Concept explainers

MacGyver Corporation manufactures a product called Miracle Goo, which comes in handy for just about anything. The thick tarry substance is sold in six-gallon drums. Two raw materials are used; these are referred to by people in the business as A and B. Two types of labor are required also. These are mixers (labor class I) and packers (labor class II). You were recently hired by the company president, Pete Thorn, to be the controller. You soon learned that MacGyver uses a standard-costing system. Variances are computed and closed into Cost of Goods Sold monthly. After your first month on the job, you gathered the necessary data to compute the month’s variances for direct material and direct labor. You finished everything up by 5:00 p.m. on the 31st, including the credit to Cost of Goods Sold for the sum of the variances. You decided to take all your notes home to review them prior to your formal presentation to Thorn first thing in the morning. As an afterthought, you grabbed a drum of Miracle Goo as well, thinking it could prove useful in some unanticipated way.

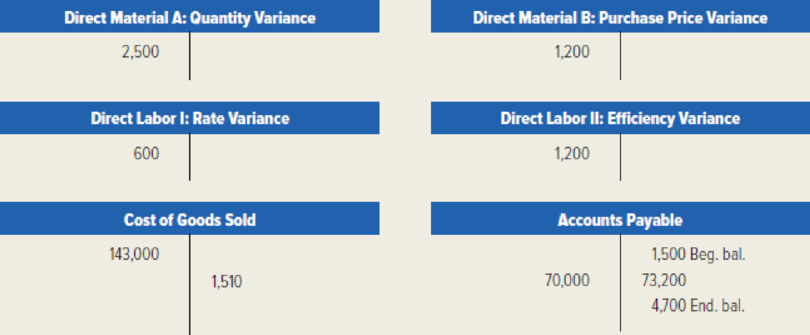

You spent the evening boning up on the data for your report and were ready to call it a night. As luck would have it though, you knocked over the Miracle Goo as you rose from the kitchen table. The stuff splattered everywhere, and, most unfortunately, obliterated most of your notes. All that remained legible is the following information.

Other assorted data gleaned from your notes:

- The standards for each drum of Miracle Goo include 10 pounds of material A at a standard price of $5 per pound.

- The standard cost of material B is $15 for each drum of Miracle Goo.

- Purchases of material A were 12,000 pounds at $4.50 per pound.

- Given the actual output for the month, the standard allowed quantity of material A was 10,000 pounds. The standard allowed quantity of material B was 5,000 gallons.

- Although 6,000 gallons of B were purchased, only 4,800 gallons were used.

- The standard wage rate for mixers is $15 per hour. The standard labor cost per drum of product for mixers is $30 per drum.

- The standards allow 4 hours of direct labor II (packers) per drum of Miracle Goo. The standard labor cost per drum of product for packers is $48 per drum.

- Packers were paid $11.90 per hour during the month.

You happened to remember two additional facts. There were no beginning or ending inventories of either work in process or finished goods for the month. The increase in accounts payable relates to direct-material purchases only.

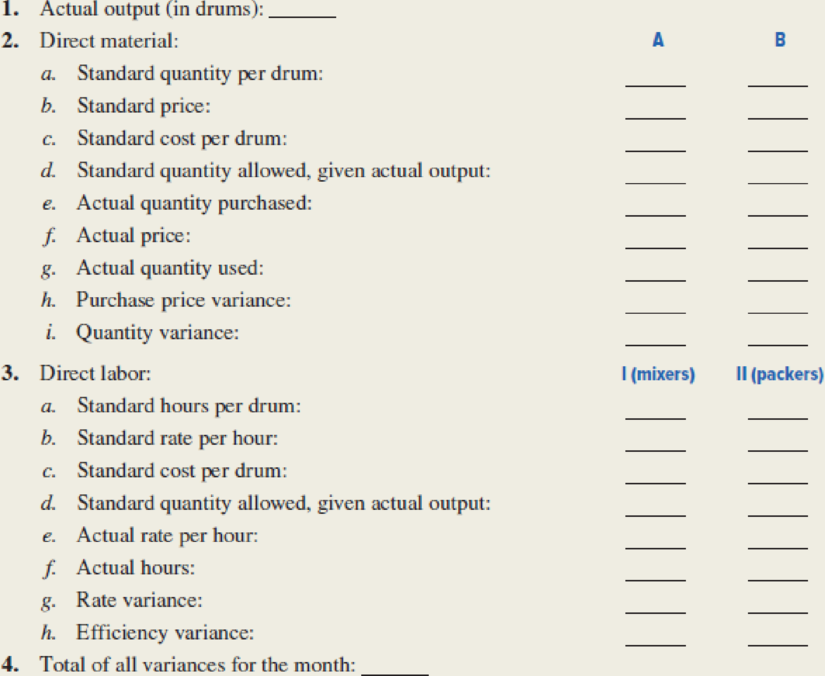

Required: Now you’ve got a major problem. Somehow you’ve got to reconstruct all the missing data in order to be ready for your meeting with the president. You start by making the following list of the facts you want to use in your presentation. Before getting down to business, you need a brief walk to clear your head. Out to the trash you go, and toss the remaining Miracle Goo.

Fill in the missing amounts in the list, using the available facts.

Calculate the missing amount of Company M.

Explanation of Solution

Variance: Variance refers to the difference level in the actual cost incurred and standard cost. The total cost variance is subdivided into separate cost variances; this cost variance indicates that the amount of variance that is attributable to specific casual factors.

Calculate the missing amount of Company M as follows:

| Particulars | Amount in $ | |

| 1. Actual output (in drums) (1) | 1,000 drums | |

| 2. Direct materials: | A | B |

| a. Standard quantity per drum (2) | 10 lb | 5 gal |

| b. Standard price (3) | $5.00/lb | $3.00/gal. |

| c. Standard cost per drum (4) | $ 50.00 | $ 15.00 |

| d. Standard quantity allowed, given actual output (5) | 10,000 lb | 5,000 gal |

| e. Actual quantity purchased (6) | 12,000 lb | 6,000 gal |

| f. Actual price (7) | $4.50/lb | $3.20/gal. |

| g. Actual quantity used (8) | 10,500 lb | 4,800 gal |

| h. Purchase price variance(9) | $6,000 F | $1,200 U |

| i. Quantity variance (10) | $2,500 U | $600 F |

| 3. Direct labor: |

I (mixers) | II (packers) |

| a. Standard hours per drum (11) | 2 hr. | 4 hr. |

| b. standard rate per hour (12) | $ 15.00 | $ 12.00 |

| c. Standard cost per drum (13) | $ 30.00 | $ 48.00 |

| d. Standard quantity allowed, given actual output (14) | 2,000 hr. | 4,000 hr. |

| e. Actual rate per hour (15) | $ 15.30 | $ 11.90 |

| f. Actual hours(16) | 2,000 hr. | 4,100 hr. |

| g. Rate variance (17) | $600 U | $410 F |

| h. Efficiency variance (18) | 0 | $1,200 U |

| 4. Total of all variance for the month (19) | $1,510 F | |

Table (1)

Working note (1):

Calculate (1) the actual output of Company M.

Working note (2):

Calculate the (2. a.) standard quantity of direct material per drum:

Material A:

The standard quantity of direct material per drum of material A is 10 lb. (given).

Material B:

Note: 10,000 pound = 10lb.

Working note (3):

Calculate the (2. b.) the standard price of direct material:

Material A:

The standard price of direct material A is $5.00/lb. (given).

Material B:

Working note (4):

Calculate the (2. c.) the standard cost per drum:

Material A:

Material B:

Standard cost of direct material B is $15 (given).

Working note (5):

Calculate the (2. d.) the standard quantity allowed for actual output:

The standard quantity allowed for actual output of Material A is 10,000 lb. (given).

The standard quantity allowed for actual output of Material B is 5,000 gal. (given).

Working note (6):

Calculate the (2. e.) the actual quantity purchased:

The actual quantity purchased for Material A is 12,000 lb. (given).

The actual quantity purchased for Material B is 6,000 gal (given).

Working note (7):

Calculate the (2. f.) the actual price of direct material:

Material A:

The actual price of direct material A is $4.50/lb. (given).

Material B:

Working note (8):

Calculate the (2. g.) the actual quantity used during the month:

Material A:

Material B:

The actual quantity of material B used during the month is 4,800 gal (given).

Working note (9):

Calculate the (2. h.) the price variance for direct material:

Material A:

Material B:

The price variance of material B is $1,200 Unfavorable (given).

Working note (10):

Calculate the (2. i.) the quantity variance for direct material:

Material A:

The quantity variance of direct material A is $2,500 Unfavorable (given).

Material B:

Note: Debit side of variance account indicates the unfavorable variance, and credit side of variance account indicates the favorable variance.

Working note (11):

Calculate the (3. a.) the standard direct labor hours per drum:

Mixers:

Packers:

The standard direct labor hour per drum is 4 hours (given).

Working note (12):

Calculate the (3. b.) the standard rate per hour:

Mixers:

The standard rate per hour for mixers is $15.00 (given).

Packers:

Working note (13):

Calculate the (3. c.) the standard cost per drum:

The standard cost per drum for Mixers (type-I labor) is $30.00 (given).

The standard cost per drum for Packers (type-II labor) is $48.00 (given).

Working note (14):

Calculate the (3. d.) the standard quantity allowed for actual output:

Mixers:

Packers:

Working note (15):

Calculate the (3. e.) the actual rate per hour:

Mixers:

Packers:

The actual rate per hour for packers (type-II labor) is $11.90 (given).

Working note (16):

Calculate the (3. f.) the actual direct labor hours:

Mixers:

In this case, there is no efficiency variance for type I labors. Hence standard hours are equal to actual hours. Therefore, the actual direct labor hours for type I labors is 2,000 hours (given).

Packers:

Working note (17):

Calculate the (3. g.) the direct labor rate variance:

Mixers:

The direct labor rate variance for type-I labor is $600 Unfavorable (given).

Packers:

Working note (18):

Calculate the (3. h.) the direct labor efficiency variance:

The direct labor efficiency variance of mixtures (type-I labor) is $0 (given).

The direct labor efficiency variance of packers (type-II labor) is $1,200 Unfavorable (given).

Working note (19):

Calculate the (4) the total of all variances for the month:

| Particulars | Amount in $ |

| Direct-material variances: | |

| Price variance of material A (9) | 6,000 F |

| Quantity variance of material A (10) | -2,500 U |

| Price variance of material B (9) | -1,200 U |

| Quantity variance of material B (10) | 600 F |

| Direct-labor variances: | |

| Rate variance of type I labor (17) | -600 U |

| Efficiency variance of type I labor (18) | 0 |

| Rate variance of type II labor (17) | 410 F |

| Efficiency variance of type II labor (18) | -1,200 U |

| Total of all variances | 1,510 F |

Table (2)

Want to see more full solutions like this?

Chapter 10 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- Johnny Lee Incorporated produces a line of small gasoline-powered engines that can be used in a variety of residential machines, ranging from different types of lawnmowers, to snowblowers, to garden tools (such as tillers and weed-whackers). The basic product line consists of three different models, each meant to fill the needs of a different market. Assume you are the cost accountant for this company and that you have been asked by the owner of the company to construct a flexible budget for factory overhead costs, which seem to be growing faster than revenues. Currently, the company uses machine hours (MHs) as the basis for assigning both variable and fixed factory overhead costs to products. Within the relevant range of output, you determine that the following factory fixed overhead costs per month should occur: engineering support, $15,200; insurance on the manufacturing facility, $5,200; property taxes on the manufacturing facility, $12,200; depreciation on manufacturing…arrow_forwardQualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the Denver Cover Plant, which makes seat covers. Ted Vosilo is the plant manager of the Denver Cover Plant but also serves as the regional production manager for the company. His budget as the regional manager is charged to the Denver Cover Plant. Vosilo has just heard that QualSupport has received a bid from an outside vendor to supply the equivalent of the entire annual output of the Denver Cover Plant for $35 million. Vosilo was astonished at the low outside bid because the budget for the Denver Cover Plant’s operating costs for the upcoming year was set at $52 million. If this bid is accepted, the Denver Cover Plant will be closed down. The budget for Denver Cover’s operating costs for the coming year is presented below. Denver Cover PlantAnnual Budget for Operating Costs Materials $ 14,000,000…arrow_forwardThe Glickman Electronics Company in Washington, DC produces two products: (1) the Glickman x-pod, a portable music player and (2) the Glickman BlueBerry, an internet-connected color telephone. The production process for each product is similar in that both require a certain number of hours of electronic work and a certain number of labor-hours in the assembly department. Each x=pod takes 4 hours of electronic work and 2 hours in the assembly shop. Each BlueBerry requires 3 hours in electronics and 1 hour in assembly. During the current production period, 240 hours of electronic time are available, and 100 hours of assembly department time are available. Each x-pod sold yields a profit of $7; each BlueBerry produced may be sold for a $5 profit. Glickman’s problem is to determine the best possible combination of x-pods and BlueBerrys to manufacture to reach the maximum profit.arrow_forward

- Johnny Lee Inc. produces a line of small gasoline-powered engines that can be used in a variety of residential machines, ranging from different types of lawnmowers, to snowblowers, to garden tools (such as tillers and weed-whackers). The basic product line consists of three different models, each meant to fill the needs of a different market. Assume you are the cost accountant for this company and that you have been asked by the owner of the company to construct a flexible budget for factory overhead costs, which seem to be growing faster than revenues. Currently, the company uses machine hours (MHs) as the basis for assigning both variable and fixed factory overhead costs to products. Within the relevant range of output, you determine that the following factory fixed overhead costs per month should occur: engineering support, $15,000; insurance on the manufacturing facility, $5,000; property taxes on the manufacturing facility, $12,000; depreciation on manufacturing equipment,…arrow_forwardJohnny Lee Inc. produces a line of small gasoline-powered engines that can be used in a variety of residential machines, ranging from different types of lawnmowers, to snowblowers, to garden tools (such as tillers and weed-whackers). The basic product line consists of three different models, each meant to fill the needs of a different market. Assume you are the cost accountant for this company and that you have been asked by the owner of the company to construct a flexible budget for factory overhead costs, which seem to be growing faster than revenues. Currently, the company uses machine hours (MHs) as the basis for assigning both variable and fixed factory overhead costs to products. Within the relevant range of output, you determine that the following factory fixed overhead costs per month should occur: engineering support, $15,800; insurance on the manufacturing facility, $5,800; property taxes on the manufacturing facility, $12,800; depreciation on manufacturing equipment,…arrow_forwardualSupport Corporation manufactures seats for automobiles, vans, trucks, and various recreational vehicles. The company has a number of plants around the world, including the Denver Cover Plant, which makes seat covers. Ted Vosilo is the plant manager of the Denver Cover Plant but also serves as the regional production manager for the company. His budget as the regional manager is charged to the Denver Cover Plant. Vosilo has just heard that QualSupport has received a bid from an outside vendor to supply the equivalent of the entire annual output of the Denver Cover Plant for $20.19 million. Vosilo was astonished at the low outside bid because the budget for the Denver Cover Plant’s operating costs for the upcoming year was set at $23.49 million. If this bid is accepted, the Denver Cover Plant will be closed down. The budget for Denver Cover’s operating costs for the coming year is presented below. Denver Cover Plant Annual Budget for Operating Costs Materials $…arrow_forward

- *Merriweather Corporation is a manufacturer of tables sold to schools, restaurants, hotels, and other institutions. The table tops are manufactured by Merriweather, but the table legs are purchased from an outside supplier. The Assembly Department takes a manufactured table top and attaches the four purchased table legs. It takes 20 minutes of labor to assemble a table. The company follows a policy of producing enough tables to ensure that 40% of next month's sales are in the finished goods inventory. Merriweather also purchases sufficient raw materials (legs) to ensure that raw materials (legs) inventory is 60% of the following month's scheduled production needs. Merriweather's sales budget in units for the next quarter is as follows: (CMA adapted) July 2,500 August 2,700 September 2,300 Merriweather's ending inventories in units for June 30 are: Finished goods 2,100 Raw materials (legs) 4,200 Assume the required production for August and…arrow_forwardPixel Studio, Incorporated, is a small company that creates computer-generated animations for films and television. Much of the company’s work consists of short commercials for television, but the company also does realistic computer animations for special effects in movies. The young founders of the company have become increasingly concerned with the economics of the business—particularly since many competitors have sprung up recently in the local area. To help understand the company’s cost structure, an activity-based costing system has been designed. Three major activities are carried out in the company: animation concept, animation production, and contract administration. The animation concept activity is carried out at the contract proposal stage when the company bids on projects. This is an intensive activity that involves individuals from all parts of the company in creating story boards and prototype stills to be shown to the prospective client. Once a project is accepted by…arrow_forwardShaw is a lumber company that also manufactures custom cabinetry. It is made up of two divisions: Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use; the Cabinetry Division produces custom-ordered cabinetry. The lumber produced by the Lumber Division has a variable cost of $2.10 per linear foot and full cost of $3.10. Comparable quality wood sells on the open market for $6.30 per linear foot. Required: Assume you are the manager of the Cabinetry Division. Determine the maximum amount you would pay for lumber. Assume you are the manager of the Lumber Division. Determine the minimum amount you would charge for the lumber if you have excess capacity. Repeat assuming you have no excess capacity. Assume you are the president of Shaw. Determine a mutually beneficial transfer price assuming there is excess capacity.arrow_forward

- Pixel Studio, Inc., is a small company that creates computer-generated animations for films and television. Much of the company’s work consists of short commercials for television, but the company also does realistic computer animations for special effects in movies. The young founders of the company have become increasingly concerned with the economics of the business—particularly since many competitors have sprung up recently in the local area. To help understand the company’s cost structure, an activity-based costing system has been designed. Three major activities are carried out in the company: animation concept, animation production, and contract administration. The animation concept activity is carried out at the contract proposal stage when the company bids on projects. This is an intensive activity that involves individuals from all parts of the company in creating story boards and prototype stills to be shown to the prospective client. Once a project is accepted by the…arrow_forwardShaw is a lumber company that also manufactures custom cabinetry. It is made up of two divisions: Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use; the Cabinetry Division produces custom-ordered cabinetry. The lumber produced by the Lumber Division has a variable cost of $3.00 per linear foot and full cost of $4.00. Comparable quality wood sells on the open market for $9.00 per linear foot.Required:1. Assume you are the manager of the Cabinetry Division. Determine the maximum amount you would pay for lumber. (Enter your answers to 2 decimal places.)2. Assume you are the manager of the Lumber Division. Determine the minimum amount you would charge for the lumber if you have excess capacity. Repeat assuming you have no excess capacity. (Enter your answers to 2 decimal places.) minimum price with excess capacity minimum price without excess capacity 3. Assume you are the president of Shaw. Determine a mutually beneficial…arrow_forwardShaw is a lumber company that also manufactures custom cabinetry. It is made up of two divisions: Lumber and Cabinetry. The Lumber Division is responsible for harvesting and preparing lumber for use; the Cabinetry Division produces custom-ordered cabinetry. The lumber produced by the Lumber Division has a variable cost of $3.90 per linear foot and full cost of $4.90. Comparable quality wood sells on the open market for $11.70 per linear foot.Required:1. Assume you are the manager of the Cabinetry Division. Determine the maximum amount you would pay for lumber.2. Assume you are the manager of the Lumber Division. Determine the minimum amount you would charge for the lumber if you have excess capacity. Repeat assuming you have no excess capacity.3. Assume you are the president of Shaw. Determine a mutually beneficial transfer price assuming there is excess capacity.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning