Concept explainers

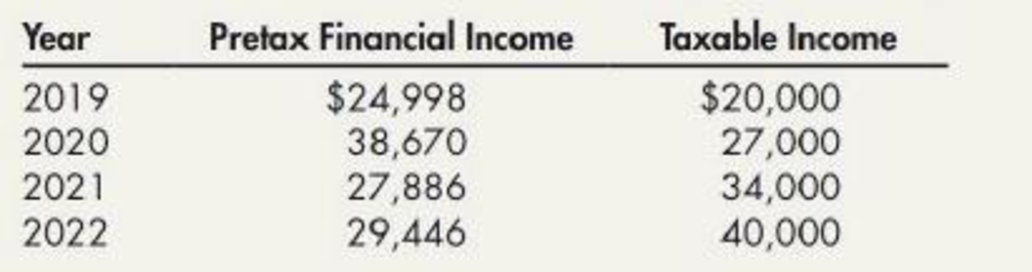

For 2019 through 2022, Gire reported pretax financial income and taxable income of the following amounts (the differences are due solely to the depreciation temporary differences):

Over the entire 4-year period, Gire was subject to an income tax of 30%, and no change in the tax rate had been enacted for future years.

Required:

- 1. Prepare a schedule that shows for each year, 2019 through 2022, the (a) MACRS depreciation, (b) straight-line depreciation, (c) annual depreciation temporary difference, and (d) accumulated temporary difference at the end of each year.

- 2. Prepare Gire’s income tax

journal entry at the end of (a) 2019, (b) 2020, (c) 2021, and (d) 2022. (Round to the nearest dollar.) - 3. Prepare the lower portion of Gire’s income statement for (a) 2019, (b) 2020, (c) 2021, and (d) 2022.

1 (a)

Prepare a schedule that shows MACRS depreciation from 2019 through 2022.

Explanation of Solution

Prepare a schedule that shows MACRS depreciation from 2019 through 2022:

| Year | MACRS Depreciation rate | MACRS Depreciation (Tax purpose) |

| (1) | ||

| 2019 | 33.33% | $19,998 |

| 2020 | 44.45% | $26,670 |

| 2021 | 14.81% | $8,886 |

| 2022 | 7.41% | $4,446 |

Table (1)

1 (b)

Prepare a schedule that shows straight line depreciation from 2019 through 2022.

Explanation of Solution

Straight-line Depreciation: Under the straight-line method of depreciation, the same amount of depreciation is allocated every year over the estimated useful life of an asset. The formula to calculate the depreciation cost of the asset using the residual value is shown as below:

Prepare a schedule that shows straight line depreciation from 2019 through 2022.

Given, the cost of the asset is $60,000 and the estimated useful life is 4 years. So, the straight line depreciation is $15,000

| Year | Straight line Depreciation (Financial reporting purpose) |

| 2019 | $15,000 |

| 2020 | $15,000 |

| 2021 | $15,000 |

| 2022 | $15,000 |

Table (2)

1 (c)

Prepare a schedule that shows the annual depreciation temporary difference from 2019 through 2022.

Explanation of Solution

Temporary Difference: Temporary difference refers to the difference of one income recognized by the tax rules and accounting rules of a company in different periods. Consequently the difference between the amount of assets and liabilities reported in the financial reports and the amount of assets and liabilities as per the company’s tax records is known as temporary difference.

Prepare a schedule that shows the annual depreciation temporary difference from 2019 through 2022:

| Year | MACRS Depreciation (Tax purpose) | Straight line Depreciation (Financial reporting purpose) | Temporary difference between annual depreciation |

| 2019 | $19,998 | $15,000 | $4,998 |

| 2020 | $26,670 | $15,000 | $11,670 |

| 2021 | $8,886 | $15,000 | ($6,114) |

| 2022 | $4,446 | $15,000 | ($10,554) |

Table (3)

Note: The temporary difference of annual depreciation is calculated by subtracting MACRS depreciation (Requirement 1 (a)) and straight line depreciation (Requirement 1 (b)).

1 (d)

Prepare a schedule that shows the accumulated temporary difference from 2019 through 2022.

Explanation of Solution

Prepare a schedule that shows the accumulated temporary difference from 2019 through 2022:

| Year | Temporary difference between annual depreciation | Accumulated Temporary difference |

| 2019 | $4,998 | $4,998 |

| 2020 | $11,670 | $16,668 |

| 2021 | ($6,114) | $10,554 |

| 2022 | ($10,554) | $0 |

Table (4)

Note: The accumulated temporary difference is determined by adding the temporary difference of annual depreciation of each of the year from 2019 through 2022.

2 (a)

Record the income tax journal entry at the end of 2019 for Company C.

Explanation of Solution

Record the income tax journal entry at the end of 2019 for Company C.

| Date | Account title and Explanation | Post ref. | Amount | |

| Debit | Credit | |||

| 2019 | ||||

| December 31 | Income tax expense (1) | $7,499 | ||

| Income tax payable (2) | $6,000 | |||

| Deferred tax liability (3) | $1,449 | |||

| (To record the income tax payable ) | ||||

Table (5)

- Income tax expense is an expense that decreases the stockholder’s equity and it is increased. Thus, it is debited.

- Income tax Payable is a liability and it is increased. Thus, it is credited.

- Deferred tax liability is a liability and it is increased. Thus, it is credited.

Working note 1: Determine the income tax expense:

Working note 2: Determine the income tax payable:

Given, the taxable income is $20,000 and the tax rate is 30%.

Working note 3: Determine the deferred tax liability:

Given, the accumulated temporary difference is $4,998 for year 2019 as computed in Table (4) and the tax rate is 30%.

2 (b)

Record the income tax journal entry at the end of 2020 for Company C.

Explanation of Solution

Record the income tax journal entry at the end of 2020 for Company C.

| Date | Account title and Explanation | Post ref. | Amount | |

| Debit | Credit | |||

| 2020 | ||||

| December 31 | Income tax expense (4) | $11,601 | ||

| Income tax payable (5) | $8,100 | |||

| Deferred tax liability (6) | $3,501 | |||

| (To record the income tax payable ) | ||||

Table (6)

- Income tax expense is an expense that decreases the stockholder’s equity and it is increased. Thus, it is debited.

- Income tax Payable is a liability and it is increased. Thus, it is credited.

- Deferred tax liability is a liability and it is increased. Thus, it is credited.

Working note 4: Determine the income tax expense:

Working note 5: Determine the income tax payable:

Given, the taxable income is $27,000 and the tax rate is 30%.

Working note 6: Determine the deferred tax liability:

Given, the accumulated temporary difference is $16,668 for year 2020 as computed in Table (4) and the tax rate is 30%.

2 (c)

Record the income tax journal entry at the end of 2021 for Company C.

Explanation of Solution

Record the income tax journal entry at the end of 2021 for Company C.

| Date | Account title and Explanation | Post ref. | Amount | |

| Debit | Credit | |||

| 2021 | ||||

| December 31 | Income tax expense (balancing figure) | $8,366 | ||

| Deferred tax liability (7) | $1,834 | |||

| Income tax payable (8) | $10,200 | |||

| (To record the income tax payable ) | ||||

Table (7)

- Income tax expense is an expense that decreases the stockholder’s equity and it is increased. Thus, it is debited.

- Deferred tax liability is a liability and it is decreased. Thus, it is debited.

- Income tax Payable is a liability and it is increased. Thus, it is credited.

Working note 7: Determine the deferred tax liability:

Given, the accumulated temporary difference is $10,554 for year 2021 as computed in Table (4) and the tax rate is 30%.

Working note 8: Determine the income tax payable:

Given, the taxable income is $34,000 and the tax rate is 30%.

2 (d)

Record the income tax journal entry at the end of 2022 for Company C.

Explanation of Solution

Record the income tax journal entry at the end of 2022 for Company C.

| Date | Account title and Explanation | Post ref. | Amount | |

| Debit | Credit | |||

| 2022 | ||||

| December 31 | Income tax expense (balancing figure) | $8,834 | ||

| Deferred tax liability (9) | $3,166 | |||

| Income tax payable (10) | $12,000 | |||

| (To record the income tax payable ) | ||||

Table (8)

- Income tax expense is an expense that decreases the stockholder’s equity and it is increased. Thus, it is debited.

- Deferred tax liability is a liability and it is decreased. Thus, it is debited.

- Income tax Payable is a liability and it is increased. Thus, it is credited.

Working note 9: Determine the deferred tax liability:

Given, the accumulated temporary difference is $0 for year 2022 as computed in Table (4) and the tax rate is 30%.

Working note 10: Determine the income tax payable:

Given, the taxable income is $40,000 and the tax rate is 30%.

3 (a)

Prepare the lower portion of Company G’s income statement.

Explanation of Solution

Income statement: The financial statement which reports revenues and expenses from business operations and the result of those operations as net income or net loss for a particular time period is referred to as income statement.

Prepare the lower portion of Company G’s income statement:

| Company G | |

| Income Statement | |

| For the year ended 2019 | |

| Pretax Operating Income | $24,998 |

| Less: Income tax expense | ($7,499) |

| Net Income | $17,499 |

Table (9)

Thus, the net income of Company G is $17,499.

3 (b)

Prepare the lower portion of Company G’s income statement.

Explanation of Solution

Prepare the lower portion of Company G’s income statement:

| Company G | |

| Income Statement | |

| For the year ended 2020 | |

| Pretax Operating Income | $38,670 |

| Less: Income tax expense | ($11,601) |

| Net Income | $27,069 |

Table (10)

Thus, the net income of Company G is $27,069.

3 (c)

Prepare the lower portion of Company G’s income statement.

Explanation of Solution

Prepare the lower portion of Company G’s income statement:

| Company G | |

| Income Statement | |

| For the year ended 2021 | |

| Pretax Operating Income | $27,886 |

| Less: Income tax expense | ($8,366) |

| Net Income | $19,520 |

Table (11)

Thus, the net income of Company G is $19,520.

3 (d)

Prepare the lower portion of Company G’s income statement.

Explanation of Solution

Prepare the lower portion of Company G’s income statement:

| Company G | |

| Income Statement | |

| For the year ended 2017 | |

| Pretax Operating Income | $29,446 |

| Less: Income tax expense | ($8,834) |

| Net Income | $20,612 |

Table (12)

Thus, the net income of Company G is $20,612.

Want to see more full solutions like this?

Chapter 18 Solutions

Intermediate Accounting: Reporting And Analysis

- At the beginning of 2019, Conley Company purchased an asset at a cost of 10,000. For financial reporting purposes, the asset has a 4-year life with no residual value and is depreciated by the straight-line method beginning in 2019. For tax purposes, the asset is depreciated under MACRS using a 5-year recovery period. Prior to 2019, Conley had no deferred tax liability or asset. The difference between depreciation for financial reporting purposes and income tax purposes is the only temporary difference between pretax financial income and taxable income. The current income tax rate is 30%, and no change in the tax rate has been enacted for future years. In 2019 and 2020, taxable income will be higher or lower than financial income by what amount?arrow_forwardDeferred Tax Asset and Valuation Account Zeta Corporation reported taxable income for 2019 of 200,000. The enacted tax rate for 2019 is 40%. During 2019, Zeta became the defendant in a lawsuit. The lawsuit has not been resolved at the end of the period, but Zetas lawyers believe that it is probable that the company will be held liable. The legal office estimated that the amount of loss will IK 80,000. AS a result, the lawsuit has been recognized as a contingent liability. However, the legal obligation is not deductible for tax purposes during 2019. The lawsuit represents the only difference between financial income and taxable income for the year. Required: 1. Assume that Zeta Corporation has been quite profitable in past periods and expects to continue that pattern in the future. Record a journal entry to recognize tax expense, tax payable, and deferred tax for 2019. 2. Assume that there is substantial doubt about whether Zeta Corporation will be profitable in future periods. As a result, the company believes that one-half of the future deduction for legal costs will not be realized. Record a journal entry to recognize tax expense, tax payable, and deferred tax for the year. 3. Next Level Explain what circumstances require that a valuation allowance account should be utilized when deferred tax is recognized. How should that account be presented on the financial statements? 4. Prepare your answer to Requirement 2 assuming that Zeta prepares financial statements according to IFRS.arrow_forwardTurnip Company purchased an asset at a cost of 10,000 with a 10-year life during the current year. Turnip uses differing depreciation methods for financial reporting and income tax purposes. The depreciation expense during the current year for financial reporting is 1,000 and for income tax purposes is 2,000. Turnip is subject to a 30% enacted future tax rate. Prepare a schedule to compute Turnips (a) ending future taxable amount, (b) ending deferred tax liability, and (c) change in deferred tax liability (deferred tax expense) for the current year.arrow_forward

- Prior to and during 2019, Shadrach Company reported tax depreciation at an amount higher than the amount of financial depreciation, resulting in a book value of the depreciable assets of 24,500 for financial reporting purposes and of 20,000 for tax purposes at the end of 2019. In addition, Shadrach recognized a 3,500 estimated liability for legal expenses in the financial statements during 2019; it expects to pay this liability (and deduct it for tax purposes) in 2023. The current tax rate is 30%, no change in the tax rate has been enacted, and the company expects to be profitable in future years. What is the amount of the net deferred tax liability at the end of 2019? a. 300 b. 450 c. 1,050 d. 1,350arrow_forwardComprehensive Colt Company reports pretax financial income of 143,000 in 2019. In addition to pretax income from continuing operations (of which revenues are 295,000), the following items are included in this pretax income: Colts taxable income totals 93,000 in 2019. The difference between the pretax financial income and the taxable income is due to the excess of tax depreciation over financial depreciation on assets used in continuing operations. At the beginning of 2019, Colt had a retained earnings balance of 310.000 and a deferred tax liability of 8,100. During 2019, Colt declared and paid dividends of 48,000. It is subject to tax rates of 15% on the first 50,000 of income and 30% on income in excess of 50,000. Based on proper interperiod tax allocation procedures, Colt has determined that its 2019 ending deferred tax liability is 14,100. Required: 1. Prepare a schedule for Colt to allocate the total 2019 income tax expense to the various components of pretax income. 2. Prepare Colts income tax journal entry at the end of 2019. 3. Prepare Colts 2019 income statement. 4. Prepare Colts 2019 statement of retained earnings. 5. Show the related income tax disclosures on Colts December 31, 2019, balance sheet.arrow_forwardIncomc Taxes Then Company has been in operation for several years. It has both a deductible and a taxable temporary difference. At the beginning of 2019, its deferred tax asset was 690, and its deferred tax liability was 750. The company expects its lutine deductible amount to be deductible in 2020 and its Inline taxable amount to 1 taxable in 2021. In 2018, Congress enacted income tax rates for future years as follows: 2019, 30%; 2020, 34%; and 2021, 35%. At the end of 2019, Then reported income taxes payable of 25,800, an increase in its deferred tax liability of 300, and an ending balance in its deferred tax asset of 860. Thun has prepared the following schedule of items related to its income taxes for 2019. Required: Fill in the blanks in the preceding schedule. Show your calculations.arrow_forward

- Interperiod Tax Allocation Peterson Company has computed its pretax financial income to be 66,000 in 2019 after including the effects of the appropriate items from the following information: Petersons accountant has prepared the following schedule showing the future taxable and deductible amounts at the end of 2019 for its three temporary differences: At the beginning of 2019, Peterson had a deferred tax liability of 12,540 related to the depreciation difference and 4,710 related to the accrual-basis sales difference. In addition, it had a deferred tax asset of 14,850 related to the warranty difference. The current tax rate is 30%, and no change in the tax rate has been enacted for future years. Required: 1. Compute Petersons taxable income for 2019. 2. Prepare Petersons income tax journal entry for 2019 (assume no valuation allowance is necessary). 3. Next Level Identify the permanent differences in Items 1 through and explain why you did or did not account for them as deferred tax items in Requirement 2.arrow_forwardIn March 2019, Helen Carlon acquired used equipment for her business at a cost of 300,000. The equipment is five-year property for regular tax depreciation purposes. a. If Helen depreciates the equipment using the method that will produce the greatest deduction for 2019 for regular income tax purposes, what is the amount of the AMT adjustment? b. Draft a letter to Helen regarding the choice of depreciation methods. Helens address is 500 Monticello Avenue, Glendale, AZ 85306.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT