EBK HORNGREN'S COST ACCOUNTING

16th Edition

ISBN: 8220103631723

Author: Rajan

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 23, Problem 23.34P

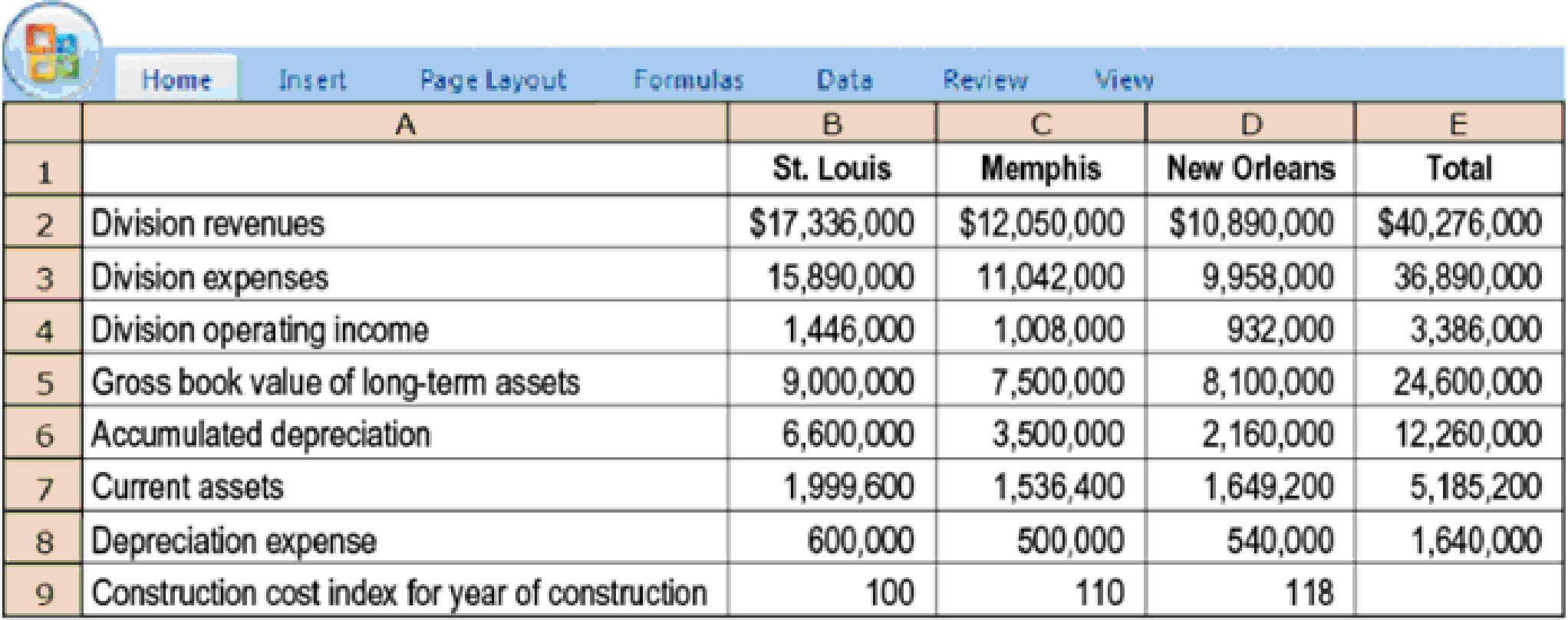

- 1. Calculate ROI for each division using net book value of total assets. Required

- 2. Using the technique in Figure 23-2, compute ROI using current-cost estimates for long-term assets and

depreciation expense. The construction cost index for 2017 is 122. Estimated useful life of operational assets is 15 years. - 3. How does the choice of long-term asset valuation affect management decisions regarding new capital investments? Why might this choice be more significant to the St. Louis division manager than to the New Orleans division manager?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

ROI, measurement alternatives for performance measures Appleton’s owns and operates a variety of casual dining restaurants in three cities: St. Louis, Memphis, and New Orleans. Each geographic market is considered a separate division. The St. Louis division includes four restaurants, each built in early 2007. The Memphis division consists of three restaurants, each built in January 2011. The New Orleans division is the newest, consisting of three restaurants built 4 years ago. Division managers at Appleton’s are evaluated on the basis of ROI. The following information refers to the three divisions at the end of 2017:

) Sales Mix Analysis

Delving further into the operations, another branch which is in the restaurant business is brought into focus.

Management desires a net income of $ 135,000 from this division which has fixed costs of $ 300,000 per year.

The following information about the operations of the division for the past two years has been supplied.

(please refer to image)

You are required to prepare a report to show :

1. The total sales required to achieve the desired net income

2. The total sales of each product required to meet the objective.

Faced with headquarters’ desire to add a new product line, Stefan Grenier, manager of Bilti Products’ East Division, felt that he had to see the numbers before he made a move. His division’s ROI has led the company for three years, and he doesn’t want any letdown.

Bilti Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROI. Operating results for the company’s East Division for last year are given below:

Sales

$

28,700,000

Variable expenses

14,390,000

Contribution margin

14,310,000

Fixed expenses

12,301,000

Operating income

$

2,009,000

Divisional operating assets

$

7,175,000

The company had an overall ROI of 16% last year (considering all divisions). The new product line that headquarters wants Grenier’s East Division to add would require an investment of $4,100,000. The cost and revenue characteristics…

Chapter 23 Solutions

EBK HORNGREN'S COST ACCOUNTING

Ch. 23 - Prob. 23.1QCh. 23 - Prob. 23.2QCh. 23 - What factors affecting ROI does the DuPont method...Ch. 23 - RI is not identical to ROI, although both measures...Ch. 23 - Describe EVA.Ch. 23 - Give three definitions of investment used in...Ch. 23 - Distinguish between measuring assets based on...Ch. 23 - Prob. 23.8QCh. 23 - Why is it important to distinguish between the...Ch. 23 - Prob. 23.10Q

Ch. 23 - Managers should be rewarded only on the basis of...Ch. 23 - Explain the role of benchmarking in evaluating...Ch. 23 - Explain the incentive problems that can arise when...Ch. 23 - Prob. 23.14QCh. 23 - Prob. 23.15QCh. 23 - During the current year, a strategic business unit...Ch. 23 - Assuming an increase in price levels over time,...Ch. 23 - If ROI Is used to evaluate a managers performance...Ch. 23 - The Long Haul Trucking Company is developing...Ch. 23 - ABC Inc. desires to maintain a capital structure...Ch. 23 - ROI, comparisons of three companies. (CMA,...Ch. 23 - Prob. 23.22ECh. 23 - ROI and RI. (D. Kleespie, adapted) The Sports...Ch. 23 - ROI and RI with manufacturing costs. Excellent...Ch. 23 - ROI, RI, EVA. Hamilton Corp. is a reinsurance and...Ch. 23 - Goal incongruence and ROI. Comfy Corporation...Ch. 23 - ROI, RI, EVA. Performance Auto Company operates a...Ch. 23 - Capital budgeting, RI. Ryan Alcoa, a new associate...Ch. 23 - Prob. 23.29ECh. 23 - ROI, RI, EVA, and performance evaluation. Cora...Ch. 23 - Prob. 23.31ECh. 23 - Prob. 23.32ECh. 23 - ROI performance measures based on historical cost...Ch. 23 - ROI, measurement alternatives for performance...Ch. 23 - Multinational firms, differing risk, comparison of...Ch. 23 - ROI, Rl, DuPont method, investment decisions,...Ch. 23 - Division managers compensation, levers of control...Ch. 23 - Executive compensation, balanced scorecard. Acme...Ch. 23 - Financial and nonfinancial performance measures,...Ch. 23 - Prob. 23.40PCh. 23 - Prob. 23.41PCh. 23 - RI, EVA, measurement alternatives, goal...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dantrell Palmer has just been appointed manager of Kirchner Glass Products Division. He has two years to make the division profitable. If the division is still showing a loss after two years, it will be eliminated, and Dantrell will be reassigned as an assistant divisional manager in another division. The divisional income statement for the most recent year is as follows: Upon arriving at the division, Dantrell requested the following data on the divisions three products: He also gathered data on a proposed new product (Product D). If this product is added, it would displace one of the current products; the quantity that could be produced and sold would equal the quantity sold of the product it displaces, although demand limits the maximum quantity that could be sold to 20,000 units. Because of specialized production equipment, it is not possible for the new product to displace part of the production of a second product. The information on Product D is as follows: Required: 1. Prepare segmented income statements for Products A, B, and C. 2. Determine the products that Dantrell should produce for the coming year. Prepare segmented income statements that prove your combination is the best for the division. By how much will profits improve given the combination that you selected? (Hint: Your combination may include one, two, or three products.)arrow_forwardSegmented Income Statement, Management Decision Making FunTime Company produces three lines of greeting cards: scented, musical, and regular. Segmented income statements for the past year are as follows: Kathy Bunker, president of FunTime, is concerned about the financial performance of her firm and is seriously considering dropping both the scented and musical product lines. However, before making a final decision, she consults Jim Dorn, FunTimes vice president of marketing. Required: 1. CONCEPTUAL CONNECTION Jim believes that by increasing advertising by 1,000 (250 for the scented line and 750 for the musical line), sales of those two lines would increase by 30%. If you were Kathy, how would you react to this information? 2. CONCEPTUAL CONNECTION Jim warns Kathy that eliminating the scented and musical lines would lower the sales of the regular line by 20%. Given this information, would it be profitable to eliminate the scented and musical lines? 3. CONCEPTUAL CONNECTION Suppose that eliminating either line reduces sales of the regular cards by 10%. Would a combination of increased advertising (the option described in Requirement 1) and eliminating one of the lines be beneficial? Identify the best combination for the firm.arrow_forwardKanye Achebe just became the operations manager of Weston Transportation. Weston transports large crates for online companies and transports containers overseas. Kanye would like to evaluate each divisional manager on a basis similar to segmental reporting required by generally accepted accounting principles (GAAP) financial statements contained in annual reports. These data include a presentation of net sales, operating profit and loss before and after taxes, total identifiable assets, and depreciation for segment reported. Kanye thinks that evaluating business division managers by the same criteria as the total company is appropriate. A. Explain why you think the chief financial officer (CFO) disagrees and tells Kanye that publicly reporting information might demotivate managers. B. For better evaluation of the managers, what type of information should Kanye propose that the CFO might accept?arrow_forward

- Rizzo Goal Inc. produces and sells hockey equipment, often custom made for online orders. The company has the following performance metrics on its balanced scorecard: days from ordered to delivered, number of shipping errors, customer retention rate, and market share. A measure map illustrates that the days from ordered to delivered and the number of shipping errors are both expected to directly affect the customer retention rate, which affects market share. Additional internal analysis finds that: Every shipping error over three shipping errors per month reduces the customer retention rate by 1.5%. On average, each day above three days from ordered to delivered yields a reduction in the customer retention rate of 1%. Each day before three days from order to delivery yields an increase in the customer retention rate of 1%, on average. Rizzo Goal Inc.s current customer retention rate is 60%. The company estimates that for every 1% increase or decrease in the customer retention rate, market share changes 0.5% in the same direction. Rizzo Goal Inc.s current market share is 21.4%. Ignoring any other factors, if the company has six shipping errors this month and an average of 3.5 days from ordered to delivered, determine (a) the new customer retention rate and (b) the new market share that Rizzo Goal Inc. expects to have.arrow_forwardCoulson and Company is a large retail business that has a firm-wide balanced scorecard. Recently, management has discussed the need for the balanced scorecard to be more relevant to each individual department of the company. Specifically, management wants to come up with unique scorecards for its Public Relations and Inventory Management departments. For both departments, management recognizes that properly and efficiently training employees is important. For these purposes, management gathers data on the median training hours per employee and new employee performance review ratings. For the Inventory Management Department, management is focused on reducing stockouts (running out of certain inventory items) and keeping accurate inventory counts. For these purposes, the company tracks the number of back orders and discrepancies between the physical and record counts of inventory, respectively. For the Public Relations Department, management is focused on improving the publics CSR image of the company and attracting new customers. Management measures these objectives using Forbes CSR Rating of Coulson and Company and the number of new customers, respectively. a. Identify the term for Coulson and Companys plan to create unique balanced scorecards for its individual departments. b. Draw the unique balanced scorecards of each department. Identify the departments common and unique measures, and include all the elements of the balanced scorecard that you can in your drawings, given the information provided.arrow_forwardGrate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of ROI performance. Only those managers who produce the best ROIs are selected to receive bonuses and to fill higher-level managerial positions. Fred Olsen, manager of the Hair Products Division, has always been one of the top performers. For the past two years, Freds division has produced the largest ROI; last year, the division earned an operating income of 2.56 million and employed average operating assets valued at 16 million. Fred is pleased with his divisions performance and has been told that if the division does well this year, he will be in line for a headquarters position. For the coming year, Freds division has been promised new capital totaling 1.5 million. Any of the capital not invested by the division will be invested to earn the companys required rate of return (9 percent). After some careful investigation, the marketing and engineering staff recommended that the division invest in equipment that could be used to produce a crimping and waving iron, a product currently not produced by the division. The cost of the equipment was estimated at 1.2 million. The divisions marketing manager estimated operating earnings from the new line to be 156,000 per year. After receiving the proposal and reviewing the potential effects, Fred turned it down. He then wrote a memo to corporate headquarters, indicating that his division would not be able to employ the capital in any new projects within the next eight to 10 months. He did note, however, that he was confident that his marketing and engineering staff would have a project ready by the end of the year. At that time, he would like to have access to the capital. Required: 1. Explain why Fred Olsen turned down the proposal to add the capability of producing a crimping and waving iron. Provide computations to support your reasoning. 2. Compute the effect that the new product line would have on the profitability of the firm as a whole. Should the division have produced the crimping and waving iron? 3. Suppose that the firm used residual income as a measure of divisional performance. Do you think Freds decision might have been different? Why? 4. Explain why a firm like Grate Care might decide to use both residual income and return on investment as measures of performance. 5. Did Fred display ethical behavior when he turned down the investment? In discussing this issue, consider why he refused to allow the investment.arrow_forward

- At the end of 20x1, Mejorar Company implemented a low-cost strategy to improve its competitive position. Its objective was to become the low-cost producer in its industry. A Balanced Scorecard was developed to guide the company toward this objective. To lower costs, Mejorar undertook a number of improvement activities such as JIT production, total quality management, and activity-based management. Now, after two years of operation, the president of Mejorar wants some assessment of the achievements. To help provide this assessment, the following information on one product has been gathered: Required: 1. Compute the following measures for 20x1 and 20x3: a. Actual velocity and cycle time b. Percentage of total revenue from new customers (assume one unit per customer) c. Percentage of very satisfied customers (assume each customer purchases one unit) d. Market share e. Percentage change in actual product cost (for 20x3 only) f. Percentage change in days of inventory (for 20x3 only) g. Defective units as a percentage of total units produced h. Total hours of training i. Suggestions per production worker j. Total revenue k. Number of new customers 2. For the measures listed in Requirement 1, list likely strategic objectives, classified according to the four Balance Scorecard perspectives. Assume there is one measure per objective.arrow_forwardMerkley Company, a manufacturer of machine parts, implemented lean manufacturing at the end of 20X1. Three value streams were established: one for new product development and two order fulfillment value streams. One of the value streams set a goal to increase its ROS to 45% of sales by the end of the year. During the year, the value stream made significant improvements in several areas. The Box Scorecard below was prepared, with performance measures for the beginning of the year, midyear, and end of year. Although the members of the value stream were pleased with their progress, they were disappointed in the financial results. They were still far from the targeted ROS of 45%. They were also puzzled as to why the improvements made did not translate into significantly improved financial performance. Required: 1. From the scorecard, what was the focus of the value-stream team for the first 6 months? The second 6 months? What are the implications of these changes? 2. Using information from the scorecard, offer an explanation for why the financial results were not as good as expected.arrow_forwardCommunication The Norse Division of Gridiron Concepts Inc. experienced significant revenue and profit growth from 20Y4 to 20Y6 as shown in the following divisional income statements: There are no support department allocations, and the division operates as an investment center that must maintain a 15% return on invested assets. Determine the profit margin, investment turnover, and return on investment for the Norse Division for 20Y420Y6. Based on your computations, write a brief memo to the president of Gridiron Concepts Inc., Knute Holz, evaluating the divisions performance.arrow_forward

- Faced with headquarters’ desire to add a new product line, Stefan Grenier, manager of Bilti Products’ East Division, felt that he had to see the numbers before he made a move. His division’s ROI has led the company for three years, and he doesn’t want any letdown. Bilti Products is a decentralized wholesaler with four autonomous divisions. The divisions are evaluated on the basis of ROI, with year-end bonuses given to divisional managers who have the highest ROI. Operating results for the company’s East Division for last year are given below: Sales $ 23,800,000 Variable expenses 13,760,000 Contribution margin 10,040,000 Fixed expenses 8,374,000 Operating income $ 1,666,000 Divisional operating assets $ 5,950,000 The company had an overall ROI of 16% last year (considering all divisions). The new product line that headquarters wants Grenier’s East Division to add would require an investment of $3,400,000. The cost and revenue characteristics of…arrow_forwardROI, RI, EVA, and performance evaluation. Cora Manufacturing makes fashion products and competes on the basis of quality and leading-edge designs. The company has two divisions, clothing and cosmetics. Cora has $5,000,000 invested in assets in its clothing division. After-tax operating income from sales of clothing this year is $1,000,000. The cosmetics division has $12,500,000 invested in assets and an after-tax operating income this year of $2,000,000. The weightedaverage cost of capital for Cora is 6%. The CEO of Cora has told the manager of each division that the division that “performs best” this year will get a bonus.arrow_forwardManagerial Accounting: An Overview Ethics and the Manager Richmond, Inc., operates a chain of 44 department stores. Two years ago, the board of directors of Richmond approved a large-scale remodelling of its stores to attract a more upscale clientele. Before finalizing these plans, two stores were remodelled as a test. Linda Perlman, assistant controller, was asked to oversee the financial reporting for these test stores, and she and other management personnel were offered bonuses based on the sales growth and profitability of these stores. While completing the financial reports, Perlman discovered a sizable inventory of outdated goods that should have been discounted for sale or returned to the manufacturer. She discussed the situation with her management colleagues; the consensus was to ignore reporting this inventory as obsolete because reporting it would diminish the financial results and their bonuses. Required: 1. According to the IMA’s Statement of Ethical Professional Practice,…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Introduction to Divisional performance measurement - ACCA Performance Management (PM); Author: OpenTuition;https://www.youtube.com/watch?v=pk8Mzoqr4VA;License: Standard Youtube License