Concept explainers

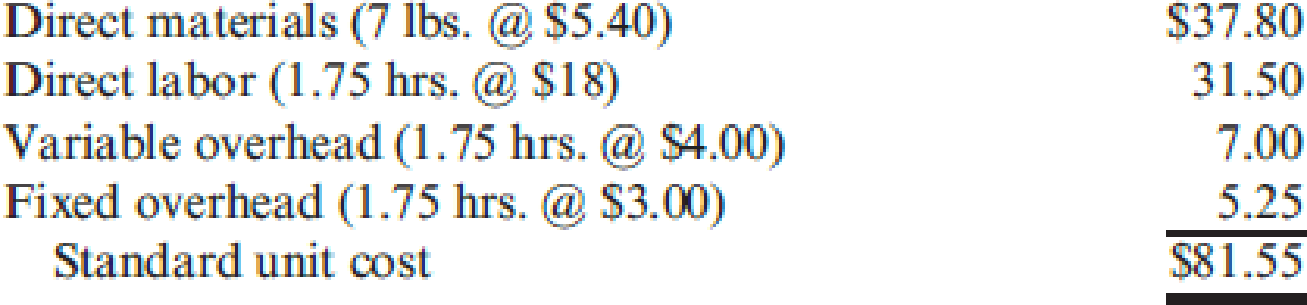

Petrillo Company produces engine parts for large motors. The company uses a

During the year, Petrillo had the following activity related to valve production:

- a. Production of valves totaled 20,600 units.

- b. A total of 135,400 pounds of direct materials was purchased at $5.36 per pound.

- c. There were 10,000 pounds of direct materials in beginning inventory (carried at $5.40 per pound). There was no ending inventory.

- d. The company used 36,500 direct labor hours at a total cost of $656,270.

- e. Actual fixed

overhead totaled $110,000. - f. Actual variable overhead totaled $168,000.

Petrillo produces all of its valves in a single plant. Normal activity is 20,000 units per year. Standard overhead rates are computed based on normal activity measured in standard direct labor hours.

Required:

- 1. Compute the direct materials price and usage variances.

- 2. Compute the direct labor rate and efficiency variances.

- 3. Compute overhead variances using a two-

variance analysis . - 4. Compute overhead variances using a four-variance analysis.

- 5. Assume that the purchasing agent for the valve plant purchased a lower-quality direct material from a new supplier. Would you recommend that the company continue to use this cheaper direct material? If so, what standards would likely need revision to reflect this decision? Assume that the end product’s quality is not significantly affected.

- 6. Prepare all possible

journal entries (assuming a four-variance analysis of overhead variances).

1.

Compute the direct materials price variance and the direct materials usage variance.

Explanation of Solution

Direct material price variance: The variation in between actual price and estimated price paid for materials multiplied by the actual quantity is called material price variance. It is used to determine difference in price paid for material the price that was supposed to be paid for material.

The following formula is used to calculate direct material price variance:

Direct material usage (efficiency) variance: It is a measure that determines the variation in between actual and standard quantity of input multiplied by the standard unit price is called material usage variance.

The following formula is used to calculate direct material usage variance:

Compute the direct materials price variance:

Compute the direct materials usage variance:

Working note 1: Calculate the standard quantity:

Working note 2: Calculate the actual quantity:

Therefore, the direct materials price variance and the usage variance is $5,416 F and $6,480 U respectively.

2.

Calculate the direct labor rate variance and labor efficiency variance.

Explanation of Solution

Direct Labor Rate Variance: The direct labor rate variance is a measure to determine the variation in the estimated cost of the direct labor and the actual cost of the direct labor and is multiplied by the actual hours is called direct labor rate variance.

The following formula is used to calculate the direct labor rate variance:

Direct labor efficiency variance is a measure that determines the difference between the estimated labor hours and the actual labor hours used and is multiplied by the standard rate per hour is called material usage variance.

The following formula is used to calculate direct labor efficiency variance:

Calculate the direct labor rate variance:

Calculate the labor efficiency variance:

Working note 3: Calculate the standard hours:

Therefore, the direct labor rat variance and the efficiency variance are $730 F and $8,100 U respectively.

3.

Calculate the overhead variances using two variance analysis.

Explanation of Solution

Calculate the overhead variances using two variance analysis:

Budget variance:

Working note 4: Calculate the actual overhead:

Working note 5: Calculate the budgeted overhead:

Step 1: Calculate the budgeted fixed overhead.

Step 2: Calculate the budgeted variable overhead.

Step 3: Calculate the total budgeted overhead.

Volume variance:

Step 1: Compute the applied fixed overhead.

Step 2: Compute the volume variance.

Working note 5: Calculate the standard hours:

Therefore, the budgeted and volume variance are $28,800 U and $3,150 F respectively.

4.

Calculate the overhead variances using a four-variance analysis.

Explanation of Solution

Overhead Variance: The overhead variance is the difference arising between the real overhead consumed in the production of a product, and the estimated overhead determined in the production of that product.

Calculate the overhead variances using a four-variance analysis:

Step 1: Compute the budgeted variable overhead cost.

Step 2: Compute the variable overhead spending variance.

Compute the variable overhead efficiency variance:

Step 1: Compute the applied variable overhead.

Step 2: Compute the variable overhead efficiency variance.

Working note 6: Calculate the direct labor hour per unit:

Working note 7: Calculate the actual direct labor hours:

Therefore, the variable overhead spending and efficiency variance are $22,000 U and $1,800 U respectively.

5.

Explain whether the company continues to purchases cheaper direct materials if so indicate the standard need revision to reflect this decision.

Explanation of Solution

The company would not continue to purchase low –quality materials because it affects the company. The budgeted cost of direct materials at the 20,600 units’ production level is $778,680

6.

Prepare journal entries (four-variance analysis of overhead variances).

Explanation of Solution

Journalizing: It is the process of recording the transactions of an organization in a chronological order. Based on these journal entries recorded, the amounts are posted to the relevant ledger accounts.

Accounting rules for journal entries:

- To increase balance of the account: Debit assets, expenses, losses and credit all liabilities, capital, revenue and gains.

- To decrease balance of the account: Credit assets, expenses, losses and debit all liabilities, capital, revenue and gains.

Prepare journal entries (four-variance analysis of overhead variances):

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Direct Materials | 731,160 | ||

| Direct Materials Price variance | 5,416 | ||

| Accounts Payable | 725,744 | ||

| (To record the purchase of direct materials) | |||

| Work in Process | 778,680 | ||

| Direct Materials Usage Variance | 6,480 | ||

| Direct Materials | 785,160 | ||

| (To record the usage of direct materials) | |||

| Work in Process | 648,900 | ||

| Direct Labor Efficiency Variance | 8,100 | ||

| Direct Labor Rate Variance | 730 | ||

| Wages Payable | 656,270 | ||

| (To record the use of direct labor) | |||

| Cost of Goods Sold | 13,850 | ||

| Direct Labor Rate Variance | 730 | ||

| Direct Materials Usage Variance | 6,480 | ||

| Direct Labor Efficiency Variance | 8,100 | ||

| (To record the use of direct material and labor variances) | |||

| Direct Materials Price variance | 5,416 | ||

| Cost of Goods Sold | 5,416 | ||

| (To close the direct materials price variance) | |||

| Variable Overhead Control | 168,000 | ||

| Miscellaneous Accounts | 168,000 | ||

| (To record incurrence of actual overhead) | |||

| Fixed Overhead Control | 110,000 | ||

| Miscellaneous Accounts | 110,000 | ||

| (To record incurrence of actual overhead) | |||

| Work in Process | 144,200 | ||

| Variable Overhead Control | 144,200 | ||

| (To close the overhead variances) | |||

| Work in Process | 108,150 | ||

| Fixed Overhead Control | 108,150 | ||

| (To close the overhead variances) | |||

| Variable Overhead Spending Variance | 22,000 | ||

| Variable Overhead Efficiency Variance | 1,800 | ||

| Fixed Overhead Spending Variance | 5,000 | ||

| Fixed Overhead Volume Variance | 3,150 | ||

| Fixed Overhead Control | 1,850 | ||

| Variable Overhead Control | 23,800 | ||

| (To close the overhead variances) | |||

| Cost of Goods Sold | 28,800 | ||

| Variable Overhead Efficiency Variance | 1,800 | ||

| Fixed Overhead Spending Variance | 5,000 | ||

| Variable Overhead Spending Variance | 22,000 | ||

| (To close the overhead variances) | |||

| Fixed Overhead Volume Variance | 3,150 | ||

| Cost of Goods Sold | 3,150 | ||

| (To close the cost of goods sold) |

Table (1)

Want to see more full solutions like this?

Chapter 9 Solutions

CengageNOWv2, 1 term Printed Access Card for Hansen/Mowen’s Cornerstones of Cost Management, 4th

- The Lubbock plant of Morrils Small Motor Division produces a major subassembly for a 6.0 horsepower motor for lawn mowers. The plant uses a standard costing system for production costing and control. The standard cost sheet for the subassembly follows: During the year, the Lubbock plant had the following actual production activity: (a) Production of motors totaled 50,000 units, (b) The company used 82,000 direct labor hours at a total cost of 1,066,000. (c) Actual fixed overhead totaled 556,000. (d) Actual variable overhead totaled 860,000. The Lubbock plants practical activity is 60,000 units per year. Standard overhead rates are computed based on practical activity measured in standard direct labor hours. Required: 1. Compute the variable overhead spending and efficiency variances. 2. CONCEPTUAL CONNECTION Compute the fixed overhead spending and volume variances. Interpret the volume variance. What can be done to reduce this variance?arrow_forwardThe Lubbock plant of Morrils Small Motor Division produces a major subassembly for a 6.0 horsepower motor for lawnmowers. The plant uses a standard costing system for production costing and control. The standard cost sheet for the subassembly follows: During the year, the Lubbock plant had the following actual production activity: a. Production of subassemblies totaled 50,000 units. b. A total of 260,000 pounds of raw materials was purchased at 4.70 per pound. c. There were 60,000 pounds of raw materials in beginning inventory (carried at 5 per lb.) There was no ending inventory. d. The company used 82,000 direct labor hours at a total cost of 1,066,000. The Lubbock plants practical activity is 60,000 units per year. Standard overhead rates are computed based on practical activity measured in standard direct labor hours. Required: 1. CONCEPTUAL CONNECTION Compute the materials price and usage variances. Of the two materials variances, which is viewed as the more controllable? To whom would you assign responsibility for the usage variance in this case? Explain. 2. CONCEPTUAL CONNECTION Compute the labor rate and efficiency variances. Who is usually responsible for the labor efficiency variance? What are some possible causes for this variance? 3. CONCEPTUAL CONNECTION Assume that the purchasing agent for the small motors plant purchased a lower-quality raw material from a new supplier. Would you recommend that the plant continue to use this cheaper raw material? If so, what standards would likely need revision to reflect this decision? Assume that the end products quality is not significantly affected. 4. Prepare all possible journal entries.arrow_forwardBox Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forward

- Box Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardCarsen Company produces handcrafted pottery that uses two inputs: materials and labor. During the past quarter, 24,000 units were produced, requiring 96,000 pounds of materials and 48,000 hours of labor. An engineering efficiency study commissioned by the local university revealed that Carsen can produce the same 24,000 units of output using either of the following two combinations of inputs: The cost of materials is 8 per pound; the cost of labor is 12 per hour. Required: 1. Compute the output-input ratio for each input of Combination F1. Does this represent a productivity improvement over the current use of inputs? What is the total dollar value of the improvement? Classify this as a technical or an allocative efficiency improvement. 2. Compute the output-input ratio for each input of Combination F2. Does this represent a productivity improvement over the current use of inputs? Now, compare these ratios to those of Combination F1. What has happened? 3. Compute the cost of producing 24,000 units of output using Combination F1. Compare this cost to the cost using Combination F2. Does moving from Combination F1 to Combination F2 represent a productivity improvement? Explain.arrow_forwardWyandotte Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 256,900, direct labor cost was 176,000, and overhead cost was 308,400. There were 40,000 units produced. Required: 1. Calculate the total cost of direct materials used in production. 2. Calculate the cost of goods manufactured. Calculate the unit manufacturing cost. 3. Of the unit manufacturing cost calculated in Requirement 2, 6.62 is direct materials and 7.71 is overhead. What is the prime cost per unit? Conversion cost per unit?arrow_forward

- Brees, Inc., a manufacturer of golf carts, has just received an offer from a supplier to provide 2,600 units of a component used in its main product. The component is a track assembly that is currently produced internally. The supplier has offered to sell the track assembly for 66 per unit. Brees is currently using a traditional, unit-based costing system that assigns overhead to jobs on the basis of direct labor hours. The estimated traditional full cost of producing the track assembly is as follows: Prior to making a decision, the companys CEO commissioned a special study to see whether there would be any decrease in the fixed overhead costs. The results of the study revealed the following: 3 setups1,160 each (The setups would be avoided, and total spending could be reduced by 1,160 per setup.) One half-time inspector is needed. The company already uses part-time inspectors hired through a temporary employment agency. The yearly cost of the part-time inspectors for the track assembly operation is 12,300 and could be totally avoided if the part were purchased. Engineering work: 470 hours, 45/hour. (Although the work decreases by 470 hours, the engineer assigned to the track assembly line also spends time on other products, and there would be no reduction in his salary.) 75 fewer material moves at 30 per move. Required: 1. Ignore the special study, and determine whether the track assembly should be produced internally or purchased from the supplier. 2. Now, using the special study data, repeat the analysis. 3. Discuss the qualitative factors that would affect the decision, including strategic implications. 4. After reviewing the special study, the controller made the following remark: This study ignores the additional activity demands that purchasing would cause. For example, although the demand for inspecting the part on the production floor decreases, we may need to inspect the incoming parts in the receiving area. Will we actually save any inspection costs? Is the controller right?arrow_forwardCool Pool has these costs associated with production of 20,000 units of accessory products: direct materials, $70; direct labor, $110; variable manufacturing overhead, $45; total fixed manufacturing overhead, $800,000. What is the cost per unit under both the variable and absorption methods?arrow_forwardThe following product costs are available for Stellis Company on the production of erasers: direct materials, $22,000; direct labor, $35,000; manufacturing overhead, $17,500; selling expenses, $17,600; and administrative expenses; $13,400. What are the prime costs? What are the conversion costs? What is the total product cost? What is the total period cost? If 13,750 equivalent units are produced, what is the equivalent material cost per unit? If 17,500 equivalent units are produced, what is the equivalent conversion cost per unit?arrow_forward

- Algers Company produces dry fertilizer. At the beginning of the year, Algers had the following standard cost sheet: Algers computes its overhead rates using practical volume, which is 54,000 units. The actual results for the year are as follows: a. Units produced: 53,000 b. Direct materials purchased: 274,000 pounds at 2.50 per pound c. Direct materials used: 270,300 pounds d. Direct labor: 40,100 hours at 17.95 per hour e. Fixed overhead: 161,700 f. Variable overhead: 122,000 Required: 1. Compute price and usage variances for direct materials. 2. Compute the direct labor rate and labor efficiency variances. 3. Compute the fixed overhead spending and volume variances. Interpret the volume variance. 4. Compute the variable overhead spending and efficiency variances. 5. Prepare journal entries for the following: a. The purchase of direct materials b. The issuance of direct materials to production (Work in Process) c. The addition of direct labor to Work in Process d. The addition of overhead to Work in Process e. The incurrence of actual overhead costs f. Closing out of variances to Cost of Goods Soldarrow_forwardMoleno Company produces a single product and uses a standard cost system. The normal production volume is 120,000 units; each unit requires 5 direct labor hours at standard. Overhead is applied on the basis of direct labor hours. The budgeted overhead for the coming year is as follows: At normal volume. During the year, Moleno produced 118,600 units, worked 592,300 direct labor hours, and incurred actual fixed overhead costs of 2,150,400 and actual variable overhead costs of 1,422,800. Required: 1. Calculate the standard fixed overhead rate and the standard variable overhead rate. 2. Compute the applied fixed overhead and the applied variable overhead. What is the total fixed overhead variance? Total variable overhead variance? 3. CONCEPTUAL CONNECTION Break down the total fixed overhead variance into a spending variance and a volume variance. Discuss the significance of each. 4. CONCEPTUAL CONNECTION Compute the variable overhead spending and efficiency variances. Discuss the significance of each.arrow_forwardApril Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub