Concept explainers

1.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Accounts payable control account and subsidiary ledger

Accounts payable account and subsidiary ledger is the ledger which is used to post the creditors transaction in one particular ledger account. It helps the business to locate the error in the creditor ledger balance. After all transactions of creditor accounts are posted, the balances in the accounts payable subsidiary ledger should be totaled, and compare with the balance in the general ledger of accounts payable. If both the balance does not agree, the error has been located and corrected.

Purchase journal

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash payments journal

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

To Prepare: A single column revenue journal and cash receipt journal, and post the accounts in the accounts payable subsidiary ledger.

1.

Explanation of Solution

Purchase journal

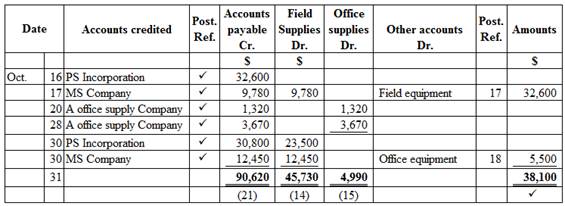

Purchase journal of Company WTE in the month of October 2016 is as follows:

Figure (1)

Cash payment journal

Cash payment journal of Company WTE in the month of October 2016 is as follows:

Cash payment journal

| Date | Check No. | Account debited | Post Ref. | Other accounts Dr. | Accounts payable Dr. | Cash Dr. | |

| Oct. | 16 | 1 | Rent expense | 71 | 7,000 | 7,000 | |

| 18 | 2 | Field supplies | 14 | 4,570 | 4,570 | ||

| Office supplies | 15 | 650 | 650 | ||||

| 24 |

|

✓ | 32,600 | 32,600 | |||

| 26 |

|

✓ | 9,780 | 9,780 | |||

| 28 | Land | 240,000 | 240,000 | ||||

| 30 |

|

✓ | 1,320 | 1,320 | |||

| 31 | Salary expense | 61 | 32,000 | 32,000 | |||

| 31 | 284,220 | 43,700 | 327,920 | ||||

| ✓ | (21) | (11) | |||||

Table (1)

Accounts payable subsidiary ledger

| Name: A Office supply Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| Oct. | 20 | P1 | 1,320 | 1,320 | ||

| 28 | P1 | 3,670 | 4,990 | |||

| 30 | CP1 | 1,320 | 3,670 | |||

Table (2)

| Name: MS Company | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| Oct. | 17 | P1 | 9,780 | 9,780 | ||

| 26 | CP1 | 9,780 | - | |||

| 30 | P1 | 12,450 | 12,450 | |||

Table (3)

| Name: PS Incorporation | ||||||

| Date | Item | Post. Ref | Debit ($) |

Credit ($) | Balance ($) | |

| Oct. | 16 | P1 | 32,600 | 32,600 | ||

| 24 | CP1 | 32,600 | - | |||

| 30 | P1 | 30,800 | 30,800 | |||

Table (4)

2. and 3.

To

2. and 3.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | CP1 | 327,920 | 327,920 | |||

Table (5)

| Account: Field supplies Account no. 14 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 18 | CP1 | 4,570 | 4,570 | |||

| 31 | P1 | 47,530 | 52,100 | ||||

Table (6)

| Account: Office supplies Account no. 15 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 18 | CP1 | 650 | 650 | |||

| 31 | P1 | 4,990 | 5,460 | ||||

Table (7)

| Account: Prepaid rent Account no. 16 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | J1 | 15,000 | 15,000 | |||

Table (8)

| Account: Field equipment Account no. 17 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 16 | P1 | 32,600 | 32,600 | |||

| 31 | J1 | 15,000 | 17,600 | ||||

Table (9)

| Account: Office equipment Account no. 18 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 31 | P1 | 5,500 | 5,500 | ||||

Table (10)

| Account: Land Account no. 19 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 23 | CP1 | 240,000 | 240,000 | |||

Table (11)

| Account: Accounts payable Account no. 21 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | P1 | 90,620 | 90,620 | |||

| 31 | CP1 | 43,700 | 46,920 | ||||

Table (12)

| Account: Salary expense Account no. 61 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 31 | CP1 | 32,000 | 32,000 | |||

Table (13)

| Account: Rent expense Account no. 71 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| Oct. | 16 | CP1 | 7,000 | 7,000 | |||

Table (14)

| Journal Page 01 | |||||

| Date | Description | Post. Ref | Debit ($) | Credit ($) | |

| Oct. | 31 | Prepaid rent | 16 | 15,000 | |

| Field equipment | 17 | 15,000 | |||

| (To record leasing of field equipment) | |||||

Table (15)

4.

To prepare: The accounts payable creditor balances.

4.

Explanation of Solution

Accounts payable creditor balance

Accounts payable creditor balance is as follows:

| Company WTE | |

| Accounts payable creditor balances | |

| October 31, 2016 | |

| Amount ($) | |

| A Office supply Company | 3,670 |

| MS Company | 12,450 |

| PS Incorporation | 30,800 |

| Total accounts receivable | 46,920 |

Table (16)

Accounts payable controlling account

Ending balance of accounts payable controlling account is as follows:

| Company WTE | |

| Accounts payable (Controlling account) | |

| October 31, 2016 | |

| Amount ($) | |

| Opening balance | 0 |

| Add: | |

| Total credits (from purchase journal) | 90,620 |

| 90,620 | |

| Less: | |

| Total debits (from cash payment journal) | (43,700) |

| Total accounts payable | 46,920 |

Table (17)

In this case, accounts payable subsidiary ledger is used to identify, and locate the error by way of cross-checking the creditor balance and accounts payable controlling account. From the above calculation, we can understand that both balances of accounts payable is agree, hence there is no error in the recording and posing of transactions.

5.

To discuss: The reason for using subsidiary ledger for the field equipment.

5.

Explanation of Solution

A subsidiary ledger for the field equipment helps the company to track the cost of each piece of equipment, location, useful life, and other necessary data. This information is used for safeguarding the equipment and determining

Want to see more full solutions like this?

Chapter 5 Solutions

Accounting (Text Only)

- Transactions related to revenue and cash receipts completed by Albany Architects Co. during the period November 230, 2016, are as follows: Instructions 1. Insert the following balances in the general ledger as of November 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of November 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for November. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer balances agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a controlling account as performed in step 5 for Accounts Receivable?arrow_forwardTransactions related to revenue and cash receipts completed by Sterling Engineering Services during the period June 230, 2016, are as follows: Instructions 1. Insert the following balances in the general ledger as of June 1: 2. Insert the following balances in the accounts receivable subsidiary ledger as of June 1: 3. Prepare a single-column revenue journal (p. 40) and a cash receipts journal (p. 36). Use the following column headings for the cash receipts journal: Fees Earned Cr., Accounts Receivable Cr., and Cash Dr. The Fees Earned column is used to record cash fees. Insert a check mark () in the Post. Ref. column when recording cash fees. 4. Using the two special journals and the two-column general journal (p. 1), journalize the transactions for June. Post to the accounts receivable subsidiary ledger, and insert the balances at the points indicated in the narrative of transactions. Determine the balance in the customers account before recording a cash receipt. 5. Total each of the columns of the special journals, and post the individual entries and totals to the general ledger. Insert account balances after the last posting. 6. Determine that the sum of the customer accounts agrees with the accounts receivable controlling account in the general ledger. 7. Why would an automated system omit postings to a control account as performed in step 5 for Accounts Receivable?arrow_forwardThe transactions completed by Franklin Company during January, its first month of operations, are listed below. Assume that Franklin Company uses the following journals: cash payments (CP), purchases (P), and general (G). Assume that it uses accounts receivable and accounts payable subsidiary ledgers as well as a general ledger. Indicate by letters which journal would be used for each transaction and whether or not the entry requires a posting to a subsidiary ledger. Clear All P, subsidiary posting G, no subsidiary posting CP, no subsidiary posting CP, subsidiary posting Purchased supplies on account Purchased a computer for cash Recorded the adjustment for supplies used during the month Paid for the equipment purchased on accountarrow_forward

- Revenue and Cash Receipts Journals Lasting Summer Inc. has $2,360 in the October 1 balance of the accounts receivable account consisting of $1,090 from Champion Co. and $1,270 from Wayfarer Co. Transactions related to revenue and cash receipts completed by Lasting Summer Inc. during the month of October 20Y5 are as follows: Oct. 3. Issued Invoice No. 622 for services provided to Palace Corp., $2,480. 5. Received cash from Champion Co., on account, for $1,090. 8. Issued Invoice No. 623 for services provided to Sunny Style Inc., $4,270. 12. Received cash from Wayfarer Co., on account, for $1,270. 18. Issued Invoice No. 624 for services provided to Amex Services Inc., $3,000. 23. Received cash from Palace Corp. for Invoice No. 622 of October 3. 28. Issued Invoice No. 625 to Wayfarer Co., on account, for $2,530. 30. Received cash from Rogers Co. for services provided, $90. a. Prepare a single-column revenue journal to record these transactions.…arrow_forwardRevenue and Cash Receipts Journals Transactions related to revenue and cash receipts completed by Augusta Inc. during the month of March 20Y8 are as follows: Mar. 2. Issued Invoice No. 512 to Santorini Co., $1,095. 4. Received cash from CMI Inc., on account, for $275. 8. Issued Invoice No. 513 to Gabriel Co., $385. 12. Issued Invoice No. 514 to Yarnell Inc., $965. 19. Received cash from Yarnell Inc., on account, $735. 20. Issued Invoice No. 515 to Electronic Central Inc., $210. 28. Received cash from Marshall Inc. for services provided, $155. 29. Received cash from Santorini Co. for Invoice No. 512 of March 2. 31. Received cash from McCleary Co. for services provided, $90. Prepare a single-column revenue journal and a cash receipts journal to record these transactions. Enter the transactions in chronological order. Question Content Area REVENUE JOURNAL PAGE 8 DATE Invoice No. Account Debited Post. Ref.…arrow_forwardRevenue and Cash Receipts Journals Lasting Summer Inc. has $1,840 in the October 1 balance of the accounts receivable account consisting of $850 from Champion Co. and $990 from Wayfarer Co. Transactions related to revenue and cash receipts completed by Lasting Summer Inc. during the month of October 20Y5 are as follows: Oct. 3. Issued Invoice No. 622 for services provided to Palace Corp., $1,930. 5. Received cash from Champion Co., on account, for $850. 8. Issued Invoice No. 623 for services provided to Sunny Style Inc., $3,330. 12. Received cash from Wayfarer Co., on account, for $990. 18. Issued Invoice No. 624 for services provided to Amex Services Inc., $2,340. 23. Received cash from Palace Corp. for Invoice No. 622 of October 3. 28. Issued Invoice No. 625 to Wayfarer Co., on account, for $1,970. 30. Received cash from Rogers Co. for services provided, $70. a. Prepare a single-column revenue journal to record these transactions. Enter…arrow_forward

- Presented below is information related to Wildhorse Company for its first month of operations. Credit Purchases Cash Paid Jan. 06 Gorst Company $9,800 Jan. 11 Gorst Company $5,600 Jan. 10 Tian Company 12,600 Jan. 16 Tian Company 12,600 Jan. 23 Maddox Company 12,300 Jan. 29 Maddox Company 6,500 Determine the balances that appear in the accounts payable subsidiary ledger. What Accounts Payable balance appears in the general ledger at the end of January? Subsidary Ledger General Ledger Gorst Company Tian Company Maddox Company Balance of Accounts Payable $ $ $ $arrow_forwardThe transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardThe transactions completed by AM Express Company during March 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March 2016, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning