Megatronics Corporation, a massive retailer of electronic products, is organized in four separate divisions. The four divisional managers are evaluated at year-end, and bonuses are awarded based on

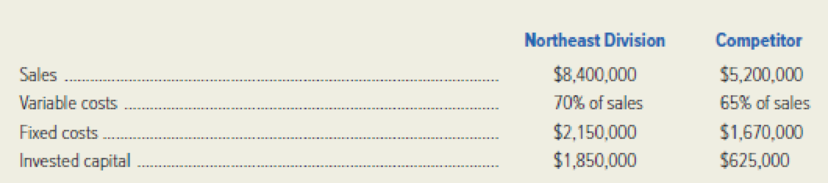

During the past week, management of the company’s Northeast Division was approached about the possibility of buying a competitor that had decided to redirect its retail activities. (If the competitor is acquired, it will be acquired at its book value.) The data that follow relate to recent performance of the Northeast Division and the competitor:

Management has determined that in order to upgrade the competitor to Megatronics’ standards, an additional $375,000 of invested capital would be needed.

Required: As a group, complete the following requirements.

- 1. Compute the current ROI of the Northeast Division and the division’s ROI if the competitor is acquired.

- 2. What is the likely reaction of divisional management toward the acquisition? Why?

- 3. What is the likely reaction of Megatronics’ corporate management toward the acquisition? Why?

- 4. Would the division be better off if it didn’t upgrade the competitor to Megatronics’ standards? Show computations to support your answer.

- 5. Assume that Megatronics uses residual income to evaluate performance and desires a 12 percent minimum return on invested capital. Compute the current residual income of the Northeast Division and the division’s residual income if the competitor is acquired. Will divisional management be likely to change its attitude toward the acquisition? Why?

1.

Calculate the current return on investment of northeast division of company M and calculate the return on investment of northeast division of Company M if competitor is acquired.

Explanation of Solution

Return on investment (ROI): Return on investment evaluates how efficiently the assets are used in earning income from operations. So, ROI is a tool used to measure and compare the performance of a units or divisions or a companies.

Calculate the current return on investment of northeast division of company M and calculate the return on investment of northeast division of Company M if competitor is acquired as follows:

Current return on investment of northeast division:

Return on investment of northeast division if competitor is acquired:

Working note (1):

Calculate the net income of northeast division.

| Particulars | Amount in ($) |

| Sales revenue | $8,400,000 |

| Less: Variable cost | $5,880,000 |

| Less: Fixed cost | $2,150,000 |

| Income | $370,000 |

Table (1)

Working note (2):

Calculate the variable cost of northeast division after acquisition.

Working note (3):

Calculate the net income of northeast division after acquisition.

| Particulars | Amount in ($) |

| Sales revenue | $13,600,000 |

| Less: Variable cost (2) | $9,260,000 |

| Less: Fixed cost | $3,820,000 |

| Income | $520,000 |

Table (2)

2.

State the reaction of division management towards the acquisition.

Explanation of Solution

State the reaction of division management towards the acquisition as follows:

Division management will be against to the acquisition because return on investment of northeast division would decrease from 20% to 18.25% and it will provide less compensation to divisional management since the bonuses are awarded on the basis of return on investment (ROI).

3.

State the reaction of corporate management towards the acquisition

Explanation of Solution

Corporate management will be favor to the acquisition because competitor’s return on investment of 24% (5) is more than return on investment of northeast division (20%) and it will provide more compensation to corporate management even if the addition investment is made by competitor.

Working note (4):

Calculate the net income of competitor.

| Particulars | Amount in ($) |

| Sales revenue | $5,200,000 |

| Less: Variable cost | $3,380,000 |

| Less: Fixed cost | $1,670,000 |

| Income | $150,000 |

Table (3)

Working note (5):

Calculate the return on investment of competitor.

4.

Explain whether the division would be better off if it did not upgrade.

Explanation of Solution

Explain whether the division would be better off if it did not upgrade as follows:

Yes, the division would be better if it did not upgrade, because the divisional return on investment would increase from 18.25% to 21.01% (5). However, the absence of upgrade would lead to long run problems and customer would be confused by the two different retail environments from one business outlets.

Working note (5):

Calculate the combined return on investment before the additional investment of competitor.

5.

Calculate the current residual income of northeast division and residual income of northeast division after acquisition and explain whether the divisional management would be likely to change its attitude toward the acquisition.

Explanation of Solution

Calculate the current residual income of northeast division and residual income of northeast division after acquisition as follows:

Current residual income of northeast division:

| Particulars | Amount in ($) |

| Divisional profit | $ 370,000 |

| Less: Imputed interest charge | $222,000 |

| Residual income | $ 148,000 |

Table (4)

Residual income of northeast division after acquisition:

| Particulars | Amount in ($) |

| Divisional profit | $ 520,000 |

| Less: Imputed interest charge (6) | $342,000 |

| Residual income | $ 178,000 |

Table (5)

Working note (6):

Calculate the combined imputed interest charge.

Explain whether the divisional management would be likely to change its attitude toward the acquisition as follows

Yes, divisional management should change its attitude because the residual income has increased from $148,000 to $178,000 after acquisition.

Want to see more full solutions like this?

Chapter 13 Solutions

Loose-Leaf for Managerial Accounting: Creating Value in a Dynamic Business Environment

- Kent Tessman, manager of a Dairy Products Division, was pleased with his divisions performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the divisions reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management. Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The divisions cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of 250,000, and Proposal B requires 312,500. Both projects could be funded, given the status of the divisions capital budget. Both have an expected life of six years and have the following projected after-tax cash flows: After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B. Required: 1. Compute the NPV for each proposal. 2. Compute the payback period for each proposal. 3. According to your analysis, which proposal(s) should be accepted? Explain. 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardJavier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.arrow_forward

- Last Resort Industries Inc. is a privately held diversified company with five separate divisions organized as investment centers. A condensed income statement for the Specialty Products Division for the past year, assuming no support department allocations, along with asset information is as follows: The manager of the Specialty Products Division was recently presented with the opportunity to add an additional product line, which would require invested assets of 14,400,000. A projected income statement for the new product line is as follows: The Specialty Products Division currently has 27,000,000 in invested assets, and Last Resort Industries Inc.s overall return on investment, including all divisions, is 10%. Each division manager is evaluated on the basis of divisional return on investment. A bonus is paid, in 8,000 increments, for each whole percentage point that the divisions return on investment exceeds the company average. The president is concerned that the manager of the Specialty Products Division rejected the addition of the new product line, even though all estimates indicated that the product line would be profitable and would increase overall company income. You have been asked to analyze the possible reasons the Specialty Products Division manager rejected the new product line. a. Determine the return on investment for the Specialty Products Division for the past year. b. Determine the Specialty Products Division managers bonus for the past year. c. Determine the estimated return on investment for the new product line. Round percentages to one decimal place and the investment turnover to two decimal places. d. Why might the manager of the Specialty Products Division decide to reject the new product line? Support your answer by determining the projected return on investment for 20Y6, assuming that the new product line was launched in the Specialty Products Division and 20Y6 actual operating results were similar to those of 20Y5. e. Suggest an alternative performance measure for motivating division managers to accept new investment opportunities that would increase the overall company income and return on investment.arrow_forwardGrate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of ROI performance. Only those managers who produce the best ROIs are selected to receive bonuses and to fill higher-level managerial positions. Fred Olsen, manager of the Hair Products Division, has always been one of the top performers. For the past two years, Freds division has produced the largest ROI; last year, the division earned an operating income of 2.56 million and employed average operating assets valued at 16 million. Fred is pleased with his divisions performance and has been told that if the division does well this year, he will be in line for a headquarters position. For the coming year, Freds division has been promised new capital totaling 1.5 million. Any of the capital not invested by the division will be invested to earn the companys required rate of return (9 percent). After some careful investigation, the marketing and engineering staff recommended that the division invest in equipment that could be used to produce a crimping and waving iron, a product currently not produced by the division. The cost of the equipment was estimated at 1.2 million. The divisions marketing manager estimated operating earnings from the new line to be 156,000 per year. After receiving the proposal and reviewing the potential effects, Fred turned it down. He then wrote a memo to corporate headquarters, indicating that his division would not be able to employ the capital in any new projects within the next eight to 10 months. He did note, however, that he was confident that his marketing and engineering staff would have a project ready by the end of the year. At that time, he would like to have access to the capital. Required: 1. Explain why Fred Olsen turned down the proposal to add the capability of producing a crimping and waving iron. Provide computations to support your reasoning. 2. Compute the effect that the new product line would have on the profitability of the firm as a whole. Should the division have produced the crimping and waving iron? 3. Suppose that the firm used residual income as a measure of divisional performance. Do you think Freds decision might have been different? Why? 4. Explain why a firm like Grate Care might decide to use both residual income and return on investment as measures of performance. 5. Did Fred display ethical behavior when he turned down the investment? In discussing this issue, consider why he refused to allow the investment.arrow_forwardIn 20x5, Major Company initiated a full-scale, quality improvement program. At the end of the year, Jack Aldredge, the president, noted with some satisfaction that the defects per unit of product had dropped significantly compared to the prior year. He was also pleased that relationships with suppliers had improved and defective materials had declined. The new quality training program was also well accepted by employees. Of most interest to the president, however, was the impact of the quality improvements on profitability. To help assess the dollar impact of the quality improvements, the actual sales and the actual quality costs for 20x4 and 20x5 are as follows by quality category: All prevention costs are fixed (by discretion). Assume all other quality costs are unit-level variable. Required: 1. Compute the relative distribution of quality costs for each year and prepare a pie chart. Do you believe that the company is moving in the right direction in terms of the balance among the quality cost categories? Explain. 2. Prepare a one-year trend performance report for 20x5 (compare the actual costs of 20x5 with those of 20x4, adjusted for differences in sales volume). How much have profits increased because of the quality improvements made by Major Company? 3. Estimate the additional improvement in profits if Major Company ultimately reduces its quality costs to 2.5 percent of sales revenues (assume sales of 10 million).arrow_forward

- Jarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.arrow_forwardThe three divisions of Yummy Foods are Snack Goods, Cereal, and Frozen Foods. The divisions are structured as investment centers. The following responsibility reports were prepared for the three divisions for the prior year: a. Which division is making the best use of invested assets and should be given priority for future capital investments? b. b. Assuming that the minimum acceptable return on new projects is 19%, would all investments that produce a return in excess of 19% be accepted by the divisions? Explain. c. c. Identify opportunities for improving the companys financial performance.arrow_forwardRenslen, Inc., a truck manufacturing conglomerate, has recently purchased two divisions: Meyers Service Company and Wellington Products, Inc. Meyers provides maintenance service on large truck cabs for 10-wheeler trucks, and Wellington produces air brakes for the 10-wheeler trucks. The employees at Meyers take pride in their work, as Meyers is proclaimed to offer the best maintenance service in the trucking industry. The management of Meyers, as a group, has received additional compensation from a 10 percent bonus pool based on income before income taxes and bonus. Renslen plans to continue to compensate the Meyers management team on this basis as it is the same incentive plan used for all other Renslen divisions, except for the Wellington division. Wellington offers a high-quality product to the trucking industry and is the premium choice even when compared to foreign competition. The management team at Wellington strives for zero defects and minimal scrap costs; current scrap levels are at 2 percent. The incentive compensation plan for Wellington management has been a 1 percent bonus based on gross margin. Renslen plans to continue to compensate the Wellington management team on this basis. The following condensed income statements are for both divisions for the fiscal year ended May 31, 20x1: Renslen, Inc. Divisional Income Statements For the Year Ended May 31, 20x1 Each division has 1,000,000 of management salary expense that is eligible for the bonus pool. Renslen has invited the management teams of all its divisions to an off-site management workshop in July where the bonus checks will be presented. Renslen is concerned that the different bonus plans at the two divisions may cause some heated discussion. Required: 1. Determine the 20x1 bonus pool available for the management team at: a. Meyers Service Company b. Wellington Products, Inc. 2. Identify at least two advantages and disadvantages to Renslen, Inc., of the bonus pool incentive plan at: a. Meyers Service Company b. Wellington Products, Inc. 3. Having two different types of incentive plans for two operating divisions of the same corporation can create problems. a. Discuss the behavioral problems that could arise within management for Meyers Service Company and Wellington Products, Inc., by having different types of incentive plans. b. Present arguments that Renslen, Inc., can give to the management teams of both Meyers and Wellington to justify having two different incentive plans.arrow_forward

- Xenold, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands): The income tax rate for Xenold, Inc., is 40 percent. Xenold, Inc., has two sources of financing: bonds paying 5 percent interest, which account for 25 percent of total investment, and equity accounting for the remaining 75 percent of total investment. Xenold, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Xenold stock has an opportunity cost of 5 percent over the 4 percent long-term government bond rate. Xenolds total capital employed is 5.04 million (2,600,000 for the Home Division, 1,700,000 for the Restaurant Division, and the remainder for the Specialty Division). Required: 1. Prepare a segmented income statement for Xenold, Inc., for last year. 2. Calculate Xenolds weighted average cost of capital. (Round to four significant digits.) 3. Calculate EVA for each division and for Xenold, Inc. 4. Comment on the performance of each of the divisions.arrow_forwardMalone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?arrow_forwardAt the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: Required: 1. Compute the following measures for 20x1 and 20x3: a. Actual velocity and cycle time b. Percentage of total revenue from new customers (assume one unit per customer) c. Percentage of very satisfied customers (assume each customer purchases one unit) d. Market share e. Percentage change in actual product cost (for 20x3 only) f. Percentage change in days of inventory (for 20x3 only) g. Defective units as a percentage of total units produced h. Total hours of training i. Suggestions per production worker j. Total revenue k. Number of new customers 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College