Concept explainers

Equipment Replacement and Performance Measures

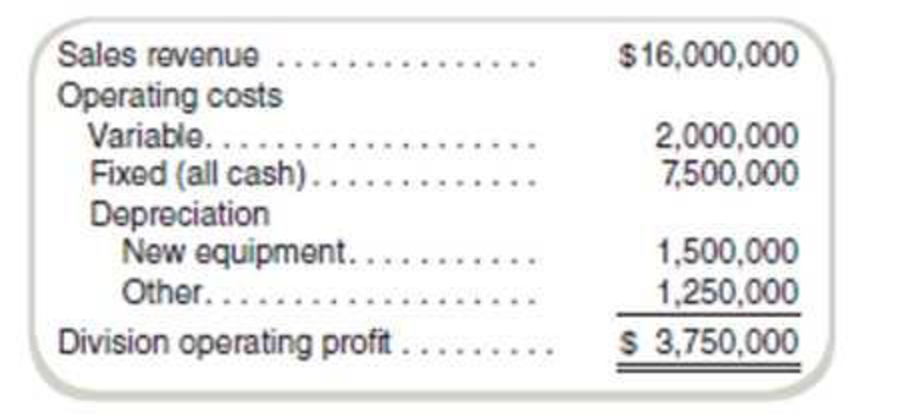

Oscar Clemente is the manager of Forbes Division of Pitt, Inc., a manufacturer of biotech products. Forbes Division, which has $4 million in assets, manufactures a special testing device. At the beginning of the current year, Forbes invested $5 million in automated equipment for test machine assembly. The division’s expected income statement at the beginning of the year was as follows:

A sales representative from LSI Machine Company approached Oscar in October. LSI has for $6.5 million a new assembly machine that offers significant improvements over the equipment Oscar bought at the beginning of the year. The new equipment would expand division output by 10 percent while reducing cash fixed costs by 5 percent. It would be

The old machine, which has no salvage value, must be disposed of to make room for the new machine.

Pitt has a performance evaluation and bonus plan based on ROI. The return includes any losses on disposal of equipment. Investment is computed based on the end-of-year balance of assets, net book value Ignore taxes.

Required

- a. What is Forbes Division’s ROI if Oscar docs not acquire the new machine?

- b. What is Forbes Division's ROI this year if Oscar acquires the new machine?

- c. If Oscar acquires the new machine and it operates according to specifications, what ROI is expected for next year?

a.

Calculate the division F’s ROI if Company O does not acquire the new machine

Answer to Problem 46P

The return on investment is 60% when Company O does not acquire the new machine.

Explanation of Solution

Return on investment:

Return on investment is the amount of total profit earned by a division with its assets. The return on investment is used to check the efficiency of the unit. It shows the efficiency of the unit to utilize its assets to generate the profit.

Calculate the ROI if Company O does not acquire the new machine:

Thus, the return on investment is 60% when Company O does not acquire the new machine.

Working note 1:

Calculate the net asset value:

| Particulars | Amount |

| Opening asset value | $4,000,000 |

| Add: addition in the year | $5,000,000 |

| Total asset value | $9,000,000 |

| Less: depreciation on new equipment | $1,500,000 |

| Less: depreciation on others | $1,250,000 |

| Net asset value | $6,250,000 |

Table: (1)

b.

Calculate the division F’s ROI if Company O acquires the new machine

Answer to Problem 46P

The return on investment is 2.7% when Company O does not acquire the new machine.

Explanation of Solution

Divisional ROI:

Divisional ROI is the return on investment for a division of a business. It is calculated by dividing the operating profit of the division from the divisional assets.

Calculate the ROI if Company O acquires the new machine:

Thus, the return on investment is 2.7% when Company O does not acquire the new machine.

Working note 2:

Calculate the net asset value:

| Particulars | Amount |

| Opening asset value | $4,000,000 |

| Add: improvement in the asset | $6,500,000 |

| Total asset value | $10,500,000 |

| Less: depreciation on others | $1,250,000 |

| Net asset value | $9,250,000 |

Table: (2)

Working note 3:

Calculate the after-tax divisional profit:

| Particulars | Amount |

| Operating profit | $3,750,000 |

| Less: loss on old equipment | $5,000,000 |

| Add: saving in the depreciation of old equipment | $1,500,000 |

| Net operating profit | $250,000 |

Table: (3)

c.

Calculate the ROI if the company acquires a new machine and operates it according to specifications.

Answer to Problem 46P

The return on investment is 83.75% if the company acquires a new machine and operates it according to specifications.

Explanation of Solution

Divisional income:

A business may be operating in various departments or units. Each unit has its own cost and profit structure. The profit of a specific unit is called divisional income. It is calculated by deducting the divisional expense from the divisional profit.

Calculate the ROI if Company O acquires the new machine:

Thus, the return on investment is 83.75% when Company O does not acquire the new machine.

Working note 4:

Calculate the divisional operating income:

| Particulars |

Amount (a) |

% change (b) |

Net amount |

| Sales | $16,000,000 | +10% | $17,600,000 |

| Operating costs: | |||

| Variable | $2,000,000 | +10% | $2,200,000 |

| Fixed | $7,500,000 | -5% | $7,125,000 |

| Deprecation: | |||

| New equipment(6) | $1,500,000 | $2,000,000 | |

| Others | $1,250,000 | $1,250,000 | |

| Divisional operating profit | $5,025,000 |

Table: (4)

Working note 5:

Calculate the net asset value:

| Particulars | Amount |

| Opening asset value | $4,000,000 |

| Add: improvement in the asset | $6,500,000 |

| Total asset value | $10,500,000 |

| Less: depreciation on others | $2,500,000 |

| Less: depreciation on improved assets(6) | $2,000,000 |

| Net asset value | $6,000,000 |

Table: (5)

Working note 6:

Calculate the depreciation on new equipment:

Want to see more full solutions like this?

Chapter 14 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.arrow_forwardDantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forwardMerkley Company, a manufacturer of machine parts, implemented lean manufacturing at the end of 20X1. Three value streams were established: one for new product development and two order fulfillment value streams. One of the value streams set a goal to increase its ROS to 45% of sales by the end of the year. During the year, the value stream made significant improvements in several areas. The Box Scorecard below was prepared, with performance measures for the beginning of the year, midyear, and end of year. Although the members of the value stream were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 45%. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first 6 months? The second 6 months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected.arrow_forward

- Cost Classification, Income Statement Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateways work comes from contracts with city and state agencies in Nebraska. The companys sales volume averages 3 million, and profits vary between 0 and 10% of sales. Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids. Jack believes that Gateways current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe. With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of 165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own 114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters. Required: 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and overhead costs. The company never has significant work in process (most jobs are started and completed within a day). 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?arrow_forwardThe following environmental cost reports for 20x3, 20x4, and 20x5 (year end December 31) are for the Communications Products Division of Kartel, a telecommunications company. In 2011, Kartel committed itself to a continuous environmental improvement program, which was implemented throughout the company. At the beginning of 20x5, Kartel began a new program of recycling nonhazardous scrap. The effort produced recycling income totaling 25,000. The marketing vice president and the environmental manager estimated that sales revenue had increased by 200,000 per year since 20x3 because of an improved public image relative to environmental performance. The companys Finance Department also estimated that Kartel saved 80,000 in 20x5 because of reduced finance and insurance costs, all attributable to improved environmental performance. All reductions in environmental costs from 20x3 to 20x5 are attributable to improvement efforts. Furthermore, any reductions represent ongoing savings. Required: 1. Prepare an environmental financial statement for 20x5 (for the Products Division). In the cost section, classify environmental costs by category (prevention, detection, etc.). 2. Evaluate the changes in environmental performance.arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forward

- Product costing and decision analysis for a service company Blue Star Airline provides passenger airline service, using small jets. The airline connects four major cities: Charlotte, Pittsburgh, Detroit, and San Francisco. The company expects to fly 170,000 miles during a month. The following costs are budgeted for a month: Blue Star management wishes to assign these costs to individual flights in order to gauge the profitability of its service offerings. The following activity bases were identified with the budgeted costs: The size of the companys ground operation in each city is determined by the size of the workforce. The following monthly data are available from corporate records for each terminal operation: Three recent representative flights have been selected for the profitability study. Their characteristics are as follows: Instructions Determine the fuel, crew, and depreciation cost per mile flown. Determine the cost per arrival or departure by terminal city. Use the information in (1) and (2) to construct a profitability report for the three flights. Each flight has a single arrival and departure to its origin and destination city pairs.arrow_forwardEthics in Action In August, Lannister Company introduced a new performance measurement system in manufacturing operations. One of the new performance measures is lead time, which is determined by tagging a random sample of items with a log sheet throughout the month. The log sheets recorded the time that the sample items started production and the time that they ended production, as well as all steps in between. At the end of the month, the controller collected the log sheets and computed the average lead time of the tagged products. This number was reported to central management and was used to evaluate the performance of the plant manager. Because of the poor lead time results reported for August, the plant was under extreme pressure to reduce lead time in September. The following memo was intercepted by the controller. Date: September 3 To: Hourly Employees From: Plant Manager During last month, you may have noticed that some of the products were tagged with a log sheet. This sheet records the time that a product enters production and the time that it leaves production. The difference between these two times is termed the lead time. Our plant is evaluated on improving lead time. From now on, I ask all of you to keep an eye out for the tagged items. When you see a tagged item, it is to receive special attention. Work on that item first, and then immediately move it to the next operation. Under no circumstances should tagged items wait on any other work that you have. Naturally, report accurate information. I insist that you record the correct times on the log sheet as the product goes through your operations. How should the controller respond to this discovery?arrow_forwardJarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.arrow_forward

- Katayama Company produces a variety of products. One division makes neoprene wetsuits. The divisions projected income statement for the coming year is as follows: Required: 1. Compute the contribution margin per unit, and calculate the break-even point in units. Repeat, using the contribution margin ratio. 2. The divisional manager has decided to increase the advertising budget by 140,000 and cut the average selling price to 200. These actions will increase sales revenues by 1 million. Will this improve the divisions financial situation? Prepare a new income statement to support your answer. 3. Suppose sales revenues exceed the estimated amount on the income statement by 612,000. Without preparing a new income statement, determine by how much profits are underestimated. 4. How many units must be sold to earn an after-tax profit of 1.254 million? Assume a tax rate of 34 percent. (Round your answer up to the next whole unit.) 5. Compute the margin of safety in dollars based on the given income statement. 6. Compute the operating leverage based on the given income statement. (Round to three significant digits.) If sales revenues are 20 percent greater than expected, what is the percentage increase in profits?arrow_forwardLindell Manufacturing embarked on an ambitious quality program that is centered on continual improvement. This improvement is operationalized by declining quality costs from year to year. Lindell rewards plant managers, production supervisors, and workers with bonuses ranging from 1,000 to 10,000 if their factory meets its annual quality cost goals. Len Smith, manager of Lindells Boise plant, felt obligated to do everything he could to provide this increase to his employees. Accordingly, he has decided to take the following actions during the last quarter of the year to meet the plants budgeted quality cost targets: a. Decrease inspections of the process and final product by 50% and transfer inspectors temporarily to quality training programs. Len believes this move will increase the inspectors awareness of the importance of quality; also, decreasing inspection will produce significantly less downtime and less rework. By increasing the output and decreasing the costs of internal failure, the plant can meet the budgeted reductions for internal failure costs. Also, by showing an increase in the costs of quality training, the budgeted level for prevention costs can be met. b. Delay replacing and repairing defective products until the beginning of the following year. While this may increase customer dissatisfaction somewhat, Len believes that most customers expect some inconvenience. Besides, the policy of promptly dealing with customers who are dissatisfied could be reinstated in 3 months. In the meantime, the action would significantly reduce the costs of external failure, allowing the plant to meet its budgeted target. c. Cancel scheduled worker visits to customers plants. This program, which has been very well received by customers, enables Lindell workers to see just how the machinery they make is used by the customer and also gives them first-hand information on any remaining problems with the machinery. Workers who went on previous customer site visits came back enthusiastic and committed to Lindells quality program. Lindells quality program staff believes that these visits will reduce defects during the following year. Required: 1. Evaluate Lens ethical behavior. In this evaluation, consider his concern for his employees. Was he justified in taking the actions described? If not, what should he have done? 2. Assume that the company views Lens behavior as undesirable. What can the company do to discourage it? 3. Assume that Len is a CMA and a member of the IMA. Refer to the ethical code for management accountants in Chapter 1. Were any of these ethical standards violated?arrow_forwardAt the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: Required: 1. Compute the following measures for 20x1 and 20x3: a. Actual velocity and cycle time b. Percentage of total revenue from new customers (assume one unit per customer) c. Percentage of very satisfied customers (assume each customer purchases one unit) d. Market share e. Percentage change in actual product cost (for 20x3 only) f. Percentage change in days of inventory (for 20x3 only) g. Defective units as a percentage of total units produced h. Total hours of training i. Suggestions per production worker j. Total revenue k. Number of new customers 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning