College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 14, Problem 8SEB

JOURNALIZE

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

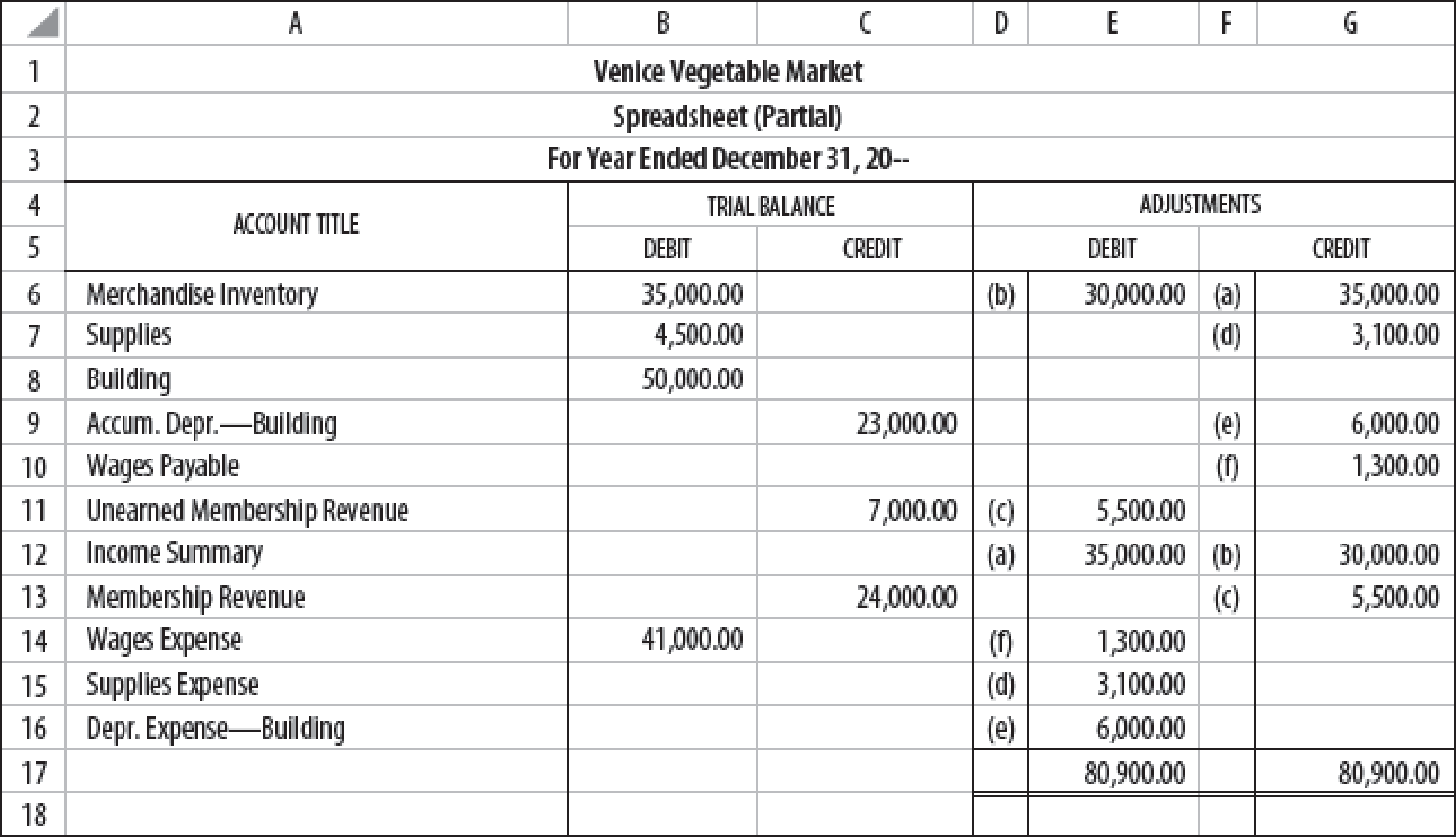

JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING BUSINESS Thefollowing partial spreadsheet is taken from the books of the Venice Vegetable Market, for the year ended December 31, 20--. Journalize the adjustments in a general journal.

JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING BUSINESS

The following partial spreadsheet is taken from the books of Vinnie'sVegetable Market, for the year ended December 31, 20--. Journalize the adjustments in a general journal.

Journalize Adjusting Entries for a Merchandising Business

The following partial spreadsheet is taken from the books of Vinnie’s Vegetable Market, for the year ended December 31, 20--.

Vinnie’s Vegetable MarketEnd-of-Period Spreadsheet (Partial)For Year Ended December 31, 20--

ACCOUNT TITLE

TRIAL BALANCE

ADJUSTMENTS

DEBIT

CREDIT

DEBIT

CREDIT

Merchandise Inventory

47,000.00

(b) 49,000.00

(a) 47,000.00

Supplies

11,000.00

(d) 7,500.00

Building

48,000.00

Accum. Depr.—Building

12,000.00

(e) 4,000.00

Wages Payable

(f) 1,200.00

Unearned Membership Fees

4,000.00

(c) 3,000.00

Income Summary

(a) 47,000.00

(b) 49,000.00

Membership Fees

18,000.00

(c) 3,000.00

Wages Expense

36,000.00

(f) 1,200.00

Supplies Expense

(d) 7,500.00

Depr. Expense—Building

(e) 4,000.00

111,700.00

111,700.00

Journalize the adjustments in a general journal.

Chapter 14 Solutions

College Accounting, Chapters 1-27

Ch. 14 - Under the periodic inventory system, the beginning...Ch. 14 - Under the periodic inventory system, the ending...Ch. 14 - The cash received in advance before delivering a...Ch. 14 - Unearned revenue is adjusted into an expense...Ch. 14 - Sales Returns and Allowances is classified as a...Ch. 14 - Under the periodic inventory system, what account...Ch. 14 - Under the periodic inventory system, what account...Ch. 14 - Under the periodic inventory system, what account...Ch. 14 - Unearned revenue is classified as what type of...Ch. 14 - Under the perpetual inventory method, what account...

Ch. 14 - Prepare the cost of goods sold section for Josephs...Ch. 14 - The Venice Theatre sold and collected cash of...Ch. 14 - Information relating to inventory for Janie Par...Ch. 14 - Using the spreadsheet provided below, prepare the...Ch. 14 - Prob. 5CECh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - What spreadsheet amounts are used to compute cost...Ch. 14 - Why are both the debit and credit amounts in the...Ch. 14 - What is an unearned revenue?Ch. 14 - Give three examples of unearned revenue.Ch. 14 - Prob. 6RQCh. 14 - Prob. 7RQCh. 14 - A firm is preparing to make adjusting entries at...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC...Ch. 14 - DETERMINING THE BEGINNING AND ENDING INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING...Ch. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - ADJUSTMENTS FOR A MERCHANDISING BUSINESS:...Ch. 14 - JOURNALIZE ADJUSTING ENTRY FOR INVENTORY...Ch. 14 - PREPARATION OF ADJUSTMENTS ON A SPREADSHEET FOR A...Ch. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - ADJUSTMENT FOR MERCHANDISE INVENTORY USING T...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - CALCULATION OF COST OF GOODS SOLD: PERIODIC...Ch. 14 - ADJUSTMENT FOR UNEARNED REVENUES USING T ACCOUNTS...Ch. 14 - MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC...Ch. 14 - DETERMINING THE BEGINNING AND ENDING INVENTORY...Ch. 14 - JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING...Ch. 14 - JOURNAL ENTRIES UNDER THE PERPETUAL INVENTORY...Ch. 14 - ADJUSTMENTS FOR A MERCHANDISING BUSINESS:...Ch. 14 - JOURNALIZE ADJUSTING ENTRY FOR INVENTORY...Ch. 14 - Prob. 12SPBCh. 14 - WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO...Ch. 14 - A friend of yours recently opened Abracadabra, a...Ch. 14 - Jason Tierro, an inventory clerk at Lexmar...Ch. 14 - John Neff owns and operates Waikiki Surf Shop. A...Ch. 14 - Block Foods, a retail grocery store, has agreed to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- JOURNALIZE ADJUSTING ENTRIES FOR A MERCHANDISING BUSINESS The following partial work sheet is taken from the books of Kellys Kittens, a local pet kernel, for the year ended December 31, 20--. Journalize the adjustments in a general journal.arrow_forwardEND-OF-PERIOD SPREADSHEET, ADJUSTING, CLOSING, AND REVERSING ENTRIES Vickis Fabric Store shows the trial balance on page 601 as of December 31, 20-1. At the end of the year, the following adjustments need to be made: (a, b)Merchandise inventory as of December 31, 31,600. (c, d, e)Vicki estimates that customers will be granted 2,500 in refunds of this years sales next year and the merchandise expected to be returned will have a cost of 1,800. (f)Unused supplies on hand, 350. (g)Insurance expired, 2,400. (h)Depreciation expense for the year on building, 20,000. (i)Depreciation expense for the year on equipment, 4,000. (j)Wages earned but not paid (Wages Payable), 520. (k)Unearned revenue on December 31, 20-1, 1,200. PROBLEM 15-10A CONT. REQUIRED 1. Prepare an end-of-period spreadsheet. 2. Prepare adjusting entries and post adjusting entries to an Income Summary T account. 3. Prepare closing entries and post to a Capital T account. There were no additional investments this year. 4. Prepare a post-closing trial balance. 5. Prepare reversing entry(ies).arrow_forwardWORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TO DETERMINE ADJUSTING ENTRIES The partial spreadsheet shown below is taken from the books of Albers Pet Supply, a business owned by Carm Albers, for the year ended December 31, 20--. Albers is on the periodic inventory system. REQUIRED 1. Determine the adjusting entries by analyzing the difference between the adjusted trial balance and the trial balance. 2. Journalize the adjusting entries in a general journal.arrow_forward

- Journalize the required adjusting entries for the year ended December 31 for Butler Spa and Pool Accessories. Butler Spa and Pool Accessories uses the periodic inventory system. ab. On December 31, a physical count of inventory was taken. The physical count amounted to 22,624. The Merchandise Inventory account shows a balance of 21,696. c. On July 1 of this year, 2,400 was paid for a one-year insurance policy. d. On November 1 of this year, 420 was paid for three months of advertising. e. As of December 31, the balance of the Unearned Membership Fees account is 15,600. Of this amount, 9,200 has been earned. f. Equipment purchased on May 1 of this year for 8,000 is expected to have a useful life of five years with a trade-in value of 500. All other equipment has been fully depreciated. The straight-line method is used. g. As of December 31, three days wages at 250 per day had accrued. h. As of December 31, the balance of the supplies account is 4,200. A physical inventory of the supplies was taken, with an amount of 1,650 determined to be on hand.arrow_forwardJournalize Adjusting Entries for a Merchandising Business The following partial spreadsheet is taken from the books of Vinnie’s Vegetable Market, for the year ended December 31, 20--. Vinnie’s Vegetable MarketEnd-of-Period Spreadsheet (Partial)For Year Ended December 31, 20-- ACCOUNT TITLE TRIAL BALANCE ADJUSTMENTS DEBIT CREDIT DEBIT CREDIT Merchandise Inventory 45,000.00 (b) 50,000.00 (a) 45,000.00 Supplies 10,000.00 (d) 7,000.00 Building 60,000.00 Accum. Depr.—Building 15,000.00 (e) 5,000.00 Wages Payable (f) 1,200.00 Unearned Membership Fees 3,000.00 (c) 2,000.00 Income Summary (a) 45,000.00 (b) 50,000.00 Membership Fees 20,000.00 (c) 2,000.00 Wages Expense 37,000.00 (f) 1,200.00 Supplies Expense (d) 7,000.00 Depr. Expense—Building (e) 5,000.00 110,200.00 110,200.00 Journalize the adjustments in a general journal. Page: 1 ROW NUMBER DATE ACCOUNT TITLE DOC.NO. POST.REF. DEBIT CREDIT ROW…arrow_forwardPreparation of Adjustments on a Spreadsheet for a Merchandising Business: Periodic Method The trial balance for the Venice Beach Kite Shop, a business owned by Molly Young is shown in the End-of-Period Spreadsheet. Year-end adjustment information: (a, b) A physical count shows that merchandise inventory costing $84,000 is on hand as of December 31, 20--. (c, d, e) Young estimates that customers will be granted $5,700 in refunds of this year’s sales next year and the merchandise expected to be returned will have a cost of $4,300. (f) Supplies remaining at the end of the year, $3,300. (g) Unexpired insurance on December 31, $3,800. (h) Depreciation expense on the building for 20--, $11,500. (i) Depreciation expense on the store equipment for 20--, $6,500. (j) Unearned rent revenue as of December 31, $4,600. (k) Wages earned but not paid as of December 31, $3,400.arrow_forward

- general journal Required: Based on the information above, record the adjusting journal entries that must be made for Ambriz Distributors on June 30, 20X1. The company has a June 30 fiscal year-end. a.–b. Merchandise Inventory, before adjustment, has a balance of $6,800. The newly counted inventory balance is $7,300. c. Unearned Seminar Fees has a balance of $5,300, representing prepayment by customers for five seminars to be conducted in June, July, and August 20X1. Two seminars had been conducted by June 30, 20X1. d. Prepaid Insurance has a balance of $7,800 for six months’ insurance paid in advance on May 1, 20X1. e. Store equipment costing $17,710 was purchased on March 31, 20X1. It has a salvage value of $430 and a useful life of six years. f. Employees have earned $180 that has not been paid at June 30, 20X1. g. The employer owes the following taxes on wages not paid at June 30, 20X1: SUTA, $5.40; FUTA, $1.08; Medicare, $2.61; and social security, $11.16. h. Management estimates…arrow_forwardJournalize the transactions in a merchandising business in general journal - purchase and sales. See the template below for general journal, purchase journal, and sales journal. (This is the correct template please be guided)Write your answer on a columnar sheet. On January 15, Aeron Trading purchased from Victoria Merchandising goods amounting to ₱30,000on term 50% down, balance 2/10, n/30. The next day, Aeron Trading issued a ₱2,000 debitmemorandum to Victoria Merchandising for the return of defective merchandise bought. On January20, Aeron Trading paid ₱10,000 as partial payment. Aeron Trading settled in full the outstandingaccount with Victoria Merchandising on January 25.1. Journalize the above transactions using periodic inventory system and generaljournal of:A. Aeron TradingB. Victoria Merchandisingarrow_forwardThe income statement and balance sheet homes below are from the worksheet of a merchandising firm J.D. enterprise, for the year ended December 31,20– prepare the closing entries for the merchandising firmarrow_forward

- WORKING BACKWARD FROM ADJUSTED TRIAL BALANCE TODETERMINE ADJUSTING ENTRIES The partial spreadsheet shown belowis taken from the books of Sunstate Computer Supply, a business ownedby Michelle Thibeault, for the year ended December 31, 20-, Sunstate ison the periodic inventory system. REQUIRED1. Determine the adjusting entries by analyzing the differencebetween the adjusted trial balance and the trial balance.2. Journalize the adjusting entries in a general journal.arrow_forwardWORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following partial work sheet is taken from Nicoles Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is 37,000. 1. Complete the Adjustments columns for the merchandise inventory. 2. Extend the merchandise inventory to the Adjusted Trial Balance and Balance Sheet columns. 3. Extend the remaining accounts to the Adjusted Trial Balance and Income Statement columns. 4. Prepare a cost of goods sold section from the partial work sheet.arrow_forwardWORK SHEET EXTENSIONS FOR MERCHANDISE INVENTORY ADJUSTMENTS: PERIODIC INVENTORY SYSTEM The following partial work sheet is taken from Kevins Gift Shop for the year ended December 31, 20--. The ending merchandise inventory is 50,000. 1. Complete the Adjustments columns for the merchandise inventory. 2. Extend the merchandise inventory to the Adjusted Trial Balance and Balance Sheet columns. 3. Extend the remaining accounts to the Adjusted Trial Balance and Income Statement columns. 4. Prepare a cost of goods sold section from the partial work sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License