Concept explainers

Spiffy Shades Corporation manufactures artistic frames for sunglasses. Talia Demarest, controller, is responsible for preparing the company’s

Labor-related costs include pension contributions of $.50 per hour, workers’ compensation insurance of $.20 per hour, employee medical insurance of $.80 per hour, and employer contributions to Social Security equal to 7 percent of direct-labor wages. The cost of employee benefits paid by the company on its employees is treated as a direct-labor cost. Spiffy Shades Corporation has a labor contract that calls for a wage increase to $18.00 per hour on April 1, 20x1. Management expects to have 16,000 frames on hand at December 31, 20x0, and has a policy of carrying an end-of-month inventory of 100 percent of the following month’s sales plus 50 percent of the second following month’s sales.

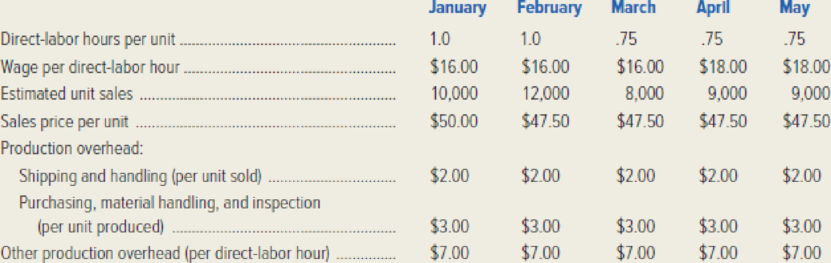

These and other data compiled by Demarest are summarized in the following table.

Required:

- 1. Prepare a production budget and a direct-labor budget for Spiffy Shades Corporation by month and for the first quarter of 20x1. Both budgets may be combined in one schedule. The direct-labor budget should include direct-labor hours and show the detail for each direct-labor cost category.

- 2. For each item used in the firm’s production budget and direct-labor budget, identify the other components of the master budget (except for financial statement budgets) that also would, directly or indirectly, use these data.

- 3. Prepare a production overhead budget for each month and for the first quarter.

1.

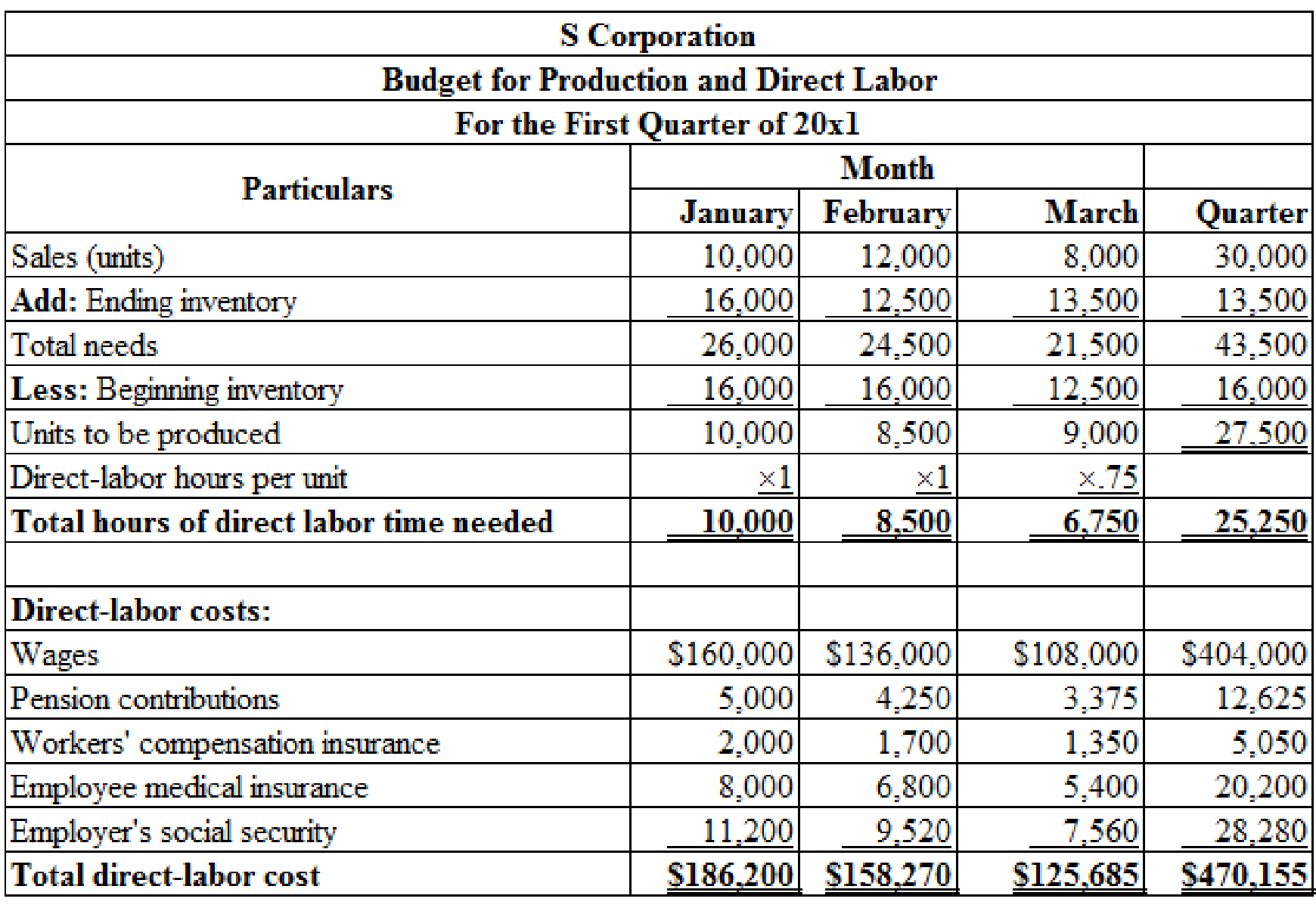

Prepare a production budget and a direct-labor budget for S Corporation by month and for the first quarter of 20x1.

Explanation of Solution

Production Budget: The production budget refers to that budget which forecasts the production for the future accounting period. The budgeted production for any financial period is planned by combining the forecasted unit of sales and the finished goods inventory and deducting the beginning goods inventory.

Direct labor budget: Direct labor budget is an estimation of direct labor hours required for the budgeted units of production is known as direct labor budget.

Prepare a production budget and a direct-labor budget for S Corporation by month and for the first quarter of 20x1:

Table (1)

Working note 1:

Calculate the amount of ending inventory for January:

Working note 2:

Calculate the amount of ending inventory for February:

Working note 3:

Calculate the amount of ending inventory for March:

Working note 4:

Calculate the amount of wages for January:

Working note 5:

Calculate the amount of wages for February:

Working note 6:

Calculate the amount of wages for March:

Working note 7:

Calculate the amount of pension contribution for January:

Working note 8:

Calculate the amount of pension contribution for February:

Working note 9:

Calculate the amount of pension contribution for March:

Working note 10:

Calculate the amount of workers’ compensation insurance for January:

Working note 11:

Calculate the amount of workers’ compensation insurance for February:

Working note 12:

Calculate the amount of workers’ compensation insurance for March:

Working note 13:

Calculate the amount of employee medical insurance for January:

Working note 14:

Calculate the amount of employee medical insurance for February:

Working note 15:

Calculate the amount of employee medical insurance for March:

Working note 16:

Calculate the amount of employee social security for January:

Working note 17:

Calculate the amount of employee social security for February:

Working note 18:

Calculate the amount of employee social security for March:

2.

Identify the other components of the master budget.

Explanation of Solution

Master Budget: The master budget is the core budget that describes the full process of budget. This budget shows all the operating and financial budgets of the company for a budgeted accounting period and this budget includes all the budgets and budgeted financial statements.

Identify the other components of the master budget:

The following are the components of the master budget except production budget and direct labor budget but use the sales data:

- Sales budget

- Cost of goods sold budget

- Selling and administrative expense budget

The following are the components of the master budget except production budget and direct labor budget but use the production data:

- Direct material budget

- Production-overhead budget

- Cost of goods sold budget

The following are the components of the master budget except production budget and direct labor budget but use the direct labor hour data:

- Production-overhead budget

The following are the components of the master budget except production budget and direct labor budget but use the direct labor cost data:

- Production-overhead budget

- Cost of goods sold budget

- Cash budget

- Budgeted income statement

3.

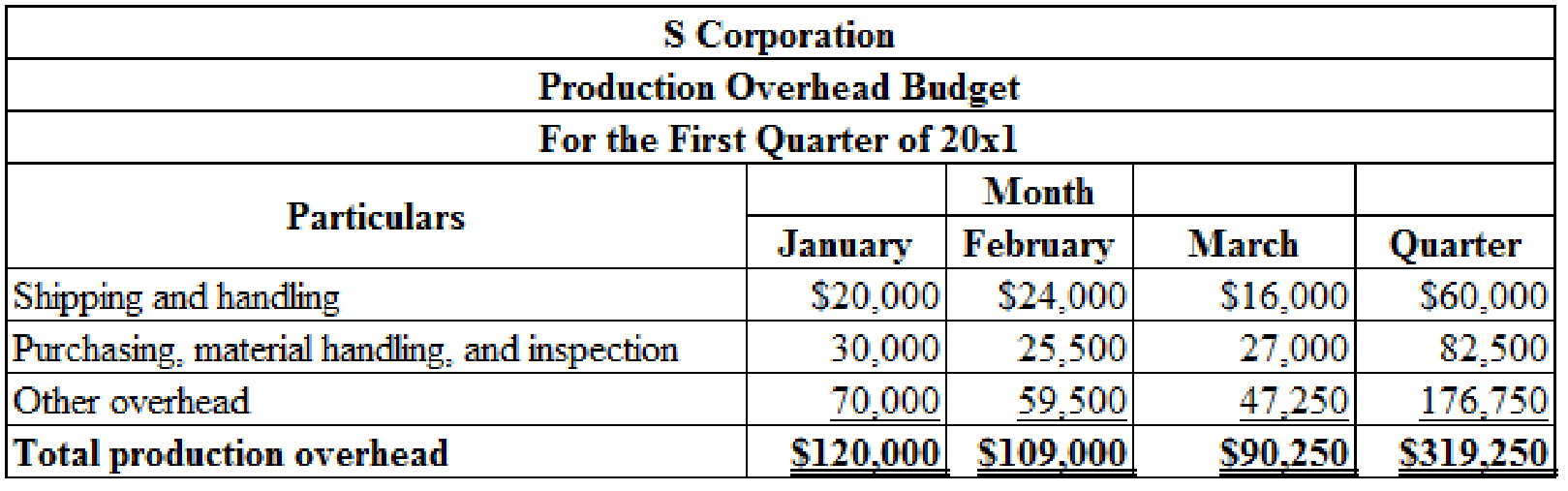

Prepare a production overhead budget for each month and for the first quarter.

Explanation of Solution

Manufacturing Overhead Budget: Manufacturing overhead budget is prepared to predict all indirect manufacturing costs. It excludes direct materials and direct labor. It is necessary to anticipate overhead budget to meet the budgeted production for the next accounting period.

Prepare a production overhead budget for each month and for the first quarter:

Table (2)

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Greiner Company makes and sells high-quality glare filters for microcomputer monitors. John Craven, controller, is responsible for preparing Greiners master budget and has assembled the following data for the coming year. The direct labor rate includes wages, all employee-related benefits, and the employers share of FICA. Labor saving machinery will be fully operational by March. Also, as of March 1, the companys union contract calls for an increase in direct labor wages that is included in the direct labor rate. Greiner expects to have 5,600 glare filters in inventory on December 31 of the current year, and has a policy of carrying 35 percent of the following month's projected sales in inventory. Information on the first four months of the coming year is as follows: Required: 1. Prepare the following monthly budgets for Greiner Company for the first quarter of the coming year. Be sure to show supporting calculations. a. Production budget in units b. Direct labor budget in hours c. Direct materials cost budget d. Sales budget 2. Calculate the total budgeted contribution margin for Greiner Company by month and in total for the first quarter of the coming year. Be sure to show supporting calculations. (CMA adapted)arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forward

- Salisbury Bottle Company manufactures plastic two-liter bottles for the beverage industry. The cost standards per 100 two-liter bottles are as follows: At the beginning of March, Salisburys management planned to produce 500,000 bottles. The actual number of bottles produced for March was 525,000 bottles. The actual costs for March of the current year were as follows: a. Prepare the March manufacturing standard cost budget (direct labor, direct materials, and factory overhead) for Salisbury, assuming planned production. b. Prepare a budget performance report for manufacturing costs, showing the total cost variances for direct materials, direct labor, and factory overhead for March. c. Interpret the budget performance report.arrow_forwardCloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardTIB makes custom guitars and prepared the following sales budget for the second quarter It also has this additional information related to its expenses: Direct material per unit $55, Direct labor per hour 20, Variable manufacturing overhead per hour 3.50, Fixed manufacturing overhead per month 3,000, Sales commissions per unit 20, Sales salaries per month 5,000, Delivery expense per unit 0.50, Utilities per month 4,000. Administrative salaries per month 20,000, Marketing expenses per month 8,000, Insurance expense per month 11,000, Depreciation expense per month 9,000. Prepare a sales and administrative expense budget for each month in the quarter ended June 30. 2018.arrow_forward

- Shalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardThomas Textiles Corporation began November with a budget for 60,000 hours of production in the Weaving Department. The department has a full capacity of 75,000 hours under normal business conditions. The budgeted overhead at the planned volumes at the beginning of November was as follows: The actual factory overhead was 725,000 for November. The actual fixed factory overhead was as budgeted. During November, the Weaving Department had standard hours at actual production volume of 64,500 hours. a. Determine the variable factory overhead controllable variance. b. Determine the fixed factory overhead volume variance.arrow_forward

- Firenza Company manufactures specialty tools to customer order. Budgeted overhead for the coming year is: Previously, Sanjay Bhatt, Firenza Companys controller, had applied overhead on the basis of machine hours. Expected machine hours for the coming year are 50,000. Sanjay has been reading about activity-based costing, and he wonders whether or not it might offer some advantages to his company. He decided that appropriate drivers for overhead activities are purchase orders for purchasing, number of setups for setup cost, engineering hours for engineering cost, and machine hours for other. Budgeted amounts for these drivers are 5,000 purchase orders, 500 setups, and 2,500 engineering hours. Sanjay has been asked to prepare bids for two jobs with the following information: The typical bid price includes a 40 percent markup over full manufacturing cost. Required: 1. Calculate a plantwide rate for Firenza Company based on machine hours. What is the bid price of each job using this rate? 2. Calculate activity rates for the four overhead activities. What is the bid price of each job using these rates? 3. Which bids are more accurate? Why?arrow_forwardKrouse Company produces two products, forged putter heads and laminated putter heads, which are sold through specialty golf shops. The company is in the process of developing itsoperating budget for the coming year. Selected data regarding the companys two products areas follows: Manufacturing overhead is applied to units using direct labor hours. Variable manufacturing overhead Ls projected to be 25,000, and fixed manufacturing overhead is expected to be15,000. The estimated cost to produce one unit of the laminated putter head is: a. 42. b. 46. c. 52. d. 62.arrow_forwardNorton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Nortons accounting staff and is interested in learning as much as possible about the companys budgeting process. During a recent lunch with Marge Atkins, sales manager, and Pete Granger, production manager, Ford initiated the following conversation. FORD: Since Im new around here and am going to be involved with the preparation of the annual budget, Id be interested in learning how the two of you estimate sales and production numbers. ATKINS: We start out very methodically by looking at recent history, discussing what we know about current accounts, potential customers, and the general state of consumer spending. Then, we add that usual dose of intuition to come up with the best forecast we can. GRANGER: I usually take the sales projections as the basis for my projections. Of course, we have to make an estimate of what this years closing inventories will be, which is sometimes difficult. FORD: Why does that present a problem? There must have been an estimate of closing inventories in the budget for the current year. GRANGER: Those numbers arent always reliable since Marge makes some adjustments to the sales numbers before passing them on to me. FORD: What kind of adjustments? ATKINS: Well, we dont want to fall short of the sales projections so we generally give ourselves a little breathing room by lowering the initial sales projection anywhere from 5 to 10 percent. GRANGER: So, you can see why this years budget is not a very reliable starting point. We always have to adjust the projected production rates as the year progresses, and of course, this changes the ending inventory estimates. By the way, we make similar adjustments to expenses by adding at least 10 percent to the estimates; I think everyone around here does the same thing. Required: 1. Marge Atkins and Pete Granger have described the use of budgetary slack. a. Explain why Atkins and Granger behave in this manner, and describe the benefits they expect to realize from the use of budgetary slack. b. Explain how the use of budgetary slack can adversely affect Atkins and Granger. 2. As a management accountant, Scott Ford believes that the behavior described by Marge Atkins and Pete Granger may be unethical and that he may have an obligation not to support this behavior. By citing the specific standards of competence, confidentiality, integrity, and/or credibility from the Statement of Ethical Professional Practice (in Chapter 1), explain why the use of budgetary slack may be unethical. (CMA adapted)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning