Concept explainers

Unter Components

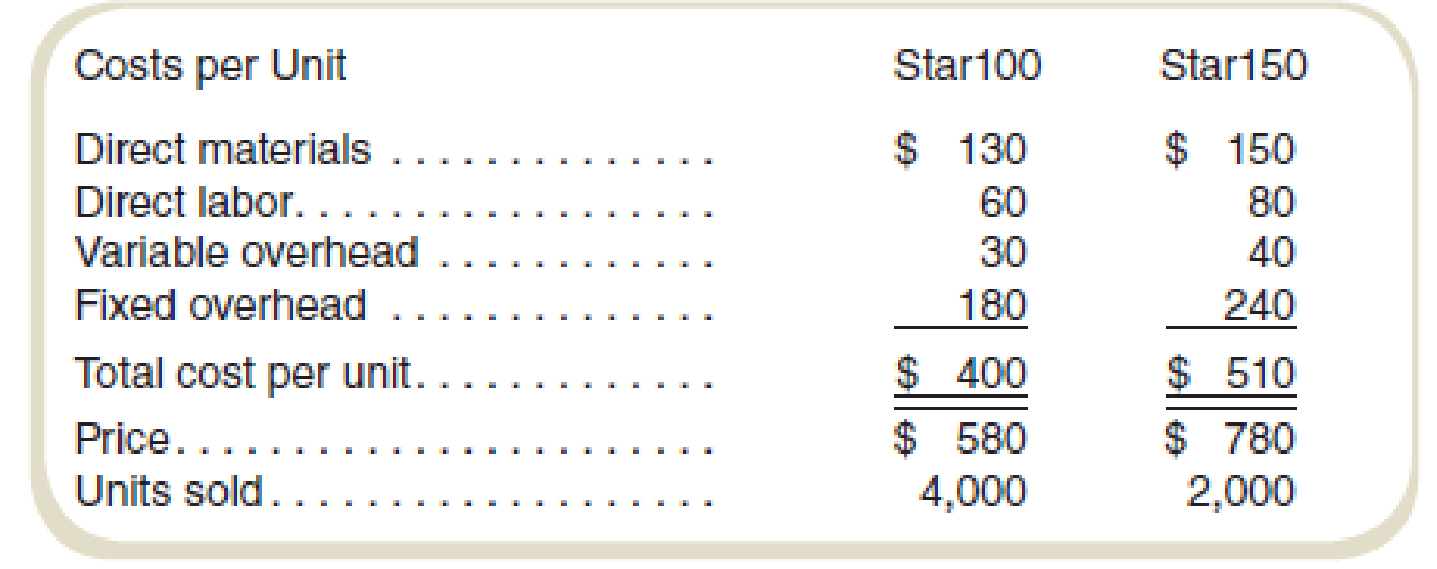

The average wage rate is $40 per hour. Variable overhead varies with the quantity of direct labor-hours. The plant has a capacity of 20,000 direct labor-hours, but current production uses only 10,000 direct labor-hours.

Required

- a. A nationwide car-sharing service has offered to buy 2,500 Star100 systems and 2,500 Star150 systems if the price is lowered to $400 and $500, respectively, per unit. If Unter accepts the offer, how many direct labor-hours will be required to produce the additional systems? How much will the profit increase (or decrease) if Unter accepts this proposal? Prices on regular sales will remain the same.

- b. Suppose that the car-sharing has offered instead to buy 3,500 each of the two models at $400 and $500, respectively. This customer will purchase the 3,500 units of each model only in an all-or-nothing deal. That is, Unter must provide all 3,500 units of each model or none. Unter’s management has decided to fill the entire special order for both models. In view of its capacity constraints, Unter will reduce sales to regular customers as needed to fill the special order. How much will the profits change if the order is accepted? Assume that the company cannot increase its production capacity to meet the extra demand.

- c. Answer the question in requirement (b), assuming instead that the plant can work overtime. Direct labor costs for the overtime production increase to $60 per hour. Variable overhead costs for overtime production are $10 per hour more than for normal production.

a.

Identify, if Company U accepts the offer, how many direct labors will be required to produce the additional systems, and calculate the change in profit in case of company accepts the offer.

Explanation of Solution

Calculate direct labor hours per unit:

| Particulars | Star 100 | Star 150 |

| Labor cost per unit (A) | $60 | $80 |

| Wage rate per labor hour (B) | $40 | $40 |

| Labor hours per unit (A) ÷ (B) | 1.5 hours | 2 hours |

Table (1)

Calculate total direct labor hours required for the additional business.

The current production uses 10,000 direct labor hours and capcity is 20,000 direct labor hours. Thus capacity will not have to expanded to accept the order.

Calculate the change in profit:

| Particulars | Star 100 | Star 150 | Total |

| Units (A) | $2,500 | $2,500 | |

| Sales price (B) | $400 | $500 | |

| Variable costs (C) | $220 | $270 | |

| Differential revenue (A × B) | $1,000,000 | $1,250,000 | $2,250,000 |

| Less: Differential variable cost (A × C) | $550,000 | $675,000 | $1,225,000 |

| Differential Profit | $450,000 | $575,000 | $1,025,000 |

Table (2)

Thus, the differential operating profit is $1,025,000, so Company U should accept the offer.

Working note 1:

Calculate the variable costs:

| Particulars | Star 100 | Star 150 |

| Direct materials | $130 | $150 |

| Add: Direct labor | $60 | $80 |

| Variable overheads | $30 | $40 |

| Total variable costs | $220 | $270 |

Table (3)

b.

Calculate the change in profit in case of acceptance of the offer.

Answer to Problem 53P

The increase in profit is $895,000 if it accepts the offer. So the company should accept the offer.

Explanation of Solution

Calculate total direct labor hours required for the additional business.

The total production time required is 10,000 hours for normal business and 12,250 direct labor hours for the special order, but the direct labor hours capacity is limited to 20,000 hours. In this case, company need to reduce the production of the units sold to the regular customers.

Due to direct labor time is the constraing resource, the companyhaving two alternatives, one is company need to reduce the number of star 100 machines sold to the regular customers, and the second is company need to reduce the number of start 150 machines sold to the regular customers.

Calculate the contribution margin per direct labor hour for each product on the basis of regular customers:

| Particulars | Star 100 | Star 150 |

| Revenue per unit | $580 | $780 |

| Less: Variable cost per unit | $220 | $270 |

| Contribution margin per unit (A) | $360 | $510 |

| Direct labor hours per unit (B) | 1.5 | 2 |

| Contribution margin per hour (A ÷ B) | $240 | $255 |

Table (4)

Star 100 model has the lower contribution margin per hour compared with the star 150 model. The company should reduce the production of this product to sell the special order.

After producing the special order, the company will have 7,750 direct labor hours (20,000 direct labor hours – 12,250 direct labor hours). Company will produce first 2,000 units of srtar 150 model (4,000 direct labor hours = 2,000 units × 2 direct labor hours). The balance direct labor hours ( 3,750 direct labor hours = 7,750 direct labor hours – 4,000 direct labor hours) to produce 2,500 units of the star 100 model.

Calculate the change in operating profit:

Thus, the changes in profit are $895,000, if it accepts the offer. So the company should accept the offer.

Working note 2:

Calculate the contribution margin in case of special order and normal production:

| Particulars | Star 100 | Star 150 | Total |

| Special order: | |||

| Sales price | $400 | $500 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $180 | $230 | |

| Number of units (B) | 3,500 | 3,500 | |

| Total contribution margin ( 1 =A × B) | $630,000 | $805,000 | $1,435,000 |

| Regular production: | |||

| Sales price | $580 | $780 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $360 | $510 | |

| Number of units (B) | 2,500 | 2,000 | |

| Total contribution margin ( 2 =A × B) | $900,000 | $1,020,000 | $1,920,000 |

| Total contribution margin (1 + 2) | $1,530,000 | $1,825,000 | $3,355,000 |

| Less: Fixed Costs | $720,000 | $480,000 | $1,200,000 |

| Net Operating Income (3) | $810,000 | $1,345,000 | $2,155,000 |

Table (5)

Working note 3:

Total contribution margin in case of normal course of business:

| Particulars | Star 100 | Star 150 | Total |

| Regular production: | |||

| Sales price | $580 | $780 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $360 | $510 | |

| Number of units (B) | 4,000 | 2,000 | |

| Total contribution margin ( C =A × B) | $1,440,000 | $1,020,000 | $2,460,000 |

| Less: Fixed costs | $720,000 | $480,000 | $1,200,000 |

| Net operating Income (4) | $720,000 | $540,000 | $1,260,000 |

Table (6)

c.

Calculate the change in profit in case of acceptance of the offer with the given change.

Answer to Problem 53P

The change in profit is $1,367,500 if it accepts the offer. So the company should accept the offer.

Explanation of Solution

Contribution margin:

The excess of sales price over the variable expenses is referred to as the contribution margin. It is computed by deducting the variable expenses from the sales revenue. A contribution margin income statement is prepared in order to record the contribution margin.

Calculate the change in operating profit:

Thus, the change in profit is $1,367,500 if, it accepts the offer. So the company should accept the offer.

Working note 4:

Calculate the contribution margin in case of special order:

| Particulars | Star 100 | Star 150 | Total |

| Special order: | |||

| Sales price | $400 | $500 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $180 | $230 | |

| Number of units (B) | 3,500 | 3,500 | |

| Total contribution margin ( 1 =A × B) | $630,000 | $805,000 | $1,435,000 |

| Regular production: | |||

| Sales price | $580 | $780 | |

| Less: Variable cost | $220 | $270 | |

| Contribution margin per unit (A) | $360 | $510 | |

| Number of units (B) | 4,000 | 2,000 | |

| Total contribution margin ( 2 =A × B) | $1,440,000 | $1,020,000 | $2,460,000 |

| Gross contribution margin (1 + 2) | $2,070,000 | $1,825,000 | $3,895,000 |

| Less: Additional direct labor costs | $45,000 | ||

| Additional variable overhead | $22,500 | ||

| Total contribution margin | $3,827,500 | ||

| Less: Fixed costs | $720,000 | $480,000 | $1,200,000 |

| Net operating Income | $2,627,500 |

Table (7)

Working note 5:

Calculate the additional labor costs:

Calculate the additional variable costs:

Want to see more full solutions like this?

Chapter 4 Solutions

Fundamentals Of Cost Accounting (6th Edition)

- Evans, Inc., has a unit-based costing system. Evanss Miami plant produces 10 different electronic products. The demand for each product is about the same. Although they differ in complexity, each product uses about the same labor time and materials. The plant has used direct labor hours for years to assign overhead to products. To help design engineers understand the assumed cost relationships, the Cost Accounting Department developed the following cost equation. (The equation describes the relationship between total manufacturing costs and direct labor hours; the equation is supported by a coefficient of determination of 60 percent.) Y=5,000,000+30X,whereX=directlaborhours The variable rate of 30 is broken down as follows: Because of competitive pressures, product engineering was given the charge to redesign products to reduce the total cost of manufacturing. Using the above cost relationships, product engineering adopted the strategy of redesigning to reduce direct labor content. As each design was completed, an engineering change order was cut, triggering a series of events such as design approval, vendor selection, bill of materials update, redrawing of schematic, test runs, changes in setup procedures, development of new inspection procedures, and so on. After one year of design changes, the normal volume of direct labor was reduced from 250,000 hours to 200,000 hours, with the same number of products being produced. Although each product differs in its labor content, the redesign efforts reduced the labor content for all products. On average, the labor content per unit of product dropped from 1.25 hours per unit to one hour per unit. Fixed overhead, however, increased from 5,000,000 to 6,600,000 per year. Suppose that a consultant was hired to explain the increase in fixed overhead costs. The consultants study revealed that the 30 per hour rate captured the unit-level variable costs; however, the cost behavior of other activities was quite different. For example, setting up equipment is a step-fixed cost, where each step is 2,000 setup hours, costing 90,000. The study also revealed that the cost of receiving goods is a function of the number of different components. This activity has a variable cost of 2,000 per component type and a fixed cost that follows a step-cost pattern. The step is defined by 20 components with a cost of 50,000 per step. Assume also that the consultant indicated that the design adopted by the engineers increased the demand for setups from 20,000 setup hours to 40,000 setup hours and the number of different components from 100 to 250. The demand for other non-unit-level activities remained unchanged. The consultant also recommended that management take a look at a rejected design for its products. This rejected design increased direct labor content from 250,000 hours to 260,000 hours, decreased the demand for setups from 20,000 hours to 10,000 hours, and decreased the demand for purchasing from 100 component types to 75 component types, while the demand for all other activities remained unchanged. Required: 1. Using normal volume, compute the manufacturing cost per labor hour before the year of design changes. What is the cost per unit of an average product? 2. Using normal volume after the one year of design changes, compute the manufacturing cost per hour. What is the cost per unit of an average product? 3. Before considering the consultants study, what do you think is the most likely explanation for the failure of the design changes to reduce manufacturing costs? Now use the information from the consultants study to explain the increase in the average cost per unit of product. What changes would you suggest to improve Evanss efforts to reduce costs? 4. Explain why the consultant recommended a second look at a rejected design. Provide computational support. What does this tell you about the strategic importance of cost management?arrow_forwardSalley is developing material and labor standards for her company. She finds that it costs $0.55 per pound of material per widget. Each widget requires 6 pounds of material per widget. Salley is also working with the operations manager to determine what the standard labor cost is for a widget. Upon observation, Salley notes that it takes 3 hours in the assembly department and 1 hour in the finishing department to complete one widget. All employees are paid $10.50 per hour. A. What is the standard materials cost per unit for a widget? 8. What is the standard labor cost per unit for a widget?arrow_forwardAdvent Software uses standards to manage the cost of the programming staff. There are two programmer levels, Level 1 and Level 2. Level 1 programmers normally work on the easier projects. Level 1 and Level 2 programmers are paid 25 and 35 per hour, respectively. It has been determined from experience that Level 2 programmers can complete 50 lines of code per hour. If a Level 1 programmer is assigned to a Level 2 task, the programming work will be slower than the Level 2 time standard, but will be accomplished at a lower labor rate. During a recent week, a Level 2 project was assigned to a Level 1 programmer. The programmer worked 40 hours and completed 1,400 lines of code. a. Determine the direct labor time variance for this worker. b. Determine the direct labor rate variance for this worker. c. Using the information in (a) and (b), is it more cost effective to use a Level 1 worker or a Level 2 worker on a Level 2 project?arrow_forward

- Box Springs. Inc., makes two sizes of box springs: queen and king. The direct material for the queen is $35 per unit and $55 is used in direct labor, while the direct material for the king is $55 per unit, and the labor cost is $70 per unit. Box Springs estimates it will make 4,300 queens and 3,000 kings in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardHeller Manufacturing has two production facilities that manufacture baseball gloves. Production costs at the two facilities differ because of varying labor rates, local property taxes, type of equipment, capacity, and so on. The Dayton plant has weekly costs that can be expressed as a function of the number of gloves produced: TCD(X)=X2X+5, where X is the weekly production volume in thousands of units, and TCD(X) is the cost in thousands of dollars. The Hamilton plants weekly production costs are given by: TCH(Y)=Y2+2Y+3, where Y is the weekly production volume in thousands of units, and TCH(Y) is the cost in thousands of dollars. Heller Manufacturing would like to produce 8,000 gloves per week at the lowest possible cost. a. Formulate a mathematical model that can be used to determine the optimal number of gloves to produce each week at each facility. b. Solve the optimization model to determine the optimal number of gloves to produce at each facility.arrow_forwardSilven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Silven produces two models of cell phones with the following expected activity demands: 1. Determine the total overhead assigned to each product using the four activity drivers. 2. Determine the total overhead assigned to each model using the two most expensive activities. The costs of the two relatively inexpensive activities are allocated to the two expensive activities in proportion to their costs. 3. Using ABC as the benchmark, calculate the percentage error and comment on the accuracy of the reduced system. Explain why this approach may be desirable.arrow_forward

- Kelson Sporting Equipment, Inc., makes two types of baseball gloves: a regular model and a catchers model. The firm has 900 hours of production time available in its cutting and sewing department, 300 hours available in its finishing department, and 100 hours available in its packaging and shipping department. The production time requirements and the profit contribution per glove are given in the following table: Assuming that the company is interested in maximizing the total profit contribution, answer the following: a. What is the linear programming model for this problem? b. Develop a spreadsheet model and find the optimal solution using Excel Solver. How many of each model should Kelson manufacture? c. What is the total profit contribution Kelson can earn with the optimal production quantities? d. How many hours of production time will be scheduled in each department? e. What is the slack time in each department?arrow_forwardBox Springs, Inc., makes two sizes of box springs: twin and double. The direct material for the twin is $25 per unit and $40 s used in direct labor, while the direct material for the double is $40 per unit, and the labor cost is $50 per unit. Box Springs estimates it will make 5,000 twins and 9,000 doubles in the next year. It estimates the overhead for each cost pool and cost driver activities as follows: How much does each unit cost to manufacture?arrow_forwardHawkins Manufacturing Company produces connecting rods for 4- and 6-cylindcr automobile engines using the same production line. The cost required to set up the production line to produce the 4-cylinder connecting rods is 2,000, and the cost required to set up the production line for the 6-cylinder connecting rods is 3,500. Manufacturing costs are 15 for each 4-cylinder connecting rod and 18 for each 6-cylinder connecting rod. There is no production on weekends, so on Friday the line is disassembled and cleaned. On Monday, the line must be set up to run whichever product will be produced that week. Once the line has been set up, the weekly production capacities are 6,000 6-cylinder connecting rods and 8,000 4-cylinder connecting rods. Let x4 = the number of 4-cylinder connecting rods produced next week x6 = the number of 6-cylinder connecting rods produced next week s4 = 1 if the production line is set up to produce the 4-cylinder connecting rods; 0 if otherwise s6 = 1 if the production line is set up to produce the 6-cylinder connecting rods; 0 if otherwise a. Using the decision variables x4 and s4, write a constraint that sets next weeks maximum production of the 4-cylinder connecting rods to either 0 or 8,000 units. b. Using the decision variables x6 and s6, write a constraint that sets next weeks maximum production of the 6-cylinder connecting rods to either 0 or 6,000 units. c. Write a constraint that requires that production be set up for exactly one of the two rods. d. Write the cost function to be minimized.arrow_forward

- Vargas, Inc., produces industrial machinery. Vargas has a machining department and a group of direct laborers called machinists. Each machinist is paid 25,000 and can machine up to 500 units per year. Vargas also hires supervisors to develop machine specification plans and to oversee production within the machining department. Given the planning and supervisory work, a supervisor can oversee three machinists, at most. Vargass accounting and production history reveal the following relationships between units produced and the costs of direct labor and supervision (measured on an annual basis): Required: 1. Prepare two graphs: one that illustrates the relationship between direct labor cost and units produced, and one that illustrates the relationship between the cost of supervision and units produced. Let cost be the vertical axis and units produced the horizontal axis. 2. How would you classify each cost? Why? 3. Suppose that the normal range of activity is between 2,400 and 2,450 units and that the exact number of machinists is currently hired to support this level of activity. Further suppose that production for the next year is expected to increase by an additional 400 units. How much will the cost of direct labor increase (and how will this increase be realized)? Cost of supervision?arrow_forwardLarsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardStacks manufactures two different levels of hockey sticks: the Standard and the Slap Shot. The total overhead of $600,000 has traditionally been allocated by direct labor hours, with 400,000 hours for the Standard and 200.000 hours for the Slap Shot. After analyzing and assigning costs to two cost pools, it was determined that machine hours is estimated to have $450.000 of overhead, with 30,000 hours used on the Standard product and 15,000 hours used on the Slap Shot product. It was also estimated that the inspection cost pool would have $150,000 of overhead, with 25,000 hours for the Standard and 5,000 hours for the Slap Shot. What is the overhead rate per product, under traditional and under ABC costing?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning