(Learning Objectives 4, 5: Calculate and analyze ratios and earnings quality for a company in the restaurant industry)

Note: This case is part of The Cheesecake Factory serial case contained in every chapter in this textbook.

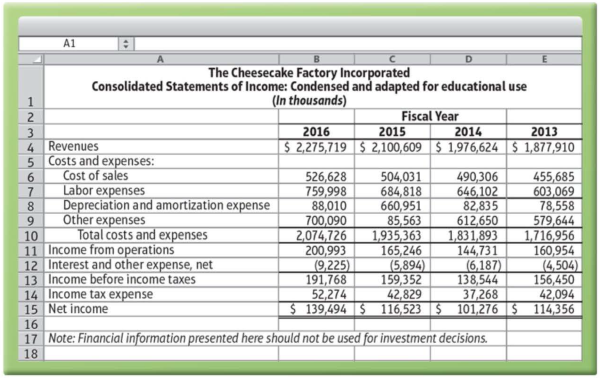

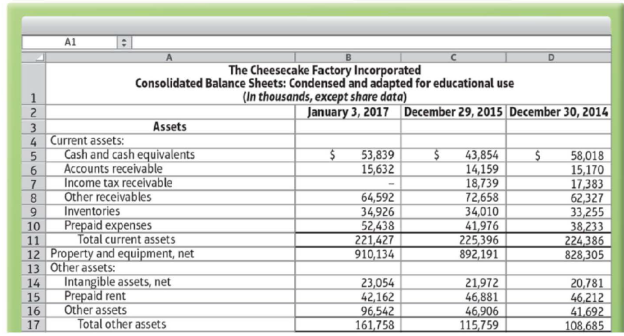

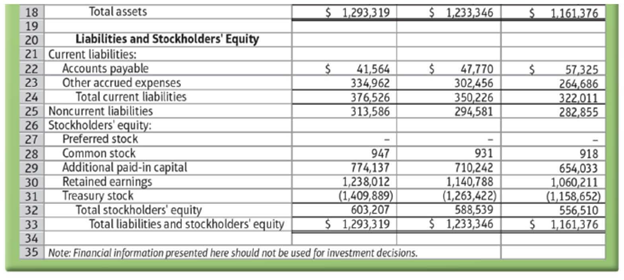

To follow are The Cheesecake Factory Incorporated's financial statements from its 2016 Form 10-K.

Data from the US. Securities and Exchange Commission EDGAR Company filings, www.sec.gov

Data from the U.S. Securities and Exchange Commission EDGAR Company filings, www.sec.gov

The preceding financial statements have been condensed and adapted for educational use and should not be used for investment decisions.

Requirements

1. Calculate The Cheesecake Factory’s net

2. Calculate The Cheesecake Factory’s

3. Calculate The Cheesecake Factory’s quick ratio for 2015 and 2016. Did the quick ratio improve or deteriorate?

4. How would you assess The Cheesecake Factory’s overall ability to pay its current liabilities? Explain.

5. Calculate inventory turnover for 2016. Next, calculate days' inventory outstanding. What does this number mean?

6. Calculate accounts receivable turnover for 2016. Assume all net revenue is from credit sales. Next, calculate days’ sales outstanding. What does this number mean?

7. Calculate accounts payable turnover for 2016. Next. calculate days’ payable outstanding. What does this number mean?

8. Calculate the cash conversion cycle (in days). Explain what this cash conversion cycle number means.

9. Calculate the debt ratio for 2016 and for 2015. Has the debt ratio increased or decreased?

10. Calculate the times-interest-earned ratio for 2016. Use “interest and other expense, net” as interest expense. What does this ratio mean?

11. Calculate the following profitability ratios for 2016:

- a. Gross margin percentage

- b. Operating income percentage

- c.

Rate of return on sales - d. Rate of return on assets

12. Comment on The Cheesecake Factory’s profitability in 2016 based on the profitability ratios you just calculated.

13. How would you evaluate the company’s earnings quality?

Want to see the full answer?

Check out a sample textbook solution

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

- You are the accountant of Spicy Yummy, a fast food company. The directors of your company require you to analyze and interpret the most recent financial statements and compare its performance with those of previous year. You are presented with the following summarised accounts for Spicy Yummy. Statements of Comprehensive Income for the year ended 31 March 2019 and 2020: 31 March 2019 31 March 2019 $'000 $'000 Sales revenue 2,000 2,900 Cost of sales (see note below) (1200) (1800) Gross profit 800 1100 Distribution costs (160) (250) Administrative expenses (200) (200) Profit from operations 440 650 Finance cost (50) (50) Profit before tax 390 600 Income tax expense (44) (46) Net profit for the period 346 554 Note: 10% and 20% of purchases and sales were for cash respectively. Cost of sales figures are made up as follows: Year ended 31 March 2019 31 March 2019 $'000 $'000 Opening inventory 180 200 Purchases 1220 1960 1400 2160 Less…arrow_forwardPlease review the rubric prior to beginning the assignment to become familiar with the expectations for successful completion.You are required to submit this assignment to LopesWrite. Please refer to the directions in the Student Success Center.Paul Duncan, financial manager of EduSoft Inc., is facing a dilemma. The firm was founded 5 years ago to provide educational software for the rapidly expanding primary and secondary school markets. Although EduSoft has done well, the firm's founder believes an industry shakeout is imminent. To survive, EduSoft must grab market share now, and this will require a large infusion of new capital.Because he expects earnings to continue rising sharply and looks for the stock price to follow suit, Mr. Duncan does not think it would be wise to issue new common stock at this time. On the other hand, interest rates are currently high by historical standards, and the firm's B rating means that interest payments on a new debt issue would be prohibitive.…arrow_forwardAssume that you have finished your MBA program and have applied for a position in the Financial Accounting Department of a large multinational company. The company is struggling with its accounting reporting matters and several accounting reports are under regulatory scrutiny. In the interview board, the recruitment committee members have asked you the following questions. What have you learnt in the BUS 505 course relating to financial accounting? How you can contribute the Financial Accounting Department of this company if you are recruited?arrow_forward

- ABC bank offers a Business Grant to encourage a fresh graduate to become an entrepreneur. However, to apply this Business Grant, you need to explain in general the overview of your business. Therefore, using the Business Model Canvas approach, develop your strategy to run ANY BUSINESS IDEA by illustrating Business Model Canvas based on NINE (9) areas, including customer segment, value proposition, marketing channels, customer relationships, key partners, key activities, key resources, cost structure, and revenue stream.arrow_forwardCintas designs, manufactures, and implements corporate identity uniform programs that it rents or sells to customers throughout the United States and Canada. The company’s stock is traded on the NASDAQ and has provided investors with significant returns over the past few years. Selected information from the company’s balance sheet follows. For 2012, the company reported sales revenue of $3,707,900 and cost of goods sold of $1,517,415.arrow_forwardStrategy The table below contains the names of six companies. Required: For each company, categorize its strategy as being focused on customer intimacy, operational excellence, or product leadership, if you wish to improve your understanding of each company’s customer value proposition before completing the exercise, review its most recent annual report. To obtain electronic access to this information, perform an Internet search on each company’s name followed by the words “annual report.”arrow_forward

- In a minimum of 175 words Imagine that you’ve been asked to explain 1 of the major accounting ratios to a group of high school students who have no background in business or accounting but are eager to learn. Choose 1 of the following ratios and describe how you would explain it in your own words, using a specific example: current ratio asset turnover profit margin on salesarrow_forwardConsider the following information (2019) on three large corporations in the consumer home- retailing industry: Williams-Sonoma, IKEA Group, and Otto Group. Values are in millions USD. Calculate all financial metrics relevant to supply chain management. Interpret the values in the financial statements and the metrics you calculate to characterize the supply chain strategies of the firms in comparison to each other You can use the Internet to gather additional information on the firms, to improve your insights.arrow_forwardABC is a leading educational institution with student population of more than 50,000. ABC continuously maintains good quality education and a roster of qualified instructors. As s result, ABC continuously produces top graduates at several fields. As at December 31, 2024, ABC has an outstanding accounts receivable balance of P100,000,000 broken down into : 0-60 days outstanding, P50,000,000; 61-120 days outstanding, P30,000,000; and over 120 days outstanding, P20,000,000. Estimated uncollectible accounts are 2%, 5% and 10% respectively. ABC wrote off P2,500,000 of its accounts receivable and recovered P500,000 from accounts previously written off in prior years. As at December 31, 2023, ABC has an allowance for uncollectible accounts of P3,000,000. Based on the aging analysis, ABC should report an. allowance for doubtful accounts as at December 31, 2024 atarrow_forward

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning