Concept explainers

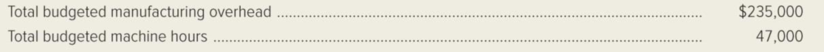

Midnight Sun Apparel Company uses normal costing, and manufacturing

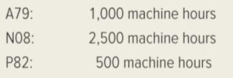

During January, the firm began the following production jobs:

During January, job numbers A79 and N08 were completed, and job number A79 was sold. The actual manufacturing overhead incurred during January was $26,000.

Required:

- 1. Compute the company’s predetermined overhead rate for the current year.

- 2. How much manufacturing overhead was applied to production during January?

- 3. Calculate the over applied or under applied overhead for January.

- 4. Prepare a

journal entry to close the balance calculated in requirement (3) into Cost of Goods Sold. - 5. Prepare a journal entry to prorate the balance calculated in requirement (3) among the Work-in-Process Inventory, Finished-Goods Inventory, and Cost of Goods Sold accounts.

1.

Calculate the predetermined overhead rate for Company MSA for the current year.

Explanation of Solution

Predetermined Overhead Rate: Predetermined overhead rate is a measure used to allocate the estimated manufacturing overhead cost to the products or job orders during a particular period. This is generally evaluated at the beginning of each reporting period. The evaluation takes into account the estimated manufacturing overhead cost and the estimated allocation base that includes direct labor hours, direct labor in dollars, machine hours and direct materials.

Calculate the predetermined overhead rate for Company MSA for the current year.

Thus, the predetermined overhead rate for Company MSA for the current year is $5 per machine hour.

2.

Calculate the amount of manufacturing overhead was applied to production for the month January.

Explanation of Solution

Manufacturing overheads:

Manufacturing overheads refers to the indirect factory- related cost that has occurred while manufacturing a product. Some of the examples of manufacturing overheads are indirect labor, indirect materials, factory building and indirect factory supplies.

Calculate the amount of manufacturing overhead was applied to production for the month January.

Thus, the amount of manufacturing overhead was applied to production for the month January is $20,000.

3.

Compute the overapplied or underapplied overhead for January.

Explanation of Solution

Underapplied overhead:

When there is a debit balance in the manufacturing overhead account during the month end, it indicates that overheads applied to jobs are less than the actual overhead cost incurred by the business. Therefore, the debit balance in the manufacturing overhead account is referred to as underapplied overhead.

Overapplied overhead:

When there is a credit balance in the manufacturing overhead account during the month end, indicates that overheads applied to jobs is more than the actual overhead cost incurred by the business. Therefore, the credit balance in the manufacturing overhead account is referred to as over- applied overhead.

Compute the overapplied or underapplied overhead for January.

During the month January, the overhead is underapplied by $6,000.

4.

Record the journal entry to close the underapplied overhead to cost of goods sold.

Explanation of Solution

Record the journal entry to close the underapplied overhead to cost of goods sold.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Cost of goods sold | 6,000 | ||

| Manufacturing overhead | 6,000 | ||

| (To close the underapplied overhead to cost of goods sold) |

Table (1)

- Cost of goods sold is an expense account and it decreases the value of stockholders’ equity. Thus, debit cost of goods sold with $6,000.

- Manufacturing overhead is credited as the overhead is underapplied. Thus, credit manufacturing overhead with $6,000.

5.

Record the journal entry to prorate the balance among the work-in-process inventory, finished goods inventory, and cost of goods sold account.

Explanation of Solution

- a. Calculate the proration amounts.

| Account | Amount | Percentage (2) | |

| Work in Process | Job P82 only | $ 2,500 | (1) 12.5% |

| Finished Goods | Job N08 only | 12,500 | (2) 2.5% |

| Cost of Goods sold | Job A79 only | 5,000 | (3) 25.00% |

| Total | $ 20,000 | 100.00% |

Table (2)

Note: The amount is calculated by using the following formula.

Working note (1):

Calculate the amount of percentage for work-in-process.

Working note (2):

Calculate the amount of percentage for finished goods.

Working note (3):

Calculate the amount of percentage for cost of goods sold.

| Account | Underapplied overhead | Percentage | Amount added to Account | |

| Work in Process | $ 6,000 | 12.50% | $ 750 | |

| Finished Goods | $6,000 | 62.50% | $3,750 | |

| Cost of Goods Sold | $6,000 | 25.00% | $1,500 | |

| Total | $ 6,000 |

Table (3)

b) Journal entry.

| Date | Account title and explanation | Debit ($) | Credit ($) |

| Work-in-process inventory | 750 | ||

| Finished-goods inventory | 3,750 | ||

| Cost of goods sold | 1,500 | ||

| Manufacturing overhead | 6,000 | ||

| (To close the underapplied overhead to cost of goods sold) |

Table (4)

- Work-in-process inventory is an asset account and it is increased. Thus, it is debited.

- Finished-goods inventory is an asset account and it is increased. Thus, it is debited.

- Cost of goods sold is an expense account and it decreases the stockholders’ equity. Thus it is debited.

- Manufacturing overhead is credited with 6,000.

Want to see more full solutions like this?

Chapter 3 Solutions

Managerial Accounting: Creating Value in a Dynamic Business Environment

- Potomac Automotive Co. manufactures engines that are made only on customers orders and to their specifications. During January, the company worked on Jobs 007, 008, 009, and 010. The following figures summarize the cost records for the month: Jobs 007 and 008 have been completed and delivered to the customer at a total selling price of 426,000, on account. Job 009 is finished but has not yet been delivered. Job 010 is still in process. There were no materials or work in process inventories at the beginning of the month. Material purchases were 115,000, and there were no indirect materials used during the month. Required: 1. Prepare a summary showing the total cost of each job completed during the month or in process at the end of the month. 2. Prepare the summary journal entries for the month to record the distribution of materials, labor, and overhead costs. 3. Determine the cost of the inventories of completed engines and engines in process at the end of the month. 4. Prepare the journal entries to record the completion of the jobs and the sale of the jobs. 5. Prepare a statement of cost of goods manufactured.arrow_forwardThe cost accountant for River Rock Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning February 1 would be 3,150,000, and total direct labor costs would be 1,800,000. During February, the actual direct labor cost totalled 160,000, and factory overhead cost incurred totaled 283,900. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for February. c. What is the February 28 balance of the account Factory OverheadBlending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead?arrow_forwardBaldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forward

- Luna Manufacturing Inc. completed Job 2525 on May 31, and there were no jobs in process in the plant. Prior to June 1, the predetermined overhead application rate for June was computed from the following data, based on an estimate of 5,000 direct labor hours: The factory has one production department and uses the direct labor hour method to apply factory overhead. Three jobs are started during the month, and postings are made daily to the job cost sheets from the materials requisitions and labor-time records. The following schedule shows the jobs and amounts posted to the job cost sheets: The factory overhead control account was debited during the month for actual factory overhead expenses of 27,000. On June 11, Job 2526 was completed and delivered to the customer using a mark-on percentage of 50% on manufacturing cost. On June 24, Job 2527 was completed and transferred to Finished Goods. On June 30, Job 2528 was still in process. Required: 1. Prepare job cost sheets for Jobs 2526, 2527, and 2528, including factory overhead applied when the job was completed or at the end of the month for partially completed jobs. 2. Prepare journal entries as of June 30 for the following: a. Applying factory overhead to production. b. Closing the applied factory overhead account. c. Closing the factory overhead account. d. Transferring the cost of the completed jobs to finished goods. e. Recording the cost of the sale and the sale of Job 2526.arrow_forwardCycle Specialists manufactures goods on a job order basis. During the month of June, three jobs were started in process. (There was no work in process at the beginning of the month.) Jobs Sprinters and Trekkers were completed and sold, on account, during the month (selling prices: Sprinters, 22,000; Trekkers, 27,000); Job Roadsters was still in process at the end of June. The following data came from the job cost sheets for each job. The factory overhead includes a total of 1,200 of indirect materials and 900 of indirect labor. Prepare journal entries to record the following: a. Materials used. b. Factory wages and salaries earned. c. Factory Overhead transferred to Work in Process d. Jobs completed. e. Jobs sold.arrow_forwardThe following information, taken from the books of Herman Brothers Manufacturing represents the operations for January: The job cost system is used, and the February cost sheet for Job M45 shows the following: The following actual information was accumulated during February: Required: 1. Using the January data, ascertain the predetermined factory overhead rates to be used during February, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Prepare a schedule showing the total production cost of Job M45 under each method of applying factory overhead. 3. Prepare the entries to record the following for February operations: a. The liability for total factory overhead. b. Distribution of factory overhead to the departments. c. Application of factory overhead to the work in process in each department, using direct labor hours. (Use the predetermined rate calculated in Requirement 1.) d. Closing of the applied factory overhead accounts. e. Recording under- and overapplied factory overhead and closing the actual factory overhead accounts.arrow_forward

