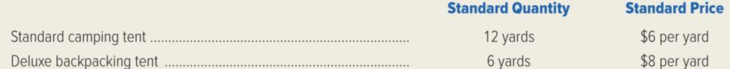

Rocky Mountain Camping Equipment, Inc. has established the following direct-material standards for its two products.

During March, the company purchased 2,100 yards of tent fabric for its standard model at a cost of $13,440. The actual March production of the standard tent was 100 tents, and 1,250 yards of fabric were used. Also during March, the company purchased 800 yards of the same tent fabric for its deluxe backpacking tent at a cost of $6,320. The firm used 720 yards of the fabric during March in the production of 120 deluxe tents.

Required:

- 1. Compute the direct-material purchase price variance and quantity variance for March.

- 2. Prepare

journal entries to record the purchase of material, use of material, and incurrence of variances in March.

1.

Calculate the direct material purchase price variance and direct material quantity variance of Company R for the month of March.

Explanation of Solution

Variance: Variance refers to the difference level in the actual cost incurred and standard cost. The total cost variance is subdivided into separate cost variances; this cost variance indicates that the amount of variance that is attributable to specific casual factors.

Standard cost: In the accounting records, the term standard cost refers to the practice of replacement of an expected cost for an actual cost. Then the difference between the expected costs and actual costs showing the variance are also recorded periodically. A standard costs is also known as target cost or predetermined cost.

Calculate the direct material purchase price variance and direct material quantity variance of Company R for the month of March as follows:

Direct material purchase price variance:

Working note (1):

Calculate the actual price for standard tent:

Working note (2):

Calculate the actual price for deluxe tent:

Working note (3):

Calculate the direct material purchased price variance of standard tent:

Working note (4):

Calculate the direct material purchased price variance of deluxe tent:

Direct material quantity variance:

Working note (5):

Calculate the standard quantity of standard tent:

Working note (6):

Calculate the standard quantity of deluxe tent:

Working note (7):

Calculate the direct material quantity variance of standard tent:

Working note (8):

Calculate the direct material quantity variance of deluxe tent:

2.

Prepare journal entries for the given transactions of Company R for the month of March.

Explanation of Solution

Prepare journal entry to record the purchase of direct material and variance:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Raw materials inventory (9) | 19,000 | ||

| Direct materials cost variance | 760 | ||

| Accounts payable | 19,760 | ||

| (To record the direct materials purchased on account) |

Table (1)

- Raw materials inventory is an asset account, and it increases the value of asset. Hence, debit the raw materials inventory account with $19,000.

- Direct materials cost variance is expense account and it decreases the value of stockholder’s equity. Hence, debit the direct material cost variance account with $760.

- Accounts payable is a liability account, and it increases the value of liabilities. Hence, credit the accounts payable account with $19,760.

Working note (9):

Calculate the raw materials inventory:

Prepare journal entry to record the use of direct material and variance:

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| Work-in-Process Inventory (10) | 12,960 | ||

| Direct Materials quantity Variance | 300 | ||

|

Raw Materials Inventory | 13,260 | ||

| (To record the direct materials used in the production process) |

Table (2)

- Work-in-process inventory is an asset account, and it increases the value of asset. Hence, debit the work-in-process inventory account with $12,960.

- Direct materials quantity variance is an expense account and it decreases the value of stockholder’s equity. Hence, debit t the direct material quantity variance account with $300.

- Raw materials inventory is an asset account, and it decreases the value of asset. Hence, credit the raw materials inventory account with $13,260.

Working note (10):

Calculate the work in process inventory:

Want to see more full solutions like this?

Chapter 10 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- MARINA Bottlers Inc, a leading softdrinks company is producing their bottle requirements. For each case of 24 eight-ounce bottles, the company prescribed the following standard product mix: Material A @2.4 lb, P50/lbs; Material B @6 lb, P22/lbs and Material C @1.6 lbs, P15/lb. During the month of August, 25,000 cases were produced from an input of: Material Pounds Cost/lb A 63,700 P49.00 B 125,200 20.50 C 48,100 16.00 Required: COMPUTE FOR THE MATERIALS MIX VARIANCE COMPUTE FOR THE MATERIALS YIELD VARIANCEarrow_forwardBig Sur Water Sports, Inc., manufactures fiberglass boards used for riding the waves at the beach. The products are sold under the brand name Crazy Board. The standard cost for material and labor is $89.20 per board. This includes 8 kilograms of direct material at a standard cost of $5.00 per kilogram and 6 hours of direct labor at $8.20 per hour. The following data pertain to November: Purchases of material: 46,500 kilograms for $248,000 Total actual direct labor costs: $301,490 Actual hours of direct labor: 36,500 hours Production: 5,600 units 1. Calculate the total direct materials variance 2. Calculate the total direct labor variance Check Figures: Total Direct Materials Variance $23,845 Unfavorable Total Direct Labor Variance $25,970 Unfavorablearrow_forwardEd Co. manufactures two types of O rings, large and small. Both rings use the same material but require different amounts. Standard materials for both are shown. Large Small Rubber 3 feet at $0.20 per foot 1.25 feet at $0.20 per foot Connector 1 at $0.02 1 at $0.02 At the beginning of the month, Ed Co. bought 25,000 feet of rubber for $7,250. The company made 3,000 large O rings and 4,000 small O rings. The company used 14,600 feet of rubber. A. What are the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance? Enter all amounts as positive numbers. If required round your answers to two decimal places. Direct materials price variance $fill in the blank 1 Direct materials quantity variance $fill in the blank 3 Total direct materials cost variance $fill in the blank 5 B. If they bought 9,000 connectors costing $190, what would the direct materials price variance be for the connectors? Round…arrow_forward

- Sarsi Bottlers Inc, a leading softdrinks company is producing their bottle requirements. For each case of 24 eight-ounce bottles, the company prescribed the following standard product mix: Material A @ 2.4 lb, P50/lbs; Material B @ 6 lb, P22/lbs and Material C @ 1.6 lbs, P15/lb. During the month of August, 25,000 cases were produced from an input of: Material Pounds Cost/lb A 63,700 49 B 125,200 20.50 C 48,100 16 a. COMPUTE FOR THE MATERIALS MIX VARIANCE b. COMPUTE FOR THE MATERIALS YIELD VARIANCEarrow_forwardardin Outfitters has a capacity to produce 16,500 of their special arctic tents per year. The company is currently producing and selling 5,000 tents per year at a selling price of $1,350 per tent. The cost of producing and selling one tent follows: Variable manufacturing costs $ 530 Fixed manufacturing costs 135 Variable selling and administrative costs 125 Fixed selling and administrative costs 95 Total costs $ 885 The company has received a special order for 1,400 tents at a price of $690 per tent from Chipman Outdoor Center. It will not have to pay any sales commission on the special order, so the variable selling and administrative costs would be only $54 per tent. The special order would have no effect on total fixed costs. The company has rejected the offer based on the following computations: Selling price per case $ 690 Variable manufacturing costs 530 Fixed manufacturing costs 135 Variable selling and administrative costs 54 Fixed selling and…arrow_forwardZee Corporation has developed the following cost standards for the production of its leather backpacks: Standard Cost Per Backpack Leather (0.9 yards × $22 per yard) $19.80 Direct labor (1.3 hours × $9.00 per hour) $11.70 Variable overhead (1.3 hours × $15.00 per hour) $19.50 Variable overhead at Zee is applied on the basis of direct labor hours. The actual results for last month were as follows: Number of backpacks produced 15,000 Direct labor hours incurred 18,800 Yards of leather purchased 14,500 Yards of leather used in production 14,100 Cost of leather purchased $306,675 Direct labor cost $159,800 Variable overhead cost $285,760 The direct materials purchases variance is computed when the materials are purchased. Required: Compute the following variances for Zee. Materials price variance. (favorable) Materials quantity variance. (unfavorable) Labor efficiency variance. (Favorable)arrow_forward

- Ed Co. manufactures two types of O rings, large and small. Both rings use the same material but require different amounts. Standard materials for both are shown. Large Small rubber 3 feet at $0.25 per foot 1.25 feet at $0.25 per foot connector 1 at $0.03 1 at $0.03 At the beginning of the month, Ed Co. bought 25,000 feet of rubber for $6,875. The company made 3,000 large O rings and 4,000 small O rings. The company used 14,500 feet of rubber. Required: What are the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance? If they bought 10,000 connectors costing $310, what would the direct materials price variance be for the connectors? If there was an unfavorable direct materials price variance of $125, how much did they pay per foot for the rubber?arrow_forwardMARINA Bottlers Inc, a leading softdrinks company is producing their bottle requirements. For each case of 24 eight-ounce bottles, the company prescribed the following standard product mix: Material A @ 2.4 lb, P50/Ibs; Material B @ 6 lb, P22/lbs and Material C @ 1.6 Ibs, P15/lb. During the month of August, 25,000 cases were produced from an input of: Material Pounds Cost/Lb A 63,700 49.00 B 125,200 20.50 C 48,100 16.00 REQUIREMENTS: PLEASE SHOW YOUR SOLUTION IN GOOD ACCOUNTING FORM THANK YOU! 1) Compute for the Materials Mix Variance2) Compute for the Materials Yield Variancearrow_forwardMcDaniel Company manufactures 100-pound bags of fertilizer that have the following unit standard costs for direct materials and direct labor: Direct materials (100 lbs. @ $1.00 per lb.) $100.00 Direct labor (0.5 hours at $24 per hour) 12.00 Total standard prime cost per 100-lb. bag $112.00 The following activities were recorded for October: 1,000 bags were manufactured. 95,000 lbs. of materials costing $76,000 were purchased. 102,500 lbs. of materials were used. $12,000 was paid for 475 hours of direct labor. There were no beginning or ending work-in-process inventories. Required: A. Compute the direct materials variances. Materials price variance $fill in the blank 1 Favorable Materials usage variance $fill in the blank 3 Unfavorable B. Compute the direct labor variances. Labor rate variance $fill in the blank 5 Unfavorable Labor efficiency variance $fill in the blank 7 Favorablearrow_forward

- Huron Company produces a commercial cleaning compound known as Zoom. The direct materials and direct labor standards for one unit of Zoom are given below: Standard Quantity or Hours Standard Price or Rate Standard Cost Direct materials 4.6 pounds $2.50 per pound $11.50 Direct labor 0.2 hours $18.00 per hour $3.60 During the most recent month, the following activity was recorded: Twenty thousand pounds of material were purchased at a cost of $2.35 per pound. All of the material purchased was used to produce 4,000 units of Zoom. 750 hours of direct labor time were recorded at a total labor cost of $14,925. Required: Compute the materials price and quantity variances for the month. Compute the labor rate and efficiency variances for the month. EXERCISE 10–7 Direct Materials Variances LO10–1 Refer to the data in Exhibit 10–6. Assume that instead of producing 4,000 units during the month, the company produced only 3,000 units, using 14,750 pounds of…arrow_forwardRE Detailing Ltd produces executive motor coaches and currently manufactures the 'Tent awnings' that accompany them at the following costs: Cost per unit ($) Variable Costs: Direct Material 1250 Direct Labour 750 Variable Overhead 500 Total variable overhead 2500 Fixed Costs: Depreciation (equipment) 500 Depreciation (building) 400 Supervisor salary 300 Total fixed cost 1200 Total cost 3700 The company received an offer from Hyderabad Tents to produce the awnings for $ 3,200 per unit and supply 1,000 awnings for the coming year’s estimated production. If the company accepts this offer and shuts down production of this part of the business, production workers and supervisors will be reassigned to other areas. Assume that for the short-term decision-making process, the company’s total labor costs (direct labor and supervisor salaries) will remain the same if the bar inserts are purchased. The…arrow_forwardXin Manufacturing Company manufactures blue rugs, using wool and dye as direct materials. One rug is budgeted to use 38 skeins of wool at a cost of $7 per skein and 0.7 gallons of dye at a cost of $5 per gallon. All other materials are indirect. At the beginning of the year Xin has an inventory of 456,000 skeins of wool at a cost of $1,048,800 and 3,400 gallons of dye at a cost of $21,760. Target ending inventory of wool and dye is zero. Xin uses the FIFO inventory cost flow method.There is no direct manufacturing labor cost for dyeing. Xin budgets 48 direct manufacturing labor-hours to weave a rug at a budgeted rate of $17 per hour. It budgets 0.3 machine-hours to dye each skein in the dyeing process. Xin blue rugs are very popular and demand is high, but because of capacity constraints the firm will produce only 275,000 blue rugs per year. The budgeted selling price is $2,400 each. There are no rugs in beginning inventory. Target ending inventory of rugs is also zero. Xin…arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,