Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.67BP

LO 2, 4, 5

(Learning Objectives 2, 4, 5: Analyze trends; calculate and interpret ratios; evaluate earnings quality)

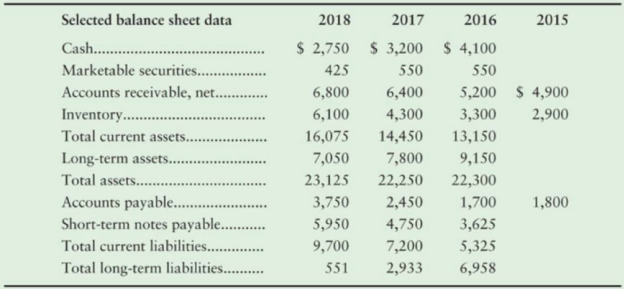

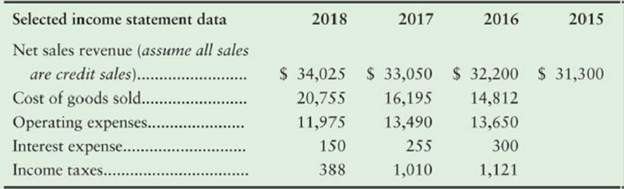

Selected data from Switzer Furniture, Inc., follows.

Industry averages have been gathered for several ratios.

| Furniture industry averages | |

| 2.4 | |

| Quick ratio................................ | 1.0 |

| Days′ inventory outstanding...... | 80.0 |

| Days′ sales outstanding.............. | 60.0 |

| Days′ payable outstanding......... | 32.0 |

| Debt ratio.................................. | 61% |

| Times-interest-earned ratio........ | 13.0 |

| Gross margin percentage........... | 52% |

| Operating income percentage.... | 12% |

Requirements

- 1. Perform a trend analysis on Switzer’s sales revenue, inventory, and receivables over the past three years, using 2015 as the base. Is the trend in each of these areas favorable or unfavorable for the company?

- 2. Using the industry averages as benchmarks, analyze Switzer’s performance over the past three years in the following areas:

- a. Liquidity

- b. Turnover

- c. Overall debt payment ability

- d. Profitability

- 3. Evaluate Switzer’s quality of earnings. Are there any red flags in your analysis? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Please take a look below at the two companies' financial ratios. Use the material your learned in the chapter to try and identify the industries these two companies operate in. You are going to be graded on the quality of your analysis and arguments (e.g. this ratio indicates that... and that ratio indicates the other,... and taken together these ratios indicate that.... (and so forth)) :

Company A

Company B

P/E Ratio: 30

Price/Sales: 6

Price/Book Value of Equity: 7.5

Profit Margin: 20%

Operating Margin: 25%

Return on Assets (ROA): 6%

Return On Equity (ROE): 25%

Current Ratio: 3

P/E Ratio: 17

Price/Sales: 0.6

Price/Book Value of Equity: 3

Profit Margin: 3%

Operating Margin: 5%

Return on Assets (ROA): 7%

Return On Equity (ROE): 15%

Current Ratio: 1

In a minimum of 175 words

Imagine that you’ve been asked to explain 1 of the major accounting ratios to a group of high school students who have no background in business or accounting but are eager to learn. Choose 1 of the following ratios and describe how you would explain it in your own words, using a specific example:

current ratio

asset turnover

profit margin on sales

Imagine that you’ve been asked to explain 1 of the major accounting ratios to a group of high school students who have no background in business or accounting but are eager to learn. Choose 1 of the following ratios and describe how you would explain it in your own words, using a specific example:

current ratio

asset turnover

profit margin on sales

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Compare and contrast the four categories of financial ratios we discussed in class. Discuss how the business owners and potential investors could benefit from these ratios. What are clear indicators of success vs. poor operations?arrow_forwardAy 1. Using your financial analysis of Gap Clothing company, Refer to the Annual Reports located in the Class Resources. You will use information in the Form 10-K to complete this assignment. Using the correct formulas and a separate tab for each analysis, calculate the following ratios using Microsoft Excel: Three liquidity ratios for the past 2 years Three solvency ratios for the past 2 years Three profitability ratios for the past 2 yearsarrow_forwardCAB Co. (CAB), a publicly accountable company specializing in children’s clothing, activities, and toys, wishes to benchmark its financial results against industry leaders for the current fiscal year. CAB’s chief executive officer feels that benchmarking CAB’s results will help identify its strengths and weaknesses. Below is some information on CAB compared to the industry average: Ratio CAB Co. Industry average Current ratio 1.02 1.05 Gross margin 30% 33% Debt-to-equity 0.6 0.5 Return on equity 23% 20% Accounts receivable days 23 31 Earnings per share 2.03 2.84 Inventory days 24 26 Quick ratio 1.2 1.3 Required: Evaluate CAB’s liquidity compared to the industry average, using two Evaluate CAB’s profitability compared to the industry average, using three Evaluate CAB’s solvency compared to the industry average, using one Evaluate how well CAB manages its assets compared to the industry…arrow_forward

- Please show work and explain answer 7.________ measures the percentage of each sales dollar remaining after all costs and expenses, including interest, taxes, and preferred stock dividends, have been deducted. A) Net profit margin B) Operating profit margin C) Gross profit margin D) Earnings available to common shareholders 8.________ measures the return earned on the common stockholders' investment in the firm. A) Net profit margin B) Price/earnings ratio C) Return on equity D) Return on total assetsarrow_forwardIn analysis earnings quality. Earnings quality refers to the reliability of the financial statements presented and whether it reflects the current business environment.Required:In 300 words, discuss the determinants of earnings qualityarrow_forwardYou are a financial consultant. You are hired by a manufacturing company to assess its performance Based on financial ratios. Your task is to come up with the following: (1) financial analysis using financial ratios on liquidity, solvency or stability, and profitability; (2) trend analysis, both vertical and horizontal; and (3) comparative financial statements. The analysis should be benchmarked with competitors. Prepare a report indicating your comments on the financial health and performance of the company (as benchmarked with competitors) using the following liquidity ratios: (1) current ratio, (2) receivable turnover, (3) inventory turnover, and (4) quick ratio. Give your insights into the relative solvency or stability of the company (as benchmarked with the competitors) using the following ratios: (1) debt ratio, (2) times interest earned ratio, and (3) debt - equity ratio, Also, assess the relative profitability of the company (as benchmarked with competitors) using the…arrow_forward

- CAB Co. (CAB), a publicly accountable company specializing in children’s clothing, activities, and toys, wishes to benchmark its financial results against industry leaders for the current fiscal year. CAB’s chief executive officer feels that benchmarking CAB’s results will help identify its strengths and weaknesses.Below is some information on CAB compared to the industry average:Ratio CAB Co. Industry averageCurrent ratio 1.02 1.05Gross margin 30% 33%Debt-to-equity 0.6 0.5Return on equity 23% 20%Accounts receivable days 23 31Earnings per share 2.03 2.84Inventory days 24 26Quick ratio 1.2 1.3Required:a) Evaluate CAB’s liquidity compared to the industry average, using two ratios.b) Evaluate CAB’s profitability compared to the industry average, using three ratios.c) Evaluate CAB’s solvency compared to the industry average, using one ratio.d) Evaluate how well CAB manages its assets compared to the industry average, using two ratios.arrow_forwardUse this data to compute the following ratios: 1.Current ratio (Dec 2020 )2.Acid-test Ratio (Dec 2020) 3.Accounts Receivable Turnover 4.Inventory Turnover 5.Return on Assets 6.Profit Margin on Sales 7.Return on Equity 8.Times Interest Earned b.Discuss the financial condition of ABC Company, Inc. based on what you learn from computing the ratios.arrow_forwardThe senior management of ABC Corp. has proposed the following three performance measures for the company: 1. Net income as a percent of stockholders' equity 2. Revenue growth 3. Employee satisfaction Management believes these three measures combine both financial and nonfinancial measures and, as such, are superior to using just financial measures. What advice would you give ABC Corp. for improving its performance measurement system?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License