Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 4AE

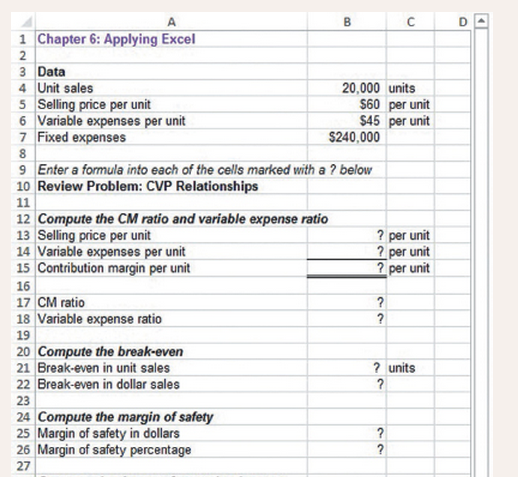

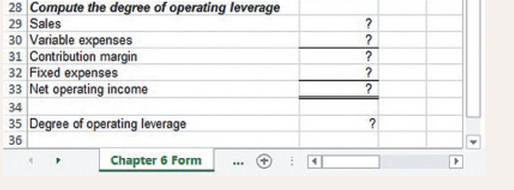

The Excel worksheet form that appears be1o is to be used to recreate portions of the Review Problem relating to Voltar Company. Download the workbook containing this form from Connect. Where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

1. Confirm the calculation you made in part (3) above by increasing the unit sales in your worksheet by 15%. What is the new net operating income and by what percentage did it increase?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The Excel worksheet form that appears below is to be used to recreate the Review Problem pertaining to the Magnetic Imaging Division of Medical Diagnostics, Inc. Download the workbook containing this form from Connect, where you will also receive instructions about how to use this worksheet form.

You should proceed to the requirements below only after completing your worksheet.

Required:

1. Check your worksheet by changing the average operating assets in cell B6 to $8,000,000. The ROI should now be 38% arid the residual income should now be $1,000,000. If you do not get these answers, find the errors in your worksheet and correct them.

Explain why the ROI and the residual income both increase when the average operating assets decrease.

2. Revise the data in your worksheet as follows:

a. What is the ROI?

b. What is the residual income?

c. Explain the relationship between the ROI and the residual income?

Directions

Below is information for Blue Company. Using this information, answer the following questions on the "Calculation" tab in the file. Show your work (how you got your answer) and format appropriately.

Blue company has prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 to 1,500 units):

Sales

$ 20,000

Variable expenses

12,000

Contribution margin

8,000

NOTE: Use the amounts in the original fact pattern to the left as your basis for the questions below.

Fixed expenses

6,000

Net operating income

$ 2,000

Questions:…

PLEASE INCLUDE THE EXCEL FORMULAS!! Thanks!!

Please don't forget to check your worksheet by changing the units sold in the Data to 6,000 for Year 2 before submitting the response to my question. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isn’t, check cell C41. The formula in this cell should be =IF(C26<C27,C26*C36+(C27-C26)*B36,C27*C36).] If your worksheet is operating properly, the net operating income under both absorption costing and variable costing should be $(34,000) for Year 2. That is, the loss in Year 2 is $34,000 under both methods. If you do not get these answers, find the errors in your worksheet and correct them. Assume that the units produced in year 2 were sold first.

If someone can help I will give a thumbs up. Thanks for the help! :)

Chapter 6 Solutions

Introduction To Managerial Accounting

Ch. 6.A - The Cheyenne Hotel in Big Sky, Montana, has...Ch. 6.A - Least-Squares Regression LOS11 Bargain Rental Car...Ch. 6.A - Prob. 3ECh. 6.A - Archer Company is a wholesaler of custom-built...Ch. 6.A - George Caloz&Freres, located in Grenchen,...Ch. 6.A - Least-Square. Regression; Scattergraph; Comparison...Ch. 6.A - Cost Behaviour; High4æw Method; Contribution...Ch. 6.A - Nova Company’s total overhead cost at various...Ch. 6.A - High-Low Method; Contribution Format Income...Ch. 6.A - Least-Squares Regression Method; Scattergraph;...

Ch. 6.A - Mixed Cost Analysis and the Relevant Range LOS-10...Ch. 6.A - Prob. 12PCh. 6 - What is the meaning of contribution margin ratio?...Ch. 6 - Prob. 2QCh. 6 - In all respects, Company A and Company B are...Ch. 6 - What is the meaning of operating leverage?Ch. 6 - What is the meaning of break-even point?Ch. 6 - In response to a request from your immediate...Ch. 6 - What is the meaning of margin of safety?Ch. 6 - Prob. 8QCh. 6 - Explain how a shift in the sales mix could result...Ch. 6 - The Excel worksheet form that appears be1o is to...Ch. 6 - The Excel work sheet from that appears below is to...Ch. 6 - Prob. 3AECh. 6 - The Excel worksheet form that appears be1o is to...Ch. 6 - Prob. 5AECh. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Prob. 11F15Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - Oslo Company prepared the following contribution...Ch. 6 - The Effect of Cha noes ¡n Activity on Net...Ch. 6 - Prob. 2ECh. 6 - Prepare a Profit Graph L062 Jaffre Enterprises...Ch. 6 - Computing and Using the CM Ratio L063 Last month...Ch. 6 - Changes in Venable Costs, Fixed Costs, Selling...Ch. 6 - Prob. 6ECh. 6 - Lin Corporation has a single product 1ose selling...Ch. 6 - Compute the Margin of Safety LO6-7 Molander...Ch. 6 - Compute and Use the Degree 01 Operating Leverage...Ch. 6 - Prob. 10ECh. 6 - Missing Data; Basic CVP Concepts L061, L069 Fill...Ch. 6 - Prob. 12ECh. 6 - Change in selling price, Sales Volume, Variable...Ch. 6 - Prob. 14ECh. 6 - Operating Leverage 1061. 1068 Magic Realm, Inc.,...Ch. 6 - Prob. 16ECh. 6 - Break-Even and Target Profit Analysis 1064, 1066,...Ch. 6 - Break-Even and Target Profit Analysis; Margin of...Ch. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - CVP Applications; Contribution Margin Ratio:...Ch. 6 - Break-Even and Target Profit Analysis LO6-6, L066...Ch. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - Prob. 27PCh. 6 - Sales Mix; Commission Structure; Multiproduct...Ch. 6 - Changes in Cost Structure; Break-Even Analysis;...Ch. 6 - Graphing; Incremental Analysis; Operating Leverage...Ch. 6 - Interpretive Questions on the CVP Graph L062, L065...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following table provides monthly revenue values for Tedstar, Inc., a company that sells valves to large industrial firms. The monthly revenue data have been graphed using a line chart in the following figure. a. What are the problems with the layout and display of this line chart? b. Create a new line chart for the monthly revenue data at Tedstar, Inc. Format the chart to make it easy to read and interpret.arrow_forwardOpen the file CVP from the website for this book at cengagebrain.com. Enter the formulas where indicated on the worksheet. Enter your name in cell A1. Save the solution as CVP2 and print the worksheet. Also print your formulas. Check figures: Break-even point in sales dollars (cell C35), 1,616,000; Net income (cell C38), 95,000.arrow_forwardWork the problem out by hand on a piece of paper so that you know what the answers should be. All dollar amounts (except EPS) should end in ",000" The schedule and statment in your output should compute mathematically from TOP to Bottom, so check and make sure that's the case Math Example: If A - B = C, then A - C = B and A = B + C Prepare an output section that produces the following items: 1) "COGS Schedule", 2) "Income Statement", and 3) "Retained Earning Statement". The reporting period is for the calendar year of 2023. The output items should be placed on a separate 'sheet' (the heading "... OUTPUT SECTION ..." should be centered over all columns to which it relates: [A1..G1]). Naming of the output 'sheet' should be "OUTPUT". No number (dollar amount, shares, or percentage) or company name should be typed (hard coded) directly into any cell in the output section, as this would prevent your output from being correct when the input is changed. Instead, the output section must…arrow_forward

- Marquette has an opportunity to sell its product through an online retailer. To begin selling through this online platform, they are required to ship 2,000 units to the retailers’ order fulfillment warehouse. The other condition of this offer is that they pay a one-time vendor marketing fee of $5,000. To get the units to the fulfillment warehouse by the deadline Marquette will need to pay for expedited shipping at a cost of $10 per unit. What is the minimum price Marquette should charge the retailer for this initial order of 2,000 units? (Show all supporting calculations). (NOTE: ignore taxes or other costs not specifically mentioned in the questions.)arrow_forwardPlease don't forget to check your worksheet by changing the units sold in the Data to 6,000 for Year 2 before submitting the response to my question. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isn’t, check cell C41. The formula in this cell should be =IF(C26<C27,C26*C36+(C27-C26)*B36,C27*C36).] If your worksheet is operating properly, the net operating income under both absorption costing and variable costing should be $(34,000) for Year 2. That is, the loss in Year 2 is $34,000 under both methods. If you do not get these answers, find the errors in your worksheet and correct them. Assume that the units produced in year 2 were sold first. ALSO PLEASE INCLUDE THE EXCEL FORMULAS!! Thanks!! If someone can help I will give a thumbs up. Thanks for the help! :)arrow_forwardPlease don't forget to check your worksheet by changing the units sold in the Data to 6,000 for Year 2 before submitting the response to my question. The cost of goods sold under absorption costing for Year 2 should now be $240,000. If it isn’t, check cell C41. The formula in this cell should be =IF(C26<C27,C26*C36+(C27-C26)*B36,C27*C36).] If your worksheet is operating properly, the net operating income under both absorption costing and variable costing should be $(34,000) for Year 2. That is, the loss in Year 2 is $34,000 under both methods. If you do not get these answers, find the errors in your worksheet and correct them. Assume that the units produced in year 2 were sold first. If someone can help I will give a thumbs up. Thanks for the help! :)arrow_forward

- Hello,there is a follow-up question,can you help me? Thank you very much Question: Calculate the critical sales volume in the estimate [units]. I will give thumbs up immediately when the answer is readyarrow_forwardA company manufactures various-sized plastic bottles for its medicinal product. The manufacturing cost for small bottles is $52 per unit (100 bottles), including fixed costs of $10 per unit. A proposal is offered to purchase small bottles from an outside source for $31 per unit, plus $3 per unit for freight. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. Open spreadsheet Prepare a differential analysis dated January 25 to determine whether the company should make (Alternative 1) or buy (Alternative 2) the bottles, assuming fixed costs are unaffected by the decision. If an amount is zero, enter "0". Enter unit costs as positive values. Use a minus sign to indicate negative Differential Effects. Differential Analysis Make Bottles (Alt. 1) or Buy Bottles (Alt. 2) January 25 Make Bottles (Alternative 1) Buy Bottles (Alternative 2)…arrow_forwardStart with the partial model in the file attached. Marvel Pence, CEO of Marvel’s Renovations, a custom building and repair company, is preparing documentation for a line of credit request from his commercial banker. Among the required documents is a detailed sales forecast for parts of 2020 and 2021: Sales Labor and Raw Materials May, 2020 $75,000 $80,000 June, 2020 $115,000 $75,000 July, 2020 $145,000 $105,000 August, 2020 $125,000 $85,000 September, 2020 $120,000 $65,000 October, 2020 $95,000 $70,000 November, 2020 $75,000 $30,000 December, 2020 $55,000 $35,000 January, 2021 $45,000 N/A Estimates obtained from the credit and collection department are as follows: collections within the month of sale, 20%; collections during the month following the sale, 60%; collections the second month following the sale, 25%. Payments for labor and raw materials are typically made during the month following the…arrow_forward

- Start with the partial model in the file attached. Marvel Pence, CEO of Marvel’s Renovations, a custom building and repair company, is preparing documentation for a line of credit request from his commercial banker. Among the required documents is a detailed sales forecast for parts of 2020 and 2021: Sales Labor and Raw Materials May, 2020 $75,000 $80,000 June, 2020 $115,000 $75,000 July, 2020 $145,000 $105,000 August, 2020 $125,000 $85,000 September, 2020 $120,000 $65,000 October, 2020 $95,000 $70,000 November, 2020 $75,000 $30,000 December, 2020 $55,000 $35,000 January, 2021 $45,000 N/A Estimates obtained from the credit and collection department are as follows: collections within the month of sale, 20%; collections during the month following the sale, 60%; collections the second month following the sale, 25%. Payments for labor and raw materials are typically made during the month following the…arrow_forwardStart with the partial model in the file attached. Marvel Pence, CEO of Marvel’s Renovations, a custom building and repair company, is preparing documentation for a line of credit request from his commercial banker. Among the required documents is a detailed sales forecast for parts of 2020 and 2021: Sales Labor and Raw Materials May, 2020 $75,000 $80,000 June, 2020 $115,000 $75,000 July, 2020 $145,000 $105,000 August, 2020 $125,000 $85,000 September, 2020 $120,000 $65,000 October, 2020 $95,000 $70,000 November, 2020 $75,000 $30,000 December, 2020 $55,000 $35,000 January, 2021 $45,000 N/A Estimates obtained from the credit and collection department are as follows: collections within the month of sale, 20%; collections during the month following the sale, 60%; collections the second month following the sale, 25%. Payments for labor and raw materials are typically made during the month following the…arrow_forwardBest Ink produces printers for personal computers. The following information is available for production of a recent order of 500 printers. Process time 16.0 hours Inspection time 3.5 hours Move time 9.0 hours Wait time 21.5 hours 1. Compute the company’s manufacturing cycle time. 2. Compute the company’s manufacturing cycle efficiency. 3. Assume the company wishes to increase its manufacturing cycle efficiency to 0.80. If process time is unchanged, what is the maximum number of hours of non-value-added time the company can have and meet this goal?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Inspection and Quality control in Manufacturing. What is quality inspection?; Author: Educationleaves;https://www.youtube.com/watch?v=Ey4MqC7Kp7g;License: Standard youtube license