Concept explainers

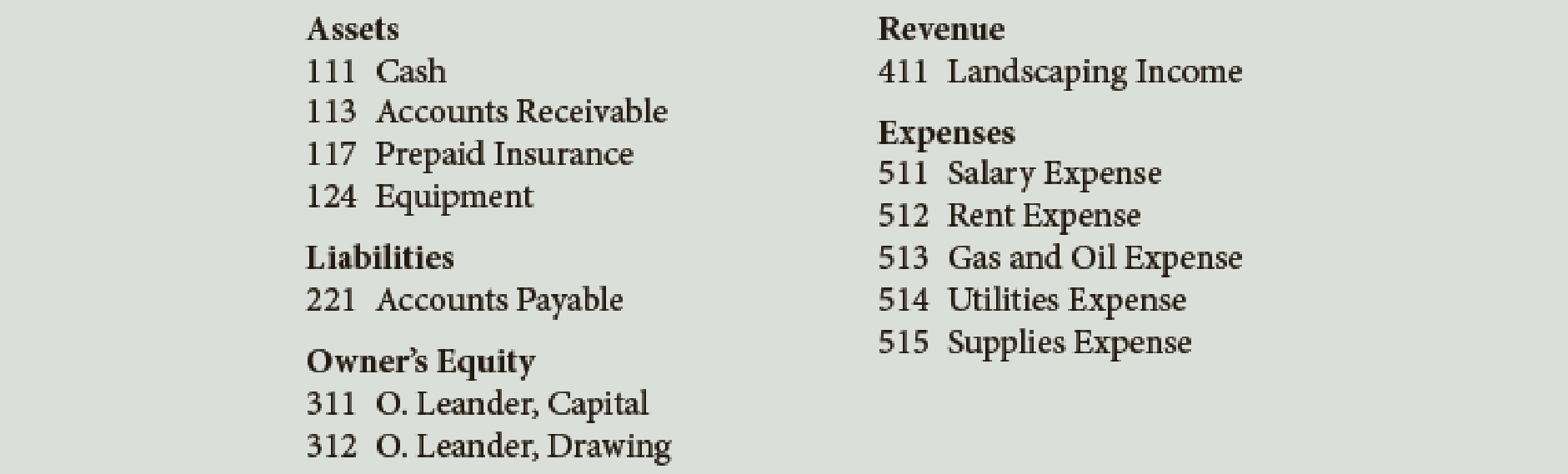

Leander’s Landscaping Service maintains the following chart of accounts:

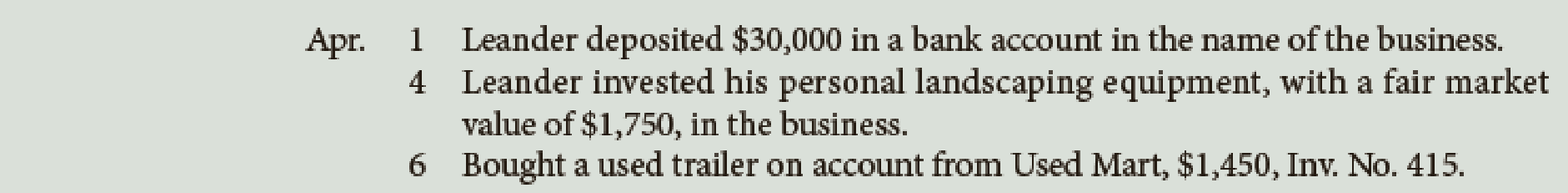

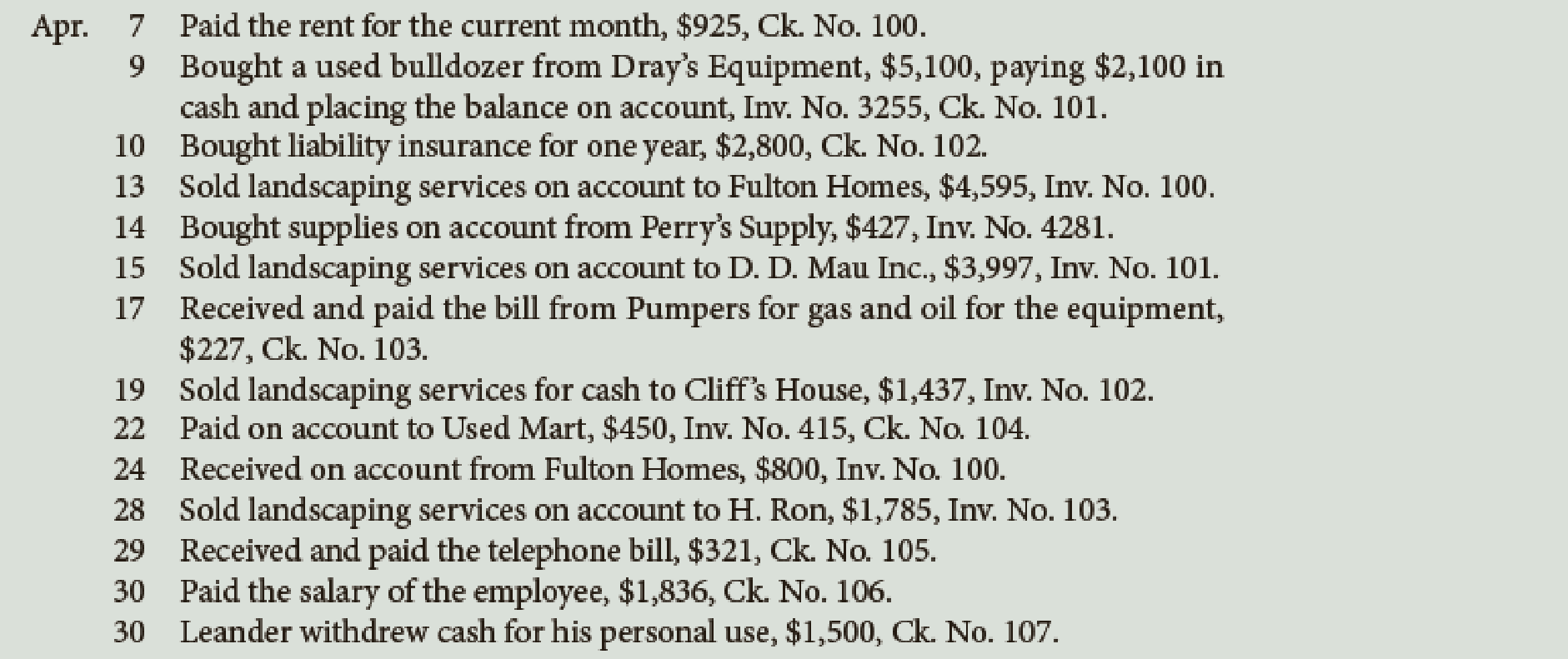

The following transactions were completed by Leander:

Required

- 1. Journalize the transactions in the general journal. Prepare a brief explanation for each entry.

- 2. If you are using working papers, write the name of the owner on the Capital and Drawing accounts.

- 3.

Post the journal entries to the general ledger accounts. (Skip this step if you are using CLGL.) - 4. Prepare a

trial balance dated April 30, 20–.

*If you are using CLGL, use the year 2020 when recording transactions and preparing reports.

1.

Prepare journal entries for the given transactions.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- ■ Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- ■ Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Prepare journal entries for the given transactions.

Transaction on April 1:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 1 | Cash | 111 | 30,000 | ||

| OL, Capital | 311 | 30,000 | ||||

| (Record cash invested in the business by OL) | ||||||

Table (1)

Description:

- ■ Cash is an asset account. Since cash is invested in the business, asset account increased, and an increase in asset is debited.

- ■ OL, Capital is an equity account. Since cash is contributed as capital by the owner, equity value increased, and an increase in equity is credited.

Transaction on April 4:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 4 | Equipment | 124 | 1,750 | ||

| OL, Capital | 311 | 1,750 | ||||

| (Record equipment invested in the business by OL) | ||||||

Table (2)

Description:

- ■ Equipment is an asset account. Since equipment is invested in the business, asset account increased, and an increase in asset is debited.

- ■ JL, Capital is an equity account. Since equipment is contributed as capital by the owner, equity value increased, and an increase in equity is credited.

Transaction on April 6:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 6 | Equipment | 124 | 1,450 | ||

| Accounts Payable | 221 | 1,450 | ||||

| (Record purchase of equipment) | ||||||

Table (3)

Description:

- ■ Equipment is an asset account. Since equipment is bought, asset account increased, and an increase in asset is debited.

- ■ Accounts Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on April 7:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 7 | Rent Expense | 512 | 925 | ||

| Cash | 111 | 925 | ||||

| (Record payment of rent expense) | ||||||

Table (4)

Description:

- ■ Rent Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on April 9:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 9 | Equipment | 124 | 5,100 | ||

| Cash | 111 | 2,100 | ||||

| Accounts Payable | 221 | 3,000 | ||||

| (Record purchase of equipment) | ||||||

Table (5)

Description:

- ■ Equipment is an asset account. Since equipment is bought, asset account increased, and an increase in asset is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

- ■ Accounts Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on April 10:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| April | 10 | Prepaid Insurance | 117 | 2,800 | ||

| Cash | 111 | 2,800 | ||||

| (Record payment of insurance in advance) | ||||||

Table (6)

Description:

- ■ Prepaid Insurance is an asset account. Since insurance is paid in advance, it is recorded as asset until it is consumed. So, asset value is increased, and an increase in asset is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on April 13:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| April | 13 | Accounts Receivable | 113 | 4,595 | ||

| Landscaping Income | 411 | 4,595 | ||||

| (Record services performed on account) | ||||||

Table (7)

Description:

- ■ Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on April 14:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 14 | Supplies | 115 | 427 | ||

| Accounts Payable | 411 | 427 | ||||

| (Record supplies bought on account) | ||||||

Table (8)

Description:

- ■ Supplies is an asset account. Since store supplies are bought, asset account increased, and an increase in asset is debited.

- ■ Accounts Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on April 15:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| April | 15 | Accounts Receivable | 113 | 3,997 | ||

| Landscaping Income | 411 | 3,997 | ||||

| (Record services performed on account) | ||||||

Table (9)

Description:

- ■ Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on April 17:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 17 | Gas and Oil Expense | 513 | 227 | ||

| Cash | 111 | 227 | ||||

| (Record payment of oil and gas expense) | ||||||

Table (10)

Description:

- ■ Gas and Oil Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on April 19:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| April | 19 | Cash | 111 | 1,437 | ||

| Landscaping Income | 411 | 1,437 | ||||

| (Record revenue earned and received) | ||||||

Table (11)

Description:

- ■ Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on April 22:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 22 | Accounts Payable | 221 | 450 | ||

| Cash | 111 | 450 | ||||

| (Record cash paid on account) | ||||||

Table (12)

Description:

- ■ Accounts Payable is a liability account. Since the payable decreased, the liability decreased, and a decrease in liability is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on April 24:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 24 | Cash | 111 | 800 | ||

| Accounts Receivable | 113 | 800 | ||||

| (Record cash received on account) | ||||||

Table (13)

Description:

- ■ Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- ■ Accounts Receivable is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on April 28:

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| April | 28 | Accounts Receivable | 113 | 1,785 | ||

| Landscaping Income | 411 | 1,785 | ||||

| (Record services performed on account) | ||||||

Table (14)

Description:

- ■ Accounts Receivable is an asset account. The amount is increased because amount to be received increased, and an increase in asset is debited.

- ■ Landscaping Income is a revenue account. Since gains and revenues increase equity, and an increase in equity is credited, Landscaping Income account is credited.

Transaction on April 29:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 29 | Utilities Expense | 514 | 321 | ||

| Cash | 111 | 321 | ||||

| (Record payment of utilities expense) | ||||||

Table (15)

Description:

- ■ Utilities Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on April 30:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 30 | Salary Expense | 511 | 1,836 | ||

| Cash | 111 | 1,836 | ||||

| (Record payment of salary expense) | ||||||

Table (16)

Description:

- ■ Salary Expense is an expense account. An increase in expense reduces the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is paid, asset account decreased, and a decrease in asset is credited.

Transaction on April 30:

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 31 | OL, Drawing | 312 | 1,500 | ||

| Cash | 111 | 1,500 | ||||

| (Record cash withdrawn by OL for personal use) | ||||||

Table (17)

Description:

- ■ OL, Drawing is a contra-capital account. The contra-capital accounts decrease the equity value, and a decrease in equity is debited.

- ■ Cash is an asset account. Since cash is withdrawn, asset account decreased, and a decrease in asset is credited.

2.

Indicate the names of owner above the Capital and Drawing accounts.

Explanation of Solution

Owners’ equity: The financial interest of the owners to invest in the business is referred to as owners’ equity or capital. Owners’ equity comprises of capital, drawings, revenues and expenses.

Write the name of owner, OL before the capital and drawings terms and name those accounts as OL, Capital account and OL, Drawing account.

3.

Post the journalized transactions in the ledger accounts.

Explanation of Solution

Ledger: Ledger is a book in which the accounts are summarized and grouped from the transactions recorded in the journal.

Post the journalized transactions in the ledger accounts.

| ACCOUNT Cash ACCOUNT NO. 111 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | 1 | 30,000 | 30,000 | |||

| 7 | 1 | 925 | 29,075 | ||||

| 9 | 1 | 2,100 | 26,975 | ||||

| 10 | 1 | 2,800 | 24,175 | ||||

| 17 | 1 | 227 | 23,948 | ||||

| 19 | 1 | 1,437 | 25,385 | ||||

| 22 | 1 | 450 | 24,935 | ||||

| 24 | 1 | 800 | 25,735 | ||||

| 29 | 1 | 321 | 25,414 | ||||

| 30 | 1 | 1,836 | 23,578 | ||||

| 30 | 1 | 1,500 | 22,078 | ||||

Table (18)

| ACCOUNT Accounts Receivable ACCOUNT NO. 113 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 13 | 1 | 4,595 | 4,595 | |||

| 15 | 1 | 3,997 | 8,592 | ||||

| 24 | 1 | 800 | 7,792 | ||||

| 28 | 1 | 1,785 | 9,577 | ||||

Table (19)

| ACCOUNT Supplies ACCOUNT NO. 115 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 14 | 1 | 427 | 427 | |||

Table (20)

| ACCOUNT Prepaid Insurance ACCOUNT NO. 117 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 10 | 1 | 2,800 | 2,800 | |||

Table (21)

| ACCOUNT Equipment ACCOUNT NO. 124 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 4 | 1 | 1,750 | 1,750 | |||

| 6 | 1 | 1,450 | 3,200 | ||||

| 9 | 1 | 5,100 | 8,300 | ||||

Table (22)

| ACCOUNT Accounts Payable ACCOUNT NO. 221 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 6 | 1 | 1,450 | 1,450 | |||

| 9 | 1 | 3,000 | 4,450 | ||||

| 14 | 1 | 427 | 4,877 | ||||

| 22 | 1 | 450 | 4,427 | ||||

Table (23)

| ACCOUNT OL, Capital ACCOUNT NO. 311 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 1 | 1 | 30,000 | 30,000 | |||

| 4 | 1 | 1,750 | 31,750 | ||||

Table (24)

| ACCOUNT OL, Drawing ACCOUNT NO. 312 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | 1 | 1,500 | 1,500 | |||

Table (25)

| ACCOUNT Landscaping Income ACCOUNT NO. 411 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 13 | 1 | 4,595 | 4,595 | |||

| 15 | 1 | 3,997 | 8,592 | ||||

| 19 | 1 | 1,437 | 10,029 | ||||

| 28 | 1 | 1,785 | 11,814 | ||||

Table (26)

| ACCOUNT Salary Expense ACCOUNT NO. 511 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 30 | 1 | 1,836 | 1,836 | |||

Table (27)

| ACCOUNT Rent Expense ACCOUNT NO. 512 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 7 | 1 | 925 | 925 | |||

Table (28)

| ACCOUNT Gas and Oil Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 17 | 1 | 227 | 227 | |||

Table (29)

| ACCOUNT Utilities Expense ACCOUNT NO. 514 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| April | 29 | 1 | 321 | 321 | |||

Table (30)

4.

Prepare the trial balance for L’s Landscaping Service as at April 301, 20--.

Explanation of Solution

Trial balance: Trial balance is a summary of all the asset, liability, and equity accounts and their balances.

Prepare the trial balance for L’s Landscaping Service as at April 30, 20--.

| L’s Landscaping Service | ||

| Trial Balance | ||

| April 30, 20-- | ||

| Account Title | Debit ($) | Credit ($) |

| Cash | $22,078 | |

| Accounts Receivable | 9,577 | |

| Supplies | 427 | |

| Prepaid Insurance | 2,800 | |

| Equipment | 8,300 | |

| Accounts Payable | $4,427 | |

| JL, Capital | 31,750 | |

| JL, Drawing | 1,500 | |

| Landscaping Income | 11,814 | |

| Salary Expense | 1,836 | |

| Rent Expense | 925 | |

| Gas and Oil Expense | 227 | |

| Miscellaneous Expense | 321 | |

| Total | $47,991 | $47,991 |

Table (31)

Hence, the debit and credit total of trial balance of L’s Landscaping Service at April 30, 20-- is $47,991.

Want to see more full solutions like this?

Chapter 3 Solutions

COLLEGE ACCOUNTING W/ ACCESS >BI<

Additional Business Textbook Solutions

Horngren's Accounting (11th Edition)

Managerial Accounting: Creating Value in a Dynamic Business Environment

Fundamentals Of Cost Accounting (6th Edition)

Intermediate Accounting

Principles Of Taxation For Business And Investment Planning 2020 Edition

Financial Accounting: Tools for Business Decision Making, 8th Edition

- During the first month of operations, Landish Modeling Agency recorded transactions in T account form. Foot and balance the accounts. Then prepare a trial balance, an income statement, a statement of owners equity, and a balance sheet dated March 31, 20--.arrow_forwardElite Realty acts as an agent in buying, selling, renting, and managing real estate. The unadjusted trial balance on March 31, 2016, follows: The following business transactions were completed by Elite Realty during April 2016: Instructions 1. Record the April 1, 2016, balance of each account in the appropriate balance column of a four-column account, write Balance in the item section, and place a check mark () in the Posting Reference column. 2. Journalize the transactions for April in a two-column journal beginning on Page 18. Journal entry explanations may be omitted. 3. Post to the ledger, extending the account balance to the appropriate balance column after each posting. 4. Prepare an unadjusted trial balance of the ledger as of April 30, 2016. 5. Assume that the April 30 transaction for salaries and commissions should have been 19,100. (a) Why did the unadjusted trial balance in (4) balance? (b) Journalize the correcting entry. (c) Is this error a transposition or slide?arrow_forwardOn October 1, 2016, Jay Pryor established an interior decorating business, Pioneer Designs. During the month, Jay completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Journal entry explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Pioneer Designs as of October 31, 2016. 4. Determine the excess of revenues over expenses for October. 5. Can you think of any reason why the amount determined in (4) might not be the net income for October?arrow_forward

- Eddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forwardThe partial work sheet for Emil Consulting for June is as follows: Required If you are using Working Papers, complete the following: 1. a.Write the owners name on the Capital and Drawing T accounts. b.Record the account balances in the T accounts for owners equity, revenue, and expenses. 2. Journalize the closing entries using the four steps in correct order. Number the closing entries 1 through 4. 3. Post the closing entries to the T accounts immediately after you journalize each one to see the effect of the closing entries. Number closing entries 1 through 4. Check Figure Debit to Income Summary, second entry, 4,930arrow_forwardOn November 1, 2016, Patty Cosgrove established an interior decorating business, Classic Designs. During the month, Patty completed the following transactions related to the business: Instructions 1. Journalize each transaction in a two-column journal beginning on Page 1, referring to the following chart of accounts in selecting the accounts to be debited and credited. (Do not insert the account numbers in the journal at this time.) Explanations may be omitted. 2. Post the journal to a ledger of four-column accounts, inserting appropriate posting references as each item is posted. Extend the balances to the appropriate balance columns after each transaction is posted. 3. Prepare an unadjusted trial balance for Classic Designs as of November 30, 2016. 4. Determine the excess of revenues over expenses for November. 5. Can you think of any reason why the amount determined in (4) might not be the net income for November?arrow_forward

- Following is the chart of accounts of Sanchez Realty Company: Sanchez completed the following transactions during April (the first month of business): Required 1. Journalize the transactions for April in the general journal. 2. Post the entries to the general ledger accounts. (Skip this step if you are using CLGL.) 3. Prepare a trial balance as of April 30, 20. 4. Prepare an income statement for the month ended April 30, 20. 5. Prepare a statement of owners equity for the month ended April 30, 20. 6. Prepare a balance sheet as of April 30, 20. If you we using CLGL, use the year 2020 when preparing all reports.arrow_forwardYou must complete the following tasks below for the month of April in the Excel workbook provided. Required: Part 1. Prepare a journal entry to record each transaction. You must provide a short explanation for each transaction. Part 2. Setup appropriate T-accounts. All accounts begin with 0 balances. Part 3. Record in the T-accounts the effects of each transaction for Sydney Stables in April, referencing each transaction in the accounts with the transaction letter. Show the ending balances in the T-accounts. Part 4. Prepare a trial balance. Part 5. Prepare a statement of earnings, a statement of shareholders’ equity and a statement of financial position for the month ended April 30, 2020.arrow_forwardFor additional help, see the demonstration problem at the beginning of each chapter in your Working Papers. The completed worksheet for Valerie Insurance Agency as of December 31 is presented in your Working Papers or in CengageNow, along with the general ledger as of December 31 before adjustments. Check Figure Post-closing trial balance total, $10, 170 Required 1. Write the name of the owner, M. Valerie, in the Capital and Drawing accounts. 2. Write the balances from the unadjusted trial balance in the general ledger. 3. Journalize and post the adjusting entries. 4. Journalize and post the closing entries in the correct order. 5. Prepare a post-closing trial balance.arrow_forward

- Hello, I am stuck with this problem. I have included the directions below and what I have done so far is included in the images. The Adjusted Trial Balance columns of a work sheet for Planta Company follow. Complete the work sheet by extending the account balances into the appropriate financial statement columns and by entering the amount of net income for the reporting period.arrow_forward⦁ The following selected transactions were completed by Next Day Delivery Services during October:Indicate the effect of each transaction on the accounting equation by the listing the numbers identifying the transaction (1) through (12), in a vertical column, and inserting at the right of each number of appropriate letter from the following transactions: 1. Purchased supplies for cash, $3,000.2. Paid cash to owner for personal use, $1,500.3. Received cash for providing delivery services, $15,125.4. Paid rent for October, $2,500. 5. Billed customers for delivery services on account, $6,900.6. Received cash from owner as additional investment, $80,000.7. Paid advertising expense, $750.8. Paid creditors on account, $4,500.9. Purchased Office Equipment on account, $95010. Acquiring Land on acc ount by $42,000. ⦁ Increase in the asset, decrease in another asset. ⦁ Increase in an asset, increase in a liability.⦁ Increase in an asset, increase in owner’s equity.⦁ Decrease an asset, decrease…arrow_forwardFollow the steps below to complete the Final of the Lawn Ranger practice set. For this part of the assignment enter the transactions for the Adjusting entries and post the journal entries to the general ledger. Turn in the journal entries, the general ledger and the financial statements (balance sheet, income statement, and statement of owners equity).arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage