Concept explainers

Candyland uses

- 1. What denominator level is Candyland using to allocate fixed

manufacturing costs to the candy? How is Candyland disposing of any favorable or unfavorable production-volume variance at the end of the year? Explain your answer briefly. - 2. How did Candyland’s accountants arrive at the breakeven volume of 25,000 units?

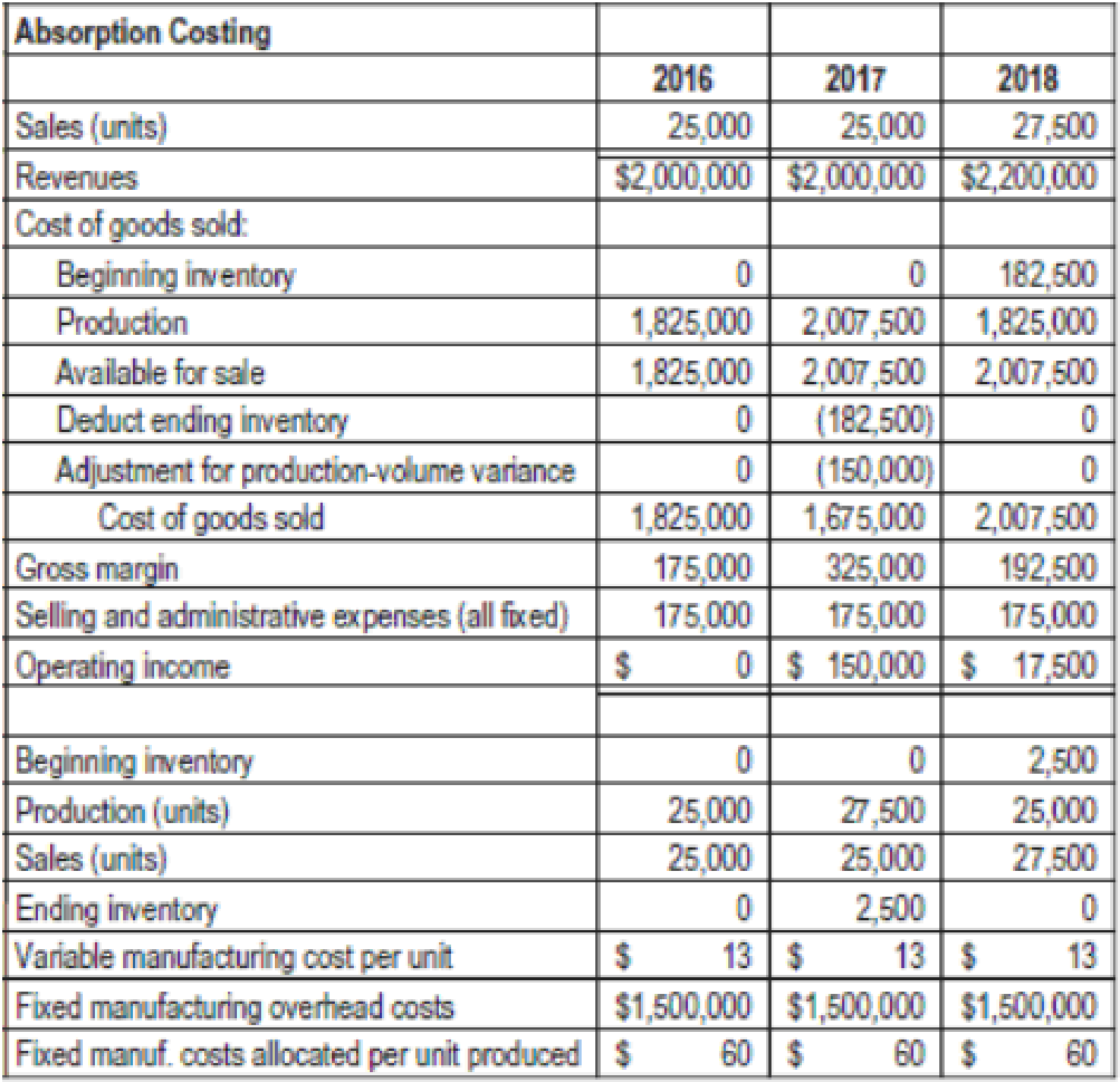

- 3. Prepare a variable costing-based income statement for each year. Explain the variation in variable costing operating income for each year based on contribution margin per unit and sales volume.

- 4. Reconcile the operating incomes under variable costing and absorption costing for each year, and use this information to explain to Jack McCay the positive operating income in 2017 and the drop in operating income in 2018.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

COST ACCOUNTING TTU >IC<

- Jadlow Company produces handcrafted leather purses. Virtually all of the manufacturing cost consists of materials and labor. Over the past several years, profits have been declining because the cost of the two major inputs has been increasing. Janice Jadlow, the president of the company, has indicated that the price of the purses cannot be increased; thus, the only way to improve or at least stabilize profits is to increase overall productivity. At the beginning of 20x2, Janice implemented a new cutting and assembly process that promised less materials waste and a faster production time. At the end of 20x2, Janice wants to know how much profits have changed from the prior year because of the new process. In order to provide this information to Janice, the controller of the company gathered the following data: Required: 1. Compute the productivity profile for each year. Comment on the effectiveness of the new production process. 2. Compute the increase in profits attributable to increased productivity. 3. Calculate the price-recovery component, and comment on its meaning.arrow_forwardKimball Company has developed the following cost formulas: Materialusage:Ym=80X;r=0.95Laborusage(direct):Yl=20X;r=0.96Overheadactivity:Yo=350,000+100X;r=0.75Sellingactivity:Ys=50,000+10X;r=0.93 where X=Directlaborhours The company has a policy of producing on demand and keeps very little, if any, finished goods inventory (thus, units produced equals units sold). Each unit uses one direct labor hour for production. The president of Kimball Company has recently implemented a policy that any special orders will be accepted if they cover the costs that the orders cause. This policy was implemented because Kimballs industry is in a recession and the company is producing well below capacity (and expects to continue doing so for the coming year). The president is willing to accept orders that minimally cover their variable costs so that the company can keep its employees and avoid layoffs. Also, any orders above variable costs will increase overall profitability of the company. Required: 1. Compute the total unit variable cost. Suppose that Kimball has an opportunity to accept an order for 20,000 units at 220 per unit. Should Kimball accept the order? (The order would not displace any of Kimballs regular orders.) 2. Explain the significance of the coefficient of correlation measures for the cost formulas. Did these measures have a bearing on your answer in Requirement 1? Should they have a bearing? Why or why not? 3. Suppose that a multiple regression equation is developed for overhead costs: Y = 100,000 + 100X1 + 5,000X2 + 300X3, where X1 = direct labor hours, X2 = number of setups, and X3 = engineering hours. The coefficient of determination for the equation is 0.94. Assume that the order of 20,000 units requires 12 setups and 600 engineering hours. Given this new information, should the company accept the special order referred to in Requirement 1? Is there any other information about cost behavior that you would like to have? Explain.arrow_forwardIngles Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Ingles, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufactured table top and attaches the four purchased table legs. It takes 16 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40 percent of next months sales are in the finished goods inventory. Ingles also purchases sufficient materials to ensure that materials inventory is 60 percent of the following months scheduled production. Ingless sales budget in units for the next quarter is as follows: Ingless ending inventories in units for July 31 are as follows: Required: 1. Calculate the number of tables to be produced during August. 2. Disregarding your response to Requirement 1, assume the required production units for August and September are 2,100 and 1,900, respectively, and the July 31 materials inventory is 4,000 units. Compute the number of table legs to be purchased in August. 3. Assume that Ingles Corporation will produce 2,340 units in September. How many employees will be required for the Assembly Department in September? (Fractional employees are acceptable since employees can be hired on a part-time basis. Assume a 40-hour week and a 4-week month.) (CMA adapted)arrow_forward

- The Chocolate Baker specializes in chocolate baked goods. The firm has long assessed the profitability of a product line by comparing revenues to the cost of goods sold. However, Barry White, the firms new accountant, wants to use an activity-based costing system that takes into consideration the cost of the delivery person. Following are activity and cost information relating to two of Chocolate Bakers major products: Using activity-based costing, which of the following statements is correct? a. The muffins are 2,000 more profitable. b. The cheesecakes are 75 more profitable. c. The muffins are 1,925 more profitable. d. The muffins have a higher profitability as a percentage of sales and, therefore, are more advantageous.arrow_forwardBienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardOrman Company produces neon-colored covers for tablets (e.g., iPads). For last year, Orman reported the following: Last year, Orman produced 89,000 units and sold 90,500 units at 10.50 per unit. Required: 1. Prepare a statement of cost of goods manufactured. 2. Prepare an absorption-costing income statement.arrow_forward

- Shannon, Inc., has two divisions. One produces and sells paper party supplies (napkins, paper plates, invitations); the other produces and sells cookware. A segmented income statement for the most recent quarter is given below: On seeing the quarterly statement, Madge Shannon, president of Shannon, Inc., was distressed and discussed her disappointment with Bob Ferguson, the companys vice president of finance. MADGE: The Party Supplies Division is killing us. Its not even covering its own fixed costs. Im beginning to believe that we should shut down that division. This is the seventh consecutive quarter it has failed to provide a positive segment margin. I was certain that Paula Kelly could turn it around. But this is her third quarter, and she hasnt done much better than the previous divisional manager. BOB: Well, before you get too excited about the situation, perhaps you should evaluate Paulas most recent proposals. She wants to spend 10,000 per quarter for the right to use familiar cartoon figures on a new series of invitations, plates, and napkins and at the same time increase the advertising budget by 25,000 per quarter to let the public know about them. According to her marketing people, sales should increase by 10 percent if the right advertising is doneand done quickly. In addition, Paula wants to lease some new production machinery that will increase the rate of production, lower labor costs, and result in less waste of materials. Paula claims that variable costs will be reduced by 30 percent. The cost of the lease is 95,000 per quarter. Upon hearing this news, Madge calmed considerably and, in fact, was somewhat pleased. After all, she was the one who had selected Paula and had a great deal of confidence in Paulas judgment and abilities. Required: 1. Assuming that Paulas proposals are sound, should Madge Shannon be pleased with the prospects for the Party Supplies Division? Prepare a segmented income statement for the next quarter that reflects the implementation of Paulas proposals. Assume that the Cookware Divisions sales increase by 5 percent for the next quarter and that the same cost relationships hold. 2. Suppose that everything materializes as Paula projected except for the 10 percent increase in salesno change in sales revenues takes place. Are the proposals still sound? What if the variable costs are reduced by 40 percent instead of 30 percent with no change in sales?arrow_forwardGaston Company manufactures furniture. One of its product lines is an economy-line kitchen table. During the last year, Gaston produced and sold 100,000 units for 100 per unit. Sales of the table are on a bid basis, but Gaston has always been able to win sufficient bids using the 100 price. This year, however, Gaston was losing more than its share of bids. Concerned, Larry Franklin, owner and president of the company, called a meeting of his executive committee (Megan Johnson, marketing manager; Fred Davis, quality manager; Kevin Jones, production manager; and Helen Jackson, controller). LARRY: I dont understand why were losing bids. Megan, do you have an explanation? MEGAN: Yes, as a matter of fact. Two competitors have lowered their price to 92 per unit. Thats too big a difference for most of our buyers to ignore. If we want to keep selling our 100,000 units per year, we will need to lower our price to 92. Otherwise, our sales will drop to about 20,000 to 25,000 per year. HELEN: The unit contribution margin on the table is 10. Lowering the price to 92 will cost us 8 per unit. Based on a sales volume of 100,000, wed make 200,000 in contribution margin. If we keep the price at 100, our contribution margin would be 200,000 to 250,000. If we have to lose, lets just take the lower market share. Its better than lowering our prices. MEGAN: Perhaps. But the same thing could happen to some of our other product lines. My sources tell me that these two companies are on the tail end of a major quality improvement programone that allows them significant savings. We need to rethink our whole competitive strategyat least if we want to stay in business. Ideally, we should match the price reduction and work to reduce the costs to recapture the lost contribution margin. FRED: I think I have something to offer. We are about to embark on a new quality improvement program of our own. I have brought the following estimates of the current quality costs for this economy line. As you can see, these costs run about 16 percent of current sales. Thats excessive, and we believe that they can be reduced to about 4 percent of sales over time. LARRY: This sounds good. Fred, how long will it take for you to achieve this reduction? FRED: All these costs vary with sales level, so Ill express their reduction rate in those terms. Our best guess is that we can reduce these costs by about 1 percent of sales per quarter. So it should take about 12 quarters, or three years, to achieve the full benefit. Keep in mind that this is with an improvement in quality. MEGAN: This offers us some hope. If we meet the price immediately, we can maintain our market share. Furthermore, if we can ever reach the point of reducing the price below the 92 level, then we can increase our market share. I estimate that we can increase sales by about 10,000 units for every 1 of price reduction beyond the 92 level. Kevin, how much extra capacity for this line do we have? KEVIN: We can handle an extra 30,000 or 40,000 tables per year. Required: 1. Assume that Gaston immediately reduces the bid price to 92. How long will it be before the unit contribution margin is restored to 10, assuming that quality costs are reduced as expected and that sales are maintained at 100,000 units per year (25,000 per quarter)? 2. Assume that Gaston holds the price at 92 until the 4 percent target is achieved. At this new level of quality costs, should the price be reduced? If so, by how much should the price be reduced, and what is the increase in contribution margin? Assume that price can be reduced only in 1 increments. 3. Assume that Gaston immediately reduces the price to 92 and begins the quality improvement program. Now, suppose that Gaston does not wait until the end of the three-year period before reducing prices. Instead, prices will be reduced when profitable to do so. Assume that prices can be reduced only by 1 increments. Identify when the first future price change should occur (if any). 4. Discuss the differences in viewpoints concerning the decision to decrease prices and the short-run contribution margin analysis done by Helen, the controller. Did quality cost information play an important role in the strategic decision making illustrated by the problem?arrow_forwardOttis, Inc., uses 640,000 plastic housing units each year in its production of paper shredders. The cost of placing an order is 30. The cost of holding one unit of inventory for one year is 15.00. Currently, Ottis places 160 orders of 4,000 plastic housing units per year. Required: 1. Compute the economic order quantity. 2. Compute the ordering, carrying, and total costs for the EOQ. 3. How much money does using the EOQ policy save the company over the policy of purchasing 4,000 plastic housing units per order?arrow_forward

- NoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Based solely on financial factors, explain why NoFat should accept or reject PUs special sales offer.arrow_forwardNoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that NoFat rejected PUs special sales offer because the 2.20 price suggested by PU was too low. In response to the rejection, PU asked NoFat to determine the price at which it would be willing to accept the special sales offer. For its regular sales, NoFat sets prices by marking up variable costs by 10%. If Allyson decides to use NoFats 10% markup pricing method to set the price for PUs special sales offer, a. Calculate the price that NoFat would charge PU for each pound of olestra. b. Calculate the relevant profit that NoFat would earn if it set the special sales price by using its markup pricing method. (Hint: Use the estimate of relevant costs that you calculated in response to Requirement 1b.) c. Explain why NoFat should accept or reject the special sales offer if it uses its markup pricing method to set the special sales price.arrow_forwardNoFat manufactures one product, olestra, and sells it to large potato chip manufacturers as the key ingredient in nonfat snack foods, including Ruffles, Lays, Doritos, and Tostitos brand products. For each of the past 3 years, sales of olestra have been far less than the expected annual volume of 125,000 pounds. Therefore, the company has ended each year with significant unused capacity. Due to a short shelf life, NoFat must sell every pound of olestra that it produces each year. As a result, NoFats controller, Allyson Ashley, has decided to seek out potential special sales offers from other companies. One company, Patterson Union (PU)a toxic waste cleanup companyoffered to buy 10,000 pounds of olestra from NoFat during December for a price of 2.20 per pound. PU discovered through its research that olestra has proven to be very effective in cleaning up toxic waste locations designated as Superfund Sites by the U.S. Environmental Protection Agency. Allyson was excited, noting that This is another way to use our expensive olestra plant! The annual costs incurred by NoFat to produce and sell 100,000 pounds of olestra are as follows: In addition, Allyson met with several of NoFats key production managers and discovered the following information: The special order could be produced without incurring any additional marketing or customer service costs. NoFat owns the aging plant facility that it uses to manufacture olestra. NoFat incurs costs to set up and clean its machines for each production run, or batch, of olestra that it produces. The total setup costs shown in the previous table represent the production of 20 batches during the year. NoFat leases its plant machinery. The lease agreement is negotiated and signed on the first day of each year. NoFat currently leases enough machinery to produce 125,000 pounds of olestra. PU requires that an independent quality team inspects any facility from which it makes purchases. The terms of the special sales offer would require NoFat to bear the 1,000 cost of the inspection team. Assume for this question that Allysons relevant analysis reveals that NoFat would earn a positive relevant profit of 10,000 from the special sale (i.e., the special sales alternative). However, after conducting this traditional, short-term relevant analysis, Allyson wonders whether it might be more profitable over the long term to downsize the company by reducing its manufacturing capacity (i.e., its plant machinery and plant facility). She is aware that downsizing requires a multiyear time horizon because companies usually cannot increase or decrease fixed plant assets every year. Therefore, Allyson has decided to use a 5-year time horizon in her long-term decision analysis. She has identified the following information regarding capacity downsizing (i.e., the downsizing alternative): The plant facility consists of several buildings. If it chooses to downsize its capacity, NoFat can immediately sell one of the buildings to an adjacent business for 30,000. If it chooses to downsize its capacity, NoFats annual lease cost for plant machinery will decrease to 9,000. Therefore, Allyson must choose between these two alternatives: Accept the special sales offer each year and earn a 10,000 relevant profit for each of the next 5 years or reject the special sales offer and downsize as described above. Assume that NoFat pays for all costs with cash. Also, assume a 10% discount rate, a 5-year time horizon, and all cash flows occur at the end of the year. Using an NPV approach to discount future cash flows to present value, a. Calculate the NPV of accepting the special sale with the assumed positive relevant profit of 10,000 per year (i.e., the special sales alternative). b. Calculate the NPV of downsizing capacity as previously described (i.e., the downsizing alternative). c. Based on the NPV of Requirements 5a and 5b, identify and explain which of these two alternatives is best for NoFat to pursue in the long term.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT