Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 21EP

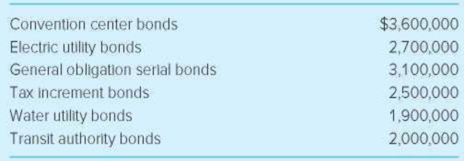

Legal Debt Margin and Direct and Overlapping Debt. (LO6-2) In preparation for a proposed bond sale, the city manager of the City of Appleton requested that you prepare a statement of legal debt margin and a schedule of direct and overlapping debt for the city as of the December 31 year end. You ascertain that the following bond issues are outstanding on that date:

You obtain other information that includes the following items:

- 1. Assessed valuation of real and taxable personal property in the city totaled $240,000,000.

- 2. The rate of debt limitation applicable to the City of Appleton was 6 percent of total real and taxable personal property valuation.

- 3. Electric utility, water utility, and transit authority bonds were all serviced by enterprise revenues. By law, such self-supporting debt is not subject to debt limitation.

- 4. The convention center bonds and tax increment bonds are subject to debt limitation.

- 5. The amount of assets segregated for debt retirement at December 31 is $1,800,000.

- 6. The city’s residents are also taxed by Clyde County for 25 percent of school district and health services debt. The school district has $15,000,000 in outstanding bonds, while health services has $8,000,000 in debt. Finally, one-third of the $2,400,000 of regional library outstanding debt is paid by taxes assessed on Appleton residents.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

For some types of debt, note disclosure is sufficient.

For each of the following items relating to the debt of Marfa City, indicate whether and how the debt would be reported on a balance sheet of one of the city's governmental funds. If it would not be reported on a balance sheet of one of the city's governmental funds, then state whether it would be reported instead on the government‐wide statement of net position or in notes to the financial statements. Insofar as you would need additional information to determine how the debt should be reported, specify such information and tell how it would affect the determination. Briefly justify your response.

The city issues $10 million in 30‐year, 6 percent revenue bonds to enable a local nursing home to construct new facilities. The facilities will be leased to the home for the term of the bonds, and the lease payments will be exactly equal to the debt service on the bonds. At the expiration of the lease, the property will revert to the…

Yarrow County engaged in the following debt-related transactions during the year. REQUIRED: Assume that the county maintains its books and records in a manner that facilitates the preparation of its government-wide financial statements. Prepare the necessary journal entries to record these transactions. Clearly indicate if debt is long-term or short-term (current). If no entry is required, write “No entry required.”

a)The county issued $10 million in 6 percent, 20-year bonds for $10,234,932 to yield 5.8 percent (2.9 percent per semi-annual period) to the investor.

b)The county made the first semi-annual interest payment on the bonds in (a).

c)The county issued $3 million in 6 percent demand bonds for which it did not enter into a take-out agreement.

d)In anticipation of finally issuing $20 million in bonds that were approved by the voters several months ago, the county borrowed $20 million from a consortium of national banks due in six months. The county also entered into a…

The City of Dylan issues a 10-year bond payable of $1 million at face value on the first day of Year 1. Debt issuance costs of $10,000 are paid on that day. For government-wide financial statements, how is this debt issuance cost reported?

$1,000 is recorded as an expense and $9,000 is recorded as an asset.

$1,000 is recorded as an expense and $9,000 is recorded as a deferred outflow of resources.

$10,000 is recorded as an expense.

$10,000 is recorded as an asset.

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The City of Frost has a 20-year debt outstanding. On the last day of the current year, this debt has an outstanding balance of $4.8 million and five years remaining until it is due. On that date, the debt is paid off early for $5 million. A new debt is issued (with a lower interest rate) for $5.4 million. How is the $200,000 between the amount paid and the outstanding balance of $4.8 million recognized on government-wide financial statements? Choose the correct.a. As an expense.b. As a reduction in liabilities.c. As a deferred outflow of resources on the statement of net position.d. As an asset on the statement of net position.arrow_forwardOn March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.Proceeds from the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.arrow_forwardI need the journal entry for these questions As of January 1, 2020, the City of Monroe had $12,000,000 in general obligation bonds outstanding. Eliminate the expenditures for bond principal. Adjust for the interest accrued in the prior year government-wide statements, but recorded as an expenditure in the 2020 fund basis statements, ($12,000,000 × 0.03 × 6/12) = $180,000.arrow_forward

- On March 2, 2018, Finch City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period from April 1, 2018, to March 31, 2019.During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest. On June 30, 2018, in which statements should Finch report the construction in progress for the civic center? Capital Projects FundBalance Sheet Government-WideStatement of Net Position a. b. c. d. Yes Yes No No Yes No No Yesarrow_forwardTuston Township issued the following bonds during the year ended June 30, Year 1: Bonds issued for the garbage collection enterprise fund that will service the debt $700,000 Revenue bonds to be repaid from admission fees collected by the Township zoo enterprise fund 500,000 What amount of these bonds should be accounted for in Tuston's government-wide financial statement as a liability resulting from governmental activities? A.) $1,200,000 B.) $700,000 C.) $500,000 D.) $0arrow_forwardThe City of Frost has a 20-year debt outstanding. On the last day of the current year, this debt has an outstanding balance of $4.8 million and five years remaining until it is due. On that date, the debt is paid off early for $5 million. A new debt is issued (with a lower interest rate) for $5.4 million. How is the $200,000 between the amount paid and the outstanding balance of $4.8 million recognized on government-wide financial statements? As an expense. As a reduction in liabilities. As a deferred outflow of resources on the statement of net position. As an asset on the statement of net position.arrow_forward

- On March 2, 2018, Beloit City issued 10-year general obligation bonds at face amount, with interest payable on March 1 and September 1. The proceeds were to be used to finance the construction of a civic center over the period of April 1, 2018, to March 31, 2019. During the fiscal year ended June 30, 2018, no resources had been provided to the debt service fund for the payment of principal and interest.The liability for the general obligation bonds should be recorded in the a. general fund. b. capital projects fund. c. general long-term debt account group. d. debt service fund.arrow_forwardEasterly City has $47 million of debt recorded in its schedule of changes in long-term obligations, made up of $30 million of general obligation debt, $1 million of compensated absences payable, $4 million of claims and judgments, and $12 million of obligations under capital leases. The state limits the amount of general obligation debt that can be issued by a city to 20 percent of the assessed value of its taxable property. The assessed value of property in Easterly City is $300 million. The city' s legal debt margin is A.) $ 13 million. B.) $ 20 million. C.) $ 30 million. D.) $60 millionarrow_forward5. Al Shahri community, located in the City of Duqm, voted to form a local improvement district to fund the construction of a new community center. The city agreed to construct the community center and administer the bond debt; however, the community was solely responsible for repaying the bond issue. To administer the bond debt, the city established the Local Improvement District Fund. Following are several events connected with the Local Improvement District Fund. 1. On June 30, 2019, the city assessed levies totaling OMR3,000,000. The levies are payable in 10 equal annual installments with 4.5 percent interest on unpaid installments. 2. All assessments for the current period were collected by June 30, 2020, as was the interest due on the unpaid installments. 3. On July 1, 2020, the first principal payment of OMR 300,000 was made to bond holders as was interest on the debt. Required Make journal entries for each of the foregoing events that affected the Local Improvement District…arrow_forward

- Which of the following statements is not true for debt service funds? Multiple Choice Interest payable may be reported as a liability of the debt service fund. Special assessment debt for which the government has some obligation is paid through the debt service fund. All tax-supported bond principal is shown as a liability of the debt service fund. Bond principal can be shown as a liability when financial resources dedicated for payment of the principal have been transferred to the debt service fund and payment of principal is due early in the following year.arrow_forwardIbri township issued the following bonds during the year. The bond issued to purchase equipment for vehicle repair service that is accounted for in an internal service fund RO 30,000, The bonds issued to construct a new city hall RO 10,000 The bonds issued to improve its water utility, which is accounted for in an enterprise fund RO 50,000. The amount of bond issued to be reported in the general fund is a. RO 10,000 b. RO 50,000 c. None of the options d. RO 30,000arrow_forwardWood City, which is legally obligated to maintain a debt service fund, issued the following general obligation bonds on July 1, Year 1: Term of bonds 10 years, Face amount $1,000,000, Issue price 95 , Stated interest rate 6% Interest is payable January 1 and July 1. What amount of bond discount should be amortized in Wood's debt service fund for purposes of fund financial reporting for the year ended December 31, Year 1? A.) $1,000 B.) $500 C.) $250 D.) $0arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License