Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134067254

Author: Braun

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.7SE

Calculate ROI (Learning Objective 3)

Refer to Epic Sports Data Set.

- A. Calculate each division’s ROI.

- B. Top management has extra funds to invest. Which division will most likely receive those funds? Why?

- C. Can you explain why one division’s ROI is higher? How could management gain more insight?

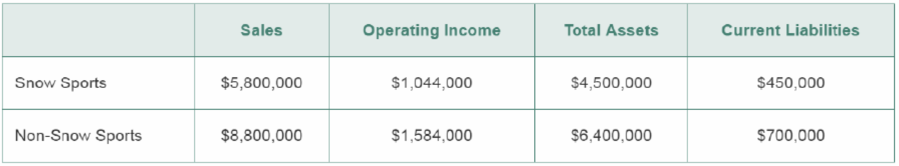

Epic Sports Data Set used for S10-7 through S10-9:

Epic Sports Company makes snowboards, downhill skis, cross-country skis, skateboards, surfboards, and inline skates. The company has found it beneficial to split operations into two divisions based on the climate required for the sport: Snow Sports and Non-Snow Sports. The following divisional information is available for the past year:

Epic’s management has specified a target 16%

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Profit Planning and Control

This case is a manufacturer and could make specialty bikes, ski or outdoor equipment, computers, food like chocolates, saltwater taffy, cookies, or donuts, etc.

Create the balance sheet, income statement, and statement of the cash flow from the following information.

Use the following information for the learning experiences

Sales volume units = 11,000

Sales price/unit = $100

Variable manufacturing costs/unit = $60

Fixed manufacturing costs = $210,000

Fixed sales & administration costs = $190,000

Business income tax rate = 25%

Current assets = $250,000 (Cash $50,000, Accounts Receivables $100,000, Inventory $100,000)

Fixed assets = $750,000

Current liabilities = $200,000 (Accounts Payable $100,000, Short Term Debt $100,000)

Long Term Debt = $300,000

Owners' Equity = $500,000

Classify costs and make a quality-initiative decision (Learning Objective 5) Sinclair Corp. manufactures radiation-shielding glass panels . Suppose Sinclair is consider-ing spending the following amounts on a new TOM program :Strength-testing one item from each batch of panels ......................... . Training employees in TOM ................................................................. . Training suppliers in TOM .................................................................... . Identifying preferred suppliers that commit to on-time delivery ofperfect quality materials ................................................................... .Sinclair expects the new program to save costs through the following:Avoid lost profits from lost sales due to disappointed customers ....... Avoid rework and spoilage ................................................................. .. Avoid inspection of raw materials ........................................................ . Avoid…

Please review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.You are required to submit this assignment to LopesWrite. Please refer to the directions in the Student Success Center.Paul Duncan, financial manager of EduSoft Inc., is facing a dilemma. The firm was founded 5 years ago to provide educational software for the rapidly expanding primary and secondary school markets. Although EduSoft has done well, the firm's founder believes an industry shakeout is imminent. To survive, EduSoft must grab market share now, and this will require a large infusion of new capital.Because he expects earnings to continue rising sharply and looks for the stock price to follow suit, Mr. Duncan does not think it would be wise to issue new common stock at this time. On the other hand, interest rates are currently high by historical standards, and the firm's B rating means that interest payments on a new debt issue would be prohibitive.…

Chapter 10 Solutions

Managerial Accounting (5th Edition)

Ch. 10 - (Learning Objective 1) Companies often...Ch. 10 - (Learning Objective 1) Which of the following is...Ch. 10 - (Learning Objective 1) In terms of responsibility...Ch. 10 - (Learning Objective 2) Which of the following is...Ch. 10 - (Learning Objective 2) A segment margin is the...Ch. 10 - Prob. 6QCCh. 10 - Prob. 7QCCh. 10 - Prob. 8QCCh. 10 - Prob. 9QCCh. 10 - Prob. 10QC

Ch. 10 - Identify and understand responsibility centers...Ch. 10 - Identify types of responsibility centers (Learning...Ch. 10 - Identify centralized and decentralized...Ch. 10 - Prob. 10.4SECh. 10 - Prob. 10.5SECh. 10 - Prob. 10.6SECh. 10 - Calculate ROI (Learning Objective 3) Refer to Epic...Ch. 10 - Prob. 10.8SECh. 10 - Prob. 10.9SECh. 10 - Prob. 10.10SECh. 10 - Prob. 10.11SECh. 10 - Interpret a performance report (Learning Objective...Ch. 10 - Prob. 10.13SECh. 10 - Classify KPIs by balanced scorecard perspective...Ch. 10 - Use vocabulary terms (Learning Objectives 1, 2, 3,...Ch. 10 - Prob. 10.16SECh. 10 - Identify type of responsibility center (Learning...Ch. 10 - Complete and analyze a performance report...Ch. 10 - Prepare a segment margin performance report...Ch. 10 - Compute and interpret the expanded ROI equation...Ch. 10 - Prob. 10.21AECh. 10 - Prob. 10.22AECh. 10 - Comparison of ROI and residual income (Learning...Ch. 10 - Prob. 10.24AECh. 10 - Comprehensive flexible budget problem (Learning...Ch. 10 - Prepare a flexible budget performance report...Ch. 10 - Work backward to find missing values (Learning...Ch. 10 - Construct a balanced scorecard (Learning Objective...Ch. 10 - Sustainability and the balanced scorecard...Ch. 10 - Identify type of responsibility center (Learning...Ch. 10 - Complete and analyze a performance report...Ch. 10 - Prob. 10.32BECh. 10 - Prob. 10.33BECh. 10 - Prob. 10.34BECh. 10 - Prob. 10.35BECh. 10 - Prob. 10.36BECh. 10 - Prob. 10.37BECh. 10 - Prob. 10.38BECh. 10 - Prob. 10.39BECh. 10 - Prob. 10.40BECh. 10 - Prob. 10.41BECh. 10 - Sustainability and the balanced scorecard...Ch. 10 - Prepare a budget with different volumes for...Ch. 10 - Prepare and interpret a performance report...Ch. 10 - Prob. 10.45APCh. 10 - Prob. 10.46APCh. 10 - Prob. 10.47APCh. 10 - Evaluate subunit performance (Learning Objectives...Ch. 10 - Prob. 10.49BPCh. 10 - Prob. 10.50BPCh. 10 - Evaluate divisional performance (Learning...Ch. 10 - Prob. 10.52BPCh. 10 - Determine transfer price at a manufacturer under...Ch. 10 - Evaluate subunit performance (Learning Objectives...Ch. 10 - Prob. 10.55SC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If you are to give your assessment on the value of Artificial Intelligence in business strategy, at what ratio (example: 50% AI, 50% in person) could AI be employed or utilized for online learning? Identify a particular course in your major (Finance) that you think AI will be useful and explain how this will contribute to a better learning experience for students, cost efficiency for students and the school, and safety and human values considerations. Please explain your answer and specify how you will incorporate AI in the course.arrow_forwardABC bank offers a Business Grant to encourage a fresh graduate to become an entrepreneur. However, to apply this Business Grant, you need to explain in general the overview of your business. Therefore, using the Business Model Canvas approach, develop your strategy to run ANY BUSINESS IDEA by illustrating Business Model Canvas based on NINE (9) areas, including customer segment, value proposition, marketing channels, customer relationships, key partners, key activities, key resources, cost structure, and revenue stream.arrow_forwardThe following if-then statements were taken from a Balanced Scorecard: a. If employee capabilities increase, then process time decreases. b. If process time decreases, then customer retention will increase. c. If customer retention increases, then market share will increase. d. If market share increases, then revenues will increase. Required: 1. Identify the lead and lag variables, and explain your reasoning. 2. Discuss the implications of Requirement 1 for the financial and learning and growth perspectives. 3. Using the first if-then statement, explain the concept of double-loop feedback.arrow_forward

- Social Media, Inc. (SMI) has two services for users. To ot!, which connects tuters with students who are looking for tutoring services, and TiX, which can be used to buy, sell, or exchange event tickets. For the following year, SMI expects the following results. Toot! TiX Total Users 13,100 20,100 33,200 Revenues $ 1,800,000 $ 1,760,000 $ 3,560,000 Engineering hours 9,300 7,300 16,600 Engineering cost $ 687,750 $ 806,250 $ 1,494,000 Administrative costs $ 1,195,200 Required: a. Compute the predetermined overhead rate used to apply administrative costs to the two services assuming SMI uses the number of users to allocate administrative costs. b. Based on the rates computed in requirement (a), what is the profit for each service?arrow_forwardP10-53B Determine transfer price at a manufacturer under various scenarios (Learning Objective 4) Assume the Small Components Division of Lang Manufacturing produces a video card used in the assembly of a variety of electronic products. The division's manufacturing costs, and variable selling expenses related to the video card are as follows: Cost per unit Direct materials $ 14.00 Direct labor $ 4.00 Variable manufacturing overhead $ 8.00 Fixed manufacturing overhead (at current production level) $ 9.00 Variable selling expenses $ 10.00 The Computer Division of Lang Manufacturing can use the video card produced by the Small Components Division and is interested in purchasing the video card in-house rather than buying it from an outside supplier. The Small Components Division has sufficient excess capacity with which to make the extra video cards. Because of competition, the market price for this video card is $30 regardless of whether the…arrow_forwardList the business, technological, and organizational challenges that were addressed throughout the project to implement a new learning management system, and explain the three-sphere model for systems management in your own words. Do not depend on the examples in the textbook.arrow_forward

- (Learning Objective 2: Distinguish a capital expenditure from an immediate expense)LimeBike, located in San Mateo, California, is a startup founded in 2017. Its mission isto make shared bicycles accessible and affordable. The company has taken the basic idea ofshared bicycles and eliminated the need to return the bike to a docking station, which may notbe near the cyclist’s destination. LimeBike charges $1 per 30 minutes of riding, or $0.50 perride for students.To use LimeBike, you first use the LimeBike app to locate one of the citrus-colored bikesnear your location. Once you are at the bike, you scan the QR code on the bike or enter thebike’s plate number into the app to unlock the bike. When you are finished using the bike, youpark the bike by a bike rack or post––anywhere that is legal and visible. Once you press downthe back-wheel lock, the trip is finalized and your payment is processed by LimeBike’s app.LimeBike does not depend on government funding, making it appealing to…arrow_forwardA firm has recently added a new product to their offerings. Manufacturing reports that production is going smoothly and factory workers are becoming familiar with the manufacture of this product. All expectations are that the current rate of learning will continue and the manufacture of future units will be more efficient (i.e., take less time). The following shown table shows the results for the first two units produced. The firm has an order for two additional units. Assuming the pattern of learning curve continues (same rate): Solve, a. At what rate is learning occurring? b. How long will it take to produce the fourth unit? c. If the labor rate is $15 per hour, what is the cumulative average labor cost per unit for the first four units produced?arrow_forwardSocial Media, Inc. (SMI) has two services for users. Toot!, which connects tutors with students who are looking for tutoring services, and TiX, which can be used to buy, sell, or exchange event tickets. For the following year, SMI expects the following results. Toot! TiX Total Users 15,500 22,100 37,600 Revenues $ 2,000,000 $ 2,080,000 $ 4,080,000 Engineering hours 10,400 8,400 18,800 Engineering cost $ 881,000 $ 999,000 $ 1,880,000 Administrative costs $ 1,504,000 The company is considering using a two-stage cost allocation system and wants to assess the effects on reported product profits. The company is considering using Engineering Hours and Users as the allocation base. Additional information follows. Toot! TiX Total Engineering hours 10,400 8,400 18,800 Users 15,500 22,100 37,600 Engineering-hour related administrative cost $ 199,280 User-related…arrow_forward

- Social Media, Inc. (SMI) has two services for users. Toot!, which connects tutors with students who are looking for tutoring services, and TIX, which can be used to buy, sell, or exchange event tickets. For the following year, SMI expects the following results. Toot! Tix Total Users 15,500 22,100 37,600 Revenues $2,000,000 $2,080,000 $4,080,000 Engineering hours 10,4000 8,400 18,800 Engineering cost $ 881,000 $ 999,000 $1,880,000 Administrative costs…arrow_forwardPrepare a balanced scorecard for Titan Computer Company with at least one objective in each of the following categories. Financial Customer Internal business process Learning and growtharrow_forwardTaylor Construction builds custom homes in Dallas, Texas. Brandon Taylor knows that his future depends on the quality of the homes he builds and the service he provides to customers. Most new-customer sales arise from word-of-mouth advertising by former customers.Identify the balanced scorecard perspective for each measure in the exercise. Perspective a. Number of customer complaints Internal business processesCustomerLearning & growthFinancial b. Employee turnover Learning & growthFinancialInternal business processesCustomer c. Net profit per house constructed Learning & growthFinancialInternal business processesCustomer d. Turnaround time on customer design changes Learning & growthInternal business processesCustomerFinancial e. Hours of training per employee Learning & growthFinancialInternal business processesCustomer f. Average labor cost per house CustomerLearning &…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is Business Analysis?; Author: WolvesAndFinance;https://www.youtube.com/watch?v=gG2WpW3sr6k;License: Standard Youtube License