1.

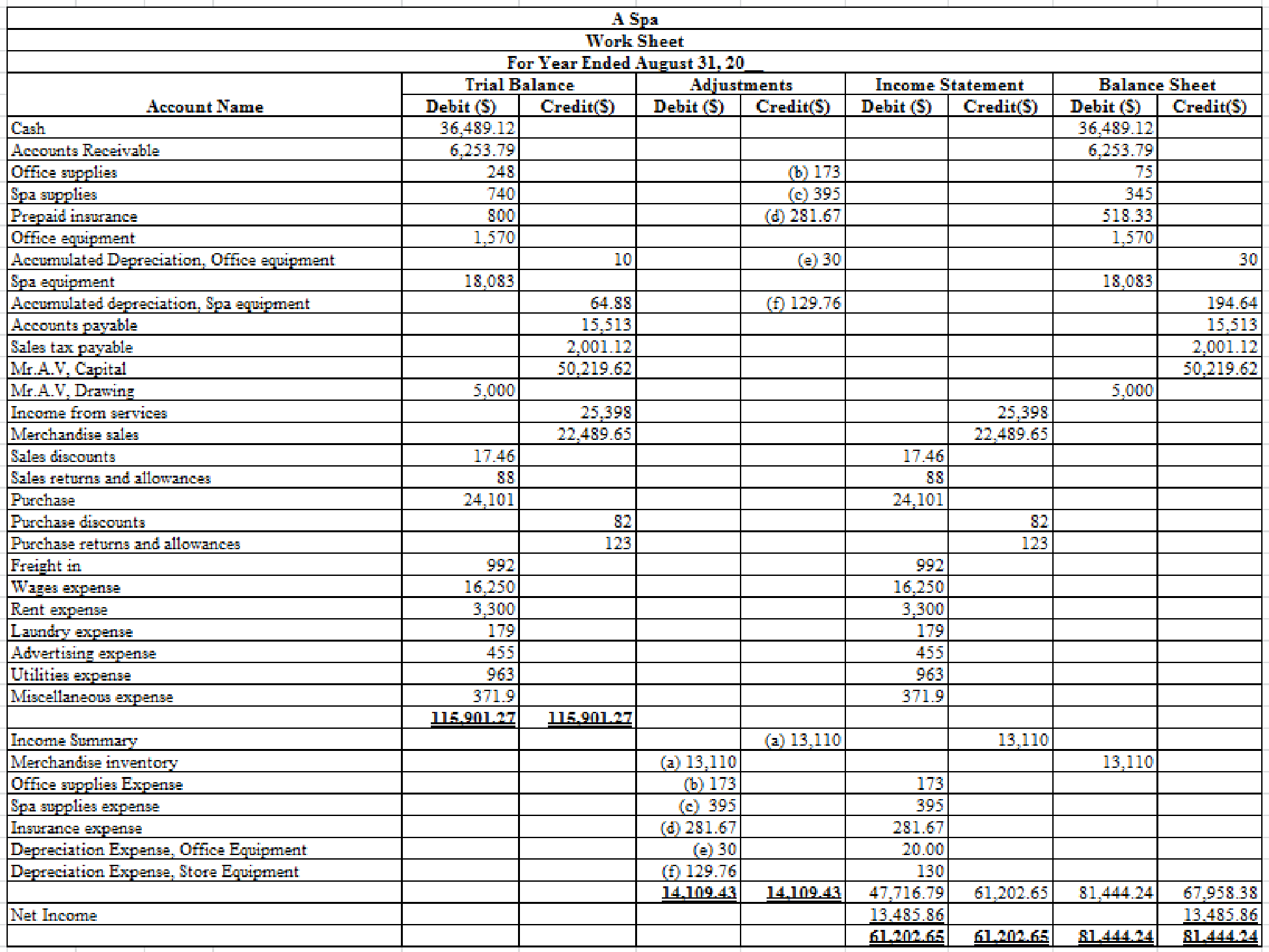

Prepare worksheet for A Spa as of August.

1.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Balance sheet: This financial statement reports a company’s resources (assets) and claims of creditors (liabilities) and stockholders (

Worksheet: A worksheet is a spreadsheet used while preparing a financial statement. It is a type of form having multiple columns and it is used in the adjustment process. The use of a worksheet is optional for any organization. A worksheet can neither be considered as a journal nor a part of the general ledger.

Prepare worksheet for A Spa.

Table (1)

2.

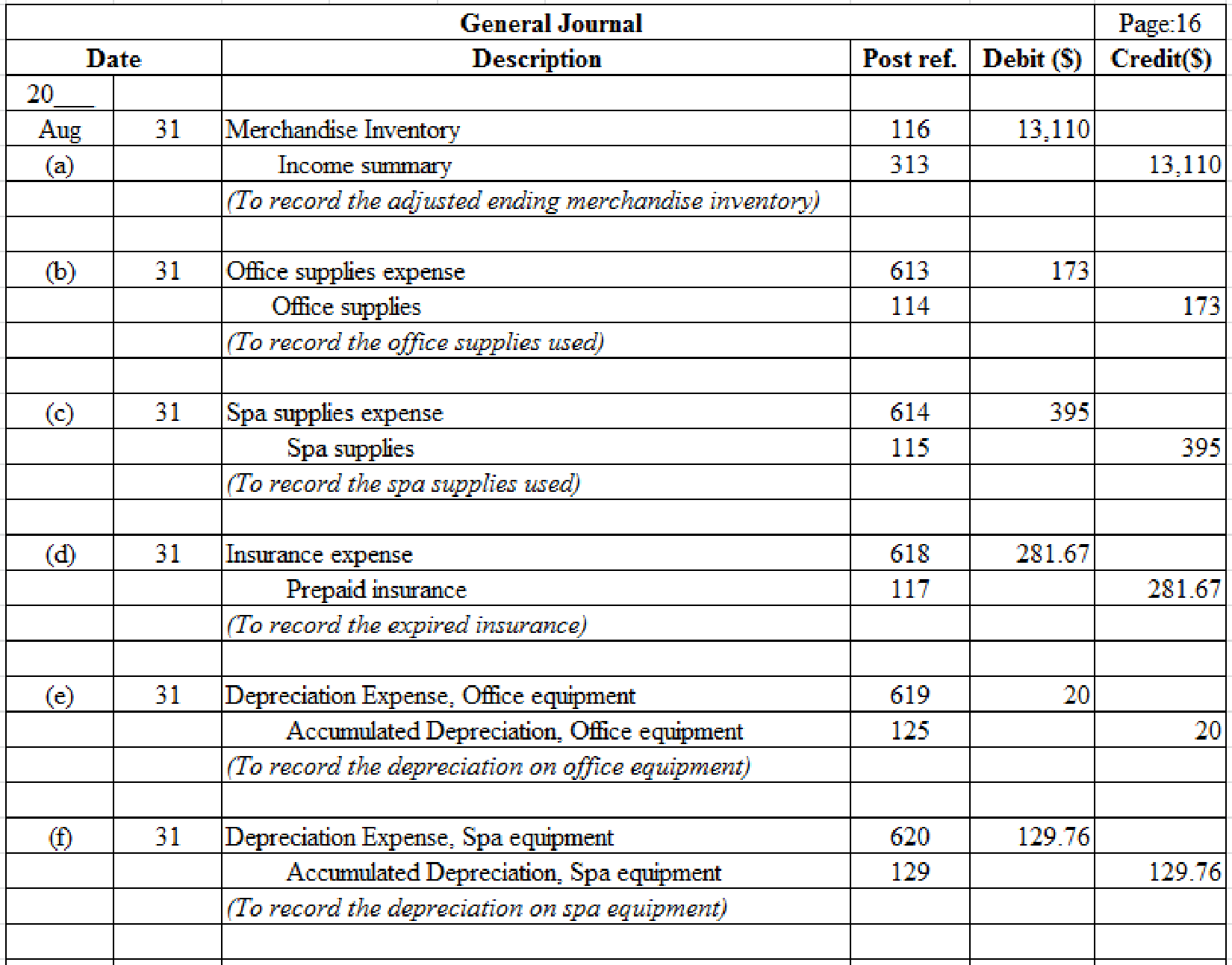

Journalize the

2.

Explanation of Solution

Adjusting entries: Adjusting entries are those entries which are recorded at the end of the year, to update the income statement accounts (revenue and expenses) and balance sheet accounts (assets, liabilities, and stockholders’ equity) to maintain the records according to accrual basis principle.

General journal: This is a journal used to record infrequent transactions like adjusting entries, closing entries, accounting errors, sale of assets, or

Journalize the adjusting entries.

Table (2)

Description:

- (a) Merchandise Inventory is an asset (current) account and it is increased. Therefore, debit the merchandise inventory. Income summary is a temporary account and it is closed. Therefore, credit the income summary.

- (b) Office supplies expense is an expense account and it is increased. Therefore, debit the Office supplies expense. Office supplies are a liability account and it is increased. Therefore, credit the Office supplies.

- (c) Spa supplies expense is revenue account and it is increased. Therefore, debit the Spa supplies expense. Spa supplies (on hand) are an asset (current) account and it is decreased. Therefore, credit the Spa supplies (on hand).

- (d) Insurance expense is an expense (operating) account and it is increased. Therefore, debit the insurance expense. Prepaid insurance is an asset (current) account and it is decreased. Therefore, credit the prepaid insurance.

- (e)

Depreciation expense (on office equipment) is an expense account and it is increased. Therefore, debit the depreciation expense.Accumulated depreciation (on office equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation. - (f) Depreciation expense (on spa equipment) is an expense account and it is increased. Therefore, debit the depreciation expense. Accumulated depreciation (on spa equipment) is a contra asset account and it is decreased. Therefore, credit the accumulated depreciation.

3.

Post the adjusting entries to the general ledger.

3.

Explanation of Solution

Posting of transaction: The process of transferring the journalized transactions into the accounts of the ledger is known as posting of transaction.

Post the adjusting entries to the general ledger:

| General ledger | |||||||

| Account: Cash | Account No: 111 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 36,489.12 | ||||

| Account: Accounts receivable | Account No: 113 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 6,253.79 | ||||

| Account: Office supplies | Account No: 114 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 248 | ||||

| Adjusting | J16 | 173 | 75 | ||||

| Account: Spa supplies | Account No: 115 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 740 | ||||

| Adjusting | J16 | 395 | 345 | ||||

| Account: Merchandise inventory | Account No: 116 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 13,110 | 13,110 | ||

| Account: Prepaid insurance | Account No: 117 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 800 | ||||

| Adjusting | J16 | 281.67 | 518.33 | ||||

| Account: Office equipment | Account No: 124 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 1,570 | ||||

| Account: Accumulated depreciation, Office equipment | Account No: 125 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 10 | ||||

| Adjusting | J11 | 20 | 30 | ||||

| Account: Spa equipment | Account No: 128 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 18,083 | ||||

| Account: Accumulated depreciation, Spa equipment | Account No: 129 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 64.88 | ||||

| Adjusting | J16 | 129.76 | 194.64 | ||||

| Account: Accounts payable | Account No: 211 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 15,513 | ||||

| Account: Wages payable | Account No: 212 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | ||||||

| Account: sales tax payable | Account No: 215 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 2,001.1 | ||||

| Account: Mr. A.V, capital | Account No: 311 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 50,219.62 | ||||

| Account: Mr. A.V, Drawing | Account No: 312 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 4,500 | ||||

| Account: Income summary | Account No: 313 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 13,110 | 13,110 | ||

| Account: Income from services | Account No: 411 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 25,398 | ||||

| Account: Merchandise sales | Account No: 412 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 22,489.65 | ||||

| Account: Sales discount | Account No: 413 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 17.46 | ||||

| Account: Sales returns and allowances | Account No: 414 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 88 | ||||

| Account: Purchase | Account No: 511 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 24,101 | ||||

| Account: Purchase discount | Account No: 512 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 82 | ||||

| Account: Purchase returns and allowances | Account No: 513 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 123 | ||||

| Account: Freight in | Account No: 515 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 992 | ||||

| Account: Wages expense | Account No: 611 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 16,250 | ||||

| Account: Rent expense | Account No: 612 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 3,300 | ||||

| Account: Office supplies expense | Account No: 613 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 173 | 173 | ||

| Account: Spa supplies expense | Account No: 614 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 395 | 395 | ||

| Account: Laundry expense | Account No: 615 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 179 | ||||

| Account: Advertising expense | Account No: 616 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 455 | ||||

| Account: Utilities expense | Account No: 617 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 963 | ||||

| Account: Insurance expense | Account No: 618 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 281.67 | 281.67 | ||

| Account: Depreciation expense, Office equipment | Account No: 619 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 20 | 20 | ||

| Account: Depreciation expense, Spa equipment | Account No: 620 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Adjusting | J16 | 129.67 | 129.67 | ||

| Account: Promotional expense | Account No: 630 | ||||||

| Date | Item | Post ref | Debit | Credit | Balance | ||

| 20___ | ($) | ($) | Debit ($) | Credit($) | |||

| Aug. | 31 | Balance | 371.9 | ||||

Table (3)

4.

Prepare a trail balance for 31st August.

4.

Explanation of Solution

Prepare a trial balance.

| A Spa | ||

| Trail balance (Adjusted) | ||

| August 31, 20__ | ||

| Account name | Debit ($) | Credit($) |

| Cash | 36,489.12 | |

| Accounts receivable | 6,253.79 | |

| Office supplies | 75 | |

| Spa supplies | 345 | |

| Merchandise inventory | 13,110 | |

| Prepaid insurance | 518.33 | |

| Office equipment | 1,570 | |

| Accumulated depreciation, office equipment | 30 | |

| Spa equipment | 18,083 | |

| Accumulated depreciation, spa equipment | 194.64 | |

| Accounts payable | 15,513 | |

| Sales tax payable | 2,001.12 | |

| Mr. A.V, capital | 50,219.62 | |

| Mr. A.V, drawings | 5,000 | |

| Income summary | 13,110 | |

| Income from services | 25,398 | |

| Merchandise sales | 22,489.65 | |

| Sales discounts | 17.46 | |

| Sales returns and allowances | 88 | |

| Purchases | 24,101 | |

| Purchases discounts | 82 | |

| Purchases returns and allowances | 123 | |

| Freight in | 992 | |

| Wages expense | 16,250 | |

| Rent expense | 3,300 | |

| Office supplies expense | 173 | |

| Spa supplies expense | 395 | |

| Laundry expense | 179 | |

| Advertising expense | 455 | |

| Utilities expense | 963 | |

| Insurance expense | 281.67 | |

| Depreciation expense, office equipment | 20 | |

| Depreciation expense, spa equipment | 129.76 | |

| Miscellaneous expense | 371.9 | |

| Total | 129,161.03 | 129,161.03 |

Table (4)

Want to see more full solutions like this?

Chapter 11 Solutions

College Accounting (Book Only): A Career Approach

- The following accounts appear in the ledger of Celso and Company as of June 30, the end of this fiscal year. The data needed for the adjustments on June 30 are as follows: ab.Merchandise inventory, June 30, 54,600. c.Insurance expired for the year, 475. d.Depreciation for the year, 4,380. e.Accrued wages on June 30, 1,492. f.Supplies on hand at the end of the year, 100. Required 1. Prepare a work sheet for the fiscal year ended June 30. Ignore this step if using CLGL. 2. Prepare an income statement. 3. Prepare a statement of owners equity. No additional investments were made during the year. 4. Prepare a balance sheet. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entry as of July 1, for the wages that were accrued in the June adjusting entry. Check Figure Net income, 14,066arrow_forwardAdjusting Entries Two months (July and August) have passed since Ms. Valli has seen the financial statements for All About You Spa. It is time to begin their preparation. Several accounts need adjusting. These include the accounts you adjusted in Chapter 4 as well as any accounts involved with merchandising. Adjusting Entry Information Merchandise Inventory Adjustment (a) A physical count of inventory was taken, and the inventory was valued at 11,310. Supplies Adjustments (b) and (c) A physical count has been taken of the two supplies accounts. The values of the remaining inventories of supplies are as follows: Prepaid Insurance Adjustment (d) A review of the insurance records determined that 233.34 in liability insurance coverage had been used during the last two months. Depreciation Adjustments (e) and (f) Estimated depreciation amounts for the two equipment accounts are as follows: Wages Expense/Wages Payable Adjustment There is no need for a Wages Expense/Wages Payable adjustment because the end of the fiscal period did not come in the middle of a pay period. Required 1. Complete a work sheet (if required by your instructor). Ignore this step if using CLGL. 2. Journalize the adjusting entries in the general journal. If you are preparing the adjusting entries with Working Papers, enter your transactions beginning on page 16. 3. Post the adjusting entries to the general ledger accounts. Ignore this step if you are using CLGL. 4. Prepare an adjusted trial balance as of August 31, 20--.arrow_forwardThe trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forward

- The trial balance of Hadden Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab.Merchandise Inventory at December 31, 64,742.80. c.Store supplies inventory (on hand), 420.20. d.Insurance expired, 738. e.Salaries accrued, 684.50. f.Depreciation of store equipment, 3,620. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardOn December 31, the end of the year, the accountant for Fireside Magazine was called away suddenly because of an emergency. However, before leaving, the accountant jotted down a few notes pertaining to the adjustments. Journalize the necessary adjusting entries. Assume that Fireside Magazine uses the periodic inventory system. ab. A physical count of inventory revealed a balance of 199,830. The Merchandise Inventory account shows a balance of 202,839. c. Subscriptions received in advance amounting to 156,200 were recorded as Unearned Subscriptions. At year-end, 103,120 has been earned. d. Depreciation of equipment for the year is 12,300. e. The amount of expired insurance for the year is 1,612. f. The balance of Prepaid Rent is 2,400, representing four months rent. Three months rent has expired. g. Three days salaries will be unpaid at the end of the year; total weekly (five days) salaries are 4,000. h. As of December 31, the balance of the supplies account is 1,800. A physical inventory of the supplies was taken, with an amount of 920 determined to be on hand.arrow_forwardA firm is preparing to make adjusting entries at the end of the accounting period. The balance of the merchandise inventory account is 200,000. If the firm is using the periodic inventory system, what does this balance represent?arrow_forward

- Bay Book and Software has two sales departments: Book and Software. After recording and posting all adjustments, including the adjustments for merchandise inventory, the accountant prepared the adjusted trial balance (shown on the next page) at the end of the fiscal year. Merchandise inventories at the beginning of the year were as follows: Book Department, 53,410; Software Department, 23,839. The bases (and sources of figures) for apportioning expenses to the two departments are as follows (rounded to the nearest dollar): Sales Salary Expense (payroll register): Book Department, 45,559; Software Department, 35,629 Advertising Expense (newspaper column inches): Book Department, 550 inches; Software Department, 450 inches Depreciation Expense, Store Equipment (property and equipment ledger): Book Department, 7,851; Software Department, 2,682 Store Supplies Expense (requisitions): Book Department, 205; Software Department, 199 Miscellaneous Selling Expense (volume of gross sales): Book Department, 240; Software Department, 110 Rent Expense and Utilities Expense (floor space): Book Department, 9,000 square feet; Software Department, 7,000 square feet Bad Debts Expense (volume of gross sales): Book Department, 1,029; Software Department, 441 Miscellaneous General Expense (volume of gross sales): Book Department, 364; Software Department, 156 Required Prepare an income statement by department to show income from operations, as well as a nondepartmentalized income statement (using the Total columns) to show net income for the entire company.arrow_forwardThe balances of the ledger accounts of Pelango Furniture as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 104,565. c. Wages accrued at December 31, 934. d. Supplies inventory (on hand) at December 31, 755. e. Depreciation of store equipment, 4,982. f. Depreciation of office equipment, 1,531. g. Insurance expired during the year, 935. h. Rent earned, 2,450. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardHere are the accounts in the ledger of Mishas Jewel Box, with the balances as of December 31, the end of its fiscal year. Here are the data for the adjustments. Assume that Mishas Jewel Box uses the perpetual inventory system. a. Merchandise Inventory at December 31, 124,630. b. Insurance expired during the year, 1,294. c. Depreciation of building, 3,300. d. Depreciation of store equipment, 6,470. e. Salaries accrued at December 31, 2,470. f. Store supplies inventory (on hand) at December 31, 1,959. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 63.arrow_forward

- The balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal year, are as follows: Data for the adjustments are as follows: ab. Merchandise Inventory at December 31, 102,765. c. Wages accrued at December 31, 1,834. d. Supplies inventory (on hand) at December 31, 645. e. Depreciation of store equipment, 5,782. f. Depreciation of office equipment, 1,791. g. Insurance expired during the year, 845. h. Rent earned, 2,500. Required 1. Complete the work sheet after entering the account names and balances onto the work sheet. Ignore this step if using CLGL. 2. Journalize the adjusting entries. If using manual working papers, record adjusting entries on journal page 16.arrow_forwardA firm is preparing to make adjusting entries at the end of the accounting period. The balance of the merchandise inventory account is 100,000. If the firm is using the perpetual inventory system, what does this balance represent?arrow_forwardEND-OF-PERIOD SPREADSHEET, ADJUSTING, CLOSING, AND REVERSING ENTRIES Vickis Fabric Store shows the trial balance on page 601 as of December 31, 20-1. At the end of the year, the following adjustments need to be made: (a, b)Merchandise inventory as of December 31, 31,600. (c, d, e)Vicki estimates that customers will be granted 2,500 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,800. (f)Unused supplies on hand, 350. (g)Insurance expired, 2,400. (h)Depreciation expense for the year on building, 20,000. (i)Depreciation expense for the year on equipment, 4,000. (j)Wages earned but not paid (Wages Payable), 520. (k)Unearned revenue on December 31, 20-1, 1,200. PROBLEM 15-10A CONT. REQUIRED 1. Prepare an end-of-period spreadsheet. 2. Prepare adjusting entries and post adjusting entries to an Income Summary T account. 3. Prepare closing entries and post to a Capital T account. There were no additional investments this year. 4. Prepare a post-closing trial balance. 5. Prepare reversing entry(ies).arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage