Concept explainers

Direct materials and direct labor,

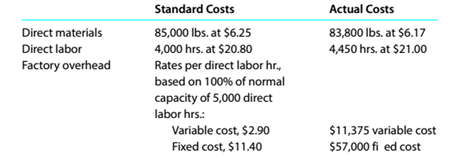

Route 66 Tire Co. manufactures automobile tires.

Instructions

Determine (a) the price variance, quantity variance, and total direct materials cost variance; (b) the rale variance, time variance, and total direct labor cost variance; and (c) Appendix: variable factory overhead controllable variance, the fixed factory overhead volume variance, and total factory overhead cost variance.

(a)

Concept Introduction:

Price variance:-It is the difference between price per unit in standard and actual price of product and multiplying that with quantity purchased in actual.

Quantity variance:-It is referred to the amount which is computed by multiplying the standard price per unit with the difference between quantity in actual term and standard term of product.

Direct Material cost variance:-This amount is calculated as the difference between standard cost and actual cost of direct material. The result is favorable when price variance is more than quantity variance. The result is unfavorable when price variance is less than quantity variance.

The price variance, quantity variance and total direct materials cost variance.

Answer to Problem 13.5P

Direct material price variance

Direct material quantity variance

Direct material cost variance

Explanation of Solution

Computation of Direct material price variance is as follows:

Computation of Direct material quantity variance is as follows:

Computation of Direct material cost variance is as follows:

(b)

Concept Introduction:

Rate variance:

It is referred to the amount which is computed by multiplying the number of actual hours with the difference between actual rate and standard rate per hour of direct labour.

Time variance:-It is referred to the amount which is computed by multiplying the standard rate per hours with the difference between the number of actual hours and standard hours of direct labour.

Direct labour cost variance:

This amount is calculated as the difference between the actual cost and standard cost of direct labour for production. If answer is in negative than it is favourable. If answer is in positive than it is unfavorable.

The rate variance, time variance and total direct labour cost variance.

Answer to Problem 13.5P

Direct labor rate variance

Direct labor time variance

Direct labor cost variance

Explanation of Solution

Computation of Direct labor rate variance is as follows:

Computation of Direct labor time variance is as follows:

Computation of Direct laborcost variance is as follows:

(c)

Concept Introduction:

Volume variance:-It is referred to the amount which is computed by multiplying the fixed standard cost rate per hour with the difference between the actual hours and standard hours of variable factory overhead.

Variable factory overhead cost variance:-This amount is calculated as the difference between the contrallable variance and volume variance of variable factory overhead. If price is in negative, then it is favourable. If price is in positive then it is unfavorable.

The variable factory overhead controlled variance, fixed factory overhead volume variance and total factory overhead cost variance.

Answer to Problem 13.5P

Variable factory overhead controlledvariance

Variable factory overhead volume variance

Variable factory overhead cost variance

Explanation of Solution

Computation of Variable factory overhead controlled variance is as follows:

Computation of Variable factory overhead volume variance is as follows:

Computation of Variable factory overhead cost variance is as follows:

Want to see more full solutions like this?

Chapter 13 Solutions

SURVEY OF ACCOUNTING W/ACCESS >BI<

- Direct materials, direct labor, and factory overhead cost variance analysis Mackinaw Inc. processes a base chemical into plastic. Standard costs and actual costs for direct materials, direct labor, and factory overhead incurred for the manufacture of 40,000 units of product were as follows: Each unit requires 0.3 hour of direct labor. Instructions Determine (A) the direct materials price variance, direct materials quantity variance, and total direct materials cost variance; (B) the direct labor rate variance, direct labor time variance, and total direct labor cost variance; and (C) the variable factory overhead controllable variance, fixed factory overhead volume variance, and total factory overhead cost variance.arrow_forwardDirect materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardCost and production data for Binghamton Beverages Inc. are presented as follows: Required: Calculate net variances for materials, labor, and factory overhead. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4. Comment on the possible causes for each of the variances that you computed. Make all journal entries to record production costs in Work in Process and Finished Goods. Determine the balance of ending Work in Process in each department. Assume that 4,000 units were sold at $40 each. Calculate the gross margin based on standard cost. Calculate the gross margin based on actual cost. Why does the gross margin at actual cost differ from the gross margin at standard cost. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.” What standards of ethical professional practice would be violated if you adhered to Paul’s order? How would you attempt to resolve this ethical conflict?arrow_forward

- Materials and labor variances Fausto Fabricators Inc. uses a standard cost system to account for its single product. The standards established for the product include the following: The following operating data came from the records for the month: In process, beginning inventory, none. In process, ending inventory, 800 units, 80% complete as to labor; material is issued at the beginning of processing. Completed during the month, 5,600 units. Materials issued to production were 51,680 lb @ .55 per pound. Direct labor was 384,000 for 40,000 hours worked. Required: Calculate the following variances, using the diagram format in Figure 8-4. 1. Materials price. 2. Materials quantity. 3. Net materials variance. 4. Labor rate. 5. Labor efficiency. 6. Net labor variance. (Hint: Before determining the standard quantity for materials and labor, you must first compute the equivalent units of production for materials and labor.)arrow_forwardStandard direct materials cost per unit from variance data The following data relating to direct materials cost for October of the current year are taken from the records of Good Clean Fun Inc., a manufacturer of organic toys: Determine the standard direct materials cost per unit of finished product, assuming that there was no inventory of work in process at either the beginning or the end of the month.arrow_forwardDelano Company uses two types of direct labor for the manufacturing of its products: fabricating and assembly. Delano has developed the following standard mix for direct labor, where output is measured in number of circuit boards. During the second week in April, Delano produced the following results: Required: 1. Calculate the yield ratio. 2. Calculate the standard cost per unit of the yield. 3. Calculate the direct labor yield variance. 4. Calculate the direct labor mix variance.arrow_forward

- Calculation of materials and labor variances Fritz Corp. manufactures and sells a single product. The company uses a standard cost system. The standard cost per unit of product follows: The charges to the manufacturing department for November, when 5,000 units were produced, follow: The Purchasing department normally buys about the same quantity as is used in production during a month. In November, 5,500 lb were purchased at a price of $2.90 per pound. Required: Calculate the following from standard costs for the data given, using the formulas on pages 421–422 and 424: Materials quantity variance. Materials purchase price variance (at time of purchase). Labor efficiency variance. Labor rate variance. Give some reasons as to why both the materials quantity variance and labor efficiency variance might be unfavorable.arrow_forwardDirect materials and direct labor variance analysis Faucet Industries Inc. manufactures faucets in a small manufacturing facility. The faucets are made from zinc. Faucet Industries has 60 employees. Each employee presently provides 36 hours of labor per week. Information about a production week is as follows: Instructions Determine (a) the standard cost per unit for direct materials and direct labor; (h) the price variance, quantity variance, and total direct materials cost variance; and (c) the rate variance, time variance, and total direct labor cost variance.arrow_forwardThe standard specifications for an electric motor manufactured by XYZ Electric Co. follow: Factory overhead rates are based on a normal 70% capacity and use the following flexible budget: The actual production was 2,500 motors, and factory overhead costs totaled $29,750. Required: Calculate the factory overhead variances using the two-variance method and the diagram format.arrow_forward

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardRefer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs: Required: 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced. 2. What if Nashler Companys actual direct materials cost were 1,175,040? How would that affect the variance for direct materials? The total cost variance?arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forward

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning