Financial Accounting (12th Edition) (What's New in Accounting)

12th Edition

ISBN: 9780134725987

Author: C. William Thomas, Wendy M. Tietz, Walter T. Harrison Jr.

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 12, Problem 12.45Q

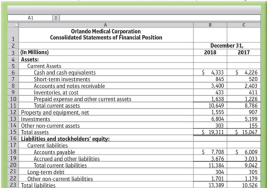

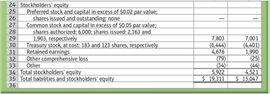

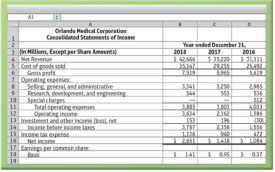

Use the Orlando Medical Corporation financial statements that follow to answer question.

Q12-45. What is the largest single item included in Orlando Medical s debt ratio at December 31. 2018?

- a. Accounts payable

- b. Cash and cash equivalents

- c. Common stock

- d. Investments

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Use the balance sheet and income statement below:

VALIUM’S MEDICAL SUPPLY CORPORATION

Balance Sheet as of December 31, 2024 and 2023

(in millions of dollars)

Assets

2024

2023

Liabilities and Equity

2024

2023

Current assets:

Current liabilities:

Cash and marketable securities

$ 74

$ 73

Accrued wages and taxes

$ 58

$ 45

Accounts receivable

199

189

Accounts payable

159

145

Inventory

322

291

Notes payable

131

131

Total

$ 595

$ 553

Total

$ 348

$ 321

Fixed assets:

Long-term debt

$ 565

$ 549

Gross plant and equipment

$ 1,084

$ 886

Stockholders’ equity:

Less: Accumulated depreciation

153

116

Preferred stock (6 thousand shares)

$ 6

$ 6

Net plant and equipment

$ 931

$ 770

Common stock and paid-in surplus (100 thousand shares)

120

120

Other long-term assets

130

130

Retained earnings

617

457

Total

$ 1,061

$ 900

Total

$ 743

$ 583

Total assets

$ 1,656

$ 1,453

Total liabilities and equity

$ 1,656

$ 1,453

VALIUM’S MEDICAL SUPPLY CORPORATION…

he following data were taken from Alvarado Company’s balance sheet:

OBJ. 6

Dec. 31, 2019

Total liabilities $4,085,000 Total owner’s equity 4,300,000

Compute the ratio of liabilities to owner’s equity.

Dec. 31, 2018

$2,880,000 3,600,000

a. b.

Has the creditor’s risk increased or decreased from December 31, 2018, to December 31, 2019?

Examine the following selected financial information for

Best Value

Corporation and

Modern

Stores, Inc., as of the end of their fiscal years ending in

2018:

Data table

(In millions)

Best Value Corporation

Modern Stores, Inc.

1.

Total assets. . . . . . . . . . . . . . . . . . . . . . . . . .

$15,256

$203,110

2.

Total common stockholders' equity. . . . .

$3,075

$71,460

3.

Operating income. . . . . . . . . . . . . . . . . . . .

$1,350

$26,820

4.

Interest expense. . . . . . . . . . . . . . . . . . . . . .

$88

$2,020

5.

Leverage ratio. . . . . . . . . . . . . . . . . . . . . . . .

6.

Total debt. . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

Debt ratio. . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Times interest earned. . . . . . . . . . . . . . . . .

Requirements…

Chapter 12 Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Ch. 12 - Prob. 1QCCh. 12 - Prob. 2QCCh. 12 - Prob. 3QCCh. 12 - Prob. 4QCCh. 12 - Expressing accounts receivable as a percentage of...Ch. 12 - Kincaid Company reported the following data (in...Ch. 12 - Prob. 7QCCh. 12 - Ratios that measure liquidity include all of the...Ch. 12 - Verba Corporation has an inventory turnover of 15...Ch. 12 - The measure of a companys ability to collect cash...

Ch. 12 - A ratio that measures a companys profitability is...Ch. 12 - Prob. 12QCCh. 12 - Prob. 13QCCh. 12 - Prob. 14QCCh. 12 - Prob. 12.1ECCh. 12 - Prob. 12.1SCh. 12 - Prob. 12.2SCh. 12 - Prob. 12.3SCh. 12 - Prob. 12.4SCh. 12 - Prob. 12.5SCh. 12 - (Learning Objective 4: Evaluate a companys quick...Ch. 12 - Prob. 12.7SCh. 12 - (Learning Objective 4: Measure ability to pay...Ch. 12 - (Learning Objective 4: Measure profitability using...Ch. 12 - Prob. 12.10SCh. 12 - (Learning Objective 4: Use ratio data to...Ch. 12 - Prob. 12.12SCh. 12 - (Learning Objective 4: Analyze a company based on...Ch. 12 - Prob. 12.14SCh. 12 - Prob. 12.15SCh. 12 - Prob. 12.16AECh. 12 - Prob. 12.17AECh. 12 - Prob. 12.18AECh. 12 - Prob. 12.19AECh. 12 - Prob. 12.20AECh. 12 - Prob. 12.21AECh. 12 - Prob. 12.22AECh. 12 - Prob. 12.23AECh. 12 - Prob. 12.24AECh. 12 - Prob. 12.25AECh. 12 - Prob. 12.26AECh. 12 - Prob. 12.27BECh. 12 - Prob. 12.28BECh. 12 - Prob. 12.29BECh. 12 - Prob. 12.30BECh. 12 - Prob. 12.31BECh. 12 - LO 4 (Learning Objective 4: Calculate ratios;...Ch. 12 - Prob. 12.33BECh. 12 - Prob. 12.34BECh. 12 - Prob. 12.35BECh. 12 - Prob. 12.36BECh. 12 - Prob. 12.37BECh. 12 - Prob. 12.38QCh. 12 - Prob. 12.39QCh. 12 - Prob. 12.40QCh. 12 - Prob. 12.41QCh. 12 - Prob. 12.42QCh. 12 - Prob. 12.43QCh. 12 - Prob. 12.44QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.46QCh. 12 - Use the Orlando Medical Corporation financial...Ch. 12 - Prob. 12.48QCh. 12 - Prob. 12.49QCh. 12 - Prob. 12.50QCh. 12 - Prob. 12.51QCh. 12 - Prob. 12.52QCh. 12 - Prob. 12.53QCh. 12 - Prob. 12.54QCh. 12 - Prob. 12.55QCh. 12 - LO 1, 2, 4 (Learning Objectives 1, 2, 4: Calculate...Ch. 12 - Prob. 12.57APCh. 12 - Prob. 12.58APCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.60APCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Group B LO 1, 2, 4 (Learning Objectives 1, 2, 4:...Ch. 12 - Prob. 12.63BPCh. 12 - Prob. 12.64BPCh. 12 - LO 4 (Learning Objective 4: Use ratios to evaluate...Ch. 12 - Prob. 12.66BPCh. 12 - LO 2, 4, 5 (Learning Objectives 2, 4, 5: Analyze...Ch. 12 - Prob. 12.68CEPCh. 12 - Prob. 12.69CEPCh. 12 - (Learning Objectives 2, 3.4: Use trend...Ch. 12 - (Learning Objectives 4, 5: Calculate and analyze...Ch. 12 - Prob. 12.72DCCh. 12 - Prob. 12.73DCCh. 12 - Prob. 12.74EICCh. 12 - Focus on Financials Apple Inc. LO 1, 2, 3, 4, 5...Ch. 12 - Comprehensive Financial Statement Analysis Project...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Debt Management Ratios Glow Corporation provides annual and quarterly financial data to the public. For the years of 2018 and 2019. Glows financial data included the following account balances: Required: Determine whether the debt to equity ratio is increasing or decreasing and whether Glow should be concerned.arrow_forwardKlynveld Companys balance sheet shows total liabilities of 94,000,000, total stockholders equity of 75,000,000, and total assets of 169,000,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forwardErnst Companys balance sheet shows total liabilities of 32,500,000, total stockholders equity of 8,125,000, and total assets of 40,625,000. Required: Note: Round answers to two decimal places. 1. Calculate the debt ratio. 2. Calculate the debt-to-equity ratio.arrow_forward

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Required: Note: Round answers to two decimal places. 1. Calculate the times-interest-earned ratio. 2. Calculate the debt ratio. 3. Calculate the debt-to-equity ratio.arrow_forwardDebt Management and Short-Term Liquidity Ratios The following items appear on the balance sheet of Figgins Company at the end of 2018 and 2019: Required: Between 2018 and 2019, indicate whether Figgins debt to equity ratio increased or decreased. Also, indicate whether Figgins current ratio increased or decreased. Interpret these ratios.arrow_forwardUse the following selected financial information for Cascabel Corporation to answer questions Cascabel Corporation Balance Sheet December 31, 2015 Assets Liabilities and stockholders' equity Current assets Current liabilities Cash 2 Accounts payable 36 Short-term investments 10 Accrued liabilities 25 Accounts receivable 52 Total current liabilities 61 Inventory 57 Other current assets 8 Long-term debt 102 Total current assets 129 Total liabilities 163 Long-term assets Stockholders' equity Net Plant 195 Common stock (10) 110 Retained earnings 51 Total stockholders'…arrow_forward

- Using the Balance Sheet and Income Statement please calculate the following: Balance Sheet Assets Liabilities and Owner’s Equity 2018 2019 2018 2019 Current Assets Current Liabilities Cash 300 325 Acts Pay 480 400 Accs Rec 275 270 Notes Pay 560 500 Inventory 600 675 Total 1,040 900 Total 1,175 1,270 Long Term Debt 950 1,200 Fixed Assets Net Fixed 2,350 2,875 Owners Equity Preferred Stock 750 845 Retained Earn 785 1,200 Total 1,535 2,045 Total Assets 3,525 4,145 Total Liabilities & OE 3,525 4,145 2019 Income Statement Net Sales 3,456 COGS 1,895 Depreciation 235 EBIT 1,326 Interest 320 Taxable Income 1,006 Taxes 211.26 Net Income 794.74 Dividends 147 Additions to Retained Earnings 647.74…arrow_forwardUse the table for the question(s) below. Consider the following balance sheet: Luther Corporation Consolidated Balance Sheet December 31, 2019 and 2018 (in $ millions) Assets 2019 2018 Liabilities and Stockholders' Equity 2019 2018 Current Assets Current Liabilities Cash 63.6 58.5 Accounts payable 87.6 73.5 Accounts receivable 55.5 39.6 Notes payable / short−term debt 10.5 9.6 Inventories 45.9 42.9 Current maturities of long−term debt 39.9 36.9 Other current assets 6.0 3.0 Other current liabilities 6.0 12.0 Total current assets 171.0 144.0 Total current liabilities 144.0 132.0 Long−Term Assets Long−Term Liabilities Land 66.6 62.1 Long−term debt 239.7 168.9 Buildings 109.5 91.5 Capital lease obligations −−− −−−…arrow_forwardCalculate the following ratios for 2025 and 2026. (Round current ratio to 2 decimal places, e.g. 12.61, debts to assets and gross profit rate to 0 decimal places, e.g.12, and all other answers to 1 decimal place, e.g. 12.6%) Please show your work. 1. Current ratio 2. Debts to assets 3. Gross profit rate 4. Profit margin 5. Return on assets (Total assets at November 1, 2024, were $35,180) 6. Return on common stockholder's equity (Total common stockholders' equity at November 1, 2024, was $25, 180. Dividends on preferred stock were $16,800 in 2025 and $18,000 in 2026)arrow_forward

- Prepare a Projected Statement of Financial Position of Sky Company dated December 31, 2019. Below is the list of accounts. Follow the Pro-forma Statement of Financial Position. Lists of accounts & their respective amount: Net, PPE – 7,627,900 Cash - 640,000 Accounts payable -5,189,350 Accounts receivable -4,224,948 Owner’s Equity -16,240,316 Short-term investments – 9,495,393 Short-term borrowings: Inventories – 1,076,000 Payable to PPE supplier - 1,200,000 Accrued taxes – 434,575arrow_forwardASAP!! Consider the given income statement and balance sheet and calculate the following ratios : Return on Assets Return on Equity Debt Ratio Current Ratio Write your comment about each of the ratios calculated what it describes. Following are the Financial Statements of CSU CORPORATION for the year ended Dec. 31, 2020 Assets : 2019 Cash $1400 Accounts Receivable 4000 Supplies 1800 Equipment 16000 Total Assets $23,200 Liabilities and Shareholders’ Equity : Liabilities : Notes Payable $5000 Accounts Payable…arrow_forwardUse the statement of financial position as at 31 December 2022, statement of comprehensive income for the year ended 31 December 2022 and additional information for 2022 (related to dividends and shares) to calculate the ratio (expressed to two decimal places) that would reflect each of the following: 1. The extent to which the claims of the short-term creditors are covered by assets that can be translated into cash in the short term2. The extent to which long-term debt is covered by shareholders’ funds3. The amount of funds available relative to sales, to pay the company’s expenses other than its cost of sales (expressed as a percentage)4. The distributions during the period allocated to each ordinary share issued5. An indication of the percentage of the profit that has been put back into the company 6. The ratio of a company's current stock price to its earnings per sharearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License