Concept explainers

All journals and general ledger;

The transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows:

Dec. 1. Issued Check No. 610 for December rent, $4,500.

2. Issued Invoice No. 940 to Capps Co., $1,980.

3. Received check for $5,100 from Trimble Co. in payment of account.

5. Purchased a vehicle on account from Boston Transportation, $39,500.

6. Purchased office equipment on account from Austin Computer Co., $4,800.

6. Issued Invoice No. 941 to Dawar Co., $5,680.

9. Issued Check No. 611 for fuel expense, $800.

10. Received check from Sing Co. in payment of $4,850 invoice.

10. Issued Check No. 612 for $360 to Office To Go Inc. in payment of invoice.

10. Issued Invoice No. 942 to Joy Co., $2,140.

11. Issued Check No. 613 for $3,240 to Essential Supply Co. in payment of account.

11. Issued Check No. 614 for $650 to Porter Co. in payment of account.

12. Received check from Capps Co. in payment of $1,980 invoice of December 2.

13. Issued Check No. 615 to Boston Transportation in payment of $39,500 balance of

December 5.

16. Issued Check No. 616 for $40,900 for cash purchase of a vehicle.

16. Cash fees earned for December 1-16, $21,700.

17. Issued Check No. 617 for miscellaneous administrative expense, $600.

18. Purchased maintenance supplies on account from Essential Supply Co., $1,750.

19. Purchased the following on account from McClain Co.: maintenance supplies, $1,500; office supplies, $325.

20. Issued Check No. 618 in payment of advertising expense, $1,990.

20. Used $3,600 maintenance supplies to repair delivery vehicles.

23. Purchased office supplies on account from Office To Go Inc., $440.

24. Issued Invoice No. 943 to Sing Co., $6,400.

24. Issued Check No. 619 to S. Holmes as a personal withdrawal, $3,200.

25. Issued Invoice No. 944 to Dawar Co., $5,720.

25. Received check for $4,100 from Trimble Co. in payment of balance.

26. Issued Check No. 620 to Austin Computer Co. in payment of $4,800 invoice of December 6.

30. Issued Check No. 621 for monthly salaries as follows: driver salaries, $16,900; office salaries, $7,600.

31. Cash fees earned for December 17-31, $19,700.

31. Issued Check No. 622 in payment for office supplies, $310.

Instructions

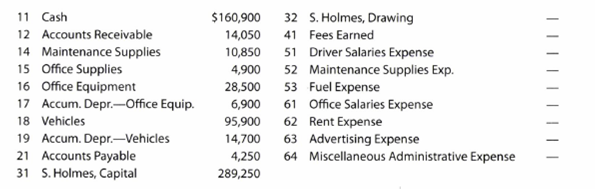

1. Enter the following account balances in the general ledger as of December 1:

2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the

3. Post the appropriate individual entries to the general ledger.

4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances.

5. Prepare a trial balance.

1, 3 and 4.

General Ledger

General ledger refers to the ledger that records all the transactions of the business related to the company’s assets, liabilities, owners’ equities, revenues, and expenses. Each subsidiary ledger is represented in the general ledger by summarizing the account.

Purchase journal:

Purchase journal refers to the journal that is used to record all purchases on account. In the purchase journal, all purchase transactions are recorded only when the business purchased the goods on account. For example, the business purchased cleaning supplies on account.

Cash receipts journal:

Cash receipts journal refers to the journal that is used to record all transaction which involves the cash receipts. For example, the business received cash from rent.

Cash payments journal:

Cash payments journal refers to the journal that is used to record all transaction which involves the cash payments. For example, the business paid cash to employees (salary paid to employees).

Revenue journal:

Revenue journal refers to the journal that is used to record the fees earned on account. In the revenue journal, all revenue transactions are recorded only when the business performed service to customer on account (credit).

To post: The account balances and individual entries to the appropriate general ledger accounts.

Explanation of Solution

Prepare the general ledger for given accounts as follows:

| Account: Cash Account no. 11 | |||||||

| Date | Item | Post. Ref |

Debit ($) | Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 1,60,900 | |||

| 31 | CR31 | 57,430 | 2,18,330 | ||||

| 31 | CP34 | 1,25,350 | 92,980 | ||||

Table (1)

|

Account: Accounts receivable |

Account no. 12 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 14,050 | |||

| 31 | R35 | 21,920 | 35,970 | ||||

| 31 | CR31 | 16,030 | 19,940 | ||||

Table (2)

| Account: Maintenance Supplies | Account no. 14 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 10,850 | |||

| 20 | J1 | 3,600 | 7,250 | ||||

| 31 | P37 | 3,250 | 10,500 | ||||

Table (3)

| Account: Office Supplies | Account no. 15 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 4,900 | |||

| 31 | CP34 | 310 | 5,210 | ||||

| 31 | P37 | 765 | 5,975 | ||||

Table (4)

| Account: Office Equipment | Account no. 16 | ||||||

| Date | Items | Post Ref. |

Debit ($) |

Credit ($) | Balance | ||

Debit ($) |

Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 28,500 | |||

| 6 | P37 | 4,800 | 33,300 | ||||

Table (5)

|

Account: Accumulated Depreciation-Office Equip. | Account no. 17 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 6,900 | |||

Table (6)

| Account: Vehicles | Account no.18 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 95,900 | |||

| 5 | P37 | 39,500 | 1,35,400 | ||||

| 16 | CP34 | 40,900 | 1,76,300 | ||||

Table (7)

|

Account: Accumulated Depreciation -Vehicles | Account no. 19 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 14,700 | |||

Table (8)

| Account: Accounts Payable | Account Number 21 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 4,250 | |||

| 31 | P37 | 48,315 | 52,565 | ||||

| 31 | CP34 | 48,550 | 4,015 | ||||

Table (9)

| Account: S. Holmes, Capital | Account Number 31 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | Balance | ✓ | 2,89,250 | |||

Table (10)

| Account: S. Holmes, Drawing | Account Number 32 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 24 | CP34 | 3,200 | 3,200 | |||

Table (11)

| Account: Fees Earned | Account Number 41 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 16 | CR31 | 21,700 | 21,700 | |||

| 31 | CR31 | 19,700 | 41,400 | ||||

| 31 | R35 | 21,920 | 63,320 | ||||

Table (12)

| Account: Driver Salaries Expense | Account Number 51 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 30 | CP34 | 16,900 | 16,900 | |||

Table (13)

| Account: Maintenance Supplies Exp. | Account Number 52 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 20 | J1 | 3,600 | 3,600 | |||

Table (14)

| Account: Fuel Expense | Account Number 53 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 9 | CP34 | 800 | 800 | |||

Table (15)

| Account: Office Salaries Expense | Account Number 61 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 30 | CP34 | 7,600 | 7,600 | |||

Table (16)

| Account: Rent Expense | Account Number 62 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 1 | CP34 | 4,500 | 4,500 | |||

Table (17)

| Account: Advertising Expense | Account Number 63 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 20 | CP34 | 1,990 | 1,990 | |||

Table (18)

|

Account: Miscellaneous Administrative Expense | Account Number 64 | ||||||

| Date | Items | Post Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 2016 | |||||||

| Dec. | 17 | CP34 | 600 | 600 | |||

Table (19)

2 and 4.

To Prepare: Purchase journal, Cash receipts journal, single column revenue journal, cash payments journal and two column general journal

Explanation of Solution

Purchase journal

Purchase journal of Company RC in the month of December, 2016 is as follows:

Purchase Journal

Page 37

| Date | Account Credited | Post Ref. | Accounts Payable Cr. | Maintenance Supplies Dr. | Office Supplies Dr. | Other Accounts Dr. | Post Ref. | Amount ($) | |

| Dec. | 5 | B Transportation | ✓ | 39,500 | Vehicles | 18 | 39,500 | ||

| 6 | A Computer Co. | ✓ | 4,800 | Office Equipment | 16 | 4,800 | |||

| 18 | E Supply Co. | ✓ | 1,750 | 1,750 | |||||

| 19 | M Co. | ✓ | 1,825 | 1,500 | 325 | ||||

| 23 | O T G Inc. | ✓ | 440 | 440 | |||||

| 31 | 48,315 | 3,250 | 765 | 44,300 | |||||

| (21) | (14) | (15) | ✓ | ||||||

Table (20)

Cash Receipt Journal

Cash receipts journal of Company RC in the month of December, 2016 is as follows:

Cash Receipts Journal

Page 31

| Date | Account Credited | Post Ref. | Other Accounts Cr. | Accounts Receivable Cr. | Cash Dr. | |

| Dec. | 3 | T Co. | ✓ | 5,100 | 5,100 | |

| 10 | S Co. | ✓ | 4,850 | 4,850 | ||

| 12 | C Co. | ✓ | 1,980 | 1,980 | ||

| 16 | Fees Earned | 41 | 21,700 | 21,700 | ||

| 25 | T Co. | ✓ | 4,100 | 4,100 | ||

| 31 | Fees Earned | 41 | 19,700 | 19,700 | ||

| 31 | 41,400 | 16,030 | 57,430 | |||

| ✓ | (12) | (11) | ||||

Table (21)

Revenue Journal

Revenue journal of Company RC in the month of December, 2016 is as follows:

Revenue Journal

Page 35

| Date | Invoice No. | Accounts Debited | Post Ref. | Accounts Receivable Dr. Fees Earned Cr. | |

| Dec. | 2 | 940 | C Co. | ✓ | 1,980 |

| 6 | 941 | D Co. | ✓ | 5,680 | |

| 10 | 942 | J Co. | ✓ | 2,140 | |

| 24 | 943 | S Co. | ✓ | 6,400 | |

| 25 | 944 | D Co. | ✓ | 5,720 | |

| 31 | 21,920 | ||||

| (12)(41) | |||||

Table (22)

Cash Payment Journal

Cash payment journal of Company RC in the month of December is as follows:

Cash payment journal

Page 34

| Date | Ck No. | Account Credited | Post Ref. | Other Accounts Dr. | Accounts Payable Dr. | Cash Cr. | |

| Dec. | 1 | 610 | Rent Expense | 62 | 4,500 | 4,500 | |

| 9 | 611 | Fuel Expense | 53 | 800 | 800 | ||

| 10 | 612 | O T G Inc. | ✓ | 360 | 360 | ||

| 11 | 613 | E Supply Co. | ✓ | 3,240 | 3,240 | ||

| 11 | 614 | Porter Co. | ✓ | 650 | 650 | ||

| 13 | 615 | B Transportation | ✓ | 39,500 | 39,500 | ||

| 16 | 616 | Vehicles | 18 | 40,900 | 40,900 | ||

| 17 | 617 | Misc. Admin. Expense | 64 | 600 | 600 | ||

| 20 | 618 | Advertising Expense | 63 | 1,990 | 1,990 | ||

| 24 | 619 | S. Holmes, Drawing | 32 | 3,200 | 3,200 | ||

| 26 | 620 | A Computer Co. | ✓ | 4,800 | 4,800 | ||

| 30 | 621 | Driver Salaries Exp. | 51 | 16,900 | 16,900 | ||

| Office Salaries Exp. | 61 | 7,600 | 7,600 | ||||

| 31 | 622 | Office Supplies | 15 | 310 | 310 | ||

| 31 | 76,800 | 48,550 | 1,25,350 | ||||

| ✓ | (21) | (11) | |||||

Table (23)

3.

To Prepare: Two column general journal to record individual entry of RC Company.

Explanation of Solution

General journal

General journal of Company RC in the month of December is as follows:

| Journal | Page 1 | ||||

| Date | Description | Post Ref. | Debit ($) |

Credit ($) | |

| 2016 | |||||

| Dec. | 20 | Maintenance Supplies Expenses | 52 | 3,600 | |

| Maintenance Supplies | 14 | 3,600 | |||

| (To record the use of maintenance supplies to repair delivery vehicles) | |||||

Table (24)

5.

To Prepare: Unadjusted Trial balances of RC Company at December 31, 2016.

Explanation of Solution

Unadjusted Trial balances of RC Company at December 31, 2016 is presented below:

| REVERE COURIER COMPANY | |||

| Unadjusted Trial Balance | |||

| December 31, 2016 | |||

| Account No. | Debit Balances ($) |

Credit Balances ($) | |

| Cash | 11 | 92,980 | |

| Accounts Receivable | 12 | 19,940 | |

| Maintenance Supplies | 14 | 10,500 | |

| Office Supplies | 15 | 5,975 | |

| Office Equipment | 16 | 33,300 | |

| Accumulated Depreciation—Office Equipment | 17 | 6,900 | |

| Vehicles | 18 | 1,76,300 | |

| Accumulated Depreciation—Vehicles | 19 | 14,700 | |

| Accounts Payable | 21 | 4,015 | |

| S. Holmes, Capital | 31 | 2,89,250 | |

| S. Holmes, Drawing | 32 | 3,200 | |

| Fees Earned | 41 | 63,320 | |

| Driver Salaries Expense | 51 | 16,900 | |

| Office Salaries Expense | 61 | 7,600 | |

| Maintenance Supplies Expense | 52 | 3,600 | |

| Fuel Expense | 53 | 800 | |

| Rent Expense | 62 | 4,500 | |

| Advertising Expense | 63 | 1,990 | |

| Miscellaneous Administrative Expense | 64 | 600 | |

| 3,78,185 | 3,78,185 | ||

Table (25)

This problem will help us to understand the process of recording of accounting transactions in journal and its further posting into respective ledgers. Additionally, it shows the process of reporting of different ledger balances in unadjusted Trial balance.

Want to see more full solutions like this?

Chapter 5 Solutions

Accounting (Text Only)

- The transactions completed by Revere Courier Company during December 2016, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of December 1: 2. Journalize the transactions for December 2016, using the following journals similar to those illustrated in this chapter: cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), single-column revenue journal (p. 35), cash payments journal (p. 34), and two-column general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals, and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardJournal entries and trial balance On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: a. Rafael Masey transferred cash from a personal bank account to an account to be used for the business in exchange for common stock, 17,500. b. Purchased supplies on account, 2,300. c. Earned sales commissions, receiving cash, 13,300. d. Paid rent on office and equipment for the month, 3,000. e. Paid creditor on account, 1,150. f. Paid dividends, 1,800. g. Paid automobile expenses (including rental charge) for month, 1,500, and miscellaneous expenses, 400. h. Paid office salaries, 2,800. i. Determined that the cost of supplies used was 1,050. Instructions 1. Journalize entries for transactions (a) through (i), using the following account titles: Cash, Supplies, Accounts Payable, Common Stock, Dividends, Sales Commissions, Rent Expense, Office Salaries Expense, Automobile Expense, Supplies Expense, Miscellaneous Expense. Journal entry explanations may be omitted. 2. Prepare T accounts, using the account titles in (1). Post the journal entries to these accounts, placing the appropriate letter to the left of each amount to identify the transactions. Determine the account balances, after all posting is complete. Accounts containing only a single entry do not need a balance. 3. Prepare an unadjusted trial balance as of August 31, 20Y7. 4. Determine the following: a. Amount of total revenue recorded in the ledger. b. Amount of total expenses recorded in the ledger. c. Amount of net income for August. 5. Determine the increase or decrease in retained earnings for August.arrow_forwardThe following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions for January using a sales journal, page 73; a purchases journal, page 56; a cash receipts journal, page 38; a cash payments journal, page 45; and a general journal, page 100. Assume the periodic inventory method is used. 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily those entries involving the Other Accounts columns and the general journal to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Add the columns of the special journals and prove the equality of the debit and credit totals. 6. Post the appropriate totals of the special journals to the general ledger. 7. Prepare a trial balance. 8. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forward

- The following transactions were completed by Hammond Auto Supply during January, which is the first month of this fiscal year. Terms of sale are 2/10, n/30. The balances of the accounts as of January 1 have been recorded in the general ledger in your Working Papers or in CengageNow. Hammond Auto Supply does not track cash sales by customer. Jan. 2Issued Ck. No. 6981 to JSS Management Company for monthly rent, 775. 2J. Hammond, the owner, invested an additional 3,500 in the business. 4Bought merchandise on account from Valencia and Company, invoice no. A691, 2,930; terms 2/10, n/30; dated January 2. 4Received check from Vega Appliance for 980 in payment of 1,000 invoice less discount. 4Sold merchandise on account to L. Paul, invoice no. 6483, 850. 6Received check from Petty, Inc., 637, in payment of 650 invoice less discount. 7Issued Ck. No. 6982, 588, to Fischer and Son, in payment of invoice no. C1272 for 600 less discount. 7Bought supplies on account from Doyle Office Supply, invoice no. 1906B, 108; terms net 30 days. 7Sold merchandise on account to Ellison and Clay, invoice no. 6484, 787. 9Issued credit memo no. 43 to L. Paul, 54, for merchandise returned. 11Cash sales for January 1 through January 10, 4,863.20. 11Issued Ck. No. 6983, 2,871.40, to Valencia and Company, in payment of 2,930 invoice less discount. 14Sold merchandise on account to Vega Appliance, invoice no. 6485, 2,050. Jan. 18Bought merchandise on account from Costa Products, invoice no. 7281D, 4,854; terms 2/10, n/60; dated January 16; FOB shipping point, freight prepaid and added to the invoice, 147 (total 5,001). 21Issued Ck. No. 6984, 194, to M. Miller for miscellaneous expenses not recorded previously. 21Cash sales for January 11 through January 20, 4,591. 23Issued Ck. No. 6985 to Forbes Freight, 96, for freight charges on merchandise purchased on January 4. 23Received credit memo no. 163, 376, from Costa Products for merchandise returned. 29Sold merchandise on account to Bruce Supply, invoice no. 6486, 1,835. 31Cash sales for January 21 through January 31, 4,428. 31Issued Ck. No. 6986, 53, to M. Miller for miscellaneous expenses not recorded previously. 31Recorded payroll entry from the payroll register: total salaries, 6,200; employees federal income tax withheld, 872; FICA Social Security tax withheld, 384.40, FICA Medicare tax withheld, 89.90. 31Recorded the payroll taxes: Social Security tax, 384.40, FICA Medicare tax, 89.90; state unemployment tax, 334.80; federal unemployment tax, 37.20. 31Issued Ck. No. 6987, 4,853.70, for salaries for the month. 31J. Hammond, the owner, withdrew 1,000 for personal use, Ck. No. 6988. Required 1. Record the transactions in the general journal for January. If you are using Working Papers, start with page 1 in the journal. Assume the periodic inventory method is used. The chart of accounts is as follows: 2. Post daily all entries involving customer accounts to the accounts receivable ledger. 3. Post daily all entries involving creditor accounts to the accounts payable ledger. 4. Post daily the general journal entries to the general ledger. Write the owners name in the Capital and Drawing accounts. 5. Prepare a trial balance. 6. Prepare a schedule of accounts receivable and a schedule of accounts payable. Do the totals equal the balances of the related controlling accounts?arrow_forwardThe transactions completed by AM Express Company during March, the first month of the fiscal year, were as follows: Instructions 1. Enter the following account balances in the general ledger as of March 1: 2. Journalize the transactions for March, using the following journals similar to those illustrated in this chapter: single-column revenue journal (p. 35), cash receipts journal (p. 31), purchases journal (p. 37, with columns for Accounts Payable, Maintenance Supplies, Office Supplies, and Other Accounts), cash payments journal (p. 34), and twocolumn general journal (p. 1). Assume that the daily postings to the individual accounts in the accounts payable subsidiary ledger and the accounts receivable subsidiary ledger have been made. 3. Post the appropriate individual entries to the general ledger. 4. Total each of the columns of the special journals and post the appropriate totals to the general ledger; insert the account balances. 5. Prepare a trial balance.arrow_forwardPost the following July transactions to T-accounts for Accounts Receivable, Sales Revenue, and Cash, indicating the ending balance. Assume no beginning balances in these accounts. A. on first day of the month, sold products to customers for cash, $13,660 B. on fifth day of month, sold products to customers on account, $22,100 C. on tenth day of month, collected cash from customer accounts, $18,500arrow_forward

- Prepare journal entries to record the following transactions. Create a T-account for Accounts Payable, post any entries that affect the account, and tally ending balance for the account. Assume an Accounts Payable beginning balance of $5,000. A. February 2, purchased an asset, merchandise inventory, on account, $30,000 B. March 10, paid creditor for part of February purchase, $12,000arrow_forwardPrepare journal entries to record the following transactions that occurred in March: A. on first day of the month, purchased building for cash, $75,000 B. on fourth day of month, purchased inventory, on account, $6,875 C. on eleventh day of month, billed customer for services provided, $8,390 D. on nineteenth day of month, paid current month utility bill, $2,000 E. on last day of month, paid suppliers for previous purchases, $2,850arrow_forwardLavender Company started its business on April 1, 2019. The following are the transactions that happened during the month of April. Prepare the journal entries in the journal on Page 1. A. The owners invested $7,500 from their personal account to the business account. B. Paid rent $600 with check #101. C. Initiated a petty cash fund $250 check #102. D. Received $350 cash for services rendered. E. Purchased office supplies for $125 with check #103. F. Purchased computer equipment $1,500, paid $500 with check #104, and will pay the remainder in 30 days. G. Received $750 cash for services rendered. H. Paid wages $375, check #105. I. Petty cash reimbursement Office Supplies $50, Maintenance Expense $80, Miscellaneous Expense $60. Cash on hand $8. Check #106. J. Increased Petty Cash by $70, check #107.arrow_forward

- Eddie Edwards and Phil Bell own and operate The Second Hand Equipment Shop. The following transactions involving notes and interest were completed during the last three months or 20--: REQUIRED 1. Prepare general journal entries for the transactions. 2. Prepare necessary adjusting entries for the notes outstanding on December 31.arrow_forwardThe trial balance of Jillson Company as of December 31, the end of its current fiscal year, is as follows: Here are the data for the adjustments. ab. Merchandise Inventory at December 31, 54,845.00. c. Store supplies inventory (on hand), 488.50. d. Insurance expired, 680. e. Salaries accrued, 692. f. Depreciation of store equipment, 3,760. Required Complete the work sheet after entering the account names and balances onto the work sheet.arrow_forwardSage Learning Centers was established on July 20, 2016, to provide educational services. The services provided during the remainder of the month are as follows: Instructions 1. Journalize the transactions for July, using a single-column revenue journal and a two-column general journal. Post to the following customer accounts in the accounts receivable ledger, and insert the balance immediately after recording each entry: D. Chase; J. Dunlop; F. Mintz; T. Quinn; K. Tisdale. 2. Post the revenue journal and the general journal to the following accounts in the general ledger, inserting the account balances only after the last postings: 3. a. What is the sum of the balances of the customer accounts in the subsidiary ledger at July 31? b. What is the balance of the accounts receivable controlling account at July 31? 4. Assume Sage Learning Centers began using a computerized accounting system to record the sales transactions on August 1. What are some of the benefits of the computerized system over the manual system?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning