Concept explainers

Activity-based costing in an insurance company

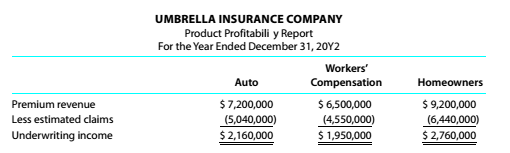

Umbrella Insurance Company carries three major lines of insurance: auto, workers' compensation, and homeowners. The company has prepared the following report for 20Y2:

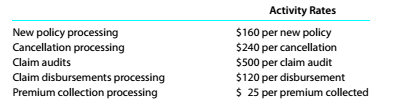

Management is concerned that the administrative expenses may make some of the insurance lines unprofitable. However, the administrative expenses have not been allocated to the insurance lines. The controller has suggested that the administrative expenses could be assigned to the insurance lines using activity-based costing. The administrative expenses are comprised of five activities. The activities and their rates are as follows:

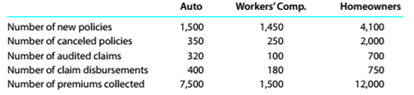

Activity-base usage data for each line of insurance were retrieved from the corporate records and are shown below.

a.Complete the product profitability report through the administrative activities.

b.Determine the underwriting income as a percent of premium revenue.

C.Determine the Operating income as a percent of premium revenue, rounded to one decimal place.

d.Interpret the report.

(a)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

Through administrative activities complete the product profitability report.

Answer to Problem 10.25E

The product profitability report through the administrative activities is given in table below.

Explanation of Solution

The product profitability report through the administrative activities is below:

| Particulars | Auto (in $) | Worker compensation (in $) | Homeowner (in $) |

| New policy processing per new policy | | | |

| Cancellation processing per cancellation | | | |

| Claim audit per claim audit | 13y13 | Y13y3 | |

| Claim disbursement per claim disbursement | | | |

| Premium collection processing per premium | | | |

| Total administrative cost | | | |

Preparation of Income statement is as follows:

| Particulars | Auto (in $) | Worker compensation (in $) | Homeowner (in $) |

| Underwriting income before administrative expenses | | | |

| Less: Administrative expenses | | | |

| Underwriting net Income | | | |

(b)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

To compute:

The underwriting income as a percent of premium revenue.

Answer to Problem 10.25E

The underwriting income as a percent of premium revenue is

Explanation of Solution

Calcultion of underwriting income as a percent of premium revenue are as follows:

Underwriting income as a percent of premium revenue is:

So, the answer is

(c)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

The operating income as a percent of premium revenue.

Answer to Problem 10.25E

Operating income as a percent of premium revenue is

Explanation of Solution

Calculation of operating income as a percent of premium revenue is as follows:

Operating income as a percent of premium revenue

So, the answer is

(d)

Concept Introduction:

Activity based costing is one of the costing method that identify the important activities in the organisation and accordingly identify their cost drivers. Then cost is allocated on the basis of activities used by each product.

The interpretation of report.

Answer to Problem 10.25E

The premium revenue's significant part is used in the administrative expenses.

Explanation of Solution

Underwriting income as a percent of premium revenue after reducing administrative expenses is

So, this clearly shows that important part of premium revenue is used in administrative expenses, which helps company in profitability.

Want to see more full solutions like this?

Chapter 10 Solutions

CengageNOWv2, 1 term Printed Access Card for Warren's Survey of Accounting, 8th

- Job-Order Costing versus Process Costing a. Hospital services b. Custom cabinet making c. Toy manufacturing d. Soft-drink bottling e. Airplane manufacturing (e.g., 767s) f. Personal computer assembly g. Furniture making (e.g., computer desks sold at discount stores) h. Custom furniture making i. Dental services j. Paper manufacturing k. Nut and bolt manufacturing l. Auto repair m. Architectural services n. Landscape design services o. Flashlight manufacturing Required: Identify each of these preceding types of businesses as using either job-order or process costing.arrow_forwardSupport department cost allocation Blue Mountain Masterpieces produces pictures, paintings, and other home decor. The Printing and Framing production departments are supported by the Janitorial and Security departments. Janitorial costs are allocated to the production departments based on square feet, and security costs are allocated based on asset value. Information about these departments is detailed in the following table: Management has experimented with different support department cost allocation methods in the past. The different allocation methods did not yield large differences of cost allocation to the production departments. Instructions 1. Determine which support department cost allocation method Blue Mountain Masterpieces would most likely use to allocate its support department costs to the production departments. 2. Determine the total costs allocated from each support department to each production department using the method you determined in part (1). 3. Without doing calculations, consider and answer the following: If Blue Mountain Masterpieces decided to use square feet instead of asset value as the cost driver for security services, how would this change the allocation of Security Department costs?arrow_forwardInterview questions are asked to determine a. what activities are being performed. b. who performs the activities. c. the relative amount of time spent on each activity by individual workers. d. possible activity drivers for assigning costs to products. e. All of these.arrow_forward

- Activity-based department rate product costing and product cost distortions Big Sound Inc. manufactures two products: receivers and loudspeakers. The factory overhead incurred is as follows: The activity base associated with the two production departments is direct labor hours. The indirect labor can be assigned to two different activities as follows: The activity-base usage quantities and units produced for the two products follow: Instructions Determine the factory overhead rates under the multiple production department rate method. Assume that indirect labor is associated with the production departments, so that the total factory overhead is 420,000 and 294,000 for the Subassembly and Final Assembly departments, respectively. Determine the total and per-unit factory overhead costs allocated to each product, using the multiple production department overhead rates in (1). Determine the activity rates, assuming that the indirect labor is associated with activities rather than with the production departments. Determine the total and per-unit cost assigned to each product under activity-based costing. Explain the difference in the per-unit overhead allocated to each product under the multiple production department factory overhead rate and activity-based costing methods. production department factory overhead rate and activity-based costing methods.arrow_forwardJob-Order Costing versus Process Costing a. Auto manufacturing b. Dental services c. Auto repair d. Costume making Required: CONCEPTUAL CONNECTION For each of the given types of industries, give an example of a firm that would use job-order costing. Then, give an example of a firm that would use process costing.arrow_forwardA process costing system Is most likely used by which of the following? airplane manufacturing a paper manufacturing company an accounting firm specializing in tax returns a hospitalarrow_forward

- Journalizing the distribution of service department costs to production departments Required: Using your solution to P4-7, prepare journal entries for the following: The distribution of the total factory overhead of $79,400 to the individual production and service departments where it originated. The distribution of the Building Maintenance overhead to the appropriate other departments. The distribution of the Factory Office overhead to the appropriate other departments.arrow_forwardClassify the following costs of activity inputs as variable, fixed, or mixed. Identify the activity and the associated activity driver that allow you to define the cost behavior. For example, assume that the resource input is cloth in a shirt. The activity would be sewing shirts, the cost behavior variable, and the activity driver units produced. Prepare your answers in the following format: a. Flu vaccine b. Salaries, equipment, and materials used for moving materials in a factory c. Forms used to file insurance claims d. Salaries, forms, and postage associated with purchasing e. Printing and postage for advertising circulars f. Equipment, labor, and parts used to repair and maintain production equipment g. Power to operate sewing machines in a clothing factory h. Wooden cabinets enclosing audio speakers i. Advertising j. Sales commissions k. Fuel for a delivery van l. Depreciation on a warehouse m. Depreciation on a forklift used to move partially completed goods n. X-ray film used in the radiology department of a hospital o. Rental car provided for a clientarrow_forwardActivity-based product costing Sweet Sugar Company manufactures three products (white sugar, brown sugar, and powdered sugar) in a continuous production process. Senior management has asked the controller to conduct an activity-based costing study. The controller identified the amount of factory overhead required by the critical activities of the organization as follows: The activity bases identified for each activity are as follows: The activity-base usage quantities and units produced for the three products were determined from corporate records and are as follows: Each product requires 0.5 machine hour per unit. Instructions Determine the activity rate for each activity. Determine the total and per-unit activity cost for all three products. Round to nearest cent. Why arent the activity unit costs equal across all three products since they require the same machine time per unit?arrow_forward

- Activity cost pools, activity rates, and product costs using activity-based costing Caldwell Home Appliances Inc. is estimating the activity cost associated with producing ovens and refrigerators. The indirect labor can be traced into four separate activity pools, based on time records provided by the employees. The budgeted activity cost and activity-base information are provided as follows: The estimated activity-base usage and unit information for two product lines was determined as follows: A. Determine the activity rate for each activity cost pool. B. Determine the activity-based cost per unit of each product.arrow_forwardCommunication The controller of New Wave Sounds Inc. prepared the following product profitability report for management, using activity-based costing methods for allocating both the factory overhead and the marketing expenses. As such, the controller has confidence in the accuracy of this report. In addition, the controller interviewed the vice president of marketing, who provided the following insight into the companys three products: The home theater speakers are an older product that is highly recognized in the marketplace. The wireless speakers are a new product that was just recently launched. The wireless headphones are a new technology that has no competition in the marketplace, and it is hoped that they will become an important future addition to the companys product portfolio. Initial indications are that the product is well received by customers. The controller believes that the manufacturing costs for all three products are in line with expectations. Based on the information provided: 1. Calculate the ratio of gross profit to sales and the ratio of operating income to sales for each product. 2. Write a brief (one-page) memo using the product profitability report and the calculations in (a) to make recommendations to management with respect to strategies for the three products.arrow_forwardThis list contains costs that various organizations incur; they fall into three categories: direct materials (DM), direct labor (DL), or overhead (OH).t Classify each of these items as direct materials, direct labor, or overhead. Glue used to attach labels to bottles containing a patented medicine. Compressed air used in operating paint sprayers for Student Painters, a company that paints houses and apartments. Insurance on a factory building and equipment. A production department supervisors salary. Rent on factory machinery. Iron ore in a steel mill. Oil, gasoline, and grease for forklift trucks in a manufacturing companys warehouse. Services of painters in building construction. Cutting oils used in machining operations. Cost of paper towels in a factory employees washroom. Payroll taxes and fringe benefits related to direct labor. The plant electricians salaries. Crude oil to an oil refinery. Copy editors salary in a book publishing company. Assume your classifications could be challenged in a court case. Indicate to your attorneys which of your answers for part a might be successfully disputed by the opposing attorneys and why. In which answers are you completely confident?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning