Concept explainers

CVP Applications; Contribution Margin Ratio: Degree of Operating Leverage L06−I , L06−3, L06−4, L06− 5, LOS−8

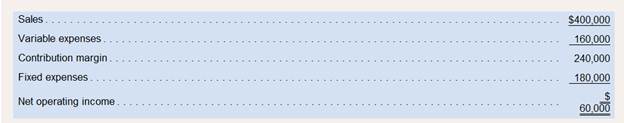

Feather Friends, Inc., distributes a high−quality that sells for S20 unit. Variable expenses are SS unit, fixed total S 180.000 per year. Its operating results for last year were as follows;

Required:

Answer each question independently based on the original data:

1. What is the product’s CM ratio?

2. Use the CM ratio to determine the break-even point in dollar sales.

3. If this year’s sales increase by $75,000 and fixed expenses do not change, how much will net Operating income increase?

4. a. What is the degree of operating leverage based on last year’s sales?

b. Assume the president expects this year’s sales to increase by 20%. Using the degree of operating leverage from last year, what percentage increase in net operating income will the company realize this year?

5. The sales manager is convinced that a 10% reduction in the selling price, combined with a $30,000 increase in advertising, would increase this year’s unit sales by 25%. If the sales manager is right what would be this year’s net operating income if his ideas are implemented? Do you recommend implementing the sales manager’s suggestions? Why?

6. The president does not want to change the selling price. Instead, he wants to increase the sales commission by $1 per unit. He thinks that this move, combined with some increase in advertising, would increase this year’s sales by 25%. How much could the president increase this veal’s advertising expense and still earn the same $60.000 net operating income as last year?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Introduction To Managerial Accounting

- Contribution Margin Ratio, Break-Even Sales, Operating Leverage Elgart Company produces plastic mailboxes. The projected income statement for the coming year follows: Required: 1. Compute the contribution margin ratio for the mailboxes. 2. How much revenue must Elgart earn in order to break even? 3. What is the effect on the contribution margin ratio if the unit selling price and unit variable cost each increase by 15%? 4. CONCEPTUAL CONNECTION Suppose that management has decided to give a 4% commission on all sales. The projected income statement does not reflect this commission. Recompute the contribution margin ratio, assuming that the commission will be paid. What effect does this have on the break-even point? 5. CONCEPTUAL CONNECTION If the commission is paid as described in Requirement 4, management expects sales revenues to increase by 80,000. How will this affect operating leverage? Is it a sound decision to implement the commission? Support your answer with appropriate computations.arrow_forwardCost-Volume-Profit, Margin of Safety Victoria Company produces a single product. Last years income statement is as follows: Required: 1. Compute the break-even point in units and sales dollars calculated using the break-even units. 2. What was the margin of safety for Victoria last year in sales dollars? 3. Suppose that Victoria is considering an investment in new technology that will increase fixed cost by 250,000 per year but will lower variable costs to 45% of sales. Units sold will remain unchanged. Prepare a budgeted income statement assuming that Victoria makes this investment. What is the new break-even point in sales dollars, assuming that the investment is made?arrow_forwardCompany A has current sales of $4,000,000 and a 45% contribution margin. Its fixed costs are $600,000. Company B is a service firm with current service revenue of $2,800,000 and a 15% contribution margin. Company Bs fixed costs are $375,000. Compute the degree of operating leverage for both companies. Which company will benefit most from a 15% increase in sales? Explain why.arrow_forward

- Contribution margin, break-even sales, cost-volume-profit chart, margin of safety, and operating leverage Belmain Co. expects to maintain the same inventories at the end of 20Y7 as at the beginning of the year. The total of all production costs for the year is therefore assumed to be equal to the cost of goods sold. With this in mind, the various department heads were asked to submit estimates of the costs for their departments during the year. A summary report of these estimates is as follows: It is expected that 12,000 units will be sold at a price of 240 a unit. Maximum sales within the relevant range are 18,000 units. Instructions 1. Prepare an estimated income statement for 20Y7. 2. What is the expected contribution margin ratio? 3. Determine the break-even sales in units and dollars. 4. Construct a cost-volume-profit chart indicating the break-even sales. 5. What is the expected margin of safety in dollars and as a percentage of sales? (Round to one decimal place.) 6. Determine the operating leverage.arrow_forwardLotts Company produces and sells one product. The selling price is 10, and the unit variable cost is 6. Total fixed cost is 10,000. Required: 1. Prepare a CVP graph with Units Sold as the horizontal axis and Dollars as the vertical axis. Label the break-even point on the horizontal axis. 2. Prepare CVP graphs for each of the following independent scenarios: (a) Fixed cost increases by 5,000, (b) Unit variable cost increases to 7, (c) Unit selling price increases to 12, and (d) Fixed cost increases by 5,000 and unit variable cost is 7.arrow_forwardStonebraker Corporation has provided the following contribution format income statement. All questions concern situations that are within the relevant range. Sales (9,000 units) $270,000 Variable expenses 189,000 Contribution margin 81,000 Fixed expenses 77,400 Net operating income $3,600 Required: A. What is the breakeven quantity? B. What is the breakeven sales dollar? C. What is the margin of safety in dollars? D. What is the degree of operating leverage? E. If sales increase to 9,400 units, what would be the estimated increase in net operating income? F. If the variable cost per unit increases by $6, spending on advertising increases by $3,000, and unit sales increase by 19,200 units, what would be the estimated net operating income? G. Estimate how many units must be sold to achieve a target profit of $26,100.arrow_forward

- Break-Even Units, Contribution Margin Ratio, Multiple-Product Breakeven, Margin of Safety, Degree of Operating Leverage Jellico Inc.'s projected operating income (based on sales of 450,000 units) for the coming year is as follows: Total Sales $ 11,700,000 Total variable cost 6,669,000 Contribution margin $ 5,031,000 Total fixed cost 3,083,444 Operating income $ 1,947,556 Required: 1(a). Compute variable cost per unit. Enter your answer to the nearest cent.$per unit 1(b). Compute contribution margin per unit. Enter your answer to the nearest cent.$per unit 1(c). Compute contribution margin ratio. % 1(d). Compute break-even point in units. units 1(e). Compute break-even point in sales dollars.$ 2. How many units must be sold to earn operating income of $404,716? units 3. Compute the additional operating income that Jellico would earn if sales were $50,000 more than expected.$ 4. For the projected level of sales, compute the margin of safety in units, and then in…arrow_forwardSuppose that a company expects the fo llowing financial resuJts from a project during its first year ope ration:• Sales revenue: $250.000• Variable costs: $80.000• Fixed costs: $50.000• Total unit produced and so ld: 1,000 units(a) Compute the contribution ma rgin pe rcentage.(b) Compute the brcakcven point in units sold.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning