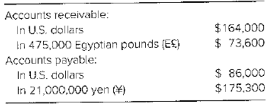

Chocolate De−lites imports and exports chocolate delicacies. Some transactions are denominated in U.S. dollars and others in foreign currencies. A summary of

The spot rates on December 31, 20X6, were

E€1 = $0.176

¥1 = $0.0081

The average exchange rates during the collection and payment period in 20X7 are

E€1 = $0.18

¥1 = $0.0078

Required

a. Prepare the adjusting entries on December 31, 20X6.

b. Record the collection of the accounts receivable in 20X7.

c. Record the payment of the accounts payable in 20X7.

d. What was the foreign currency gain or loss on the accounts receivable transaction denominated in E€ for the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

e. What was the foreign currency gain or loss on the accounts receivable transaction denominated in ¥? For the year ended December 31, 20X6? For the year ended December 31, 20X7? Overall for this transaction?

f. What was the combined foreign currency gain or loss for both transactions? What could Chocolate De-lites have done to reduce the risk associated with the transactions denominated in foreign currencies?

Want to see the full answer?

Check out a sample textbook solution

Chapter 11 Solutions

Advanced Financial Accounting

- 2 XYZ Company sells goods to a foreign customer on June 8. Payment of 3,000,000 foreign currency units (FC) is due in one month. June 30 is XYZ Company’s fiscal year-end. The following exchange rates were in effect during the period: June 8 Spot rate $1.10 June 8 30 day forward rate $1.15 June 30 Spot rate $1.14 July 8 Spot rate $1.20 A For what amount should XYZ Accounts Receivable be debited on June 8 B How much foreign exchange gain or loss should XYZ record on June 30arrow_forward1. On September 1, 20X1, Cano & Company, a U.S. corporation, sold merchandise to a foreign firm for 250,000 euros. Terms of the sale require payment in euros on February 1, 20X2. On September 1, 20X1, the spot exchange rate was $1.30 per euro. At Cano’s year-end on December 31, 20X1, the spot rate was $1.28, but the rate increased to $1.33 by February 1, 20X2, when payment was received. Required: What foreign currency transaction gain or loss should be recorded in 20X1? What foreign currency transaction gain or loss should be recorded in 20X2? Amount Gain / Loss 1. Foreign currency transaction gain (loss) 20X1 2. Foreign currency transaction gain (loss) - 20X2arrow_forwardThe Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change? Beginning Balance Sheet: Assets = 3,000 EurosEquity = 1,500 EurosLiabilities = 1,500 Euros $125, gain $375, loss $375, gain $500, loss $500, gainarrow_forward

- A foreign operation has the following local inflation rates: Year 1: 10% Year 2: 20% Year 3: 30% Year 4: 10% Year 5: 15% a. What is the applicable cumulative inflation rate that should be used for reporting as of end of year 5? b. What method will be used for remeasurement or translation of the foreign operation’s foreign currency financial statements? ANSWER A AND B BOTH PLEASE 2. XYZ, a US company has a subsidiary in Korea. The Korean sub sells inventory to a Japanese company with the sale denominated in US dollars. Between the date of sale and the date, the receivable is collected the Korean won strengthens 10% against the US dollar. Explain if there is a foreign exchange gain or loss or no FX impact and why? Answer 1 and 2 allarrow_forwardThe Simpson Corporation is calculating their adjusted balance sheet into U.S. Dollars. The exchange rate at the beginning of the year was $1 Euro = $1 U.S. dollar. The current exchange rate is .80 Euros to $1.00. Net Income for the year was zero. How much is the accounting gain/loss due to the exchange rate change? Beginning Balance Sheet: Assets = 3,000 Euros Equity = 1,500 Euros Liabilities = 1,500 Eurosarrow_forwardTristan Narvaja, S.A. (C). Calculate Tristan Narvaja’s contribution to its parent’s translation gain or loss using the current rate method if the exchange rate on December 31 is $U12 = $1.00. Assume all peso accounts remain as they were at the beginning of the year.arrow_forward

- Adjusting Entry at Balance Sheet Date Yum! Brands, Inc. has the following receivables and payables denominated in foreign currencies, prior to closing on December 31. The spot rates at December 31 are also given. Item Current $ balance FC balance December 31 spot rate 1. Receivable $65,000 1,000,000 Mexican pesos $0.06 2. Receivable 165,000 225,000 Canadian dollars 0.75 3. Payable 556,000 400,000 Jordan dinar 1.41 4. Payable 56,000 200,000 Saudi Arabian riyal 0.27 Required Prepare the adjusting entry recorded by Yum! Brands at December 31. Description Debit Credit AnswerAccounts receivableCashExchange gainExchange loss? AnswerAccounts receivableCashExchange gainExchange loss? Accounts payablearrow_forwardOn June 1, a calendar year U.S. manufacturer sells, on 60-day credit, goods to Oman importer for US$ 1,000,000. The Dollar/Rial exchange rate is OMR 1 = US$ 0.40 on June 1, and OMR 1 = $ 0.39 on August 1. Required: Prepare dated journal entries in Oman Rials to record the incurrence and settlement of this foreign currency transaction assuming It employs a two-transaction perspective.arrow_forwardAccounting for Business Combinations: Honesty Company accepted a sales order from a Singaporean Company on October 9, 2022. The contract price was S$100,000. The merchandise was delivered on November 19, 2022. The invoice was dated November 15, 2022, FOB Shipping Point. Full payment was received on January 15, 2023. The spot rate for the Singaporean Dollar on the respective dates is as follows (see image below). Answer the follwing subquestions: a. How much is Foreign Exchange Gain (Loss) to be reported in 2022? b. How much is the Sales to be reported in 2022? __________________arrow_forward

- Turbo Corporation (a U.S.-based company) acquired merchandise on account from a foreign supplier on November 1, 2017, for 100,000 markkas. It paid the foreign currency account payable on January 17, 2018. The following exchange rates for 1 markka are known:a. How does the fluctuation in exchange rates affect Turbo’s 2017 income statement?b. How does the fluctuation in exchange rates affect Turbo’s 2018 income statement?arrow_forwardTurbo Corporation (a U.S.-based company) acquired merchandise on account from a foreign supplier on November 1, 2017, for 100,000 markkas. It paid the foreign currency account payable on January 17, 2018. The following exchange rates for 1 markka are known:November 1, 2017 $0.754December 31, 2017 0.742 January 15, 2018 0.747a. How does the fluctuation in exchange rates affect Turbo’s 2017 income statement?b. How does the fluctuation in exchange rates affect Turbo’s 2018 income statement?arrow_forwardHonesty Company sold goods on account to a foreign company for 80,200 euros on October 20, 2022. The date of invoice is October 25, 2022 and the payment is due on January 29, 2023. Exchange rates were as follows (see image below). Answer the following subquestion(3): a. How much is the foreign exchange gain (loss) to be reported in 2022? ____________ thanks!arrow_forward