Essentials Of Investments

11th Edition

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Chapter1: Investments: Background And Issues

Section: Chapter Questions

Problem 1PS

Related questions

Question

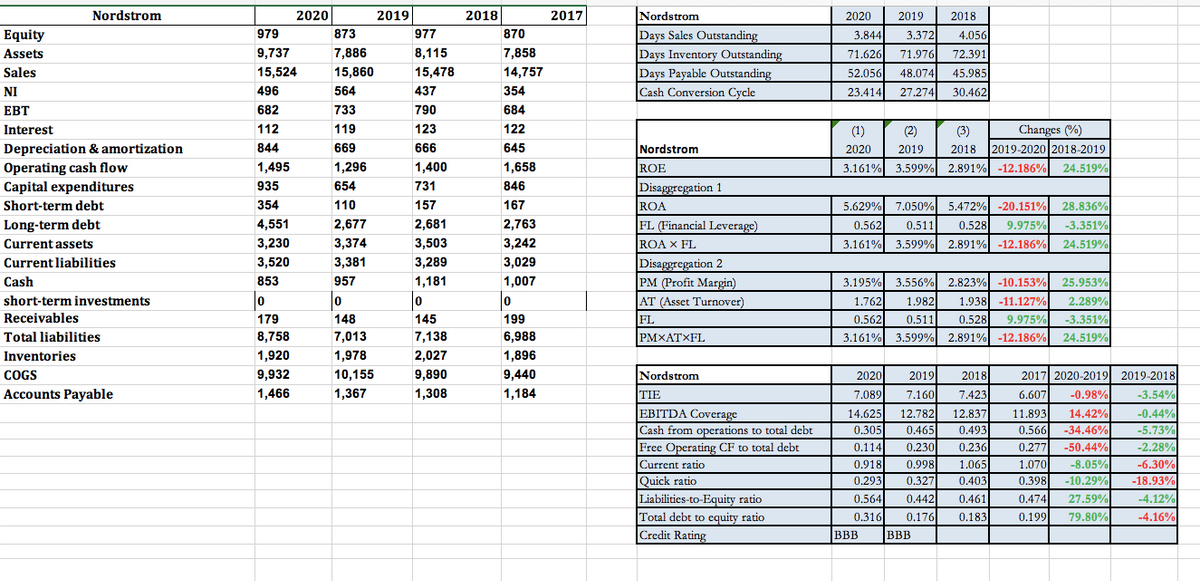

Discuss on Credit Risk of Nordstrom

Time-series analysis

Analyze credit risk in the past and current years (You may obtain information about firms’ credit ratings from financial articles as well); trend analysis

Cross-sectional analysis

- How do you think about current and

Discuss on Profitability:

- Time-series analysis

Analyze profitability in the past and current years;

Can you find patterns or trends over the three years?

Cross-sectional analysis

Transcribed Image Text:Nordstrom

2020

2019

2018

2017

Nordstrom

2020

2019

2018

873

977

870

Days Sales Outstanding

Days Inventory Outstanding

Days Payable Outstanding

Cash Conversion Cycle

Equity

979

3.844

3.372

4.056

Assets

9,737

7,886

8,115

7,858

71.626

71.976

72.391

Sales

15,524

15,860

15,478

14,757

52.056

48.074

45.985

NI

496

564

437

354

23.414

27.274

30.462

EBT

682

733

790

684

Interest

112

119

123

122

(1)

(2)

(3)

Changes (%)

Depreciation & amortization

Operating cash flow

Capital expenditures

844

669

666

645

Nordstrom

2020

2019

2018

2019-2020 2018-2019

1,495

1,296

1,400

1,658

ROE

3.161% 3.599% 2.891% -12.186%

24.519%

935

654

731

846

Disaggregation 1

Short-term debt

354

110

157

167

ROA

5.629%

7.050%

5.472% -20.151%

28.836%

Long-term debt

4,551

2,677

2,681

2,763

FL (Financial Leverage)

9.975%

-3.351%

0.562

0.511

0.528

Current assets

3,230

3,374

3,503

3,242

ROA x FL

3.161%

3.599% 2.891% -12.186%

24.519%

3,520

3,381

3,289

3,029

Disaggregation 2

PM (Profit Margin)

Current liabilities

Cash

853

957

1,181

1,007

3.195%

3.556% 2.823% -10.153%

25.953%

short-term investments

AT (Asset Turnover)

1.762

1.982

1.938 -11.127%

2.289%

Receivables

179

148

145

199

0.528

-3.351%

FL

PMXATXFL

0.562

0.511

9.975%

Total liabilities

8,758

7,013

7,138

6,988

3.161% 3.599% 2.891%| -12.186%

24.519%

Inventories

1,920

1,978

2,027

1,896

COGS

9,932

10,155

9,890

9,440

Nordstrom

2020

2019

2018

2017 2020-2019 2019-2018

Accounts Payable

1,466

1,367

1,308

1,184

7.423

-0.98%

14.42%

TIE

7.089

7.160

6.607

-3.54%

-0.44%

-5.73%

-2.28%

EBITDA Coverage

14.625

12.782

12.837

11.893

Cash from operations to total debt

Free Operating CF to total debt

Current ratio

Quick ratio

Liabilities-to-Equity ratio

0.305

0.465

0.493

0.566

-34.46%

0.114

0.230

0.236

0.277

-50.44%

0.918

0.998

1.065

1.070

-8.05%

-6.30%

0.293

0.327

0.403

0.398

-10.29%

-18.93%

27.59%

-4.12%

-4.16%

0.564

0.442

0.461

0.474

Total debt to equity ratio

0.316

0.176

0.183

0.199

79.80%

Credit Rating

BBB

BBB

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Essentials Of Investments

Finance

ISBN:

9781260013924

Author:

Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:

Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:

9780134897264

Author:

KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:

Pearson,

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i…

Finance

ISBN:

9780077861759

Author:

Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:

McGraw-Hill Education