Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

6th Edition

ISBN: 9780134486857

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 24, Problem 21AP

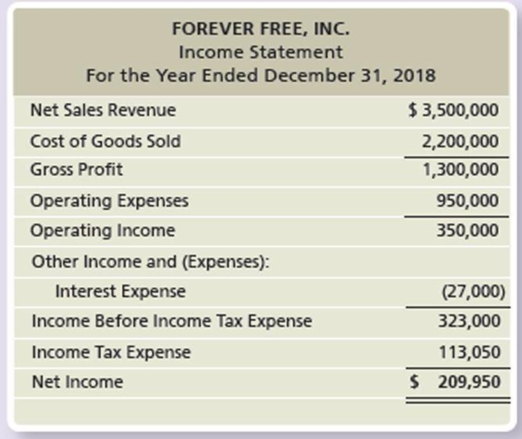

Consider the following condensed financial statements of Forever Free, Inc. The company’s target

Requirements

- 1. Calculate the company’s ROI. Round all of your answers to four decimal places.

- 2. Calculate the company’s profit margin ratio. Interpret your results.

- 3. Calculate the company’s asset turnover ratio. Interpret your results.

- 4. Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results.

- 5. Calculate the company’s RI. Interpret your results.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Suppose you manage a company, which presents the following financial indicators:

Current Ratio: 2

Average Collection Period: 76.3 days

Inventory Turnover: 6.7

Operating Income Return on Investment: 13.2%

Debt Ratio: 32%

The competition has the following results:

Current Ratio: 2

Average Collection Period: 35 days

Inventory Turnover: 6.7

Operating Income Return on Investment:10%

Debt Ratio: 60%

How is the financial situation of your company? Justify your answer.

Using ROI and RI to evaluate investment centers

Consider the following condensed financial statements of Forever Free, Inc. The Company’s target fate of return is 40%

Requirements

Calculate the company’s ROI. Round all of your answers to four decimal places.

Calculate the company’s profit margin ratio. Interpret your results.

Calculate the company’s asset turnover ratio. Interpret your results.

Use the expanded ROI formula to confirm your results from Requirement 1. Interpret your results.

Calculate the company’s RI. Interpret your results.

Ralston Company has operating income of $75,000, invested assets of $360,000, and sales of $790,000.

Use the DuPont formula to compute the return on investment (ROI), and show (a) the profit margin, (b) the investment turnover, and (c) the return on investment. Round the profit margin percentage to two decimal places, the investment turnover to three decimal places, and the return on investment to two decimal places.

Chapter 24 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Ch. 24 - Prob. 1TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 3TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 5TICh. 24 - Fill in the blanks with the phrase that best...Ch. 24 - Prob. 7TICh. 24 - Prob. 8TICh. 24 - Prob. 9TICh. 24 - Prob. 10TI

Ch. 24 - Prob. 11TICh. 24 - Prob. 12TICh. 24 - Prob. 13TICh. 24 - Match the responsibility center to the correct...Ch. 24 - Prob. 15TICh. 24 - Prob. 16TICh. 24 - Prob. 17TICh. 24 - Prob. 18TICh. 24 - Prob. 19TICh. 24 - Prob. 20TICh. 24 - Sheffield Company manufactures power tools. The...Ch. 24 - Prob. 22TICh. 24 - Which is not one of the potential advantages of...Ch. 24 - The Quaker Foods division of PepsiCo is most...Ch. 24 - Which of the following is not a goal of...Ch. 24 - Which of the following balanced scorecard...Ch. 24 - The performance evaluation of a cost center is...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Assume the Residential Division of Kipper Faucets...Ch. 24 - Penn Company has a division that manufactures a...Ch. 24 - Explain the difference between a centralized...Ch. 24 - Prob. 2RQCh. 24 - List the disadvantages of decentralization.Ch. 24 - What is goal congruence?Ch. 24 - Prob. 5RQCh. 24 - What is the purpose of a responsibility accounting...Ch. 24 - Prob. 7RQCh. 24 - Prob. 8RQCh. 24 - Prob. 9RQCh. 24 - What are the goals of a performance evaluation...Ch. 24 - Prob. 11RQCh. 24 - How is the use of a balanced scorecard as a...Ch. 24 - What is a key performance indicator?Ch. 24 - What are the four perspectives of the balanced...Ch. 24 - Explain the difference between a controllable and...Ch. 24 - Prob. 16RQCh. 24 - What are two key performance indicators used to...Ch. 24 - Prob. 18RQCh. 24 - Prob. 19RQCh. 24 - Prob. 20RQCh. 24 - Prob. 21RQCh. 24 - Prob. 22RQCh. 24 - What is the biggest advantage of using RI to...Ch. 24 - What are some limitations of financial performance...Ch. 24 - Prob. 25RQCh. 24 - Prob. 26RQCh. 24 - Prob. 27RQCh. 24 - Prob. 1SECh. 24 - Prob. 2SECh. 24 - Well-designed performance evaluation systems...Ch. 24 - Consider the following key performance indicators,...Ch. 24 - Management by exception is a term often used in...Ch. 24 - Consider the following data, and determine which...Ch. 24 - XTreme Sports Company makes snowboards, downhill...Ch. 24 - Prob. 8SECh. 24 - Using ROI and RI to evaluate investment centers...Ch. 24 - Henderson Company manufactures electronics. The...Ch. 24 - Prob. 11ECh. 24 - Prob. 12ECh. 24 - Well-designed performance evaluation systems...Ch. 24 - Consider the following key performance indicators,...Ch. 24 - One subunit of Harris Sports Company had the...Ch. 24 - The accountant for a subunit of Speed Sports...Ch. 24 - Zims, a national manufacturer of lawn-mowing and...Ch. 24 - Refer to the data in Exercise E24-17. Calculate...Ch. 24 - Prob. 19ECh. 24 - One subunit of Racer Sports Company had the...Ch. 24 - Consider the following condensed financial...Ch. 24 - Prob. 22APCh. 24 - The Harris Company is decentralized, and divisions...Ch. 24 - One subunit of Track Sports Company had the...Ch. 24 - Consider the following condensed financial...Ch. 24 - Prob. 26BPCh. 24 - The Hernandez Company is decentralized, and...Ch. 24 - Prob. 28PCh. 24 - This problem continues the Piedmont Computer...Ch. 24 - The Trolley Toy Company manufactures toy building...Ch. 24 - Dixie Irwin is the department manager for...Ch. 24 - Prob. 1FCCh. 24 - In 150 words or fewer, list each of the four...

Additional Business Textbook Solutions

Find more solutions based on key concepts

Discussion Analysis A13-41 Discussion Questions 1. How do managers use the statement of cash flows? 2. Describ...

Managerial Accounting (5th Edition)

Place the letter of the appropriate accounting cost in Column 2 in the blank next to each decision category in ...

Fundamentals of Cost Accounting

BE1-7 Indicate which statement you would examine to find each of the following items: income statement (IS), ba...

Financial Accounting

Disposal of assets. Answer the following questions. 1. A company has an inventory of 1,300 assorted parts for a...

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (4th Edition)

Interest-bearing notes payable with year-end adjustments P1 Keesha Co. borrows $200,000 cash on November 1, 201...

Financial Accounting: Information for Decisions

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Forchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forwardDuring the current year, Plainfield Manufacturing earned income of $845,000 from total sales of $9,350,000 and average capital assets of $13,500,000. Using the sales margin from the previous exercise, what is the total ROI for the company during the current year?arrow_forwardMargin, Turnover, Return on Investment, Average Operating Assets Elway Company provided the following income statement for the last year: At the beginning of last year, Elway had 28,300,000 in operating assets. At the end of the year, Elway had 23,700,000 in operating assets. Required: 1. Compute average operating assets. 2. Compute the margin and turnover ratios for last year. (Note: Round the answer for margin ratio to two decimal places.) 3. Compute ROI. (Note: Round answer to two decimal places.) 4. CONCEPTUAL CONNECTION Briefly explain the meaning of ROI. 5. CONCEPTUAL CONNECTION Comment on why the ROI for Elway Company is relatively high (as compared to the lower ROI of a typical manufacturing company).arrow_forward

- Suppose you are analyzing a firm that is successfully executing a strategy that differentiates its products from those of its competitors. Because of this strategy, you project that next year the firm will generate 6.0% revenue growth from price increases and 3.0% revenue growth from sales volume increases. Assume that the firms production cost structure involves strictly variable costs. (That is, the cost to produce each unit of product remains the same.) Should you project that the firms gross profit will increase next year? If you project that the gross profit will increase, is the increase a result of volume growth, price growth, or both? Should you project that the firms gross profit margin (gross profit divided by sales) will increase next year? If you project that the gross profit margin will increase, is the increase a result of volume growth, price growth, or both?arrow_forwardJarriot, Inc., presented two years of data for its Furniture Division and its Houseware Division. Required: 1. Compute the ROI and the margin and turnover ratios for each year for the Furniture Division. (Round your answers to four significant digits.) 2. Compute the ROI and the margin and turnover ratios for each year for the Houseware Division. (Round your answers to four significant digits.) 3. Explain the change in ROI from Year 1 to Year 2 for each division.arrow_forwardThe income statement comparison for Rush Delivery Company shows the income statement for the current and prior year. A. Determine the operating income (loss) (dollars) for each year. B. Determine the operating income (percentage) for each year. C. The company made a strategic decision to invest in additional assets in the current year. These amounts are provided. Using the total assets amounts as the investment base, calculate the ROI. Was the decision to invest additional assets in the company successful? Explain. D. Assuming an 8% cost of capital, calculate the RI for each year. Explain how this compares to your findings in part C.arrow_forward

- Alpha Milk Corp is considering taking over their competitor, Dana Dairy Products, and asked your consultancy firm to perform financial statement analysis to assess feasibility of this strategic initiative. You are given the following key financial ratios, the firm’s income statement and the balance sheet. You can assume that there are 365 days in a year. a) Using the information provided for 31 Dec 2005, calculate the following: net working capital, current ratio, quick ratio, inventory turnover, average collection period, total debt ratio, gross profit margin, net profit margin, return on total assets, return on equity. b) Evaluate the company’s performance against industry average ratios and compare with last year’s results. To answer, please refer to pictures attachedarrow_forwardThe Hydride Division of Murdoch Corporation is an investment center. It has $1,000,000 of operating assets. During 2015, the Hydride Division earned operating income of $400,000 on $6,000,000 of sales. Murdoch's companywide return on investment or desired rate of return is approximately 10%. a. What is the ROI? b. What is the margin? c. What is the turnover? d. What is the residual income?arrow_forwardSolano Company has sales of $620,000, cost of goods sold of $430,000, other operating expenses of $51,000, average invested assets of $1,900,000, and a hurdle rate of 10 percent.Required:1. Determine Solano’s return on investment (ROI), investment turnover, profit margin, and residual income.2. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario’s impact on Solano’s ROI and residual income. (Note: Treat each scenario independently.)a. Company sales and cost of goods sold increase by 30 percent.b. Operating expenses decrease by $15,500.c. Operating expenses increase by 10 percent.arrow_forward

- Solano Company has sales of $740,000, cost of goods sold of $490,000, other operating expenses of $46,000, average invested assets of $2,200,000, and a hurdle rate of 10 percent. Required: Determine Solano’s return on investment (ROI), investment turnover, profit margin, and residual income. Several possible changes that Solano could face in the upcoming year follow. Determine each scenario’s impact on Solano’s ROI and residual income. (Note: Treat each scenario independently.) Company sales and cost of goods sold increase by 30 percent. Operating expenses decrease by $10,000. Operating expenses increase by 10 percent. Average invested assets increase by $420,000. Solano changes its hurdle rate to 16 percent.arrow_forwardGabbe Industries is a division of a major corporation. Last year the division had total sales of $27,311,900, net operating income of $2,840,438, and average operating assets of $7,094,000. The company's minimum required rate of return is 15%. Required: a. What is the division's margin? (Round your percentage answer to 2 decimal places.) b. What is the division's turnover? (Round your answer to 2 decimal places.) c. What is the division's return on investment (ROI)? (Round percentage your answer to 2 decimal places.)arrow_forwardReturn on Investment (ROI) Analysis The contribution formal income statement for Huerra Company for last year is given below: The company had average operating assets of $2,000,000 during the year. Required: 1. Compute the company’s return on investment (ROI) for the period using the ROI formula stated in terms of margin and turnover. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (l) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $400,000. (The released funds are used to pay off short-term creditors.) 3. The company achieves a cost savings of $32,000 per year by using less costly materials. 4. The company issues bonds and uses the proceeds to purchase machinery and equipment that…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cost-Volume-Profit (CVP) Analysis and Break-Even Analysis Step-by-Step, by Mike Werner; Author: Accounting Step by Step;https://www.youtube.com/watch?v=D0MOfse9OWk;License: Standard Youtube License