SURVEY OF ACCOUNTING 360DAY CONNECT CAR

5th Edition

ISBN: 9781260591811

Author: Edmonds

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 15, Problem 15E

Residual income

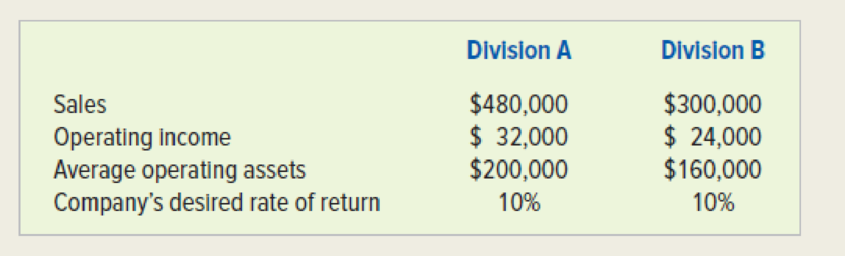

Gletchen Cough Drops operates two divisions. The following information pertains to each division for 2018.

Required

- a. Compute each division’s residual income.

- b. Which division increased the company’s profitability more?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Analyzing profitability

Camden Company has divided its business into segments based on sales territories: East Coast, Midland, and West Coast. Following are financial data for 2018:

Prepare an income statement for Camden Company for 2018 using the contribution margin format assuming total fixed costs for the company Were $435,000. Include columns for each business segment and a column for the total company.

Operating results for Division A of Alpha Company during 2019 are as follows:

Sales

$480,000

Cost of goods sold

297,600

Gross profit

182,400

Direct expenses

32,400

Common expenses

54,000

Total expenses

86,400

Net income

$96,000

If Division A would maintain the same quantity of product sold while raising selling prices by 6% and making additional advertising expenditures of $36,000, what would be the effect on the Division’s net income? (Ignore income taxes in your calculations.)

Select one:

a. Net income would decrease by $7,200

b. Net income would increase by $28,800

c. Net income would increase by $36,000

d. Net income would decrease by $28,800

e. Net income would increase by $7,200

Profit Margin, Investment Turnover, and return on investment

The condensed income statement for the Consumer Products Division of Fargo Industries Inc. is as follows (assuming no service department charges):

Sales

$82,500,000

Cost of goods sold

53,625,000

Gross profit

$ 28,875,000

Administrative expenses

15,675,000

Income from operations

$ 13,200,000

The manager of the Consumer Products Division is considering ways to increase the return on investment

a. Using the DuPont formula for return on investment, determine the profit margin, investment turnover, and return on investment of the Consumer Products Division, assuming that $55,000,000 of assets have been invested in the Consumer Products Division. If required, round the investment turnover to one decimal place.

Profit margin

fill in the blank 1%

Investment turnover

fill in the blank 2

Rate of return on investment

fill in the blank 3%

b. If expenses could be reduced by $1,650,000 without decreasing sales,…

Chapter 15 Solutions

SURVEY OF ACCOUNTING 360DAY CONNECT CAR

Ch. 15 - 1. Pam Kelly says she has no faith in budgets. Her...Ch. 15 - 7. What is a responsibility center?Ch. 15 - Prob. 3QCh. 15 - Prob. 4QCh. 15 - Prob. 5QCh. 15 - 3. When are sales and cost variances favorable and...Ch. 15 - 4. Joan Mason, the marketing manager for a large...Ch. 15 - Prob. 8QCh. 15 - Prob. 9QCh. 15 - Prob. 10Q

Ch. 15 - Prob. 11QCh. 15 - 9. Minnie Divers, the manager of the marketing...Ch. 15 - 6. How do responsibility reports promote the...Ch. 15 - Prob. 14QCh. 15 - Prob. 15QCh. 15 - Prob. 16QCh. 15 - 12. How can a residual income approach to...Ch. 15 - Prob. 18QCh. 15 - Exercise 9-6A Evaluating a profit center Helen...Ch. 15 - Prob. 2ECh. 15 - Prob. 3ECh. 15 - Prob. 4ECh. 15 - Exercise 8-3A Determining amount and type...Ch. 15 - Prob. 6ECh. 15 - Exercise 8-4A Determining sales and variable cost...Ch. 15 - Exercise 8-5A Determining flexible budget...Ch. 15 - Exercise 8-9A Responsibility for the fixed cost...Ch. 15 - Prob. 10ECh. 15 - Exercise 8-7A Evaluating a decision to increase...Ch. 15 - Prob. 12ECh. 15 - Prob. 13ECh. 15 - Exercise 9-9A Residual income Climax Corporation...Ch. 15 - Residual income Gletchen Cough Drops operates two...Ch. 15 - Prob. 16ECh. 15 - Prob. 17ECh. 15 - Prob. 18PCh. 15 - Prob. 19PCh. 15 - Prob. 20PCh. 15 - Prob. 21PCh. 15 - Problem 9-20A Return on investment Sorrento...Ch. 15 - Problem 9-21A Comparing return on investment and...Ch. 15 - Comparing return on investment and residual income...Ch. 15 - ATC 8-1 Business Applications Case Static versus...Ch. 15 - Prob. 2ATCCh. 15 - Prob. 3ATCCh. 15 - ATC 9-1 Business Applications Case Analyzing...Ch. 15 - Prob. 5ATC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Margin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forwardA Using Common Size Statements The following income statement and vertical analysis data are available for Riley Manufacturing: Required: 1. CONCEPTUAL CONNECTION Suggest why net income declined from $273,200 to $41,600 while the cost of goods sold percentage decreased each year and selling and administrative expenses remained nearly constant. 2. CONCEPTUAL CONNECTION Determine what could cause sales to decline while the gross margin percentage increases.arrow_forwardCommunication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forward

- The following revenue data were taken from the December 31, 2017, General Electric annual report (10-K): For each segment and each year, calculate intersegment sales (another name for transfer sales) as a percentage of total sales. Using Microsoft Excel or another spreadsheet application, create a clustered column graph to show the 2016 and 2017 percentages for each division. Comment on your observations of this data. How might a division sales manager use this data?arrow_forwardResidual income The Commercial Division of Galena Company has operating income of 12,680,000 and assets of 74,500,000. The minimum acceptable return on assets is 12%. What is the residual income for the division?arrow_forwardHardin Company is a division of a major corporation. The following data are for the latest year ofoperations:Sales $ 19,600,000 Net operating income $ 470,400 Average operating assets $ 5,000,000 The company's minimum required rate of return 10 % Required:a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forward

- Eacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales $14,720,000 Net operating income $1,000,960 Average operating assets $4,000,000 The company’s minimum required rate of return 14% a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardEacher Wares is a division of a major corporation. The following data are for the latest year of operations: Sales 24,480,000 Net operating assets 1,000,960 average operatign assets 4,000,000 the company minimum required rate of return 14% Required: a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardResidual Income Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results: Adams Division Jefferson Division Net (after-tax) income $623,150 $327,600 Total capital employed 4,320,000 3,672,500 In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 9%. Required: Enter negative values as negative numbers. 1. Calculate the residual income for the Adams Division.$ 2. Calculate the residual income for the Jefferson Division.$arrow_forward

- Washington Company has two divisions: the Adams Division and the Jefferson Division. The following information pertains to last year's results: Adams Division Jefferson Division Net (after-tax) income $726,000 $327,600 Total capital employed 4,280,000 3,412,500 In addition, Washington Company's top management has set a minimum acceptable rate of return equal to 11%. Calculate the residual income for the Adams Division Calculate the residual income for the Jefferson Divisionarrow_forwardHardin Company is a division of a major corporation. The following data are for the latest year ofoperations: (35 points)Sales $ 19,600,000 Net operating income $ 470,400 Average operating assets $ 5,000,000 The company's minimum required rate of return 10 % Required:a. What is the division's margin?b. What is the division's turnover?c. What is the division's return on investment (ROI)?d. What is the division's residual income?arrow_forwardResidual Income The Consumer Division of Galena Company has income from operations of $66,580 and assets of $328,000. The minimum acceptable return on assets is 7%. What is the residual income for the division?$arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License