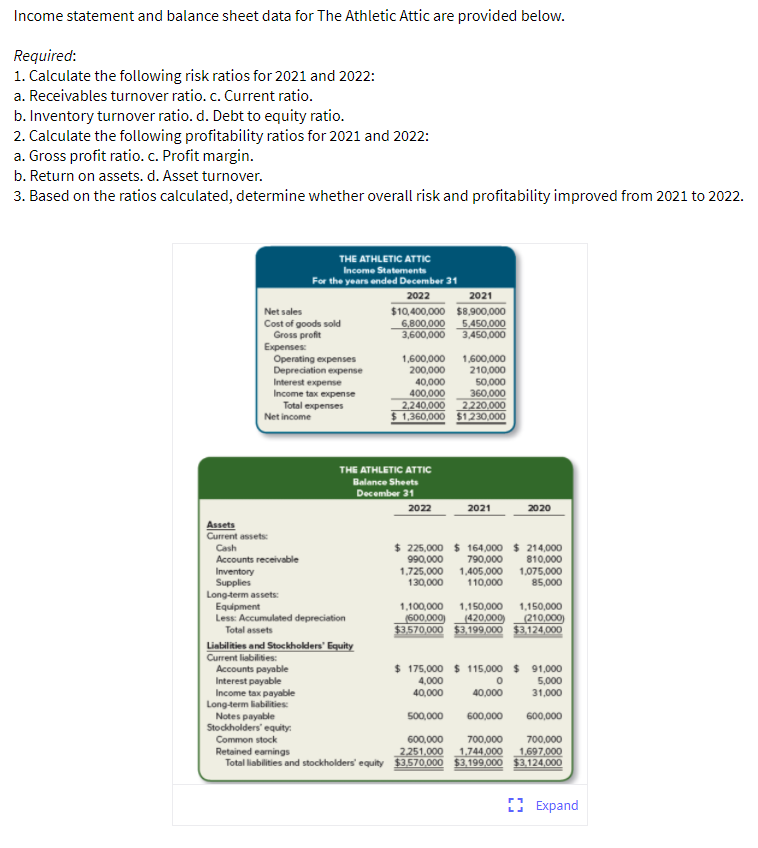

Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. c. Current ratio. b. Inventory turnover ratio. d. Debt to equity ratio.

Income statement and balance sheet data for The Athletic Attic are provided below. Required: 1. Calculate the following risk ratios for 2021 and 2022: a. Receivables turnover ratio. c. Current ratio. b. Inventory turnover ratio. d. Debt to equity ratio.

Chapter5: Evaluating Operating And Financial Performance

Section: Chapter Questions

Problem 2EP

Related questions

Question

Is this question, you guys have it answered already it just doesn't let me use it of the 5 free question.

Transcribed Image Text:Income statement and balance sheet data for The Athletic Attic are provided below.

Required:

1. Calculate the following risk ratios for 2021 and 2022:

a. Receivables turnover ratio. c. Current ratio.

b. Inventory turnover ratio. d. Debt to equity ratio.

2. Calculate the following profitability ratios for 2021 and 2022:

a. Gross profit ratio. c. Profit margin.

b. Return on assets. d. Asset turnover.

3. Based on the ratios calculated, determine whether overall risk and profitability improved from 2021 to 2022.

THE ATHLETIC ATTIC

Income Statements

For the years ended December 31

2022

2021

Net sales

$10,400,000 $8,900,000

Cost of goods sold

Gross profit

Еxpenses

Operating expenses

Depreciation expense

Interest expense

Income tax expense

6,800,000 5,450,000

3,600,000

3,450,000

1,600,000

200,000

40,000

400,000

2,240,000

1,360,000 $1230,000

1,600,000

210,000

50,000

360,000

2220,000

Total expenses

Net income

THE ATHLETIC ATTIC

Balance Sheets

December 31

2022

2021

2020

Assets

Current assets:

Cash

Accounts receivable

990,000

1,725,000

130,000

$ 225,000 $ 164,000 $ 214,000

790,000

1,405,000

110,000

810,000

1,075,000

85,000

Inventory

Supplies

Long-term assets:

Equipment

Less: Accumulated depreciation

Total assets

1,100,000

(600,000)

1,150,000

1,150,000

(420,000)

$3.570,000 $3,199,000 $3.124,000

(210,000)

Linbilities and Stockhokders' Equity

Current liabilities:

$ 175,000 $ 115,000 $ 91,000

4,000

40,000

Accounts payable

Interest payable

Income tax payable

Long-term liabilities:

Notes payable

Stodkholders' equity:

Common stock

5,000

31,000

40,000

500,000

600,000

600,000

600,000

700,000

700,000

Retained earnings

1,744,000

2251.000

Total liabilities and stockholders' equity $3570,000 $3.199,000 $3.124,000

1,697.000

E Expand

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning