Concept explainers

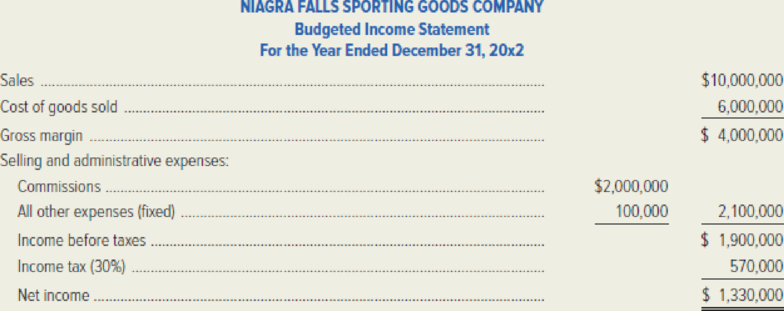

Niagra Falls Sporting Goods Company, a wholesale supply company, engages independent sales agents to market the company’s products throughout New York and Ontario. These agents currently receive a commission of 20 percent of sales, but they are demanding an increase to 25 percent of sales made during the year ending December 31, 20x2. The controller already prepared the 20x2 budget before learning of the agents’ demand for an increase in commissions. The budgeted 20x2 income statement is shown below. Assume that cost of goods sold is 100 percent variable cost.

The company’s sales manager, Joey Dulwich, is considering the possibility of employing full-time sales personnel. Three individuals would be required, at an estimated annual salary of $30,000 each, plus commissions of 5 percent of sales. In addition, a sales manager would be employed at a fixed annual salary of $160,000. All other fixed costs, as well as the variable cost percentages, would remain the same as the estimates in the 20x2

Required:

- 1. Compute Niagra Falls Sporting Goods’ estimated break-even point in sales dollars for the year ending December 31, 20x2, based on the budgeted income statement prepared by the controller.

- 2. Compute the estimated break-even point in sales dollars for the year ending December 31, 20x2, if the company employs its own sales personnel.

- 3. Compute the estimated volume in sales dollars that would be required for the year ending December 31, 20x2, to yield the same net income as projected in the budgeted income statement, if management continues to use the independent sales agents and agrees to their demand for a 25 percent sales commission.

- 4. Compute the estimated volume in sales dollars that would generate an identical net income for the year ending December 31, 20x2, regardless of whether Niagra Falls Sporting Goods Company employs its own sales personnel or continues to use the independent sales agents and pays them a 25 percent commission.

1.

Calculate the break-even point (in dollars) for N F S G Company.

Explanation of Solution

Break-Even Point: It is the point of sales at which entity neither earns a profit nor suffers a loss. It can also be said that the point of sales at which sales value of the entity recovers the entire cost of fixed and variable nature is called break-even point.

The formula to calculate the break-even point in sales dollars is as follows:

Contribution Margin ratio: It is a ratio that measures the contribution margin generated by the company from the sales to make it avialable for paying the fixed cost and generate a profit. It is expressed as percentage of margin available from each dollar sales to pay fixed expenses and to provide profit. The formula to calculate the contribution margin ratio is as follows:

Calculate the break-even point.

Working note:

- a) Calculate the contribution margin ratio.

2.

Calculate the estimated break-even point (in dollars) if the sales personnel are employed.

Explanation of Solution

Calculate the estimated break-even point (in dollars).

Working notes:

- b) Calculate the new fixed expenses.

| New fixed expenses | |

| Particulars | Amount ($) |

| Previous fixed expenses | $100,000 |

| Sales personnel salaries (c) | 90,000 |

| Sales manager’s salary | 160,000 |

| Total | $350,000 |

Table (1)

- c) Calculate the sales personnel salaries.

- d) Calculate the new contribution margin.

| Particulars | Amount ($) |

| Sales | $10,000,000 |

| Cost of goods sold | 6,000,000 |

| Gross margin | $4,000,000 |

| Commissions (at 5%) | 500,000 |

| Contribution margin | $3,500,000 |

Table (2)

- e) Calculate the contribution margin ratio.

3.

Calculate the sales volume (in dollars) to attain after- tax net income of $1,330,000.

Explanation of Solution

Target Profit: It refers to the desired amount of profit that a company expects to achieve by the end of an accounting period after it reaches its break-even point. Thus, the company needs to compute the required sales to earn the target profit.

Calculate the sales volume (in dollars).

Calculate the new contribution margin ratio.

Working note:

- f) Calculation of new contribution margin by assuming sales commission increases to 25%.

| Particulars | Amount ($) |

| Sales | $10,000,000 |

| Cost of goods sold | 6,000,000 |

| Gross margin | $4,000,000 |

| Commissions (at25%) | 2,500,000 |

| Contribution margin | $1,500,000 |

Table (3)

4.

Calculate the sales volume (in dollars) to attain before- tax income is same under the two alternatives.

Explanation of Solution

There is no change in tax rate if the management chooses any one of the approach. We can find the sales volume so that the company’s before tax income is the same under the alternatives.

If the sales volume is $1,250,000 the company will have the same before tax income under the two alternatives.

Want to see more full solutions like this?

Chapter 7 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- Eastman, Inc., manufactures and sells three products: R, S, and T. In January, Eastman, Inc., budgeted sales of the following. At the end of the year, actual sales revenue for Product R and Product S was 3,075,000 and 3,254,000, respectively. The actual price charged for Product R was 25 and for Product S was 20. Only 10 was charged for Product T to encourage more consumers to buy it, and actual sales revenue equaled 540,000 for this product. Required: 1. Calculate the sales price and sales volume variances for each of the three products based on the original budget. 2. Suppose that Product T is a new product just introduced during the year. What pricing strategy is Eastman, Inc., following for this product?arrow_forwardThe Sea Wharf Restaurant would like to determine the best way to allocate a monthly advertising budget of 1,000 between newspaper advertising and radio advertising. Management decided that at least 25% of the budget must be spent on each type of media and that the amount of money spent on local newspaper advertising must be at least twice the amount spent on radio advertising. A marketing consultant developed an index that measures audience exposure per dollar of advertising on a scale from 0 to 100, with higher values implying greater audience exposure. If the value of the index for local newspaper advertising is 50 and the value of the index for spot radio advertising is 80, how should the restaurant allocate its advertising budget to maximize the value of total audience exposure? a. Formulate a linear programming model that can be used to determine how the restaurant should allocate its advertising budget in order to maximize the value of total audience exposure. b. Develop a spreadsheet model and solve the problem using Excel Solver.arrow_forwardNorton Company, a manufacturer of infant furniture and carriages, is in the initial stages of preparing the annual budget for the coming year. Scott Ford has recently joined Nortons accounting staff and is interested in learning as much as possible about the companys budgeting process. During a recent lunch with Marge Atkins, sales manager, and Pete Granger, production manager, Ford initiated the following conversation. FORD: Since Im new around here and am going to be involved with the preparation of the annual budget, Id be interested in learning how the two of you estimate sales and production numbers. ATKINS: We start out very methodically by looking at recent history, discussing what we know about current accounts, potential customers, and the general state of consumer spending. Then, we add that usual dose of intuition to come up with the best forecast we can. GRANGER: I usually take the sales projections as the basis for my projections. Of course, we have to make an estimate of what this years closing inventories will be, which is sometimes difficult. FORD: Why does that present a problem? There must have been an estimate of closing inventories in the budget for the current year. GRANGER: Those numbers arent always reliable since Marge makes some adjustments to the sales numbers before passing them on to me. FORD: What kind of adjustments? ATKINS: Well, we dont want to fall short of the sales projections so we generally give ourselves a little breathing room by lowering the initial sales projection anywhere from 5 to 10 percent. GRANGER: So, you can see why this years budget is not a very reliable starting point. We always have to adjust the projected production rates as the year progresses, and of course, this changes the ending inventory estimates. By the way, we make similar adjustments to expenses by adding at least 10 percent to the estimates; I think everyone around here does the same thing. Required: 1. Marge Atkins and Pete Granger have described the use of budgetary slack. a. Explain why Atkins and Granger behave in this manner, and describe the benefits they expect to realize from the use of budgetary slack. b. Explain how the use of budgetary slack can adversely affect Atkins and Granger. 2. As a management accountant, Scott Ford believes that the behavior described by Marge Atkins and Pete Granger may be unethical and that he may have an obligation not to support this behavior. By citing the specific standards of competence, confidentiality, integrity, and/or credibility from the Statement of Ethical Professional Practice (in Chapter 1), explain why the use of budgetary slack may be unethical. (CMA adapted)arrow_forward

- Before the year began, the following static budget was developed for the estimated sales of 50,000. Sales are higher than expected and management needs to revise its budget. Prepare a flexible budget for 100,000 and 110,000 units of sales.arrow_forwardNozama.com Inc. sells consumer electronics over the Internet. For the next period, the budgeted cost of the sales order processing activity is 250,000 and 50,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity. b. Determine the amount of sales order processing cost associated with 30,000 sales orders.arrow_forwardCarmichael Corporation is in the process of preparing next years budget. The pro forma income statement for the current year is as follows: Required: 1. What is the break-even sales revenue (rounded to the nearest dollar) for Carmichael Corporation for the current year? 2. For the coming year, the management of Carmichael Corporation anticipates an 8 percent increase in variable costs and a 60,000 increase in fixed expenses. What is the break-even point in dollars for next year? (CMA adapted)arrow_forward

- The sales department of Macro Manufacturing Co. has forecast sales for its single product to be 20,000 units for June, with three-quarters of the sales expected in the East region and one-fourth in the West region. The budgeted selling price is 25 per unit. The desired ending inventory on June 30 is 2,000 units, and the expected beginning inventory on June 1 is 3,000 units. Prepare the following: a. A sales budget for June. b. A production budget for June.arrow_forwardBefore the year began, the following static budget was developed for the estimated sales of 100,000. Sales are sluggish and management needs to revise its budget. Use this information to prepare a flexible budget for 80,000 and 90,000 units of sales.arrow_forwardCoral Seas Jewelry Company makes and sells costume jewelry. For the coming year, Coral Seas expects sales of 15.9 million and cost of goods sold of 8.75 million. Advertising is a key part of Coral Seas business strategy, and total marketing expense for the year is budgeted at 2.8 million. Total administrative expenses are expected to be 675,000. Coral Seas has no interest expense. Income taxes are paid at the rate of 40 percent of operating income. Required: 1. Construct a budgeted income statement for Coral Seas Jewelry Company for the coming year. 2. What if Coral Seas had interest payments of 500,000 during the year? What effect would that have on operating income? On income before taxes? On net income?arrow_forward

- Foy Company has a welding activity and wants to develop a flexible budget formula for the activity. The following resources are used by the activity: Four welding units, with a lease cost of 12,000 per year per unit Six welding employees each paid a salary of 50,000 per year (A total of 9,000 welding hours are supplied by the six workers.) Welding supplies: 300 per job Welding hours: Three hours used per job During the year, the activity operated at 90 percent of capacity and incurred the actual activity and resource costs, shown on page 676. Lease cost: 48,000 Salaries: 315,000 Parts and supplies: 805,000 Required: 1. Prepare a flexible budget formula for the welding activity using welding hours as the driver. 2. Prepare a performance report for the welding activity. 3. What if welders were hired through outsourcing and paid 30 per hour (the welding equipment is provided by Foy)? Repeat Requirement 1 for the outsourcing case.arrow_forwardIona Company, a large printing company, is in its fourth year of a five-year, quality improvement program. The program began in 20x0 with an internal study that revealed the quality costs being incurred. In that year, a five-year plan was developed to lower quality costs to 10 percent of sales by the end of 20x5. Sales and quality costs for each year are as follows: Budgeted figures. Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20x5 budget for quality costs is also provided. All prevention costs are fixed; all other quality costs are variable. During 20x5, the company had 12 million in sales. Actual quality costs for 20x4 and 20x5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20x5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a one-period quality performance report for 20x5 that compares the actual quality costs of 20x4 with the actual costs of 20x5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20x1 through 20x5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second five-year plan to reduce quality costs to 2.5 percent of sales. Prepare a long-range quality cost performance report assuming sales of 15 million at the end of five years. Assume that the final planned relative distribution of quality costs is as follows: proofreading, 50 percent; other inspection, 13 percent; quality training, 30 percent; and quality reporting, 7 percent.arrow_forwardTIB makes custom guitars and prepared the following sales budget for the second quarter It also has this additional information related to its expenses: Direct material per unit $55, Direct labor per hour 20, Variable manufacturing overhead per hour 3.50, Fixed manufacturing overhead per month 3,000, Sales commissions per unit 20, Sales salaries per month 5,000, Delivery expense per unit 0.50, Utilities per month 4,000. Administrative salaries per month 20,000, Marketing expenses per month 8,000, Insurance expense per month 11,000, Depreciation expense per month 9,000. Prepare a sales and administrative expense budget for each month in the quarter ended June 30. 2018.arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning  Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning