Basics Of Engineering Economy

2nd Edition

ISBN: 9780073376356

Author: Leland Blank, Anthony Tarquin

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 39P

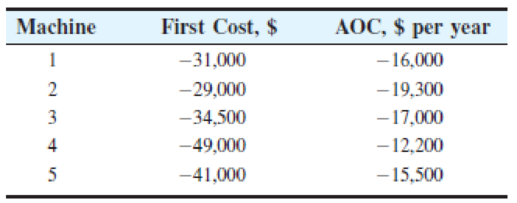

Ashley Foods, Inc. has determined that only one of five machines can be used in one phase of its dairy products operation. The first and annual costs are estimated; all machines are expected to have a 4-year useful life. If the MARR is 20% per year, determine which machine should be selected on the basis of

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What is the present worth difference between an investment of $30,000 per year for 40 years and aninvestment of $30,000 per year forever at an interest rate of 15% per year?

Q13. A small construction company has $190,000 set aside in a capital improvement fund to purchase new equipment. If $18,000 is invested at 16%, $34,000 at 21%, and the remaining $138,000 at 19% per year, what is the overall rate of return on the entire $190,000?

The overall rate of return on the entire $190,000 is % per year.

A manufacturer of electronic devices invests $650,000 in equipment for making compact piezoelectric accelerometers for general purpose vibration measurement. Estimate the rate of return from revenue of $225,000 per year for 10 years and $70,000 in salvage value from the used equipment sale in year 10. The company uses an MARR of 25%. Solve (a) Manually using interpolation, and (b) using Excel spreadsheet function.

Chapter 6 Solutions

Basics Of Engineering Economy

Ch. 6 - Prob. 1PCh. 6 - Prob. 2PCh. 6 - Prob. 3PCh. 6 - Prob. 4PCh. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Prob. 7PCh. 6 - Prob. 8PCh. 6 - A University of Massachusetts study found that...Ch. 6 - Prob. 10P

Ch. 6 - The Closing the Gaps initiative by the Texas...Ch. 6 - Prob. 12PCh. 6 - Prob. 13PCh. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Prob. 17PCh. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - A company that manufactures rigid shaft couplings...Ch. 6 - For each of the following scenarios, state whether...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Prob. 34PCh. 6 - Prob. 35PCh. 6 - The four alternatives described below are being...Ch. 6 - Prob. 37PCh. 6 - Prob. 38PCh. 6 - Ashley Foods, Inc. has determined that only one of...Ch. 6 - Five revenue projects are under consideration by...Ch. 6 - Four different machines are under consideration...Ch. 6 - Prob. 42PCh. 6 - Prob. 43PCh. 6 - Prob. 44PCh. 6 - Prob. 45PCh. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 54PCh. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60APQCh. 6 - Prob. 61APQCh. 6 - Prob. 62APQCh. 6 - Prob. 63APQCh. 6 - Prob. 64APQCh. 6 - Prob. 65APQCh. 6 - Prob. 66APQCh. 6 - Prob. 67APQCh. 6 - Prob. 68APQCh. 6 - Prob. 69APQCh. 6 - Prob. 70APQ

Additional Business Textbook Solutions

Find more solutions based on key concepts

Assume the United States is an importer of televisions and there are no trade restrictions. US consumers buy 1 ...

Principles of Microeconomics (MindTap Course List)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Determine the price elasticity of demand if, in response to an increase in price of 10 percent, quantity demand...

Microeconomics

Drought cuts the quantity of wheat grown by 2 percent. If the price elasticity of demand for wheat is 0.5, by h...

Foundations of Economics (8th Edition)

Consider the cash flows from an investment project. (a) Compute the net present worth of the project at i = 10%...

Contemporary Engineering Economics (6th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- The annual worth for years 1 through infinity of $50,000 now, $10,000 per year in years 1 through 15, and $20,000 per year in years 16 through infinity at 10% per year is closest toarrow_forwardA delivery truck has a book value of $10,000 in year 5. The purchase price of the truck is $30,000. If the minimum acceptable rate of return is 10%, what is the equivalent annual capital cost of the truck in year 7?arrow_forwardBiomet Implants is planning new online patient diagnostics for surgeons while they operate. The new system will cost $300,000 to install in an operating room, $5000 annually for maintenance, and have an expected life of 4 years. The revenue per system is estimated to be $80,000 in year 1 and to increase by $10,000 per year through year 4. Determine if the project is economically justified using PW analysis and an MARR of 10% per year.arrow_forward

- What is meant by the term equal service alternative?arrow_forwardAdams Manufacturing spent $30,000 on a new sterilization conveyor belt, which resulted in a cost savings of $4202 per year. The length of time it should take to recover the investment at 8% per year is closest to: (a) Less than 6 years (b) 7 years (c) 9 years (d) 11 yearsarrow_forwardThe president of Biomed Products is considering a long-term contract to outsource maintenance and operations that will significantly improve the energy efficiency of their imaging systems. The payment schedule has two large payments in the first years with continuing payments thereafter. The proposed schedule is $200,000 now, $300,000 four years from now, $50,000 every 5 years, and an annual amount of $8000 beginning 15 years from now and continuing indefinitely. Determine the capitalized cost at 8% per year.arrow_forward

- U.S. Steel is considering a plant expansion to produce austenitic, precipitation hardened, duplex, and martensitic stainless steel round bars that is expected to cost $13 million now and another $10 million 1 year from now. If total operating costs will be $1.5 million per year starting 1 year from now, and the estimated salvage value of the plant is virtually zero, how much must the company make annually in years 1 through 12 to recover its investment plus a return of 22% per year?arrow_forwardWhite Oaks Properties builds strip shopping centers and small malls. The company plans to replace its refrigeration, cooking, HVAC, and other equipment with newer models in the entire center built 9 years ago. The original purchase price of the equipment was $766,000 nine years ago and the operating cost has averaged $240,000 per year. Determine the equivalent annual cost of the installed equipment, if the company can now sell it for $160,000. The company’s MARR is 25% per year. The equivalent annual cost of the installed equipment is $−arrow_forwardA company that manufactures brushes blowers invested $650,000 in an automated quality controlsystem for blower housings. The resultant savings was $160,000 per year for 5 years. If the equipmenthad a salvage value of $50,000, what rate of return per year did the company make? (Initial guess i = 5%)arrow_forward

- If a manufacturer of electronic devices invests $650,000 in equipment for making compact piezoelectric accelerometers for general purpose vibration measurement, estimate the rate of return from revenue of $225,000 per year for 10 years and $70,000 in salvage value from the used equipment sale in year 10. Solve by (a) factors, and (b) spreadsheet function.arrow_forwardA large water utility is planning to upgrade its system for controlling well pumps, booster pumps, and disinfection equipment, so that everything can be controlled from one site. The first phase will reduce labor and travel costs by $14,000 per year. The second phase will reduce costs by $9,000 per year. If phase I savings occur from the start up to year 3 and phase II occurs in years 4 through 10, what is the equivalent annual worth of the upgraded system in years 1 though 10 at an interest rate of 8% per year? [round to the nearest ten dollars]arrow_forwardEV Box is a manufacturer of electric vehicle charging stations and charging software. The initial cost of one part of their manufacturing process was $130,000 with annual costs of $49,000. Revenues were $78,000 in year 1, increasing by $1000 per year. A salvage value of $23,000 was realized when the process was discontinued after 8 years. Determine the rate of return the company made on the process.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License