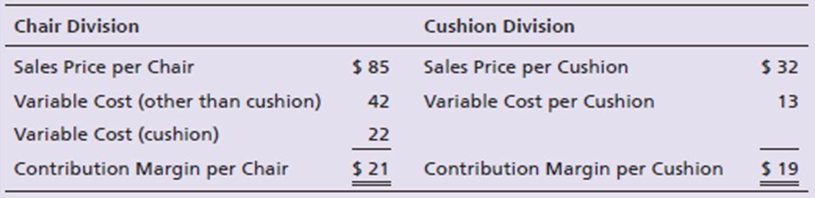

The Harris Company is decentralized, and divisions are considered investment centers. Harris has one division that manufactures oak dining room chairs with upholstered seat cushions. The Chair Division cuts, assembles, and finishes the oak chairs and then purchases and attaches the seat cushions. The Chair Division currently purchases the cushions for $22 from an outside vendor. The Cushion Division manufactures upholstered seat cushions that are sold to customers outside the company. The Chair Division currently sells 800 chairs per quarter, and the Cushion Division is operating at capacity, which is 800 cushions per quarter. The two divisions report the following information:

Requirements

- 1. Determine the total contribution margin for Harris Company for the quarter.

- 2. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current sales price. What is the total contribution margin for each division and the company?

- 3. Assume the Chair Division purchases the 800 cushions needed from the Cushion Division at its current variable cost. What is the total contribution margin for each division and the company?

- 4. Review your answers for Requirements 1, 2, and 3. What is the best option for Harris Company?

- 5. Assume the Cushion Division has capacity of 1,600 cushions per quarter and can continue to supply its outside customers with 800 cushions per quarter and also supply the Chair Division with 800 cushions per quarter. What transfer price should Harris Company set? Explain your reasoning. Using the transfer price you determined, calculate the total contribution margin for the quarter.

Want to see the full answer?

Check out a sample textbook solution

Chapter 24 Solutions

Horngren's Financial & Managerial Accounting, The Managerial Chapters (6th Edition)

Additional Business Textbook Solutions

FINANCIAL ACCT.FUND.(LOOSELEAF)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

Intermediate Accounting

Managerial Accounting: Creating Value in a Dynamic Business Environment

Advanced Financial Accounting

- Grate Care Company specializes in producing products for personal grooming. The company operates six divisions, including the Hair Products Division. Each division is treated as an investment center. Managers are evaluated and rewarded on the basis of ROI performance. Only those managers who produce the best ROIs are selected to receive bonuses and to fill higher-level managerial positions. Fred Olsen, manager of the Hair Products Division, has always been one of the top performers. For the past two years, Freds division has produced the largest ROI; last year, the division earned an operating income of 2.56 million and employed average operating assets valued at 16 million. Fred is pleased with his divisions performance and has been told that if the division does well this year, he will be in line for a headquarters position. For the coming year, Freds division has been promised new capital totaling 1.5 million. Any of the capital not invested by the division will be invested to earn the companys required rate of return (9 percent). After some careful investigation, the marketing and engineering staff recommended that the division invest in equipment that could be used to produce a crimping and waving iron, a product currently not produced by the division. The cost of the equipment was estimated at 1.2 million. The divisions marketing manager estimated operating earnings from the new line to be 156,000 per year. After receiving the proposal and reviewing the potential effects, Fred turned it down. He then wrote a memo to corporate headquarters, indicating that his division would not be able to employ the capital in any new projects within the next eight to 10 months. He did note, however, that he was confident that his marketing and engineering staff would have a project ready by the end of the year. At that time, he would like to have access to the capital. Required: 1. Explain why Fred Olsen turned down the proposal to add the capability of producing a crimping and waving iron. Provide computations to support your reasoning. 2. Compute the effect that the new product line would have on the profitability of the firm as a whole. Should the division have produced the crimping and waving iron? 3. Suppose that the firm used residual income as a measure of divisional performance. Do you think Freds decision might have been different? Why? 4. Explain why a firm like Grate Care might decide to use both residual income and return on investment as measures of performance. 5. Did Fred display ethical behavior when he turned down the investment? In discussing this issue, consider why he refused to allow the investment.arrow_forwardPosavek is a wholesale supplier of building supplies building contractors, hardware stores, and home-improvement centers in the Boston metropolitan area. Over the years, Posavek has expanded its operations to serve customers across the nation and now employs over 200 people as technical representatives, buyers, warehouse workers, and sales and office staff. Most recently, Posavek has experienced fierce competition from the large online discount stores. In addition, the company is suffering from operational inefficiencies related to its archaic information system. Posavek revenue cycle procedures are described in the following paragraphs. Revenue Cycle Posaveks sales department representatives receive orders via traditional mail, e-mail, telephone, and the occasional walk-in customer. Because Posavek is a wholesaler, the vast majority of its business is conducted on a credit basis. The process begins in the sales department, where the sales clerk enters the customers order into the centralized computer sales order system. The computer and file server are housed in Posaveks small data processing department. If the customer has done business with Posavek in the past, his or her data are already on file. If the customer is a first-time buyer, however, the clerk creates a new record in the customer account file. The system then creates a record of the transaction in the open sales order file. When the order is entered, an electronic copy of it is sent to the customers e-mail address as confirmation. A clerk in the warehouse department periodically reviews the open sales order file from a terminal and prints two copies of a stock release document for each new sale, which he uses to pick the items sold from the shelves. The warehouse clerk sends one copy of the stock release to the sales department and the second copy, along with the goods, to the shipping department. The warehouse clerk then updates the inventory subsidiary file to reflect the items and quantities shipped. Upon receipt of the stock release document, the sales clerk accesses the open sales order file from a terminal, closes the sales order, and files the stock release document in the sales department. The sales order system automatically posts these transactions to the sales, inventory control, and cost-of-goods-sold accounts in the general ledger file. Upon receipt of the goods and the stock release, the shipping department clerk prepares the goods for shipment to the customer. The clerk prepares three copies of the bill of lading. Two of these go with the goods to the carrier and the third, along with the stock release document, is filed in the shipping department. The billing department clerk reviews the closed sales orders from a terminal and prepares two copies of the sales invoice. One copy is mailed to the customer, and the other is filed in the billing department. The clerk then creates a new record in the accounts receivable subsidiary file. The sales order system automatically updates the accounts receivable control account in the general ledger file. CASH RECEIPTS PROCEDURES Mail room clerks open customer cash receipts, reviews the check and remittance advices for completeness, and prepares two copies of a remittance list. One copy is sent with the checks to the cash receipts department. The second copy of the remittance advices are sent to the billing department. When the cash receipts clerk receives the checks and remittance list, he verifies the checks received against those on the remittance list and signs the checks For Deposit Only. Once the checks are endorsed, he records the receipts in the cash receipts journal from his terminal. The clerk then fills out a deposit slip and deposits the checks in the bank. Upon receipt of the remittances, the billing department clerk records the amounts in the accounts receivable subsidiary ledger from the department terminal. The system automatically updates the AR control account in the general ledger Posavek has hired your public accounting firm to review its sales order procedures for internal control compliance and to make recommendations for changes. Required a. Create a data flow diagram of the current system. b. Create a system flowchart of the existing system. c. Analyze the physical internal control weaknesses in the system. d. (Optional) Prepare a system flowchart of a redesigned computer-based system that resolves the control weaknesses that you identified. Explain your solution.arrow_forwardMaterials used by the Instrument Division of Ziegler Inc. are currently purchased from outside suppliers at a cost of 1,350 per unit. However, the same materials are available from the Components Division. The Components Division has unused capacity and can produce the materials needed by the Instrument Division at a variable cost of 900 per unit. a. If a transfer price of 1,000 per unit is established and 75,000 units of materials are transferred, with no reduction in the Components Divisions current sales, how much would Ziegler Inc.s total operating income increase? b. How much would the Instrument Divisions operating income increase? c. How much would the Components Divisions operating income increase?arrow_forward

- Mossfort, Inc., has a division in Canada that makes long-lasting exterior wood stain. Mossfort has another U.S. division, the Retail Division, that operates a chain of home improvement stores. The Retail Division would like to buy the unique, long-lasting wood stain from the Canadian division, since this type of stain is not currently available. The Exterior Stain Division incurs manufacturing costs of 13.45 for one gallon of stain. If the Retail Division purchases the stain from the Canadian division, the shipping costs will be 1.40 per gallon, but sales commissions of 0.75 per gallon will be avoided with an internal transfer. The Retail Division plans to sell the stain for 32.80 per gallon. Normally, the Retail Division earns a gross margin of 35 percent above cost of goods sold. Required: 1. Which Section 482 method should be used to calculate the allowable transfer price? 2. Calculate the appropriate transfer price per gallon. (Round to the nearest cent.)arrow_forwardKelson Sporting Equipment, Inc., makes two types of baseball gloves: a regular model and a catchers model. The firm has 900 hours of production time available in its cutting and sewing department, 300 hours available in its finishing department, and 100 hours available in its packaging and shipping department. The production time requirements and the profit contribution per glove are given in the following table: Assuming that the company is interested in maximizing the total profit contribution, answer the following: a. What is the linear programming model for this problem? b. Develop a spreadsheet model and find the optimal solution using Excel Solver. How many of each model should Kelson manufacture? c. What is the total profit contribution Kelson can earn with the optimal production quantities? d. How many hours of production time will be scheduled in each department? e. What is the slack time in each department?arrow_forwardQuincy Farms is a producer of items made from farm products that are distributed to supermarkets. For many years, Quincys products have had strong regional sales on the basis of brand recognition. However, other companies have been marketing similar products in the area, and price competition has become increasingly important. Doug Gilbert, the companys controller, is planning to implement a standard costing system for Quincy and has gathered considerable information from his coworkers on production and direct materials requirements for Quincys products. Doug believes that the use of standard costing will allow Quincy to improve cost control and make better operating decisions. Quincys most popular product is strawberry jam. The jam is produced in 10-gallon batches, and each batch requires six quarts of good strawberries. The fresh strawberries are sorted by hand before entering the production process. Because of imperfections in the strawberries and spoilage, one quart of strawberries is discarded for every four quarts of acceptable berries. Three minutes is the standard direct labor time required for sorting strawberries in order to obtain one quart of strawberries. The acceptable strawberries are then processed with the other ingredients: processing requires 12 minutes of direct labor time per batch. After processing, the jam is packaged in quart containers. Doug has gathered the following information from Joe Adams, Quincys cost accountant, relative to processing the strawberry jam. a. Quincy purchases strawberries at a cost of 0.80 per quart. All other ingredients cost a total of 0.45 per gallon. b. Direct labor is paid at the rate of 9.00 per hour. c. The total cost of direct material and direct labor required to package the jam is 0.38 per quart. Joe has a friend who owns a strawberry farm that has been losing money in recent years. Because of good crops, there has been an oversupply of strawberries, and prices have dropped to 0.50 per quart. Joe has arranged for Quincy to purchase strawberries from his friends farm in hopes that the 0.80 per quart will put his friends farm in the black. Required: 1. Discuss which coworkers Doug probably consulted to set standards. What factors should Doug consider in establishing the standards for direct materials and direct labor? 2. Develop the standard cost sheet for the prime costs of a 10-gallon batch of strawberry jam. 3. Citing the specific standards of the IMA Statement of Ethical Professional Practice described in Chapter 1, explain why Joes behavior regarding the cost information provided to Doug is unethical. (CMA adapted)arrow_forward

- Paul Golding and his wife, Nancy, established Crunchy Chips in 1938. Over the past 60 years, the company has established distribution channels in 11 western states, with production facilities in Utah, New Mexico, and Colorado. In 1980, Pauls son, Edward, took control of the business. By 2017, it was clear that the companys plants needed to gain better control over production costs to stay competitive. Edward hired a consultant to install a standard costing system. To help the consultant establish the necessary standards, Edward sent her the following memo: The manufacturing process for potato chips begins when the potatoes are placed into a large vat in which they are automatically washed. After washing, the potatoes flow directly to an automatic peeler. The peeled potatoes then pass by inspectors, who manually cut out deep eyes or other blemishes. After inspection, the potatoes are automatically sliced and dropped into the cooking oil. The frying process is closely monitored by an employee. After the chips are cooked, they pass under a salting device and then pass by more inspectors, who sort out the unacceptable finished chips (those that are discolored or too small). The chips then continue on the conveyor belt to a bagging machine that bags them in 1-pound bags. After bagging, the bags are placed in a box and shipped. The box holds 15 bags. The raw potato pieces (eyes and blemishes), peelings, and rejected finished chips are sold to animal feed producers for 0.16 per pound. The company uses this revenue to reduce the cost of potatoes. We would like this reflected in the price standard relating to potatoes. Crunchy Chips purchases high-quality potatoes at a cost of 0.245 per pound. Each potato averages 4.25 ounces. Under efficient operating conditions, it takes four potatoes to produce one 16-ounce bag of plain chips. Although we label bags as containing 16 ounces, we actually place 16.3 ounces in each bag. We plan to continue this policy to ensure customer satisfaction. In addition to potatoes, other raw materials are the cooking oil, salt, bags, and boxes. Cooking oil costs 0.04 per ounce, and we use 3.3 ounces of oil per bag of chips. The cost of salt is so small that we add it to overhead. Bags cost 0.11 each and boxes 0.52 each. Our plant produces 8.8 million bags of chips per year. A recent engineering study revealed that we would need the following direct labor hours to produce this quantity if our plant operates at peak efficiency: Im not sure that we can achieve the level of efficiency advocated by the study. In my opinion, the plant is operating efficiently for the level of output indicated if the hours allowed are about 10% higher. The hourly labor rates agreed upon with the union are: Overhead is applied on the basis of direct labor dollars. We have found that variable overhead averages about 116% of our direct labor cost. Our fixed overhead is budgeted at 1,135,216 for the coming year. Required: 1. Discuss the benefits of a standard costing system for Crunchy Chips. 2. Discuss the presidents concern about using the result of the engineering study to set the labor standards. What standard would you recommend? 3. Form a group with two or three other students. Develop a standard cost sheet for Crunchy Chips plain potato chips. Round all computations to four decimal places. 4. Suppose that the level of production was 8.8 million bags of potato chips for the year as planned. If 9.5 million pounds of potatoes were used, compute the materials usage variance for potatoes.arrow_forwardCorazon Manufacturing Company has a purchasing department staffed by five purchasing agents. Each agent is paid 28,000 per year and is able to process 4,000 purchase orders. Last year, 17,800 purchase orders were processed by the five agents. Required: 1. Calculate the activity rate per purchase order. 2. Calculate, in terms of purchase orders, the: a. total activity availability b. unused capacity 3. Calculate the dollar cost of: a. total activity availability b. unused capacity 4. Express total activity availability in terms of activity capacity used and unused capacity. 5. What if one of the purchasing agents agreed to work half time for 14,000? How many purchase orders could be processed by four and a half purchasing agents? What would unused capacity be in purchase orders?arrow_forwardCharlies Wood Works produces wood products (e.g., cabinets, tables, picture frames, and so on). Production departments include Cutting and Assembly. The Janitorial and Security departments support the Cutting and Assembly departments. The Assembly Department spans about 46,400 square feet and holds assets valued at about 60,000. The Cutting Department spans about 33,600 square feet and holds assets valued at about 140,000. Charlies Wood Works allocates support department costs using the direct method. If costs from the Janitorial Department are allocated based on square feet and costs from the Security Department are allocated based on asset value, determine (a) the percentage of Janitorial costs that should be allocated to the Assembly Department and (b) the percentage of Security costs that should be allocated to the Cutting Department.arrow_forward

- Ballantine Corp. produces and sells lead crystal glassware. The firm consists of two divisions, Commercial and Specialty. The Commercial division manufactures 300,000 glasses per year. It incurs variable manufacturing costs of $8 per unit and annual fixed manufacturing costs of $900,000. The Commercial division sells 100,000 units externally at a price of $12 each, mostly to department stores. It transfers the remaining 200,000 units internally to the Specialty division, which modifies the units, adds an etched design, and sells them directly to consumers online. Ballantine Corp. has adopted a market-based transfer-pricing policy. For each glass it receives from the Commercial division, the Specialty division pays the weighted-average external price the Commercial division charges its customers outside the company. The current transfer price is accordingly set at $12. Eileen McCarthy, the manager of the Commercial division, receives an offer from Home Décor, a chain of upscale home…arrow_forwardBallantine Corp. produces and sells lead crystal glassware. The firm consists of two divisions, Commercial and Specialty. The Commercial division manufactures 300,000 glasses per year. It incurs variable manufacturing costs of $8 per unit and annual fixed manufacturing costs of $900,000. The Commercial division sells 100,000 units externally at a price of $12 each, mostly to department stores. It transfers the remaining 200,000 units internally to the Specialty division, which modifies the units, adds an etched design, and sells them directly to consumers online. Ballantine Corp. has adopted a market-based transfer-pricing policy. For each glass it receives from the Commercial division, the Specialty division pays the weighted-average external price the Commercial division charges its customers outside the company. The current transfer price is accordingly set at $12. Eileen McCarthy, the manager of the Commercial division, receives an offer from Home Décor, a chain of upscale home…arrow_forwardSteven oversees the production department for a factory that makes plastic outdoor chairs. department sells all of its production to external parties, and the department has an overall production capacity of 150,000 chairs. Their sales data is as follows: Sales (90,000 chairs) a $460,000, Variable Costs are $206,200, and Fixed Costs are $194,350. The internal Resale would like to purchase 26,700 chairs from the Production Department. They will be selling external retailers for $15.49 per chair. If the Resale Division negotiates a deal with the Pro Department to purchase each chair for its absorption cost plus a 2.4% markup, then what amount of Operating Income the Resale Division would report for their sale of 26,700 cha per unit cost to nearest cents. O $291,831 O $351,105 O $198,235 O $3,612arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning