Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 15C

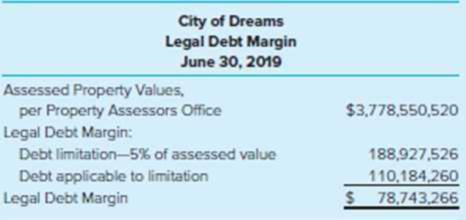

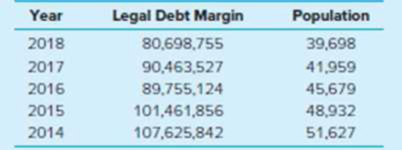

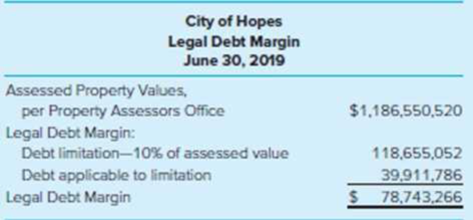

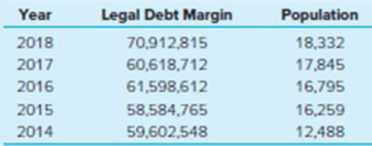

Evaluating Legal Debt Margins. (LO6-2) You’ll be moving to a nearby state after graduation and are focusing on two cities near your new job. After reading this chapter, you decide to look at the debt held by each of the governments. Disclosures of the legal debt margin for each city over the past few years are reproduced below.

Five-year trend information:

Five-year trend information:

Required

Compare the legal debt margin of the two cities. What are your observations regarding the debt position of the two governments?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

A municipality needs funding for upcoming infrastructure (water and sewer line) repair or replacement. They issue a series of $1,000, 7% semiannual, 11-year bonds

. The bonds are initially sold at a discount for $980.

If you buy a bond for $980, plan to sell it immediately following the 16th interest payment, and want to earn 9% compounded semiannually on your money, what must be the selling price?

Carry all interim calculations to 5 decimal places and then round your final answer to 2 decimal places.

The Goodsmith Charitable Foundation, which is tax-exempt, issued debt last year at 10 percent to help finance a new playground facility in Los Angeles. This year the cost of debt is 30 percent higher; that is, firms that paid 12 percent for debt last year will be paying 15.60 percent this year.

If the Goodsmith Charitable Foundation borrowed money this year, what would the aftertax cost of debt be, based on their cost last year and the 30 percent increase? (Do not round intermediate calculations. Input the answer as a percent rounded to 2 decimal places.)

If the receipts of the foundation were found to be taxable by the IRS (at a rate of 35 percent because of involvement in political activities), what would the aftertax cost of debt be? (Do not round intermediate calculations. Input the answer as a percent rounded to 2 decimal places.)

Raffie’s Kids, a nonprofit organization that provides aid to victims of domestic violence, low-income families, and special-needs children, has a 30-year, 5% mortgage on the existing building. The mortgage requires monthly payments of $3,000. Raffie’s bookkeeper is preparing financial statements for the board and, in doing so, lists the mortgage balance of $287,000 under current liabilities because the board hopes to be able to pay the mortgage off in full next year. Of the mortgage principal, $20,000 will be paid next year if Raffie’s pays according to the mortgage agreement. The board members call you, their trusted CPA, to advise them on how Raffie’s Kids should report the mortgage on its balance sheet.

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in risk-free securities to stabilize income. The various revenue-producing investments, together with annual rates of return, are as follows: The credit union will have 2 million available for investment during the coming year. State laws are credit union policies impose the following restrictions on the composition of the loans and investments: Risk-free securities may not exceed 30% of the total funds available for investment. Signature loans may not exceed 10% of the funds invested in all loans (automobile, furniture, other secured, and signature loans). Furniture loans plus other secured loans may not exceed the automobile loans. Other secured loans plus signature loans may not exceed the funds invested in risk-free securities. How should the 2 million be allocated to each of the loan/investment alternatives to maximize total annual return? What is the projected total annual return?arrow_forwardRaffie’s Kids, a nonprofit organization that provides aid to victims of domestic violence, low-income families, and special-needs children, has a 30-year, 5% mortgage on the existing building. The mortgage requires monthly payments of $3,000. Raffie’s bookkeeper is preparing financial statements for the board and, in doing so, lists the mortgage balance of $287,000 under current liabilities because the board hopes to be able to pay the mortgage off in full next year. Of the mortgage principal, $20,000 will be paid next year if Raffie’s pays according to the mortgage agreement. The board members call you, their trusted CPA, to advise them on how Raffie’s Kids should report the mortgage on its balance sheet. 1. What is the ethical issue? 2. What is the reason for your recommendation?arrow_forwardSuppose that you borrow $5500 for your first year and $6500 for your second year (the maximum amounts for a dependent student), as federal direct student loans at a 4.29% interest rate. Suppose that each loan begins on September 1 of its year, that you finish college in four years, that you do not pay the accruing interest in the meantime, and that you begin repayment on December 1 after graduation. What is your total debt on that December 1, and how much of that is interest? The first loan accumulates interest of $5500 ×× 51 ≈ $1002.79, and the second loan accumulates interest of $6500 ××39 = $906.26. Your total debt is $5500 + $1002.79 + $6500 + $906.26 = $13,909.05, including a total of $1909.05 in interest.arrow_forward

- Hello. I need help with the following question please. To calculate the after-tax cost of debt, multiply the before-tax cost of debt by(1 – T) . Omni Consumer Products Company (OCP) can borrow funds at an interest rate of 9.70% for a period of four years. Its marginal federal-plus-state tax rate is 45%. OCP’s after-tax cost of debt is 5.34% (rounded to two decimal places). At the present time, Omni Consumer Products Company (OCP) has 5-year noncallable bonds with a face value of $1,000 that are outstanding. These bonds have a current market price of $1,050.76 per bond, carry a coupon rate of 10%, and distribute annual coupon payments. The company incurs a federal-plus-state tax rate of 45%. If OCP wants to issue new debt, what would be a reasonable estimate for its after-tax cost of debt (rounded to two decimal places)? 3.83% 5.75% 4.79% 4.31%arrow_forwardThe treasurer for the Macon Blue Sox baseball team is seeking a $23,600 loan for one year from the 4th National Bank of Macon. The stated interest rate is 10 percent, and there is a 15 percent compensating balance requirement. The treasurer always keeps a minimum of $2,280 in the baseball team’s checking accounts. These funds count toward meeting any compensating balance requirements. What will be the effective rate of interest on this loan? (Use a 360-day year. Input your answer as a percent rounded to 2 decimal places.)arrow_forwardForever Savings Bank regularly purchases municipal bonds issued by small rural school districts in its region of the state. At the moment, the bank is considering purchasing an $8 million general obligation issue from the York school district, the only bond issue that the district plans this year. The bonds, which mature in 15 years, carry a nominal annual rate of return of 6.75 percent. Forever Savings, which is in the top corporate tax bracket of 35 percent, must pay an average interest rate of 4.25 percent to borrow the funds needed to purchase the municipals. Would you recommend purchasing these bonds? Calculate the net after-tax return on this bank-qualified municipal security? What is the tax advantage for being a qualified bond?arrow_forward

- It is the policy of the corporation to maintain current ratio of 1.5 to 1.0. Its current liabilities are 400,000 and present current ratio is 2 to 1. How much is the maximum level of new short term loans it can secure without violating the policy?arrow_forwardThe employee credit union at State University is planning the allocation of funds for the coming year. The credit union makes four types of loans to its members. In addition, the credit union invests in riskfree securities to stabilize income. The various revenueproducing investments together with annual rates of return are as follows: Type of Loan/Investment Annual Rate of Return (%) Automobile loans 8 Furniture loans 10 Other secured loans 11 Signature loans 12 Riskfree securities 9 The credit union will have $2,000,000 available for investment during the coming year. State laws and credit union policies impose the following restrictions on the composition of the loans and investments.•Riskfree securities may not exceed 30% of the total funds available for investment.•Signature loans may…arrow_forwardSuppose that you borrow $5500 for your first year and $6500 for your second year (the maximum amounts for a dependent student), as federal direct student loans at a 4.29% interest rate. Suppose that each loan begins on September 1 of its year, that you finish college in four years, that you do not pay the accruing interest in the meantime, and that you begin repayment on December 1 after graduation. You also borrow $7500 for each of your third and fourth years, again on September 1, all at a 4.29% interest rate. You finish college in four years, and you begin repayment on December 1 after graduation.What is your total debt then, and how much of that is interest?arrow_forward

- The monument office building has an NOI which is expected to be $137,668 in year 1, $155,936 in year 2. and $169,411 in year 3. Assume an annual mortgage payment equal to 115,421. What is the debt coverage ratioarrow_forwardBetsy, a recent retiree, requires $6,000 per year in extra income. She has $70,000 to invest and can invest in B-rated bonds paying 17% per year or in a certificate of deposit (CD) paying 7% per year. How much money should be invested in each to realize exactly $6,000 in interest per year? ( I didn't know if you could write the step to step process. I find that helpful as I study, thankyou)arrow_forwardIf possible, please solve using Excel and show formulas. You have decided to buy a 3,250 square-feet house in Denton, close to a good public school. The average price in the area is $190 per square feet. The bank will finance 80% of the house value, so you need savings for the 20% down payment. You sign a 20-year 3/1 adjustable rate mortgage (ARM), which carries a 5.2% fixed rate for the first 3 years, and then (after 3 years) is adjusted to the 1-year LIBOR + 0.75 %. Compute your monthly payments in 3 years (month 37) if the LIBOR is 6%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

The Main Types of Mortgages (EXPLAINED); Author: Bankrate;https://www.youtube.com/watch?v=tp284BA6Zxg;License: Standard Youtube License