Concept explainers

Computing Predetermined Overhead Rates and

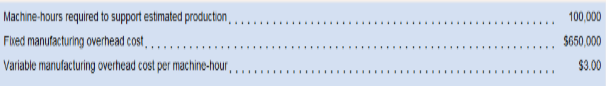

Moody Corporation uses a job-order costing system with a p1antide predetermined overhead rate based on machine-hours. At the beginningof the year, the company made the following estimates:

Required:

1. Compute the p1antide predetermined overhead rate.

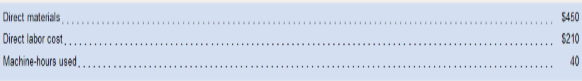

2. During the year, Job 400 was started and completed. The following information was available with respect to this job:

Compute the total

3. If Job 400 includes 52 units, what is the unit product cost for this job?

4. If Moody uses a markup percentage of 120% of its total manufacturing cost then what selling price per unit would it have established forJob 400?

5. If Moody hired you as a consultant to critique its pricing methodology, what would you say?

Predetermined overhead rate: Predetermined overhead rate refers to the rate of estimated overhead which need to be followed by a firm.

Total manufacturing cost: Total manufacturing cost refers to the overall costs of manufacturing a specific product.

Requirement − 1:

Plant wide predetermined overhead rate.

Answer to Problem 12E

Solution: Plant wide predetermined overhead rate is $9.5 per machine hour

Explanation of Solution

- Given: Following information are given in the question:

Fixed manufacturing overhead cost = $650000

Machine hours required = 100000

Variable manufacturing overhead cost per machine hour = $3.00

- Formula used: Following formula will be used for calculating plant wide predetermined overhead rate;

- Calculation: As per formula it is clear that we need to know estimated total manufacturing overhead and estimated total machine hours.

Fixed manufacturing overhead = $650000

Estimated machine hours = 100000

Now let’s put values in the above given formula;

Thus, above calculated is the plant wide predetermined overhead rate.

Requirement − 2:

Total manufacturing cost assigned to job-400.

Answer to Problem 12E

Solution:

Total manufacturing cost assigned to job is $1040

Explanation of Solution

- Given: Following information are given in the question:

Direct materials = $450

Direct labor cost = $210

Machine hours used = 40

- Formula used: Following formula will be used for calculating total manufacturing cost:

- Calculation: As per information of the question direct materials, direct labor cost are given but we have to calculate manufacturing overhead applied.

Direct materials = $450

Direct labor cost = $210

Now let’s put the values in the above mentioned formula;

Thus, above calculated is the total manufacturing cost assigned to job-400.

Requirement − 3

Unit product cost: Unit product cost refers to the average cost of goods manufactured. In other words we can say that when total manufacturing cost is divided by the number of units manufactured then we will get unit product cost.

To identify: Unit product cost for job-400.

Answer to Problem 12E

Solution:

Explanation of Solution

- Given: Following information are given in the question:

Direct materials = $450

Direct labor cost = $210

Machine hours used = 40

Overhead rate = $9.50 per machine hour

Number of units = 52

- Formula used: Following formula will be used;

- Calculation: First of all we have to calculate total manufacturing overhead;

Number of units in the job = 52 units

Now let’s put the values in the above given formula;

Thus, above calculated is the unit product cost for job-400.

Requirement − 4

Selling price per unit: Selling price per unit refers to the price at which manufactured units can be sold.

To identify: Selling price per unit if moody uses a markup percentage of 120% of it’s total manufacturing cost.

Answer to Problem 12E

Solution:

Per unit selling price will be calculated as follow:

Explanation of Solution

- Given:

Following information are available as per question:

Markup = 120% of manufacturing cost

- Formula used:

- Calculation:

Markup (120% of manufacturing cost) =

Number of units in the job = 52 units

Now let’s put the values in the above given formula;

Thus, above calculated is the per unit selling price for job-400.

Requirement − 5

To Explain: Critically analysis of pricing methodology of Moody Corporation.

Explanation of Solution

As per information of the question it is clear that Moody Corporation is selling it’s product at 120% markup. It means Moody corporation is charging 120% more than its’ manufacturing costs. So no doubt this selling price methodology is profitable to this corporation because it will result into higher amount of profits.

But we know that such high markup can make some negative impact on the overall sale of this corporation hence high markup can result into lower quantity of sale. Thus it should be kept in mind that before deciding for such high markup, a corporation must consider selling price being offered by other manufacturers too.

Thus overall we can say that although this pricing methodology of Moody Corporation is is good but negative impact of this pricing methodology must be considered.

Want to see more full solutions like this?

Chapter 2 Solutions

Introduction To Managerial Accounting

- Determining job costcalculation of predetermined rate for applying overhead by direct labor cost and direct labor hour methods Beemer Products Inc. has its factory divided into three departments, with individual factory overhead rates for each department. In each department, all the operations are sufficiently alike for the department to be regarded as a cost center. The estimated monthly factory overhead for the departments is as follows: Forming, 64,000; Shaping, 36,000; and Finishing, 10,080. The estimated production data include the following: The job cost ledger shows the following data for X6, which was completed during the month: Required: Determine the cost of X6. Assume that the factory overhead is applied to production orders, based on the following: 1. Direct labor cost 2. Direct labor hours (Hint: You must first determine overhead rates for each department, rounding rates to the nearest cent.)arrow_forwardChannel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardGerken Fabrication Inc. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of March: a. Compute the total production cost of each job. b. Prepare the journal entries to charge the costs of materials, labor, and factory overhead to Work in Process. c. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. d. Compute the unit cost of each job. e. Compute the selling price per unit for each job, assuming a mark-on percentage of 50%.arrow_forward

- A new company started production. Job 10 was completed, and Job 20 remains in production. Here is the information from job cost sheets from their first and only jobs so far: Using the information provided. A. What is the balance in work in process? B. What Is the balance in the finished goods inventory? C. If manufacturing overhead is applied on the basis of direct labor hours, what is the predetermined overhead rate?arrow_forwardThe following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forwardLorrimer Company has a job-order cost system. The following debits (credits) appeared in the Work-in-Process account for the month of June. During the month of June, direct labor totaled 30,000 and 24,000 of overhead was applied to production. Finished Goods was debited 100,000 during June. Lorrimer Company applies overhead at a predetermined rate of 80% of direct labor cost. Job number 83, the only job still in process at the end of June, has been charged with manufacturing overhead of 3,400. What was the amount of direct materials charged to Job number 83? a. 3,400 b. 4,250 c. 8,350 d. 7,580arrow_forward

- Leen Production Co. uses the job order cost system of accounting. The following information was taken from the companys books after all posting had been completed at the end of May: a. Compute the total production cost of each job. b. Prepare the journal entry to transfer the cost of jobs completed to Finished Goods. c. Compute the selling price per unit for each job, assuming a mark-on percentage of 40%. d. Prepare the journal entries to record the sale of Job 1065.arrow_forwardPrepare Job-Order Cost Sheets, Predetermined Overhead Rate, Ending Balance of WIP, Finished Goods, and COGS At the beginning of March, Mendez Company had two jobs in process, Job 86 and Job 87, with the following accumulated cost information: During March, two more jobs (88 and 89) were started. The following direct materials and direct labor costs were added to the four jobs during the month of March: At the end of March, Jobs 86, 87, and 89 were completed. Only Job 87 was sold. On March 1, the balance in Finished Goods was zero. Required: 1. Calculate the overhead rate based on direct labor cost. (Note: Round to three decimal places.) 2. Prepare a brief job-order cost sheet for the four jobs. Show the balance as of March 1 as well as direct materials and direct labor added in March. Apply overhead to the four jobs for the month of March, and show the ending balances. 3. Calculate the ending balances of Work in Process and Finished Goods as of March 31. 4. Calculate the Cost of Goods Sold for March.arrow_forwardJOURNAL ENTRIES FOR MATERIAL, LABOR, AND OVERHEAD Hilburn Manufacturing Corporation had the following transactions for its job order costing operation. Prepare general journal entries to record these transactions. Jan.1 Purchased materials on account, 17,000. 15 Issued direct materials to Job No. 104, 11,000. 20 Issued indirect materials (factory overhead), 5,000. 31 Incurred direct labor, Job No. 104, 9,000. 31 Incurred indirect labor (factory overhead), 2,500. 31 Incurred other indirect costs (factory overhead; credit Accounts Payable), 2,000.arrow_forward

- Exotic Engine Shop uses a job order cost system to determine the cost of performing engine repair work. Estimated costs and expenses for the coming period are as follows: The average shop direct labor rate is 37.50 per hour. Determine the predetermined shop overhead rate per direct labor hour.arrow_forwardOverhead application rate Creole Manufacturing Inc. uses a job order cost system and standard costs. It manufactures one product, whose standard cost follows: The standards are based on normal capacity of 2,400 direct labor hours. Actual activity for October follows: Required: 1. Compute the variable and fixed factory overhead rates per unit. 2. Compute the variable and fixed overhead rates per direct labor hour. 3. Determine the total fixed factory overhead based on normal capacity.arrow_forwardJob order cost sheets show the following costs assigned to each job: The company assigns overhead at $1.25 for each direct labor dollar spent. What is the total cost for each of the jobs?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub