Accounting For Governmental & Nonprofit Entities

18th Edition

ISBN: 9781259917059

Author: RECK, Jacqueline L., Lowensohn, Suzanne L., NEELY, Daniel G.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 22EP

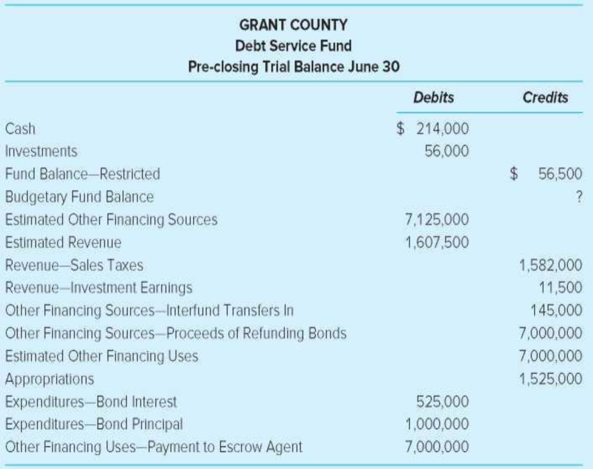

Debt Service Fund

Required

Using information provided by the trial balance, answer the following.

- a. Assuming the budget was not amended, what was the budgetary

journal entry recorded at the beginning of the fiscal year? - b. What is the budgetary fund balance?

- c. Did the debt service fund pay debt obligations related to lease agreements? Explain.

- d. Did the debt service fund perform a debt refunding? Explain.

- e. Prepare a statement of revenues, expenditures, and changes in fund balances for the debt service fund for the year ended June 30.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The unadjusted trial balance for the General Fund of the City of Allensville at June 30, 2019 is as follows:

Debits

Accounts Receivable $40,000

Cash 75,000

Due from Agency Fund 25,000

Encumbrances 60,000

Estimated Revenues 975,000

Expenditures 750,000

Taxes Receivable 250,000

$2,175,000

Credits

Allowance for Doubtful Accounts $ 5,000

Allowance for Uncollectible Taxes 50,000

Appropriations 785,000

Due to a Utility Fund 40,000

Unassigned Fund Balance (160,000)

Estimated…

Armstrong County established a COuty Office Building Construction Fund to account for a project that was exoected to take less then one year to complete. The County's fiscal year ends in June 30.

!. On July 1, 2019, Bonds were sold at par in the amount $8,000,000 for the project.

2. On July 5, a contract was signed woith Sellers Construction Company in the amount of $7,890,000

3. On December 30, a progress bill was received from Sellers in the amount $5,000,000. The bill was paid, except for 5 percent retained upon final inspection.

4. On June1 a final bill was received in the amount of $2,890,000 from Sellers, which was paid, except for the 5 percent retained. An appointment was made between the county engineer and Bill Sellers to inspect the building and to develop a list of items that needed to be corrected.

5. On the day of the meeting , the county engineer discovered that Sellers has filed for bankruptcy and moved out of the state. The city incurred a liability in the amount of…

The City of Castleton’s General Fund had the following post-closing trial balance at June 30, 2019, the end of its fiscal year:

Debits

Credits

Cash

$

476,000

Taxes Receivable—Delinquent

601,000

Allowance for Uncollectible Delinquent Taxes

$

189,120

Interest and Penalties Receivable

28,080

Allowance for Uncollectible Interest and Penalties

12,960

Inventory of Supplies

17,900

Vouchers Payable

166,500

Due to Federal Government

77,490

Deferred Inflows of Resources—Unavailable Revenues

427,000

Fund Balance—Nonspendable—Inventory of Supplies

17,900

Fund Balance—Unassigned

232,010

$

1,122,980

$

1,122,980

Prepare a General Fund balance sheet as of June 30, 2020.

Chapter 6 Solutions

Accounting For Governmental & Nonprofit Entities

Ch. 6 - Prob. 1QCh. 6 - What disclosures about long-term liabilities are...Ch. 6 - Prob. 3QCh. 6 - Prob. 4QCh. 6 - Although the most common type of general long-term...Ch. 6 - What is overlapping debt? Why would a citizen care...Ch. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - How are debt issuance costs accounted for at the...Ch. 6 - Under what circumstances might a government...

Ch. 6 - Prob. 11CCh. 6 - A citizens group in your state has placed an...Ch. 6 - A county government and a legally separate...Ch. 6 - Prob. 14CCh. 6 - Evaluating Legal Debt Margins. (LO6-2) Youll be...Ch. 6 - Prob. 17.1EPCh. 6 - Proceeds from bonds issued to construct a new city...Ch. 6 - The liability for long-term debt issued to finance...Ch. 6 - Which one of the following statements regarding...Ch. 6 - Prob. 17.5EPCh. 6 - On March 2, 2020, 20-year, 6 percent, general...Ch. 6 - Prob. 17.7EPCh. 6 - Prob. 17.8EPCh. 6 - The liability for special assessment bonds for...Ch. 6 - Total general long-term indebtedness subject to...Ch. 6 - Payment of general obligation bond interest would...Ch. 6 - Debt issuance costs a. Include legal and...Ch. 6 - If bonds are sold at a premium: a. The premium is...Ch. 6 - Prob. 17.14EPCh. 6 - Prob. 17.15EPCh. 6 - Prob. 18EPCh. 6 - Budgeted and Actual Debt Service Transactions....Ch. 6 - Lease Agreement. (LO6-5) McCormick County agreed...Ch. 6 - Legal Debt Margin and Direct and Overlapping Debt....Ch. 6 - Debt Service Fund Trial Balance. (LO6-5) Following...Ch. 6 - Prob. 23EPCh. 6 - Term Bond Debt Service Fund Transactions. (LO6-5)...Ch. 6 - Prob. 25EP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following adjusted trial balance is taken from the General Fund of Avon City for the year ended June 30. Prepare a (post-closing) Balance sheet. Allowance for uncollectible taxes Cash Due from capital projects fund Due to debt service fund Encumbrances Encumbrances outstanding Expenditures Fund Balance, nonspendable Fund Balance, unassigned Inventory of supplies Other financing sources -- bond proceeds Other financing uses -- transfers out Revenues Taxes receivable Unearned (unavailable) grant revenues Vouchers payable 5,000 121,000 32,000 19,000 23,000 23,000 57,000 9,000 14,000 9,000 18,000 12,000 130,000 25,000 38,000 23,000 DO NOT GIVE SOLUTION IN IMAGEarrow_forwardBilberry County voted to establish an internal service fund to account for printing and copying for all its departments and agencies. The county engaged in the following activities related to the new fund on 1/1/2019. a) The county commission voted to transfer $300,000 from the general fund to the internal service fund to establish the new fund. b) Entered into a capital lease for equipment to be used in printing activities. The total present value of the lease obligation is $600,000. c) Issued $2 million in general obligation bonds at 101. The bonds were issued to acquire additional equipment and are to be serviced from the internal service fund. d) Purchased equipment for $1,950,000. The equipment has an estimated useful life of 10 years and an estimated salvage value of $150,000. e) Billed the general fund for copying and printing charges, $70,000. f) Paid salaries to printing employees, $50,000. a. Total Fixed Asset reported on the financial statement as of 1/1/2019 is? b. Total…arrow_forwardBilberry County voted to establish an internal service fund to account for printing and copying for all its departments and agencies. The county engaged in the following activities related to the new fund on 1/1/2019. a) The county commission voted to transfer $300,000 from the general fund to the internal service fund to establish the new fund. b) Entered into a capital lease for equipment to be used in printing activities. The total present value of the lease obligation is $600,000. c) Issued $2 million in general obligation bonds at 101. The bonds were issued to acquire additional equipment and are to be serviced from the internal service fund. d) Purchased equipment for $1,950,000. The equipment has an estimated useful life of 10 years and an estimated salvage value of $150,000. e) Billed the general fund for copying and printing charges, $70,000. f) Paid salaries to printing employees, $50,000. Total liability reported on the Financial statement as of 1/1/2019 is? answer please.arrow_forward

- Hi, I am in Advanced Acc. and I need to create a closing worksheet for a government fund. The following trial balance is taken form the General Fund of the City of Jennings for the year ending December 31, 2017. debit credit accounts payable $90,000 cash $30,000 contracts payable 90,000 unavailable revenues 40,000 due from capital projects fund 60,000 due to debt service funds 40,000 expenditures 530,000 fund…arrow_forwardThe general fund pays rent for two months. Which of the following is not correct? Rent expense should be reported in the government-wide financial statements. Rent expense should be reported in the general fund. An expenditure should be reported in the fund financial statements. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forwardThe general fund pays rent for two months. Which of the following is not correct? Choose the correct.a. Rent expense should be reported in the government-wide financial statements.b. Rent expense should be reported in the general fund.c. An expenditure should be reported in the fund financial statements.d. If one month of rent is in the first year with the other month in the next year, either the purchases method or the consumption method can be used in fund statements.arrow_forward

- The government makes appropriations of RO 150,000 to Muscat School for the month of January 2019. During the month the following transactions occurred:Salary paid RO 35,000Purchase orders were placed for office supplies RO 49,000Office supplies were received with a voucher for RO 45,000An amount of RO 15,000 was transferred to Debt service fund.The unreserved fund balance at the end of the period is:arrow_forwardPrepare the journal entries for the following transactions to consolidate financial statements from fund-level statements to government-wide statements. Deferred property taxes at the end of the year was $92.arrow_forwardYou are given the following post-closing trial balance for the Special Assessment Capital Projects Fund of the city of Stone Creek as of January 1, 2018. The project was started last year and should be completed in June of 2018. Debit CreditCash . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 290,000Contracts Payable—Retained Percentage. . . . . . . . . . . 60,000Fund Balance—Restricted . . . . . . . . . . . . . . . . . . . . . . . . . 150,000Fund Balance—Assigned for Encumbrance . . . . . . . . . 80,000Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 290,000 290,000The special assessments are collected by the debt service fund, which also makes payments of principal and interest on special assessment bonds. The city has…arrow_forward

- The following information pertains to the City of Williamson for 2020, its first year of legal existence. For convenience, assume that all transactions are for the general fund, which has three separate functions: general government, public safety, and health and sanitation. Receipts: Property taxes $320,000 Franchise taxes 42,000 Charges for general government services 5,000 Charges for public safety services 3,000 Charges for health and sanitation services 42,000 Issued long-term note payable 200,000 Receivables at end of year: Property taxes (90% estimated to be collectible) 90,000 Payments: Salary: General government 66,000 Public safety 39,000 Health and sanitation 22,000 Rent: General government 11,000 Public safety 18,000 Health and sanitation 3,000 Maintenance: General government 21,000 Public safety 5,000 Health and sanitation 9,000 Insurance: General government 8,000 Public safety ($2,000 still prepaid…arrow_forwardKilbourne County engaged in the following transactions in summary form during its fiscal year. All amounts are in millions. You need not be concerned with the category of funds balances to which reserves for encumbrances are classified on the fund balance sheet. Its commissioners approved a budget for the current fiscal year. It included total revenues of $860 and total appropriations of $850. It ordered office supplies for $20. It incurred the following costs, paying in cash. These items had not previously been encumbered. Salaries $610 Repairs $ 40 Rent $ 25 Utilities $ 41 Other operating costs $119 It ordered equipment costing $9. It received the equipment and was billed for $10, rather than $9 as anticipated. It received the previously ordered supplies and was billed for the amount originally estimated. The county reports the receipt of supplies as expenditures; it does not maintain an inventory account for supplies. It earned and collected revenues of $865.…arrow_forwardA County had the following transactions. The county's fiscal year end is December 31. Analyze the effects of each transaction on the accounting equations of each fund or nonfund accounts affected by the transaction. 1. County issued $10 million of general obligation, 10%, 10-year bonds at 105 on October 1, 20X8. Bond interest is payable semiannually on March 31 and September 30. The bonds were issued to finance construction of a new county office building. 2. The county board of supervisors voted to use the premium on the bonds to pay principal and interest charges on the debt when it matures. Resources were transferred to the appropriate fund. 3. The county paid $2 million to Roger Construction Company during 20X8 for work completed during the year. 4. Reflect any interest accrual required or permitted at year end. 5. The county purchased a police vehicle for $22,000 and paid cash. 6. The county owned and operated electric utility billed residents and businesses $2,000,000 for…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

What is Fund Accounting?; Author: Aplos;https://www.youtube.com/watch?v=W5D5Dr0j9j4;License: Standard Youtube License