Translation

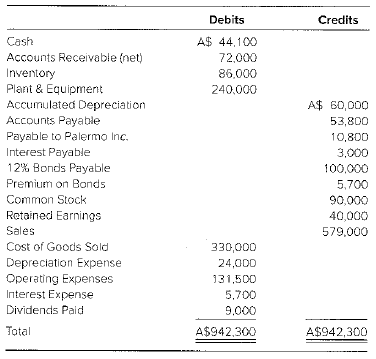

Palermo Inc. purchased 80 percent of the outstanding stock of Salina Ranching Company, located in Australia, on January 1, 20X3. The purchase price in Australian dollars (AS) was A$200,000, and A$40,000 of the differential was allocated lo plant and equipment, which is amortized over a 10-year period. The remainder of the differential was attributable to a Patent. Palermo Inc. amortizes the patent over 10 years. Salina Ranching’s

Additional Information

1. Salina Ranching uses average cost for cost of goods sold. Inventory increased by A$20,000 during the year. Purchases were made uniformly during 20X3. The ending inventory was acquired at the average exchange rate for the year.

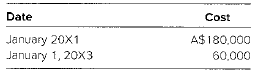

2. Plain and equipment were acquired as follows:

3. Plant and equipment are

4. The payable to Palermo is in Australian dollars. Palermo’s books show a receivable from Salina Ranching of $6,480.

5. The 10−year bonds were issued on July 1, 20X3, for A$106,000. The premium is amortized on a straight−line basis. The interest is paid on April 1 and October 1,

6. The dividends were declared arid paid on April 1.

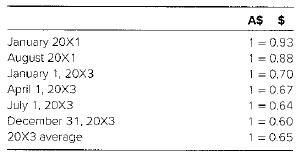

7. Exchange rates were as follows:

Required

a. Prepare a schedule translating the December 31, 20X3, trial balance of Salina Ranching from Australian dollars to U.S. dollars.

b. Prepare a schedule providing a proof of the translation adjustment.

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

ADVANCED FINANCIAL ACCOUNTING IA

- The following intangible assets were purchased by Goldstein Corporation: A. A patent with a remaining legal life of twelve years is bought, and Goldstein expects to be able to use it for seven years. B. A copyright with a remaining life of thirty years is purchased, and Goldstein expects to be able to use it for ten years. For each of these situations, determine the useful life over which Goldstein will amortize the intangible assets.arrow_forwardThe following intangible assets were purchased by Hanna Unlimited: A. A patent with a remaining legal life of twelve years is bought, and Hanna expects to be able to use it for six years. It is purchased at a cost of $48,000. B. A copyright with a remaining life of thirty years is purchased, and Hanna expects to be able to use it for ten years. It is purchased for $70,000. Determine the annual amortization amount for each intangible asset.arrow_forwardPanama Company acquired 60 %of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilitiesapproximated book values on that date. Panama uses the initial value methodto account for its investment in Samoa.On 1/2019, Panama bought equipment from Samoa for $60,000 that hadoriginally cost Samoa $120,000 and had $ 90,000of Accumulated depreciation at the time. The equipment had a five-yearremaining life and was being depreciated using the straight line method.You are preparing the worksheet for the 2020 fiscal year.a. Was this equipment sale upstream or downstream?b. How much unrealized net gain from the equipment transfer remains at thebeginning of 2020? (this is the amount you will need for the *TA entry at 1/2020.)c. Which company's Retained earnings account will be adjusted in the *TA entryin part a? (Which company was the “initiator” of the transaction?)d. How much excess depreciation will there be in each of the first five yearsafter the transfer?e. Panama's 2020 net…arrow_forward

- Panama Company acquired 60 %of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilitiesapproximated book values on that date. Panama uses the initial value methodto account for its investment in Samoa.On 1/2019, Panama bought equipment from Samoa for $60,000 that hadoriginally cost Samoa $120,000 and had $ 90,000of Accumulated depreciation at the time. The equipment had a five-yearremaining life and was being depreciated using the straight line method.You are preparing the worksheet for the 2020 fiscal year.d. How much excess depreciation will there be in each of the first five yearsafter the transfer?e. Panama's 2020 net income, without including any investment income, was$ 360,000 and Samoa reported net income of $ 115,000 in 2020.What consolidated income will be reported before removing the noncontrollinginterest's share of the subsidiary's net income? (This includes the effectof the ED entry.)f. What will the noncontrolling interest's share of the subsidiary's net…arrow_forwardPanama Company acquired 60 % of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilities approximated book values on that date. Panama uses the initial value method to account for its investment in Samoa. only answer D.) E.) F.) On 1/2019, Panama bought equipment from Samoa for $60,000 that had originally cost Samoa $120,000 and had $ 90,000 of Accumulated depreciation at the time. The equipment had a five-year remaining life and was being depreciated using the straight line method. You are preparing the worksheet for the 2020 fiscal year. a. Was this equipment sale upstream or downstream?b. How much unrealized net gain from the equipment transfer remains at the beginning of 2020? (this is the amount you will need for the *TA entry at 1/2020.)c. Which company's Retained earnings account will be adjusted in the *TA entry in part a? (Which company was the “initiator” of the transaction?)d. How much excess depreciation will there be in each of the first five years after…arrow_forwardPanama Company acquired 60% of Samoa Corporation on 1/2018. Fair values of Samoa's assets and liabilities approximated book values on that date. Panama uses the initial value method to account for its investment in Samoa. On 1/2019, Panama bought equipment from Samoa for $60,000 that had originally cost Samoa $120,000 and had $ 110,000of Accumulated depreciation at the time. The equipment had a five-year remaining life and was being depreciated using the straight-line method. You are preparing the worksheet for the 2020 fiscal year. a. Was this equipment sale upstream or downstream?b. How much unrealized net gain from the equipment transfer remains at the beginning of 2020? (this is the amount you will need for the *TA entry at 1/2020.)c. Which company's Retained earnings account will be adjusted in the *TA entry in part a? (Which company was the "initiator" of the transaction?)d. How much excess depreciation will there be in each of the first five years after the transfer?e. Panama's…arrow_forward

- Tesla acquired Amazon, for $33,520,000. The fair value of all Amazon's identifiable tangible and intangible assets was $30,000,000. Short will amortize any goodwill over the maximum number of years allowed. What is the annual amortization of goodwill for this acquisition? Multiple Choice O O $880,000 $1,760,000 $O $3,520,000 < Prev 6 of 25 Save & Ex Nextarrow_forwardTourmalet sold an item of plant for $50 million on 1 April 20X4. The plant had a carrying amount of $40 million at the date of sale, which was charged to cost of sales. On the same date, Tourmalet entered into an agreement to lease back the plant for the next five years (being the estimated remaining life of the plant) at a cost of $14 million per annum payable annually in arrears. An arrangement of this type is normally deemed to have a financing cost of 10% per annum. What amount will be shown as income from this transaction in the statement of profit or loss for the year ended 30 September 20X4?arrow_forward22 On January 1, 2022, Estrime Company purchases an investment property at a cost of P50,000,000 including transaction costs. On October 1, 2022, the fair value of property increases to P51,000,000. At December 31, 2022 the fair value of property is P47,000,000. The rental income received per quarter is P1,550,000. The property has a useful life of 50 years. If the company uses the cost model, what is the net effect on the profit or loss for the year ended December 31, 2022 in relation to the investment property? If the company uses the fair value model, what is the net effect on the profit or loss for the six months ended December 31, 2022 in relation to the investment property?arrow_forward

- On January 1, 2022, J Company acquired an intangible asset from a foreign company. The invoice price of the intangible was P5,000,000 subject to a 10% discount if acquired on a cash basis. J Company paid P500,000 import duties and professional fees of P50,000 in relation to its acquisition. At what amount should the intangible asset be initially recorded in the books of J Company? NOTE: ANSWER ONLYarrow_forwarda. On January 1, 2024, UTS completed the purchase of Heinrich Corporation for $3,153,000 in cash. The fair value of the net Identifiable assets of Heinrich was $2,850,000. b. Included in the assets purchased from Heinrich was a patent valued at $91,200. The original legal life of the patent was 20 years; there are 12 years remaining, but UTS believes the patent will be useful for only eight more years. c. UTS acquired a franchise on July 1, 2024, by paying an initial franchise fee of $356,000. The contractual life of the franchise is 10 years. Required: 1. Record amortization expense for the Intangible assets at December 31, 2024. 2. Prepare the intangible asset section of the December 31, 2024, balance sheet. Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the intangible asset section of the December 31, 2024, balance sheet.arrow_forwardIdentify how much to add or deduct from the Investment in Associate account of ABC based on the following transactions or events: The fair value of an equipment held by X is P500,000 while its carrying value is P360,000 as of the beginning of the year. It has a remaining useful life of 3 years as of Dec. 31, 2021. X sold inventories costing P150,000 to ABC for P200,000. Only 75% of these inventories were sold by ABC to third parties as of the end of the year.arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College