Concept explainers

Jeffrey Vaughn, president of Frame-It Company, was just concluding a budget meeting with his senior staff. It was November of 20x0, and the group was discussing preparation of the firm’s

In response to a question about financing the acquisition, Vaughn replied as follows: “The robot will cost $1,000,000. We’ll finance it with a one-year $1,000,000 loan from Shark Bank and Trust Company. I’ve negotiated a repayment schedule of four equal installments on the last day of each quarter. The interest rate will be 10 percent, and interest payments will be quarterly as well.” With that the meeting broke up, and the budget process was on.

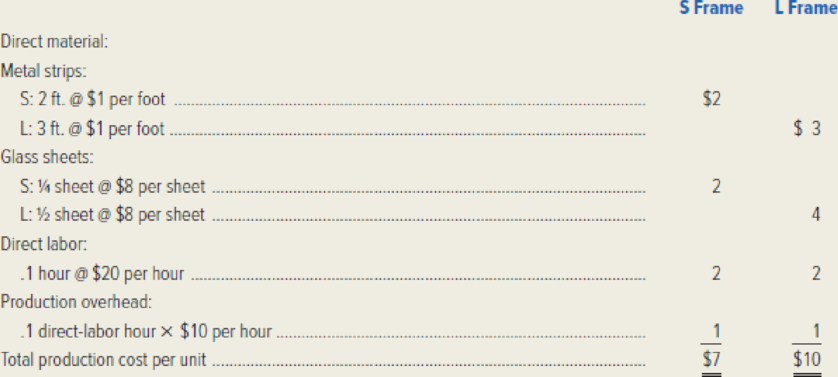

Frame-It Company is a manufacturer of metal picture frames. The firm’s two product lines are designated as S (small frames, 5×7 inches) and L (large frames, 8 × 10 inches). The primary raw materials are flexible metal strips and 9-inch by 24-inch glass sheets. Each S frame requires a 2-foot metal strip; an L frame requires a 3-foot strip. Allowing for normal breakage and scrap glass, Frame-It can get either four S frames or two L frames out of a glass sheet. Other raw materials, such as cardboard backing, are insignificant in cost and are treated as indirect materials. Emily Jackson, Frame-It’s controller, is in charge of preparing the master budget for 20x 1. She has gathered the following information:

- 1. Sales in the fourth quarter of 20x0 are expected to be 50,000 S frames and 40,000 L frames. The sales manager predicts that over the next two years, sales in each product line will grow by 5,000 units each quarter over the previous quarter. For example, S frame sales in the first quarter of 20x1 are expected to be 55,000 units.

- 2. Frame-It’s sales history indicates that 60 percent of all sales are on credit, with the remainder of the sales in cash. The company’s collection experience shows that 80 percent of the credit sales are collected during the quarter in which the sale is made, while the remaining 20 percent is collected in the following quarter. (For simplicity, assume the company is able to collect 100 percent of its

accounts receivable .) - 3. The S frame sells for $10, and the L frame sells for $15. These prices are expected to hold constant throughout 20x1.

- 4. Frame-It’s production manager attempts to end each quarter with enough finished-goods inventory in each product line to cover 20 percent of the following quarter’s sales. Moreover, an attempt is made to end each quarter with 20 percent of the glass sheets needed for the following quarter’s production. Since metal strips are purchased locally, Frame-It buys them on a just-in-time basis; inventory is negligible.

- 5. All of Frame-It’s direct-material purchases are made on account, and 80 percent of each quarter’s purchases are paid in cash during the same quarter as the purchase. The other 20 percent is paid in the next quarter.

- 6. Indirect materials are purchased as needed and paid for in cash. Work-in-process inventory is negligible.

- 7. Projected production costs in 20x1 are as follows:

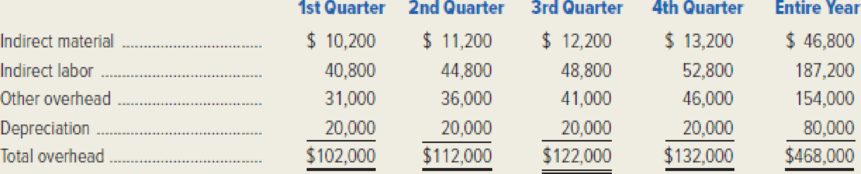

- 8. The predetermined overhead rate is $10 per direct-labor hour. The following production overhead costs are budgeted for 20x1.

All of these costs will be paid in cash during the quarter incurred except for the

- 9. Frame-It’s quarterly selling and administrative expenses are $100,000, paid in cash.

- 10. Jackson anticipates that dividends of $50,000 will be declared and paid in cash each quarter.

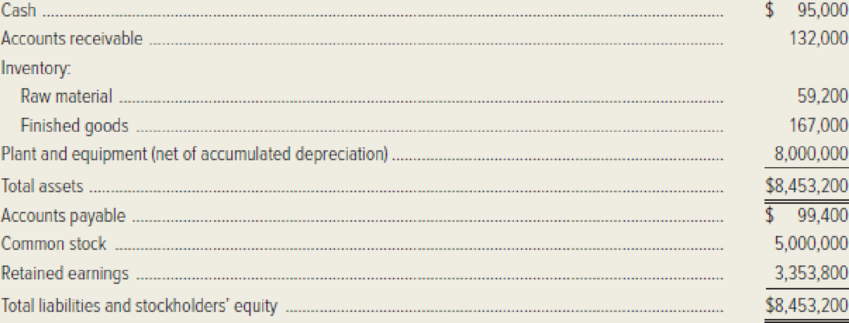

- 11. Frame-It’s projected balance sheet as of December 31, 20x0, follows:

Required: Prepare Frame-It Company’s master budget for 20x1 by completing the following schedules and statements.

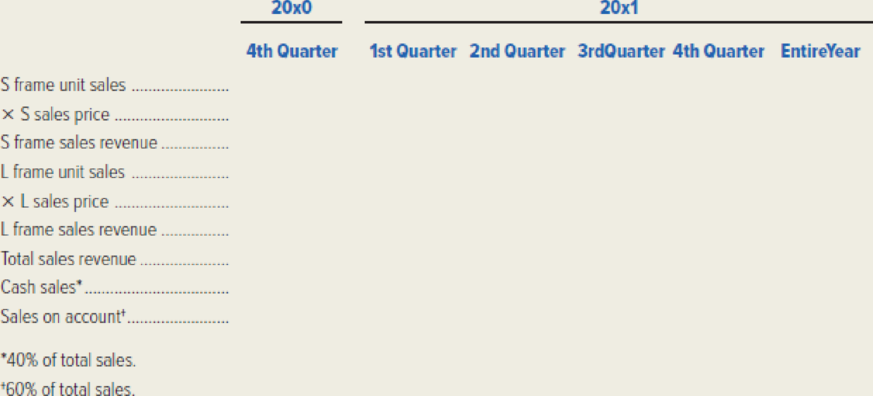

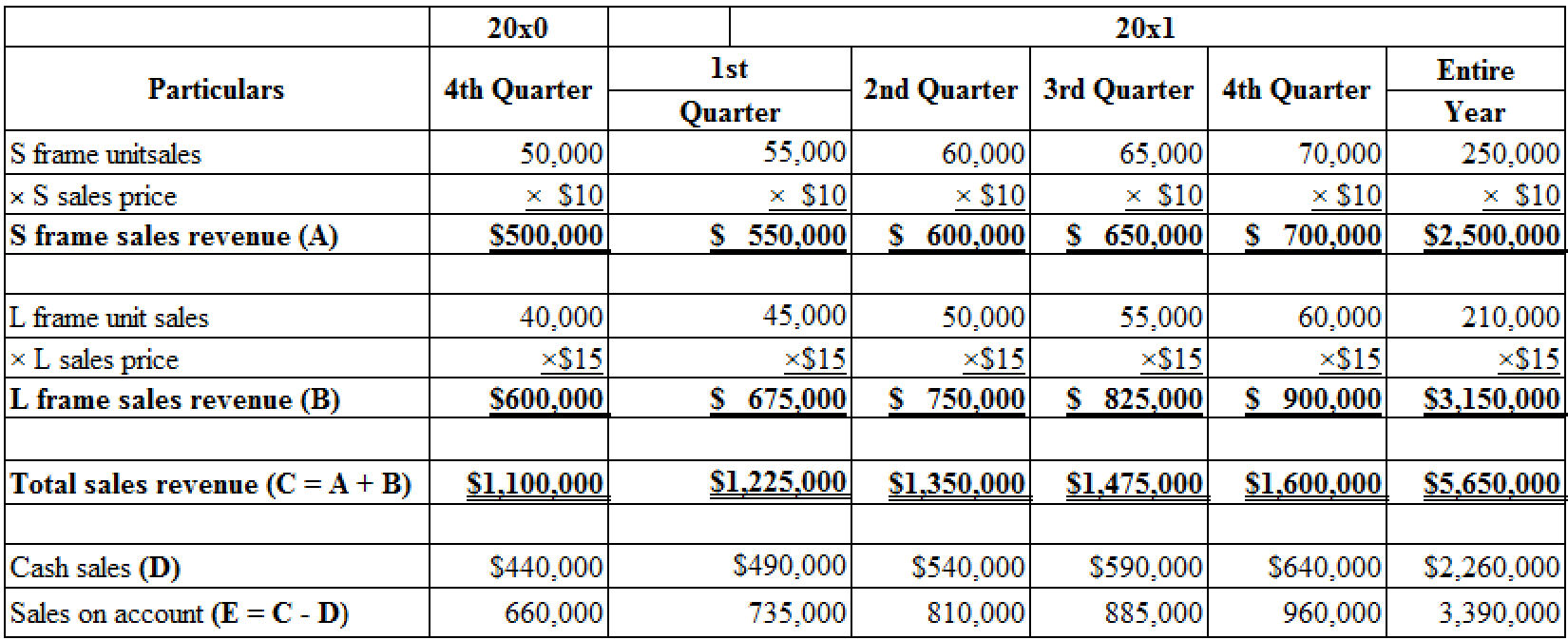

- 1. Sales budget:

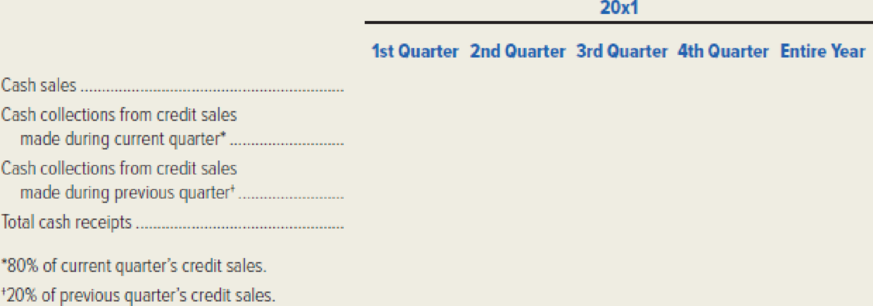

- 2. Cash receipts budget:

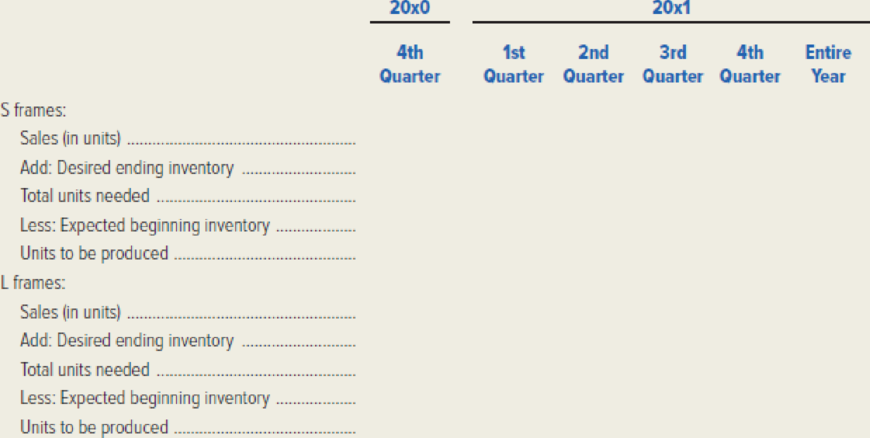

- 3. Production budget:

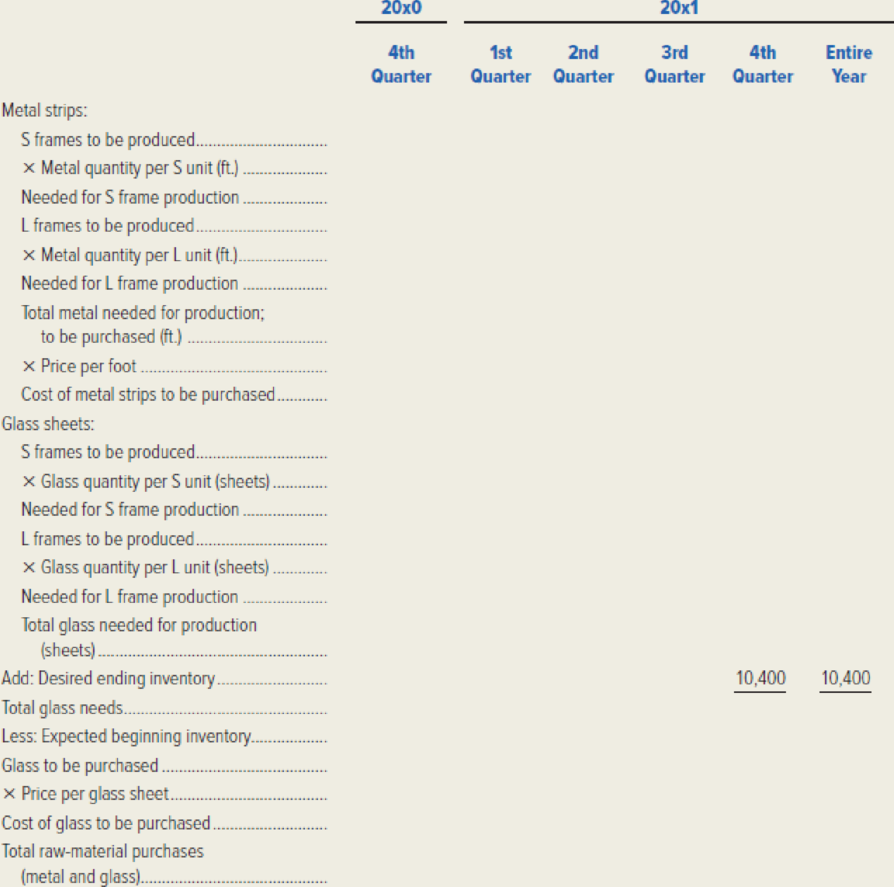

- 4. Direct-material budget:

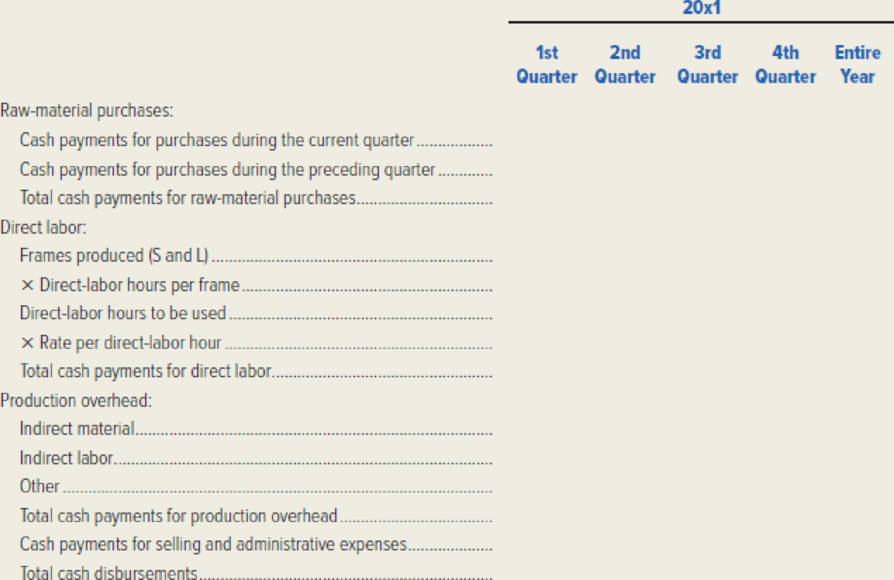

- 5. Cash disbursements budget:

- 6. Summary

cash budget :

- 7. Prepare a budgeted schedule of cost of goods manufactured and sold for the year 20x1. (Hint: In the budget, actual and applied overhead will be equal.)

- 8. Prepare Frame-It’s

budgeted income statement for 20x1. (Ignore income taxes.) - 9. Prepare Frame-It’s budgeted statement of

retained earnings for 20x1. - 10. Prepare Frame-It’s budgeted balance sheet as of December 31, 20x1.

1.

Prepare a sales budget.

Explanation of Solution

Sales budget: This budget is prepared by the organization for the yearly or monthly basis as per need. It includes all the estimated revenues from the entire operating source.

Sales budget is prepared to estimate or project the sales in dollars and units for a particular period of time.

Prepare a sales budget:

Table (1)

Working note 1:

20x0:

Calculate the amount of cash sales for 4th quarter:

Working note 2:

20x1:

Calculate the amount of cash sales for 1st quarter:

Calculate the amount of cash sales for 2nd quarter:

Calculate the amount of cash sales for 3rd quarter:

Calculate the amount of cash sales for 4th quarter:

Working note 3:

20x0:

Calculate the amount of sales on account for 4th quarter:

Working note 2:

20x1:

Calculate the amount of sales on account for 1st quarter:

Calculate the amount of sales on account for 2nd quarter:

Calculate the amount of sales on account for 3rd quarter:

Calculate the amount of sales on account for 4th quarter:

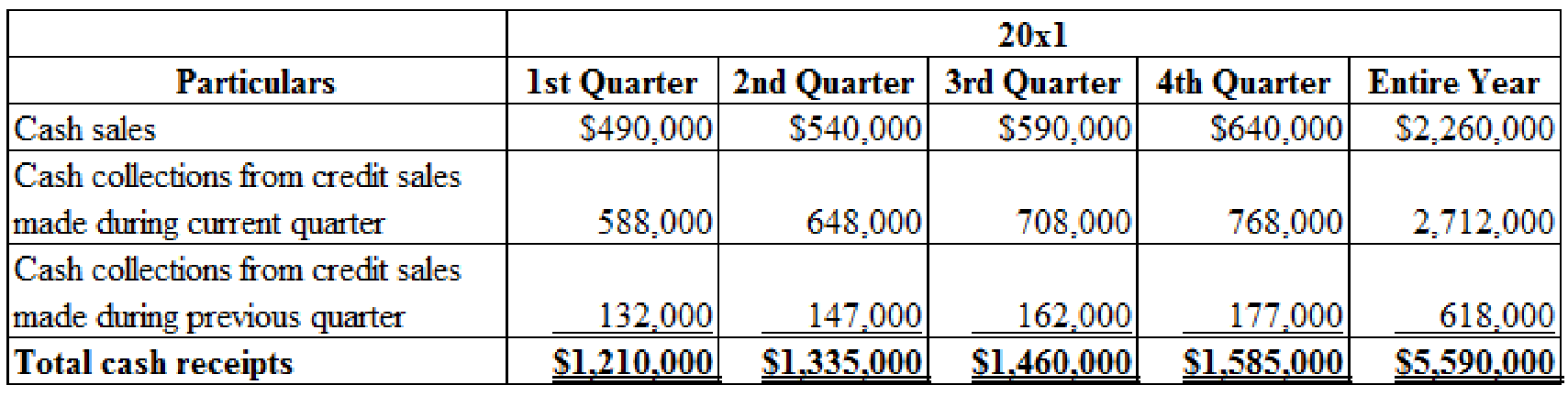

2.

Prepare a cash receipts budget.

Explanation of Solution

Cash receipts Budget: The cash budget is a part of the financial statements which is a plan for the cash receipts for a particular accounting period. This budget gives an estimation of all the cash inflows of a business for the given financial period.

Prepare a cash receipts budget:

Table (2)

Working note 1:

20x1:

Calculate the cash collection from credit sales made during current quarter:

1st quarter:

3rd quarter:

4th quarter:

Working note 2:

20x1:

Calculate the cash collection from credit sales made during previous quarter:

1st quarter:

2nd quarter:

3rd quarter:

4th quarter:

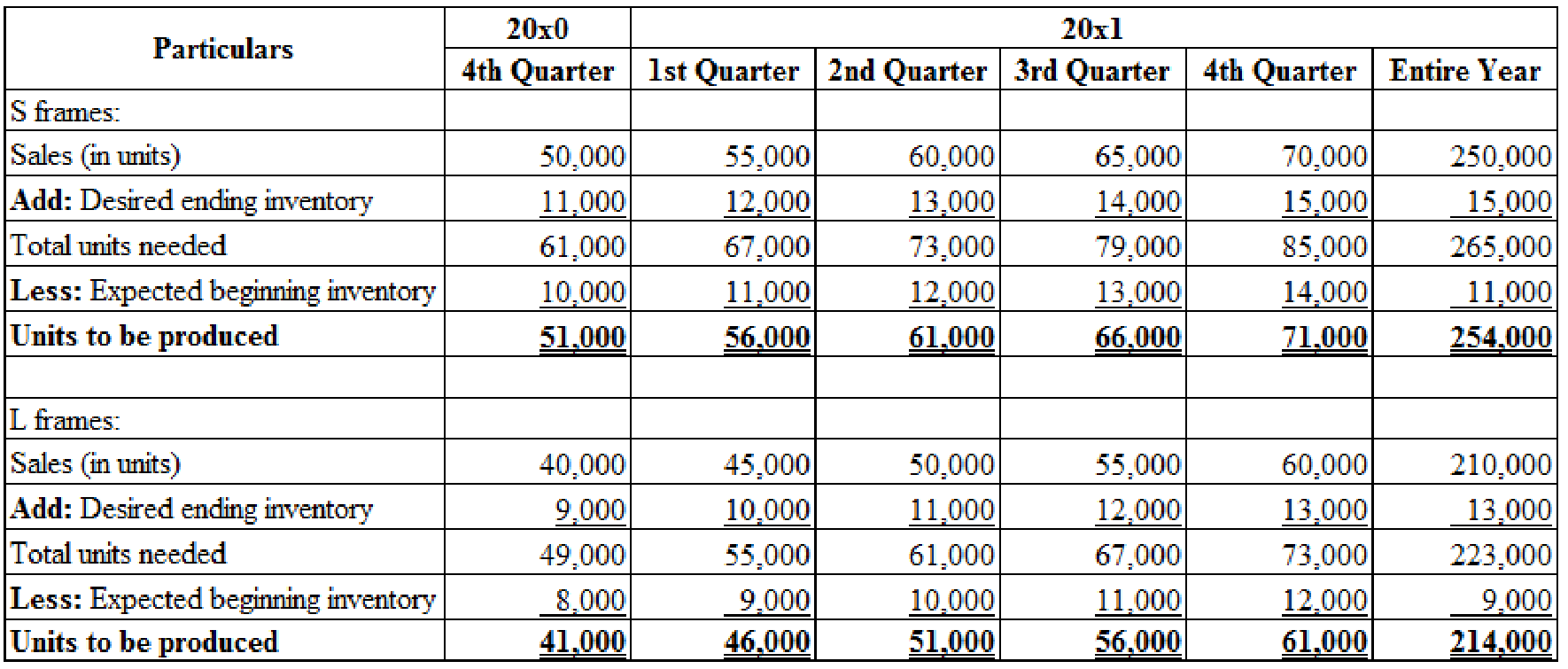

3.

Prepare a production budget.

Explanation of Solution

Production Budget: The production budget refers to that budget which forecasts the production for the future accounting period. The budgeted production for any financial period is planned by combining the forecasted unit of sales and the finished goods inventory and deducting the beginning goods inventory.

Prepare a production budget:

Table (3)

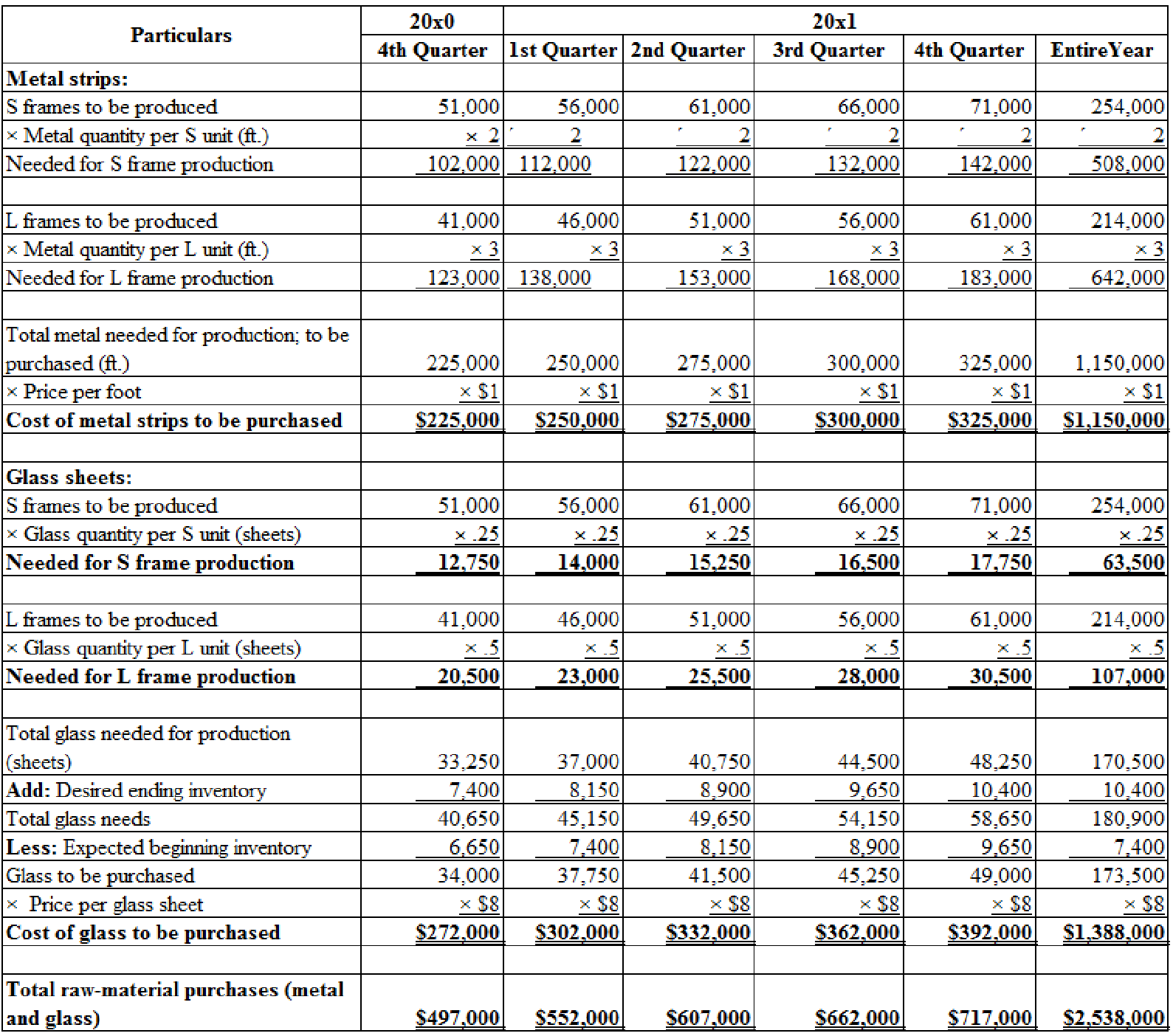

4.

Prepare a direct-material budget.

Explanation of Solution

Direct material budget: This budget shows the expected requirement of raw material (in units and in dollar amount) for the budgeted period.

Prepare a direct-material budget:

Table (4)

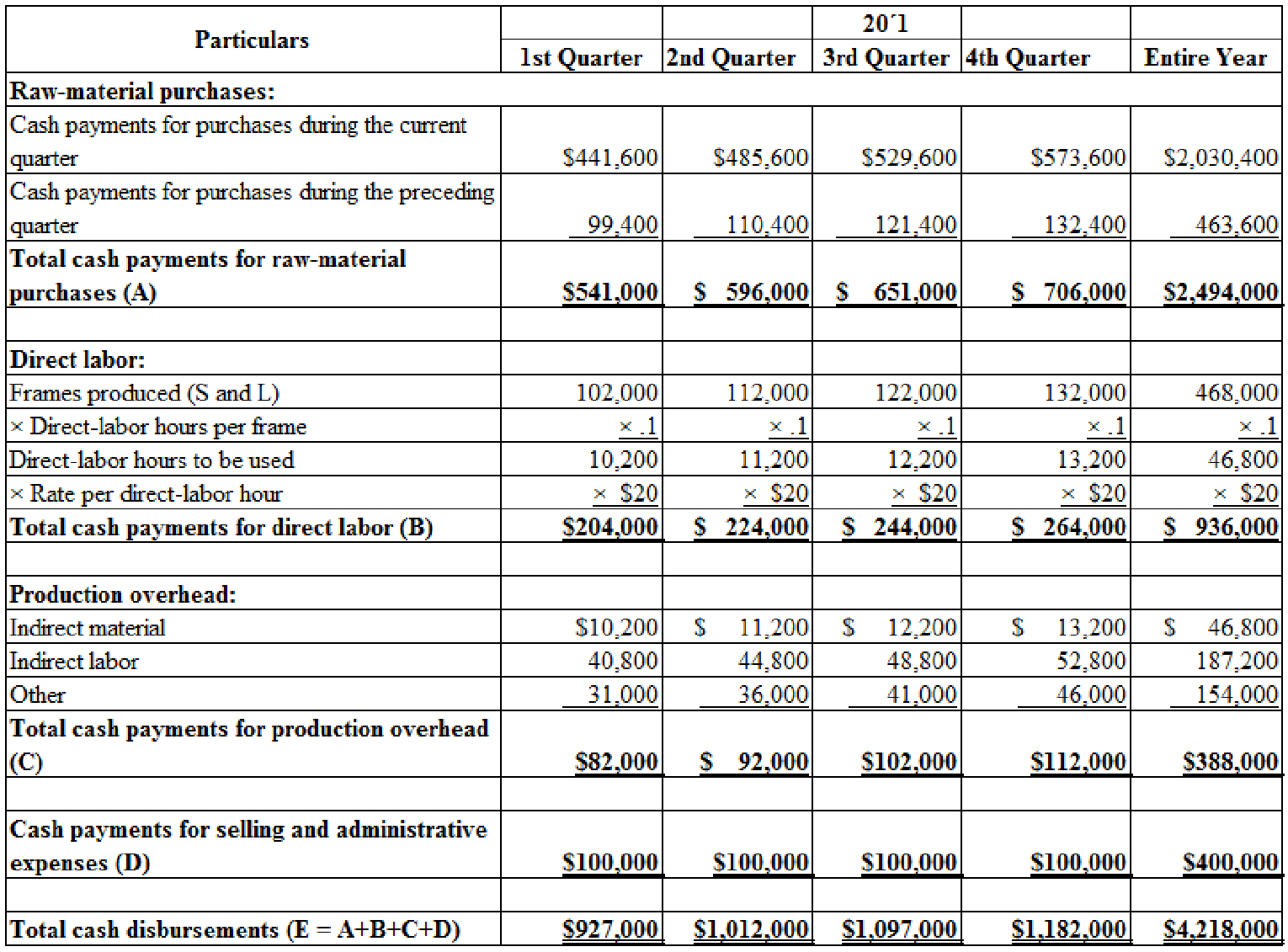

5.

Prepare a cash disbursement budget.

Explanation of Solution

Cash payments for purchases: This Schedule is prepared for the estimation of the cash payment for purchase for the period. This includes all probable cash payment.

Budgeted cash disbursement: Budgeted cash disbursements are the cash outflows expected for a budgeted period.

Prepare a cash disbursement budget:

Table (5)

Working note 1:

20x1:

Calculate the cash payments for purchase during current quarter:

1st quarter:

2nd quarter:

3rd quarter:

4th quarter:

Working note 2:

20x1:

Calculate the cash payments for purchase during previous quarter:

1st quarter:

2nd quarter:

3rd quarter:

4th quarter:

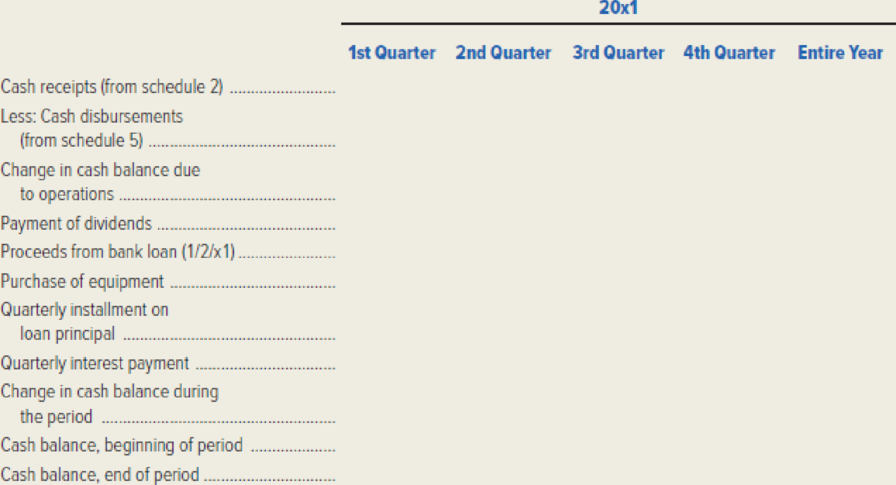

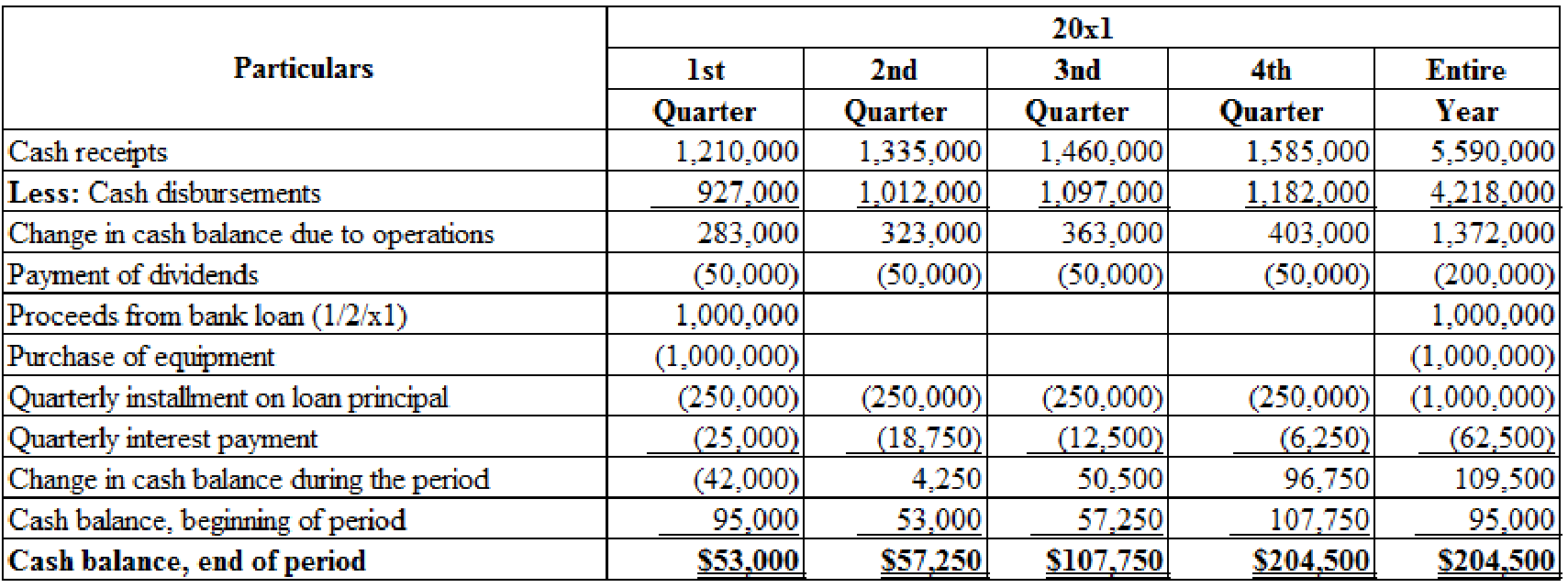

6.

Prepare a cash budget.

Explanation of Solution

Cash Budget: Cash budget shows the expected cash inflows and cash outflows for a budgeted period.

Prepare a cash budget:

Table (6)

Working note 1:

20x1:

Calculate the quarterly interest payment:

1st quarter:

2nd quarter:

3rd quarter:

4th quarter:

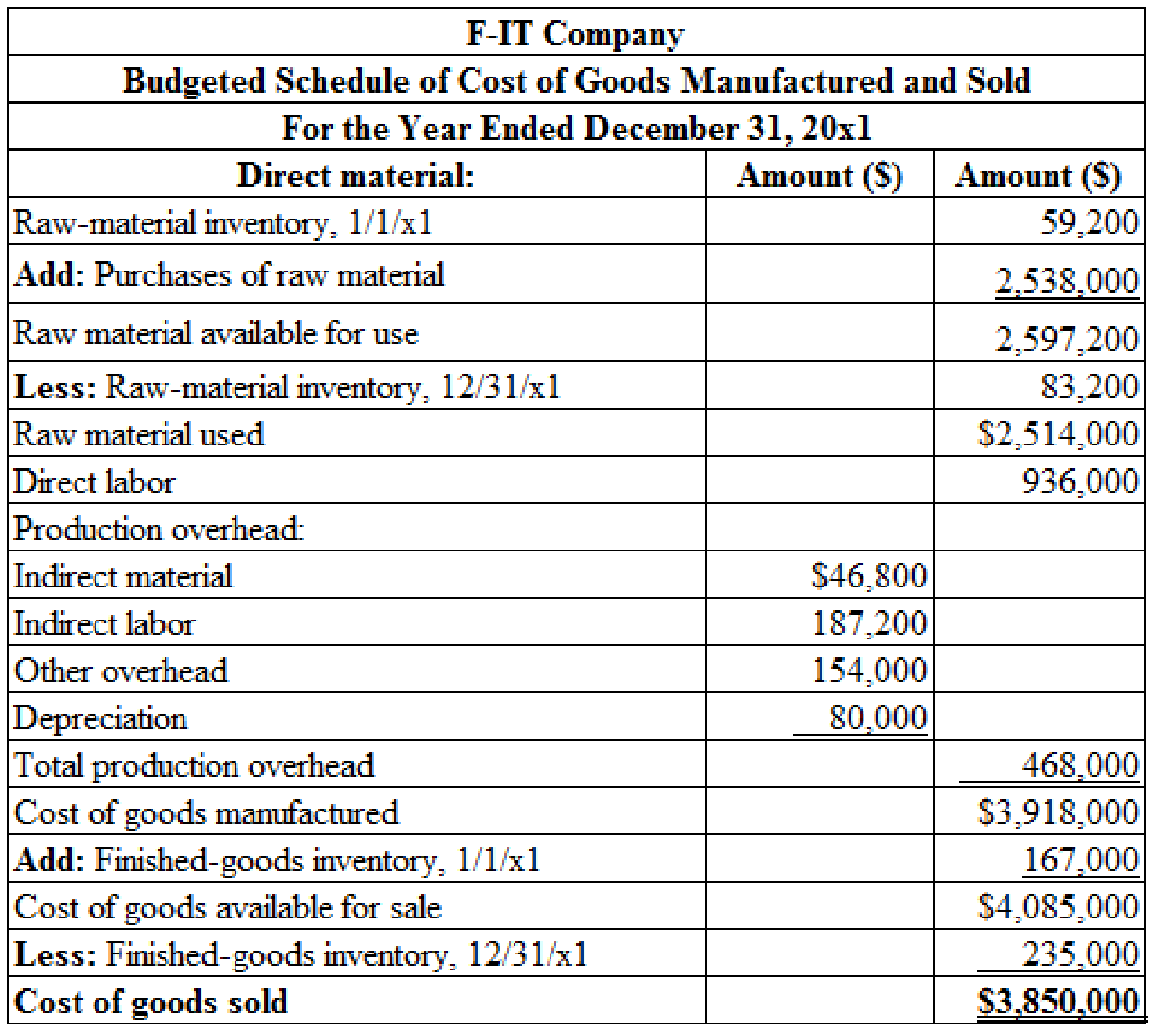

7.

Prepare a budgeted schedule of cost of goods manufactured and sold for the year 20x1.

Explanation of Solution

Cost of goods sold budget: The cost of goods sold budget is the budget prepared to estimate the direct materials, labor and overhead for the coming financial period. This budget is the part of the operating budget.

Prepare a budgeted schedule of cost of goods manufactured and sold for the year 20x1:

Table (7)

Working note 1:

Calculate the cost of total production overhead applied:

| Cost of total production overhead applied | ||

| Particulars | Amount ($) | |

| Total number of frames produced | 468,000 | |

| × Direct-labor hours per frame | ×.1 | |

| Total direct-labor hours | 46,800 | |

| × Predetermined overhead rate per hour | ×$10 | |

| Total production overhead applied | $468,000 | |

Table (8)

Working note 2:

Calculate the cost of goods sold manufactured:

| Particulars | S Frames | L Frames |

| Frames produced | 254,000 | 214,000 |

| × Production cost per unit | × $7 | × $10 |

| Total production cost | $1,778,000 | $2,140,000 |

| Grand total (S frames and L frames) | $3,918,000 | |

Table (9)

Working note 3:

Calculate the finished goods inventory on 12/31/x1:

| Particulars | S Frames | L Frames |

| Projected inventory on 12/31/x1 | 15,000 | 13,000 |

| Production cost per unit | × $7 | × $10 |

| Cost of ending inventory | $ 105,000 | $ 130,000 |

| Total cost of ending inventory (S and L) | $235,000 | |

Table (10)

Working note 4:

Calculate the cost of goods sold:

| Particulars | S Frames | L Frames |

| Frames sold | 250,000 | 210,000 |

| Production cost per unit | × $7 | × $10 |

| Cost of goods sold | $1,750,000 | $2,100,000 |

| Total cost of goods sold (S and L) | $3,850,000 | |

Table (11)

8.

Prepare F-IT Company budgeted income statement for 20x1.

Explanation of Solution

Budgeted Income Statement: The statement that indicates the expected profitability of operations for the budget period is known as the budgeted income statement. It also provides the basis for evaluating the performance of a company, and act as a call to action.

Prepare budgeted income statement:

| F-IT Company | ||

| Budgeted Income Statement | ||

| For the Year Ended December 31, 20x1 | ||

| Particulars | Amount ($) | Amount ($) |

| Sales revenue | $5,650,000 | |

| Less: Cost of goods sold | 3,850,000 | |

| Gross margin | $1,800,000 | |

| Selling and administrative expense | $400,000 | |

| Interest expense | 62,500 | 462,500 |

| Net income | $1,337,500 | |

Table (12)

9.

Prepare F-IT Company budgeted statement of retained earnings for 20x1.

Explanation of Solution

Retained earnings: Retained earnings are that portion of profits which are earned by a company but not distributed to stockholders in the form of dividends. These earnings are retained for various purposes like expansion activities, or funding any future plans.

| F-IT Company | ||

| Budgeted Statement of Retained Earnings | ||

| For the Year Ended December 31, 20x1 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, 12/31/x0 | $3,353,800 | |

| Add: Net income | 1,337,500 | |

| Subtotal | 4,691,300 | |

| Less: Dividends | 200,000 | |

| Retained earnings, 12/31/x1 | $4,491,300 | |

Table (13)

10.

Prepare F-IT Company budgeted balance sheet as of December 31,20x1.

Explanation of Solution

Budgeted Balance Sheet: Budgeted Balance Sheet is one of the budgeted financial statements which summarize the budgeted assets, the liabilities, and the Shareholder’s equity of a company at a given date.

Prepare F-IT Company budgeted balance sheet as of December 31,20x1:

| F – IT Company | |

| Budgeted Balance Sheet | |

| December 31, 20x1 | |

| Assets | Amount ($) |

| Cash | 204,500 |

| Accounts receivable | 192,000 |

| Inventory: | |

| Raw material | 83,200 |

| Finished goods | 235,000 |

| Plant and equipment (net of accumulated depreciation | 8,920,000 |

| Total assets | $9,634,700 |

| Accounts payable | 143,400 |

| Common stock | 5,000,000 |

| Retained earnings | 4,491,300 |

| Total liabilities and stockholders' equity | $9,634,700 |

Table (14)

Working note 1:

Calculate the amount of accounts receivable:

Working note 2:

Calculate the amount of plant and equipment:

Working note 3:

Calculate the amount of accounts payable:

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Adam Corporation manufactures computer tables and has the following budgeted indirect manufacturing cost information for the next year: If Adam uses the step-down (sequential) method, beginning with the Maintenance Department, to allocate support department costs to production departments, the total overhead (rounded to the nearest dollar) for the Machining Department to allocate to its products would be: a. 407,500. b. 422,750. c. 442,053. d. 445,000.arrow_forwardShalimar Company manufactures and sells industrial products. For next year, Shalimar has budgeted the follow sales: In Shalimars experience, 10 percent of sales are paid in cash. Of the sales on account, 65 percent are collected in the quarter of sale, 25 percent are collected in the quarter following the sale, and 7 percent are collected in the second quarter after the sale. The remaining 3 percent are never collected. Total sales for the third quarter of the current year are 4,900,000 and for the fourth quarter of the current year are 6,850,000. Required: 1. Calculate cash sales and credit sales expected in the last two quarters of the current year, and in each quarter of next year. 2. Construct a cash receipts budget for Shalimar Company for each quarter of the next year, showing the cash sales and the cash collections from credit sales. 3. What if the recession led Shalimars top management to assume that in the next year 10 percent of credit sales would never be collected? The expected payment percentages in the quarter of sale and the quarter after sale are assumed to be the same. How would that affect cash received in each quarter? Construct a revised cash budget using the new assumption.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forward

- Optima Company is a high-technology organization that produces a mass-storage system. The design of Optimas system is unique and represents a breakthrough in the industry. The units Optima produces combine positive features of both compact and hard disks. The company is completing its fifth year of operations and is preparing to build its master budget for the coming year (20X1). The budget will detail each quarters activity and the activity for the year in total. The master budget will be based on the following information: a. Fourth-quarter sales for 20X0 are 55,000 units. b. Unit sales by quarter (for 20X1) are projected as follows: The selling price is 400 per unit. All sales are credit sales. Optima collects 85% of all sales within the quarter in which they are realized; the other 15% is collected in the following quarter. There are no bad debts. c. There is no beginning inventory of finished goods. Optima is planning the following ending finished goods inventories for each quarter: d. Each mass-storage unit uses 5 hours of direct labor and three units of direct materials. Laborers are paid 10 per hour, and one unit of direct materials costs 80. e. There are 65,700 units of direct materials in beginning inventory as of January 1, 20X1. At the end of each quarter, Optima plans to have 30% of the direct materials needed for next quarters unit sales. Optima will end the year with the same amount of direct materials found in this years beginning inventory. f. Optima buys direct materials on account. Half of the purchases are paid for in the quarter of acquisition, and the remaining half are paid for in the following quarter. Wages and salaries are paid on the 15th and 30th of each month. g. Fixed overhead totals 1 million each quarter. Of this total, 350,000 represents depreciation. All other fixed expenses are paid for in cash in the quarter incurred. The fixed overhead rate is computed by dividing the years total fixed overhead by the years budgeted production in units. h. Variable overhead is budgeted at 6 per direct labor hour. All variable overhead expenses are paid for in the quarter incurred. i. Fixed selling and administrative expenses total 250,000 per quarter, including 50,000 depreciation. j. Variable selling and administrative expenses are budgeted at 10 per unit sold. All selling and administrative expenses are paid for in the quarter incurred. k. The balance sheet as of December 31, 20X0, is as follows: l. Optima will pay quarterly dividends of 300,000. At the end of the fourth quarter, 2 million of equipment will be purchased. Required: Prepare a master budget for Optima Company for each quarter of 20X1 and for the year in total. The following component budgets must be included: 1. Sales budget 2. Production budget 3. Direct materials purchases budget 4. Direct labor budget 5. Overhead budget 6. Selling and administrative expenses budget 7. Ending finished goods inventory budget 8. Cost of goods sold budget (Note: Assume that there is no change in work-in-process inventories.) 9. Cash budget 10. Pro forma income statement (using absorption costing) (Note: Ignore income taxes.) 11. Pro forma balance sheet (Note: Ignore income taxes.)arrow_forwardIona Company, a large printing company, is in its fourth year of a five-year, quality improvement program. The program began in 20x0 with an internal study that revealed the quality costs being incurred. In that year, a five-year plan was developed to lower quality costs to 10 percent of sales by the end of 20x5. Sales and quality costs for each year are as follows: Budgeted figures. Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20x5 budget for quality costs is also provided. All prevention costs are fixed; all other quality costs are variable. During 20x5, the company had 12 million in sales. Actual quality costs for 20x4 and 20x5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20x5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a one-period quality performance report for 20x5 that compares the actual quality costs of 20x4 with the actual costs of 20x5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20x1 through 20x5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second five-year plan to reduce quality costs to 2.5 percent of sales. Prepare a long-range quality cost performance report assuming sales of 15 million at the end of five years. Assume that the final planned relative distribution of quality costs is as follows: proofreading, 50 percent; other inspection, 13 percent; quality training, 30 percent; and quality reporting, 7 percent.arrow_forwardCarmichael Corporation is in the process of preparing next years budget. The pro forma income statement for the current year is as follows: Required: 1. What is the break-even sales revenue (rounded to the nearest dollar) for Carmichael Corporation for the current year? 2. For the coming year, the management of Carmichael Corporation anticipates an 8 percent increase in variable costs and a 60,000 increase in fixed expenses. What is the break-even point in dollars for next year? (CMA adapted)arrow_forward

- The Sea Wharf Restaurant would like to determine the best way to allocate a monthly advertising budget of 1,000 between newspaper advertising and radio advertising. Management decided that at least 25% of the budget must be spent on each type of media and that the amount of money spent on local newspaper advertising must be at least twice the amount spent on radio advertising. A marketing consultant developed an index that measures audience exposure per dollar of advertising on a scale from 0 to 100, with higher values implying greater audience exposure. If the value of the index for local newspaper advertising is 50 and the value of the index for spot radio advertising is 80, how should the restaurant allocate its advertising budget to maximize the value of total audience exposure? a. Formulate a linear programming model that can be used to determine how the restaurant should allocate its advertising budget in order to maximize the value of total audience exposure. b. Develop a spreadsheet model and solve the problem using Excel Solver.arrow_forwardFriendly Bank is attempting to determine the cost behavior of its small business lending operations. One of the major activities is the application activity. Two possible activity drivers have been mentioned: application hours (number of hours to complete the application) and number of applications. The bank controller has accumulated the following data for the setup activity: Required: 1. Estimate a regression equation with application hours as the activity driver and the only independent variable. If the bank forecasts 2,600 application hours for the next month, what will be the budgeted application cost? 2. Estimate a regression equation with number of applications as the activity driver and the only independent variable. If the bank forecasts 80 applications for the next month, what will be the budgeted application cost? 3. Which of the two regression equations do you think does a better job of predicting application costs? Explain. 4. Run a multiple regression to determine the cost equation using both activity drivers. What are the budgeted application costs for 2,600 application hours and 80 applications?arrow_forwardThe sales department of Macro Manufacturing Co. has forecast sales for its single product to be 20,000 units for June, with three-quarters of the sales expected in the East region and one-fourth in the West region. The budgeted selling price is 25 per unit. The desired ending inventory on June 30 is 2,000 units, and the expected beginning inventory on June 1 is 3,000 units. Prepare the following: a. A sales budget for June. b. A production budget for June.arrow_forward

- Cloud Shoes manufactures recovery sandals and is planning on producing 12.000 units in March and 11,500 in April. Each sandal requires 1.2 yards if material, which costs $3.00 per yard. The companys policy is to have enough material on hand to equal 15% of next months production needs and to maintain a finished goods inventory equal to 20% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forwardCASH BUDGETING Helen Bowers, owner of Helens Fashion Designs, is planning to request a line of credit from her bank. She has estimated the following sales forecasts for the firm for parts of 2019 and 2020: Estimates regarding payments obtained from the credit department are as follows: collected within the month of sale, 10%; collected the month following the sale, 75%; collected the second month following the sale, 15%. Payments for labor and raw materials are made the month after these services were provided. Here are the estimated costs of labor plus raw materials: General and administrative salaries are approximately 27,000 a month. Lease payments under long-term leases are 9,000 a month. Depreciation charges are 36,000 a month. Miscellaneous expenses are 2,700 a month. Income tax payments of 63,000 are due in September and December. A progress payment of 180,000 on a new design studio must be paid in October. Cash on hand on July 1 will be 132,000, and a minimum cash balance of 90,000 should be maintained throughout the cash budget period. a. Prepare a monthly cash budget for the last 6 months of 2019. b. Prepare monthly estimates of the required financing or excess fundsthat is, the amount of money Bowers will need to borrow or will have available to invest. c. Now suppose receipts from sales come in uniformly during the month (that is, cash receipts come in at the rate of 1/30 each day), but all outflows must be paid on the 5th. Will this affect the cash budget? That is, will the cash budget you prepared be valid under these assumptions? If not, what could be done to make a valid estimate of the peak financing requirements? No calculations are required, although if you prefer, you can use calculations to illustrate the effects. d. Bowers sales are seasonal, and her company produces on a seasonal basis, just ahead of sales. Without making any calculations, discuss how the companys current and debt ratios would vary during the year if all financial requirements were met with short-term bank loans. Could changes in these ratios affect the firms ability to obtain bank credit? Explain.arrow_forwardSunrise Poles manufactures hiking poles and is planning on producing 4,000 units in March and 3,700 in April. Each pole requires a half pound of material, which costs $1.20 per pound. The companys policy is to have enough material on hand to equal 10% of the next months production needs and to maintain a finished goods inventory equal to 25% of the next months production needs. What is the budgeted cost of purchases for March?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning