Foundations of Financial Management

16th Edition

ISBN: 9781259277160

Author: Stanley B. Block, Geoffrey A. Hirt, Bartley Danielsen

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 3, Problem 12P

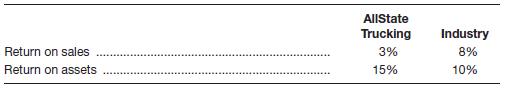

AllState Trucking Co. has the following ratios compared to its industry for last year:

Explain why the return-on-assets ratio is so much more favorable than the return-on-sales ratio compared to the industry. No numbers are necessary; a one- sentence answer is all that is required.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

AllState Trucking Co. has the following ratios compared to its industry for 2007.

AllState Trucking

Industry

Return on sales (i.e. Profit margin)

3%

8%

Return on assets

15%

10%

Please use Du Pont system of analysis to calculate and explain why the return-on-assets ratio is so much more favorable than the return-on-sales ratio compared to the industry.

Pollux Company had the following income statement for last year

Sales-$360,000

Less: Cost of goods sold-$195,000

Gross margin-$165,000

Less: Selling & administration expense-$78,600

Operating income- $86,400

Beginning assets were $565,000 and ending assets were $597, 000.

Carry computations out to three decimals places

A. What are average operating assets?

B. what is margin?

C. what is turnover?

D. What is ROI?

The following information is available to you for the Wooden Company:

2011 2010

Net Income. 53,394 39,510

Net Sales 233,715 182,795

From the information provided, calculate Wooden’s profit margin ratio for each year. Be sure to show your calculations.

2011

2010

Comment on the results, assuming that the industry average for the profit margin ratio is 25% for each of the two years.

Chapter 3 Solutions

Foundations of Financial Management

Ch. 3 - If we divide users of ratios into short-term...Ch. 3 - Explain how the Du Pont system of analysis breaks...Ch. 3 - If the accounts receivable turnover ratio is...Ch. 3 - Prob. 4DQCh. 3 - Is there any validity in rule-of-thumb ratios for...Ch. 3 - Why is trend analysis helpful in analyzing ratios?...Ch. 3 - Inflation can have significant effects on income...Ch. 3 - What effect will disinflation following a highly...Ch. 3 - Why might disinflation prove favorable to...Ch. 3 - Comparisons of income can be very difficult for...

Ch. 3 - Low Carb Diet Supplement Inc. has two divisions....Ch. 3 - Database Systems is considering expansion into a...Ch. 3 - Prob. 3PCh. 3 - Prob. 4PCh. 3 - Prob. 5PCh. 3 - Dr. Zhivà€go Diagnostics Corp.’s income...Ch. 3 - The Haines Corp. shows the following financial...Ch. 3 - Easter Egg and Poultry Company has $2,000,000 in...Ch. 3 - Prob. 9PCh. 3 - Prob. 10PCh. 3 - Baker Oats had an asset turnover of 1.6 times per...Ch. 3 - AllState Trucking Co. has the following ratios...Ch. 3 - Front Beam Lighting Company has the following...Ch. 3 - Prob. 14PCh. 3 - Prob. 15PCh. 3 - Jerry Rice and Grain Stores has $4,780,000 in...Ch. 3 - Prob. 17PCh. 3 - Prob. 18PCh. 3 - Prob. 19PCh. 3 - Prob. 20PCh. 3 - Jim Short’s Company makes clothing for schools....Ch. 3 - The balance sheet for Stud Clothiers is shown...Ch. 3 - The Lancaster Corporation’s income statement is...Ch. 3 - Prob. 24PCh. 3 - Prob. 25PCh. 3 - Prob. 26PCh. 3 - Prob. 27PCh. 3 - Prob. 28PCh. 3 - The Global Products Corporation has three...Ch. 3 - Prob. 30PCh. 3 - Prob. 31PCh. 3 - Prob. 32PCh. 3 - Prob. 33PCh. 3 - Prob. 34PCh. 3 - The following information is from Harrelson...Ch. 3 - Using the financial statements for the Snider...Ch. 3 - Given the financial statements for Jones...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following statements is correct? When cost of goods sold as a percentage of sales increases, the gross profit margin will increase. If the gross profit margin increases from one year to the next, then the net profit margin will also increase from one year to the next. If the gross profit margin is the same for the current and past year, then sales and cost of goods sold in dollars did not change. It is possible that when cost of goods sold in dollars increases, cost of goods sold as a percentage of sales decreases.arrow_forwardOver the past year, Stop-n’-Shop has realized an increase in its current ratio and a drop in itstotal assets turnover ratio. However, the firm’s sales revenues, quick ratio, and fixed assetsturnover ratio have remained constant. What might explain these changes?arrow_forwardConglong Limited is a manufacturing company. Conglong’s accountant has just calculated the ratios for the latest financial year and obtained industry averages for these ratios. However, the accountant is unable to provide any insight into what Conglong Limited’s ratios reveal when compared with the industry averages. The company’s ratios and the ratios for industry averages are detailed below. Ratio Conglong Limited Industry averages RoCE 15% 36% Sales to total capital employed (Asset turnover) 1.5 times 3 times Operating profit margin 10% 12% Gross profit 40% 30% Current ratio 1 time 2 times Quick Acid ratio 0.6 times 1.6 times Inventory days 60 days 15 days Trade receivables days 60 days 30 days Trade payables days 20 days 30 days Interest cover 3 times 5 times Required: Using the ratios above, explain to the directors of Conglong Limited what the ratios reveal about Conglong Limited’s…arrow_forward

- Conglong Limited is a manufacturing company. Conglong’s accountant has just calculated the ratios for the latest financial year and obtained industry averages for these ratios. However, the accountant is unable to provide any insight into what Conglong Limited’s ratios reveal when compared with the industry averages. The company’s ratios and the ratios for industry averages are detailed below. Ratio Conglong Limited Industry averages RoCE 15% 36% Sales to total capital employed (Asset turnover) 1.5 times 3 times Operating profit margin 10% 12% Gross profit 40% 30% Current ratio 1 time 2 times Quick Acid ratio 0.6 times 1.6 times Inventory days 60 days 15 days Trade receivables days 60 days 30 days Trade payables days 20 days 30 days Interest cover 3 times 5 times Required: Identify and explain the nature of five (5) challenges associated with the use of ratio analysis.arrow_forwardCarson Electronics’ management has long viewed BGT Electronics as an industry leader and uses this firm as a model firm for analyzing its own performance. The balance sheet and income statements for the two firms are as follows: Calculate the following ratios for both Carson and BGT: a) Current ratio: b) Times interest earned: c) Inventory turnover:arrow_forwardTwo companies are in the retail sales business, but their performance results are different, which is evidenced by the following data: Financial performance ratio Return on capital employed (ROCE) Return on ordinary share financing (ROSF) 30% Average debt collection period Average debt payment period Gross profit margin Net profit margin Average stock turnover period 20% 63 days 50 days 40% 10% 52 days Comp A Company B 17% 18% 21 days 45 days 15% 10% 25 days Perform the analysis of these data and describe the differences between these two companies. It is known that in one of them the work with consumers is well organised, while the other one is offering competitive prices. Which of these advantages are attributable to each company?arrow_forward

- Which of the following is true regarding the contribution margin ratio of asingle product company? a. As fixed expenses decrease, the contribution margin ratio increases b. The contribution margin ratio increases as the number of units sold increase c. The contribution margin ratio multiplied by the variable expense per unit equals thecontribution margin per unit d. If sales increase, the peso increase in net operating income can be computed bymultiplying the contribution margin ratio by the peso increase in salesarrow_forwardWhich of the following statements is false? a. As business volume increases, fixed cost per unit decreases. b. In the hotel and restaurant business, a sale is the exchange products or services for value. c. Fixed costs change with volume of sales. d. Sales may be expressed in terms of the number of units sold. How much were the sales in November 2022 in Burnaby Hideaway restaurant if the Cost of Sales was $46,500, the Cost of Labor was $33,247, the fixed costs totaled $65,883, and the restaurant experienced loss of $2,129? a. $145,630 b. $143,501 c. $143,501 d. $158,759 Which of the following statements is true? a. Restaurant recipes show food, beverage, labor and other total costs. b. A restaurant income statement shows total food, and if alcoholic beverages are served, total beverage costs and other total costs. c. A restaurant’s income statement includes both, unit and total costs. d. In a restaurant that serves alcoholic beverages, total costs are only the costs of…arrow_forwardOver the past year, M.D. Ryngaert & Co. has realized an increase in its current ration and a drop in its total assets turnover ratio. However, the company’s sales, quick ration, and fixed assets turnover ratio have remained constant. What explains these changes?arrow_forward

- Explain the impact on the financial ratios if the company decided to reduce the cost of goods sold due to a decrease in product demand and restricted access to raw materials. Balance Sheet 2018 2019 Cash $63,000 $201,000 Accounts Receivable 199,000 305,000 Marketable Securities 81,000 42,000 Inventories 441,000 455,000 Prepaids 5,000 9,000 Total Current Assets 789,000 1,012,000 Property, Plant, and Equipment, net 858,000 858,000 Total Assets $1,647,000 $1,870,000 Account Payable $150,000 $100,000 Accruals 101,000 95,000 Total Current Liabilities $251,000 $195,000 Bonds Payable 405,000 575,000 Total Liabilities 656,000 770,000 Common Stocks 700,000 700,000 Retained Earnings 291,000 400,000 Total Stockholders’ Equity 991,000 1,100,000 Total Liabilities &…arrow_forwardSmith Corporation had Sales of $2,350,000 in 2021 and $2,125,000 in 2020. Cost of Good Sold were $1,400,000 in 2021 and $1,325,000 in 2020. a. What was the percentage change in Sales year to year? b. What was the percentage change in Cost of Goods Sold year to year? c. Relative to the percentage in Sales, would you say the percentage change on Cost of Goods Sold was favorable or unfavorable? d. Is this an example of horizontal or vertical analysis?arrow_forwardForchen, Inc., provided the following information for two of its divisions for last year: Required: 1. For the Small Appliances Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 2. For the Cleaning Products Division, calculate: a. Average operating assets b. Margin c. Turnover d. Return on investment (ROI) 3. What if operating income for the Small Appliances Division was 2,000,000? How would that affect average operating assets? Margin? Turnover? ROI? Calculate any changed ratios (round to four significant digits).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License