merchandise bought. On January20, Aeron Trading paid ₱10,000 as partial payment. Aeron Trading settled in full the outstandingaccount with Victoria Merchandising on January 25.1. Journalize the above transactions using periodic inventory system and generaljournal of:A. Aeron TradingB. Victoria Merchandisingarrow_forwardABC is an online-to-offline platform that sells e-commerce products to offline customers through a network of agents. ABC gives a commission to agents for each sale made. ABC has 4 main product categories: electronics, fashion, supermarket, and others. Please refer to the exhibits for data sets pertaining to the questions below. Today is May 16th. What is the average growth in average sales per agent per month from March to May target? Answer:..... % Which one is the category with the highest and lowest average month-on-month sales growth from March to May target? Answer: Highest : .......... Lowest:............. Today is 16th May We have got the interim result of the sales figures in the first half of May. Typically, the first half of the month constitutes of 40% of sales. Using this assumption, will we reach our May target? What % over the target will we over/under-deliver? Answer: under/over-deliver by ......... % of target Using that assumption, which…arrow_forward

- Identifying and Recording Customer Option for Additional Merchandise A large clothing retailer chain, Koll’s, offers a sales incentive program where customers receive direct credit toward future purchases based upon the dollar amount of purchases today. For every $50 spent today, the customer will earn a $5 credit to be used at Koll’s in two weeks. The credit expires 5 days after it becomes active. Not all customers will redeem the credit in the 5-day window of time. Based upon historical trends, Koll’s estimates that 35% of the credits will be redeemed. a. Determine how many performance obligations are included in a sales transaction during the sales incentive program. Answerb. Assuming that Koll’s sold $700,000 of merchandise (cost of $280,000) during the first day of the sales incentive period, record the journal entry(ies) to record sales revenue. Assume all sales were cash sales.Note: Round each allocated transaction price to the nearest whole dollar. Performance…arrow_forwardSara is considering whether to open a gadgets shop. She provided you, as a consultant, the following information: Sales of $60,000 and $72,000 are expected for July and August, respectively. All goods are sold on account. The collection pattern for Accounts Receivable is 80 percent in the month of sale and 20 percent in the month following the sale. Purchases of $40,000 and $54,000 are expected for July and August. The payment pattern for purchases is 70 percent in the month of purchase, 30 percent in the month following the purchase. Other monthly expenses are $8,000, which includes $2000 of depreciation. All operating expenses are paid in the month of their incurrence. $2,000 of cash is available on August 1, 2021. Required: Prepare the cash collection budget for the two months ending August 31, 2021 Prepare the cash budget for the two months ending August 31, 2021arrow_forwardOne Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began thelast quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000.The following transactions took place during the quarter.October 10 100 clocks were purchased on account at a cost of $6,225 each. In addition,One Stop paid $120 cash on each clock to have the inventory shipped fromthe vendor’s warehouse to their warehouseOctober 31 During the month 90 clocks were sold at a price of $8,300 each. (20 of theseclocks sold were on account to a long-standing customer of the business)November 1 A new batch of 60 clocks was purchased at a total cost of $406,500November 10 5 of the clocks purchased on November 1 were returned to the supplier, asthey were damagedNovember 30 The sales for November were 58 clocks which yielded total sales revenue of$498,800December 2 Owing to increased demand, a further 110 clocks were purchased at a cost of$7,400 each and these…arrow_forward

- One Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000. The following transactions took place during the quarter.October 10 100 clocks were purchased on account at a cost of $6,225 each. In addition, One Stop paid $120 cash on each clock to have the inventory shipped from the vendor’s warehouse to their warehouseOctober 31 During the month 90 clocks were sold at a price of $8,300 each. (20 of these clocks sold were on account to a long-standing customer of the business)November 1 A new batch of 60 clocks was purchased at a total cost of $406,500November 10 5 of the clocks purchased on November 1 were returned to the supplier, as they were damagedNovember 30 The sales for November were 58 clocks which yielded total sales revenue of $498,800December 2 Owing to increased demand, a further 110 clocks were purchased at a cost of $7,400 each…arrow_forwardOne Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000. The following transactions took place during the quarter.October 10 100 clocks were purchased on account at a cost of $6,225 each. In addition, One Stop paid $120 cash on each clock to have the inventory shipped from the vendor’s warehouse to their warehouseOctober 31 During the month 90 clocks were sold at a price of $8,300 each. (20 of these clocks sold were on account to a long-standing customer of the business)November 1 A new batch of 60 clocks was purchased at a total cost of $406,500November 10 5 of the clocks purchased on November 1 were returned to the supplier, as they were damagedNovember 30 The sales for November were 58 clocks which yielded total sales revenue of $498,800December 2 Owing to increased demand, a further 110 clocks were purchased at a cost of $7,400 each…arrow_forwardOne Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000. The following transactions took place during the quarter.October 10 100 clocks were purchased on account at a cost of $6,225 each. In addition, One Stop paid $120 cash on each clock to have the inventory shipped from the vendor’s warehouse to their warehouseOctober 31 During the month 90 clocks were sold at a price of $8,300 each. (20 of these clocks sold were on account to a long-standing customer of the business)November 1 A new batch of 60 clocks was purchased at a total cost of $406,500November 10 5 of the clocks purchased on November 1 were returned to the supplier, as they were damagedNovember 30 The sales for November were 58 clocks which yielded total sales revenue of $498,800December 2 Owing to increased demand, a further 110 clocks were purchased at a cost of $7,400 each…arrow_forward

- One Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000. The following transactions took place during the quarter.October 10 100 clocks were purchased on account at a cost of $6,225 each. In addition, One Stop paid $120 cash on each clock to have the inventory shipped from the vendor’s warehouse to their warehouseOctober 31 During the month 90 clocks were sold at a price of $8,300 each. (20 of these clocks sold were on account to a long-standing customer of the business)November 1 A new batch of 60 clocks was purchased at a total cost of $406,500November 10 5 of the clocks purchased on November 1 were returned to the supplier, as they were damagedNovember 30 The sales for November were 58 clocks which yielded total sales revenue of $498,800December 2 Owing to increased demand, a further 110 clocks were purchased at a cost of $7,400 each…arrow_forwardOne Stop Electrical Shop are merchandisers of household fixtures & fittings. The business began the last quarter of 2020 (October to December) with 25 Starburst Wall Clocks at a total cost of $153,000. The following transactions took place during the quarter.October 10 100 clocks were purchased on account at a cost of $6,225 each. In addition, One Stop paid $120 cash on each clock to have the inventory shipped from the vendor’s warehouse to their warehouseOctober 31 During the month 90 clocks were sold at a price of $8,300 each. (20 of these clocks sold were on account to a long-standing customer of the business)November 1 A new batch of 60 clocks was purchased at a total cost of $406,500November 10 5 of the clocks purchased on November 1 were returned to the supplier, as they were damagedNovember 30 The sales for November were 58 clocks which yielded total sales revenue of $498,800December 2 Owing to increased demand, a further 110 clocks were purchased at a cost of $7,400 each…arrow_forwardI need help working out problems like these. Please explain in detail each step used to complete these journals. Perpetual: LIFO and Moving-Average Vozniak Company began business on January 1, 20-1. Purchases and sales during the month of January follow. Date Purchases Sales Units Cost/Unit Units Jan. 1 100 $2.00 Jan. 5 500 2.30 Jan. 7 300 Jan. 12 300 2.40 Jan. 15 300 Jan. 17 200 2.50 Jan. 19 500 2.70 Jan. 24 800 Jan. 28 100 Jan. 31 200 2.90 Required: Calculate the total amount to be assigned to cost of goods sold for January and the ending inventory on January 31, under each of the following methods. In your calculations round the average unit cost to four decimal places. If required, round your final answers to the nearest cent. Cost of Goods Sold Inventory on Hand 1. Perpetual LIFO inventory method $ $ 2. Perpetual moving-average inventory method $ $arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning