Concept explainers

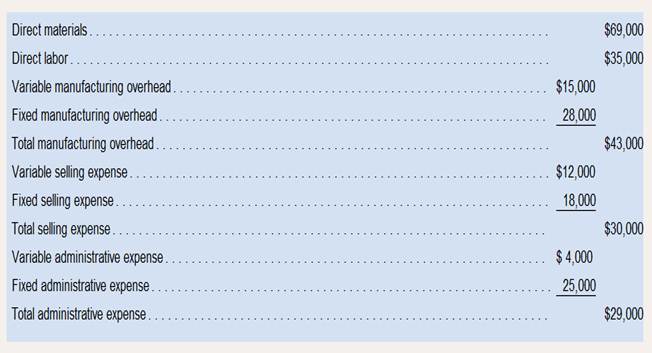

Different Cost Classifications for Different PurposesDozier Company produced and sold 1,000 units during its first month of operations. It reported the following costs and expenses for the month:

Required:

1. With respect to cost classifications for preparing financial statements:

a. What is the total product cost?

b. What is the total period cost?

2. With respect to cost classifications for assigning costs to cost objects:

a. What is total direct

b. What is the total indirect manufacturing cost?

3. With respect to cost classifications for manufacturers:

a. What is the total manufacturing cost?

b. What is the total nonmanufacturing cost?

c. What is the total conversion cost and prime cost?

4. With respect to cost classifications for predicting cost behaviour:

a. What is the total variable manufacturing cost?

b. What is the total fixed cost for the company as a whole?

c. What is the variable cost per unit produced and sold?

5. With respect to cost classifications for decision making:

a. If Dozier had produced 1,001 units instead of 1,000 units, how much incremental manufacturing cost would it have incurred to make the additional unit?

1.

(a)

To identify: The total product cost.

Product Cost: Product Cost is the total cost incurred to produce a product which includes cost of material used, labor cost and overhead.

Answer to Problem 24P

Solution:

Total product cost is $147,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Total manufacturing overhead is $43,000.

Formula to calculate total product cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $43,000 for total manufacturing overhead.

Hence, total product cost is $147,000.

(b)

To identify: The total period cost.

Period Costs: Period Costs is the cost incurred by the business except the cost of goods sold. Period costs are the expense of the same period in which it is incurred.

Answer to Problem 24P

Solution:

Total period cost is $59,000.

Explanation of Solution

Given,

Total selling expense is $30,000.

Total administrative expense is $29,000.

Formula to calculate total period cost,

Substitute $30,000 for total selling expense and $29,000 for total administrative expense.

Hence, total period cost is $59,000.

2.

(a)

To identify: The total direct manufacturing cost.

Direct manufacturing: Direct manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and direct expenses.

Answer to Problem 24P

Solution:

Total direct manufacturing cost is $119,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15,000.

Formula to calculate total direct manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $15,000 for total variable manufacturing overhead.

Hence, total direct manufacturing cost is $119,000.

(b)

To identify: The total indirect manufacturing cost.

Indirect manufacturing: Indirect manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and indirect expenses.

Answer to Problem 24P

Solution:

Total indirect manufacturing cost is $132,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Fixed manufacturing overhead is $28,000.

Formula to calculate total indirect manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $28,000 for total fixed manufacturing overhead.

Hence, total indirect manufacturing cost is $132,000.

3.

(a)

To identify: The total manufacturing cost.

Manufacturing Cost: Manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and manufacturing overheads.

Answer to Problem 24P

Solution:

Total manufacturing cost is $147,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Total manufacturing overhead is $43,000.

Formula to calculate total manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $43,000 for total manufacturing overhead.

Hence, total manufacturing cost is $147,000.

(b)

To identify: The total nonmanufacturing cost.

Nonmanufacturing: Nonmanufacturing cost is the cost which is not directly linked with the manufacturing of a product but it includes selling and administration expense.

Answer to Problem 24P

Solution:

Total nonmanufacturing cost is $59,000.

Explanation of Solution

Given,

Total selling expense is $30,000.

Total administrative expense is $29,000.

Formula to calculate total nonmanufacturing cost,

Substitute $30,000 for total selling expense and $29,000 for total administrative expense.

Hence, total nonmanufacturing cost is $59,000.

(c)

To identify: The total conversion cost and prime cost.

Prime Costs: Prime cost is the primary cost incurred to produce product, it is a sum total of direct material costs and direct manufacturing labor costs.

Conversion Costs: Conversion cost is the cost of transferring the raw material into finished product, it is sum total of direct manufacturing labor costs and manufacturing overhead costs.

Answer to Problem 24P

Solution:

Total conversion cost is $78,000 and prime cost is $104,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Total manufacturing overhead is $43,000.

Formula to calculate total conversion cost,

Substitute $35,000 for direct labor and $43,000 for total manufacturing overhead.

Formula to calculate total prime cost,

Substitute $35,000 for direct labor and $69,000 for direct material.

Hence, conversion cost is $78,000 and prime cost is $104,000.

4.

(a)

To identify: The total variable manufacturing cost.

Variable manufacturing cost: Variable manufacturing cost is the total cost incurred to manufacture a product which includes cost of material used, labor cost and variable overheads.

Answer to Problem 24P

Solution:

Total variable manufacturing cost is $119,000.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15,000.

Formula to calculate total variable manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor and $15,000 for total variable manufacturing overhead.

Hence, total variable manufacturing cost is $119,000.

(b)

To identify: The total fixed cost.

Fixed Cost: Fixed cost refers the cost which remains constant for particular time duration and there is no effect of the level of production on it.

Answer to Problem 24P

Solution:

Total fixed cost is $71,000.

Explanation of Solution

Given,

Fixed selling expense is $18,000.

Fixed administrative expense is $25,000.

Fixed manufacturing overhead is $28,000.

Formula to calculate total fixed cost,

Substitute $18,000 for fixed selling expense, $25,000 for fixed administrative expense and $28,000 for total fixed manufacturing overhead.

Hence, total fixed cost is $71,000.

(c)

To identify: The variable cost per unit.

Variable Cost: Variable cost refers the cost which varies due to the change in the level of production. Higher the production level, higher is the variable cost, and lowers the production level, lower is the variable cost.

Answer to Problem 24P

Solution:

Variable cost per unit produced and sold is $135.

Explanation of Solution

Given,

Direct material is $69,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15,000.

Variable selling expense is $12,000.

Variable administrative expense is $4,000.

Units produced and sold are $1,000.

Formula to calculate variable cost per unit,

Substitute $69,000 for direct material, $35,000 for direct labor, $15,000 for total variable manufacturing overhead, $12,000 for variable selling expense, $4,000 for variable administrative expense and 1,000 for units produced and sold.

Hence, variable cost per unit produced and sold is $135.

5.

To identify: The incremental manufacturing cost.

Incremental Manufacturing cost: Incremental manufacturing cost is the increase in the total cost incurred to manufacture a product which includes the cost of material used, labor cost and manufacturing overheads.

Answer to Problem 24P

Solution: Total incremental manufacturing cost is $119.

Explanation of Solution

Given,

Direct material is $69,000.

Fixed manufacturing overhead is $28,000.

Direct labor is $35,000.

Variable manufacturing overhead is $15.

Formula to calculate per unit variable manufacturing cost,

Substitute $69,000 for direct material, $35,000 for direct labor, $15,000 for total variable manufacturing overhead and 1,000 for units produced and sold.

Only variable manufacturing cost will increase as fixed cost remains constant irrespective of units sold, therefore incremental manufacturing cost is equal to the variable cost per unit.

Hence, total incremental manufacturing cost is $119.

Want to see more full solutions like this?

Chapter 1 Solutions

Connect Access Card for Introduction to Managerial Accounting

- At the end of the first year of operations, 21,500 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardCost flow relationships The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Using the information given, determine the following missing amounts: A. Cost of goods sold B. Finished goods inventory at the end of the month C. Direct materials cost D. Direct labor cost E. Work in process inventory at the end of the montharrow_forward

- Absorption and variable costing income statements During the first month of operations ended July 31, YoSan Inc. manufactured 2,400 flat panel televisions, of which 2,000 were sold. Operating data for the month are summarized as follows: Instructions 1. Prepare an income statement based on the absorption costing concept. 2. Prepare an income statement based on the variable costing concept. 3. Explain the reason for the difference in the amount of operating income reported in (1) and (2).arrow_forwardCushing, Inc., costs products using a normal costing system. The following data are available for last year: Overhead is applied on the basis of direct labor hours. What was last years per unit product cost? a. 1.39 b. 4.40 c. 4.43 d. 3.01arrow_forwardOn October 31, the end of the first month of operations, Maryville Equipment Company prepared the following income statement, based on the variable costing concept: Prepare an income statement under absorption costing.arrow_forward

- Total and Unit Product Cost Martinez Manufacturing Inc. showed the following costs for last month: Last month, 4,000 units were produced and sold. Required: 1. Classify each of the costs as product cost or period cost. 2. What is the total product cost for last month? 3. What is the unit product cost for last month?arrow_forwardOReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardCicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forward

- The standard cost summary for the most popular product of Phenom Products Co. is shown as follows, together with production and cost data for the period. One gallon each of liquid lead and varnish are added at the start of processing. The balance of the materials is added when the process is two-thirds complete. Labor and overhead are added evenly throughout the process. There were no units in process at the beginning of the month. Required: Calculate equivalent production for materials, labor, and overhead. (Be sure to refer to the standard cost summary to help determine the percentage of materials in ending work in process.) Calculate materials and labor variances and indicate whether they are favorable or unfavorable, using the diagram format shown in Figure 8-4. Determine the cost of materials and labor in the work in process account at the end of the month.arrow_forwardDuring the first month of operations ended May 31, Big Sky Creations Company produced 40,000 designer cowboy boots, of which 36,000 were sold. Operating data for the month are summarized as follows: During June, Big Sky Creations produced 32,000 designer cowboy boots and sold 36,000 cowboy boots. Operating data for June are summarized as follows: Instructions 1. Using the absorption costing concept, prepare income statements for (a) May and (b) June. 2. Using the variable costing concept, prepare income statements for (a) May and (b) June. 3. a. Explain the reason for the differences in operating income in (1) and (2) for May. b. Explain the reason for the differences in operating income in (1) and (2) for June. 4. Based on your answers to (1) and (2), did Big Sky Creations Company operate more profitably in May or in June? Explain.arrow_forwardDavis Co. uses backflush costing to account for its manufacturing costs. The trigger points are the purchase of materials, the completion of goods, and the sale of goods. Prepare journal entries to account for the following: a. Purchased raw materials, on account, 70,000. b. Requisitioned raw materials to production, 70,000. c. Distributed direct labor costs, 15,000. d. Factory overhead costs incurred, 45,000. (Use Various Credits for the account in the credit part of the entry.) e. Completed all of the production started. f. Sold the completed production for 195,000, on account. (Hint: Use a single account for raw materials and work in process.)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,