Term Bond Debt Service Fund Transactions. (LO6-5) On July 1, 2019, the first day of its 2020 fiscal year, the Town of Bear Creek issued at par $2,000,000 of 6 percent term bonds to renovate a historic wing of its main administrative building. The bonds mature in five years on July 1, 2024. Interest is payable semiannually on January 1 and July 1.

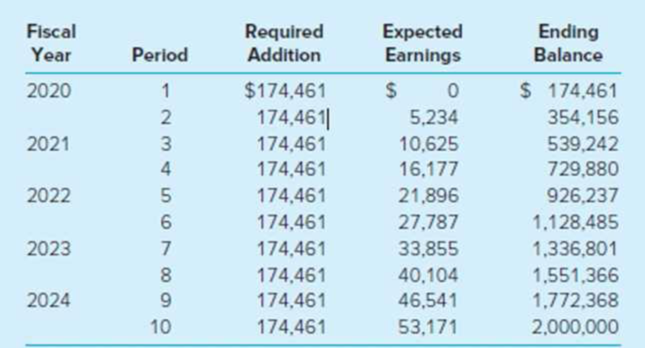

As illustrated in the table below, a sinking fund is to be established with equal semiannual additions made on June 30 and December 31. Cash for the sinking fund additions and the semiannual interest payments will be transferred from the General Fund shortly before the due dates. Investment earnings are added to the investment principal.

Required

Create a term bond debt service fund for the town and prepare

- a. On July 1, 2019, record the budget for the fiscal year ended June 30, 2020. Include all interfund transfers to be received from the General Fund during the year. An appropriation should be provided only for the interest payment due on January 1, 2020.

- b. On December 28, 2019, the General Fund transferred $234,461 to the debt service fund. The addition to the sinking fund was immediately invested in 6 percent certificates of deposit.

- c. On December 28, 2019, the city issued checks to bondholders for the interest payment due on January 1, 2020.

- d. On June 27, 2020, the General Fund transferred $234,461 to the debt service fund. The addition for the sinking fund was invested immediately in 6 percent certificates of deposit.

- e. Actual interest earned on sinking fund investments at year-end (June 30, 2020) was the same as the amount budgeted in the table. This interest adds to the sinking fund balance.

- f. All appropriate closing entries were made at June 30, 2020, for the debt service fund.

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

- On March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.Proceeds from the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.arrow_forwardOn March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.The liability for the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.arrow_forwardRaygun County had outstanding $35 million in Series 1998 general obligation bonds on June 30, 2018. The bonds were issued at an interest rate of 10 percent with interest payable on June 30 and December 31. In July 2018, interest rates declined substantially, and the county issued refunding bonds in the amount of $35 million at 5 percent. The proceeds of the refunding bonds were placed in escrow along with $2,800,000 held in the county’s debt service fund as a sinking fund for the 1998 debt. The proceeds of the refunding bonds and the sinking fund amount would be used in December 2018 (the call date) to purchase the 1998 debt at a 3 percent call premium, totaling $1,050,000, plus accrued interest of $1,750,000. The County had $250,000 of unamortized debt issue costs on the 1998 bonds, which it reported in its government-wide financial statements. This amount combined with the call premium resulted in a $3,050,000 “loss” on the refunding. (a) What journal entries should the county make…arrow_forward

- On March 2, 2018, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2018, to March 31, 2019.During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2018, in which statements should Finch report the construction in progress for the civic center? Capital Projects FundBalance Sheet Government-WideStatement of Net Position a. b. c. d. Yes Yes No No Yes No No Yesarrow_forwardI need the journal entry for these questions As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding. Eliminate the expenditures for bond principal. Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 × 0.03 × 6/12) = $180,000.arrow_forwardThe town of McHenry Has $10,000,000 in general obligation bonds outstanding and maintains a single debt service fund for all debt service transactions. On july 1, 2020, a current refunding took pace in which $10,000,000 in new general obligation bonds were issued. Record the transaction on the books of the debt service fund.arrow_forward

- The City of Bernard starts the year of 2020 with the following unrestricted amounts in its general fund: cash of $42,250 and investments of $82,500. In addition, it holds a small building bought on January 1, 2019, for general government purposes for $318,000 and a related long-term debt of $254,400. The building is depreciated on the straight-line method over 10 years. The annual interest rate on the debt is 10 percent. The general fund has four separate functions: general government, public safety, public works, and health and sanitation. Other information includes the following: Receipts: Property taxes $597,000 Sales taxes 107,800 Dividend income 25,000 Charges for general government services 19,400 Charges for public safety services 12,050 Charges for public works 5,700 Charges for health and sanitation services 40,800 Charges for landfill 9,200 Grant to be used for salaries for health workers (no eligibility requirements) 28,500 Issued long-term…arrow_forwardThe Village of Hawksville issued $4,000,000 in 5 percent general obligations, tax supported bonds on July 1, 2019, at 102. A fiscal agent is not used.Resources for principal and interest payments are to come from the General Fun. Interest pyments dates are December 31 and June 30. The first of 20 annual principal payments is to be made June 30, 2020. Hawksbill has a calander fiscal year. 1. A capital projects fund transferred the premium ( in the amountof $40,000) to the debt service fund. 2. On December 31, 2019 funds in the amount of $100,000 were received from the General Fund and the first interest payment was made. 3. The books were closed for 2019. 4. On June30,2020 funds in the amount of $220,000 were received from the General Fund, and the second interest payment ($100,00) was madealong with the first pricipal payment ($200,000) 5. On December 31,2020 funds inthe amount of $95,000 were received from the General Fund and the third interest payment was made (also in the amount of…arrow_forwardA city keeps its books on a calendar-year basis. On April 1, 2019, the city sold $500,000 of 2% general obligation bonds, payable in semi-annual installments. The first installment, due October 31, 2019 covered interest of $5,000 and principal of $10,000. For the year ended December 31, 2019, how much should the Debt Service Fund report as expenditures? $15,000 $5,000 $15,000, plus an accrual for three months' interest $5,000, plus an accrual for three months' interest and principalarrow_forward

- On October 31, 2020, the Village of Lexington issued $1,000,000 of 3% general obligation serial bonds. The bonds pay interest on April 30 and October 31. Starting on October 31, 2021, the first of 20 equal annual serial payments of $50,000 was made. At December 31, 2022, what is the amount of accrued but unmatured interest that is not reported by the debt service fund? A. $4,875. B. $5,000. C. $4,500. D. $4,750.arrow_forwardThe following information relates to Redwood City during its fiscal year ended December 31, 2019:a. On October 31, 2019, to finance the construction of a city hall annex, Redwood issued 8%, 10-year general obligation bonds at their face value of $600,000. Construction expenditures during the period equaled $364,000.b. Redwood reported $109,000 from hotel room taxes, restricted for tourist promotion, in a special revenue fund. The fund paid $81,000 for general promotions and $22,000 for a motor vehicle.c. 2019 general fund revenues of $104,500 were transferred to a debt service fund and used to repay $100,000 of 9%, 15-year term bonds and $4,500 of interest. The bonds were used to acquire a citizens’ center.d. At December 31, 2019, as a consequence of past services, city firefighters had accumulated entitlements to compensated absences valued at $140,000. General fund resources available at December 31, 2019, are expected to be used to settle $30,000 of this amount, and $110,000 is…arrow_forwardThe City of Dylan issues a 10-year bond payable of $1 million at face value on the first day of Year 1. Debt issuance costs of $10,000 are paid on that day. For government-wide financial statements, how is this debt issuance cost reported? Choose the correct.a. $1,000 is recorded as an expense and $9,000 is recorded as an asset.b. $1,000 is recorded as an expense and $9,000 is recorded as a deferred outflow of resources.c. $10,000 is recorded as an expense.d. $10,000 is recorded as an asset.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education