- Channel Products Inc. uses the job order cost system of accounting. The following is a list of the jobs completed during March, showing the charges for materials issued to production and for direct labor. Assume that factory overhead is applied on the basis of direct labor costs and that the predetermined rate is 200%. Required: Compute the amount of overhead to be added to the cost of each job completed during the month. Compute the total cost of each job completed during the month. Compute the total cost of producing all the jobs finished during the month.arrow_forwardLeMans Company produces specialty papers at its Fox Run plant. At the beginning of June, the following information was supplied by its accountant: During June, direct labor cost was 143,000, direct materials purchases were 346,000, and the total overhead cost was 375,800. The inventories at the end of June were: Required: 1. Prepare a cost of goods manufactured statement for June. 2. Prepare a cost of goods sold schedule for June.arrow_forwardDouglas Davis, controller for Marston, Inc., prepared the following budget for manufacturing costs at two different levels of activity for 20X1: During 20X1, Marston worked a total of 80,000 direct labor hours, used 250,000 machine hours, made 32,000 moves, and performed 120 batch inspections. The following actual costs were incurred: Marston applies overhead using rates based on direct labor hours, machine hours, number of moves, and number of batches. The second level of activity (the right column in the preceding table) is the practical level of activity (the available activity for resources acquired in advance of usage) and is used to compute predetermined overhead pool rates. Required: 1. Prepare a performance report for Marstons manufacturing costs in the current year. 2. Assume that one of the products produced by Marston is budgeted to use 10,000 direct labor hours, 15,000 machine hours, and 500 moves and will be produced in five batches. A total of 10,000 units will be produced during the year. Calculate the budgeted unit manufacturing cost. 3. One of Marstons managers said the following: Budgeting at the activity level makes a lot of sense. It really helps us manage costs better. But the previous budget really needs to provide more detailed information. For example, I know that the moving materials activity involves the use of forklifts and operators, and this information is lost when only the total cost of the activity for various levels of output is reported. We have four forklifts, each capable of providing 10,000 moves per year. We lease these forklifts for five years, at 10,000 per year. Furthermore, for our two shifts, we need up to eight operators if we run all four forklifts. Each operator is paid a salary of 30,000 per year. Also, I know that fuel costs about 0.25 per move. Assuming that these are the only three items, expand the detail of the flexible budget for moving materials to reveal the cost of these three resource items for 20,000 moves and 40,000 moves, respectively. Based on these comments, explain how this additional information can help Marston better manage its costs. (Especially consider how activity-based budgeting may provide useful information for non-value-added activities.)arrow_forward

- Flaherty, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows: During the year, the company had the following activity: Actual fixed overhead was 12,000 less than budgeted fixed overhead. Budgeted variable overhead was 5,000 less than the actual variable overhead. The company used an expected actual activity level of 12,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold. Required: 1. Compute the unit cost using (a) absorption costing and (b) variable costing. 2. Prepare an absorption-costing income statement. 3. Prepare a variable-costing income statement. 4. Reconcile the difference between the two income statements.arrow_forwardAAA Appliances Inc. has two production departments. The nature of the process is such that no units remain in process in Finishing at the end of the period. At the beginning of the period, 10,000 units with a cost of 30,000 were transferred from Assembly to Finishing. Finishing incurred costs of 8,800 for materials, 7,200 for labor, and 8,800 for factory overhead, and finished 10,000 units during the month. a. Determine the unit cost for the month in Finishing. b. Determine the unit cost of the products transferred to finished goods.arrow_forwardFoamy Inc. manufactures shaving cream and uses the weighted average cost method. In November, production is 14,800 equivalent units for materials and 13,300 units for labor and overhead. During the month, materials, labor, and overhead costs were as follows: Beginning work in process for November had a cost of 11,360 for materials, 11,666 for labor, and 9,250 for overhead. Compute the following: a. Weighted average cost per unit for materials b. Weighted average cost per unit for labor c. Weighted average cost per unit for overhead d. Total unit cost for the montharrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,