Concept explainers

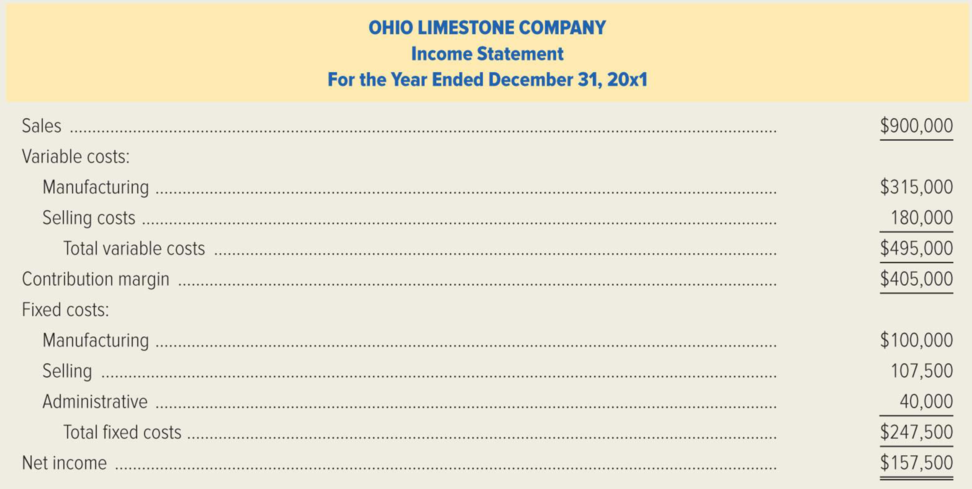

Ohio Limestone Company produces thin limestone sheets used for cosmetic facing on buildings. The following income statement represents the operating results for the year just ended. The company had sales of 1,800 tons during the year. The manufacturing capacity of the firm’s facilities is 3,000 tons per year. (Ignore income taxes.)

Required:

- 1. Calculate the company’s break-even volume in tons for 20x1.

- 2. If the sales volume is estimated to be 2,100 tons in the next year, and if the prices and costs stay at the same levels and amounts, what is the net income that management can expect for 20x2?

- 3. Ohio Limestone has been trying for years to get a foothold in the European market. The company has a potential German customer that has offered to buy 1,500 tons at $450 per ton. Assume that all of the firm’s costs would be at the same levels and rates as in 20x1. What net income would the firm earn if it took this order and rejected some business from regular customers so as not to exceed capacity?

- 4. Ohio Limestone plans to market its product in a new territory. Management estimates that an advertising and promotion program costing $61,500 annually would be needed for the next two or three years. In addition, a $25 per ton sales commission to the sales force in the new territory, over and above the current commission, would be required. How many tons would have to be sold in the new territory to maintain the firm’s current net income? Assume that sales and costs will continue as in 20x1 in the firm’s established territories.

- 5. Management is considering replacing its labor-intensive process with an automated production system. This would result in an increase of $58,500 annually in fixed

manufacturing costs . The variable manufacturing costs would decrease by $25 per ton. Compute the new break-even volume in tons and in sales dollars. - 6. Ignore the facts presented in requirement (5). Assume that management estimates that the selling price per ton would decline by 10 percent next year. Variable costs would increase by $40 per ton, and fixed costs would not change. What sales volume in dollars would be required to earn a net income of $94,500 next year?

1.

Calculate the O Limestone Company’s break-even volume in tons for 20x1.

Explanation of Solution

Break-Even Point: It is the point of sales at which entity neither earns a profit nor suffers a loss. It can also be said that the point of sales at which sales value of the entity recovers the entire cost of fixed and variable nature is called break-even point.

Calculate break-even volume in tons.

2.

Calculate the net income, if the sales volume is estimated to be 2,100 tons in the next year and costs stay at the same levels.

Explanation of Solution

Net income: The bottom line of income statement which is the result of excess of earnings from operations (revenues) over the costs incurred for earning revenues (expenses) is referred to as net income.

Calculate the projected net income.

| Particulars | Amount ($) |

| Projected contribution margin (1) | $472,500 |

| Projected fixed costs | 247,500 |

| Projected net income | $225,000 |

Table (1)

Working Notes:

(1) Calculate the projected contribution margin.

3.

Compute the net income, if the order is taken and rejected some business from regular customers so as not to exceed capacity.

Explanation of Solution

Compute the net income.

Step 1: Compute the contribution margin.

| Particulars | Amount ($) | Amount ($) |

| Sales in tons | 1,500 | 1,500 |

| Contribution margin per ton: | ||

| Foreign order (2) | ×$175 | |

| Regular sales (3) | × $225 | |

| Total contribution margin | $262,500 | $337,500 |

Table (2)

Working Notes:

(2) Calculate the foreign order.

(3) Calculate the regular sales.

(4) Calculate the variable cost per ton.

(5) Calculate the sales price per ton for regular orders.

Step 2: Compute the net income.

| Particulars | Amount ($) |

| Contribution margin on foreign order | $262,500 |

| Contribution margin on regular sales | 337,500 |

| Total contribution margin | $600,000 |

| Fixed costs | 247,500 |

| Net income | $352,500 |

Table (3)

4.

Calculate the number of tons to sell in the new territory to maintain the firm’s current net income.

Explanation of Solution

O Limestone Company needs to break even on sales in the new territory, to maintain its current net income. So, calculate the break-even point as given below:

Hence, the number of tons to sell in the new territory to maintain the firm’s current net income would be 307.5 tons.

5.

Calculate the new break-even volume in tons and sales dollars, if fixed manufacturing costs increases by $58,500 and variable manufacturing costs decreases by $25 per ton.

Explanation of Solution

Calculate the break-even point in tons.

Calculate the break-even point in sales dollars.

6.

Calculate the sales volume in dollars to earn a net income of $94,500 next year, if selling price per ton decreases by 10 percent next year and variable cost increases by $40 per ton; fixed cost would not change.

Explanation of Solution

Variable cost: A variable cost is the cost that proportionately changes with the changes in the activity base such as units of production.

Fixed Cost: It is the cost that remains constant in total dollar amount irrespective to the changes in the activity base such as units of production.

Calculate the sales volume in dollars to earn a net income of $94,500 next year.

Step 1: Calculate the new contribution margin ratio.

Working note:

(1) Calculate new contribution margin.

Step 2: Calculate the sales volume in dollars.

Hence, the sales volume in dollars to earn a net income of $94,500 next year is $1,140,000.

Want to see more full solutions like this?

Chapter 7 Solutions

MANAGERIAL ACCOUNTING-ACCESS

- Using the information in the previous exercises about Marleys Manufacturing, determine the operating income for department B, assuming department A sold department B 1,000 units during the month and department A reduces the selling price to the market price.arrow_forwardCost Classification, Income Statement Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateways work comes from contracts with city and state agencies in Nebraska. The companys sales volume averages 3 million, and profits vary between 0 and 10% of sales. Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids. Jack believes that Gateways current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe. With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of 165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own 114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters. Required: 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and overhead costs. The company never has significant work in process (most jobs are started and completed within a day). 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?arrow_forwardFaldo Company produces a single product. The projected income statement for the coming year, based on sales of 200,000 units, is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. Suppose that 30,000 units are sold above the break-even point. What is the profit? 2. Compute the contribution margin ratio and the break-even point in dollars. Suppose that revenues are 200,000 greater than expected. What would the total profit be? 3. Compute the margin of safety in sales revenue. 4. Compute the operating leverage. Compute the new profit level if sales are 20 percent higher than expected. 5. How many units must be sold to earn a profit equal to 10 percent of sales? 6. Assume the income tax rate is 40 percent. How many units must be sold to earn an after-tax profit of 180,000?arrow_forward

- Roper Furniture manufactures office furniture and tracks cost data across their process. The following are some of the costs that they incur. Classify these costs as fixed or variable costs, and as product costs or period costs. Wood used to produce desks ($125,00 per desk) Production labor used to produce desks ($15 per hour) Production supervisor salary ($45,000 per year) Depreciation on factory equipment ($60,000 per year) Selling and administrative expenses ($45,000 per year) Rent on corporate office ($44,000 per year) Nails, glue, and other materials required to produce desks (varies per desk) Utilities expenses for production facility Sales staff commission (5% of gross sales)arrow_forwardKlamath Company produces a single product. The projected income statement for the coming year is as follows: Required: 1. Compute the unit contribution margin and the units that must be sold to break even. 2. Suppose 10,000 units are sold above break-even. What is the operating income? 3. Compute the contribution margin ratio. Use the contribution margin ratio to compute the break-even point in sales revenue. (Note: Round the contribution margin ratio to four decimal places, and round the sales revenue to the nearest dollar.) Suppose that revenues are 200,000 more than expected for the coming year. What would the total operating income be?arrow_forwardEllerson Company provided the following information for the last calendar year: During the year, direct materials purchases amounted to 278,000, direct labor cost was 189,000, and overhead cost was 523,000. During the year, 100,000 units were completed. Refer to Exercise 2.21. Last calendar year, Ellerson recognized revenue of 1,312,000 and had selling and administrative expenses of 204,600. Required: 1. What is the cost of goods sold for last year? 2. Prepare an income statement for Ellerson for last year.arrow_forward

- The activity of moving materials uses four forklifts, each leased for 18,000 per year. A forklift is capable of making 5,000 moves per year, where a move is defined as a round trip from the plant to the warehouse and back. During the year, a total of 18,000 moves were made. What is the cost of the unused capacity for the moving goods activity? a. 5,400 b. 1,800 c. 7,200 d. 3,600arrow_forwardPaladin Company manufactures plain-paper fax machines in a small factory in Minnesota. Sales have increased by 50 percent in each of the past three years, as Paladin has expanded its market from the United States to Canada and Mexico. As a result, the Minnesota factory is at capacity. Beryl Adams, president of Paladin, has examined the situation and developed the following alternatives. 1. Add a permanent second shift at the plant. However, the semiskilled workers who assemble the fax machines are in short supply, and the wage rate of 15 per hour would probably have to be increased across the board to 18 per hour in order to attract sufficient workers from out of town. The total wage increase (including fringe benefits) would amount to 125,000. The heavier use of plant facilities would lead to increased plant maintenance and small tool cost. 2. Open a new plant and locate it in Mexico. Wages (including fringe benefits) would average 3.50 per hour. Investment in plant and equipment would amount to 300,000. 3. Open a new plant and locate it in a foreign trade zone, possibly in Dallas. Wages would be somewhat lower than in Minnesota, but higher than in Mexico. The advantages of postponing tariff payments on parts imported from Asia could amount to 50,000 per year. Required: Advise Beryl of the advantages and disadvantages of each of her alternatives.arrow_forwardSuppose that Kicker had the following sales and cost experience (in thousands of dollars) for May of the current year and for May of the prior year: In May of the prior year, Kicker started an intensive quality program designed to enable it to build original equipment manufacture (OEM) speaker systems for a major automobile company. The program was housed in research and development. In the beginning of the current year, Kickers accounting department exercised tighter control over sales commissions, ensuring that no dubious (e.g., double) payments were made. The increased sales in the current year required additional warehouse space that Kicker rented in town. (Round ratios to four decimal places. Round sales dollars computations to the nearest dollar.) Required: 1. Calculate the contribution margin ratio for May of both years. 2. Calculate the break-even point in sales dollars for both years. 3. Calculate the margin of safety in sales dollars for both years. 4. CONCEPTUAL CONNECTION Analyze the differences shown by your calculations in Requirements 1, 2, and 3.arrow_forward

- Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.arrow_forwardGelbart Company manufactures gas grills. Fixed costs amount to 16,335,000 per year. Variable costs per gas grill are 225, and the average price per gas grill is 600. Required: 1. How many gas grills must Gelbart Company sell to break even? 2. If Gelbart Company sells 46,775 gas grills in a year, what is the operating income? 3. If Gelbart Companys variable costs increase to 240 per grill while the price and fixed costs remain unchanged, what is the new break-even point?arrow_forwardVariety Artisans has a bottleneck in their production that occurs within the engraving department. Arjun Naipul, the COO, is considering hiring an extra worker, whose salary will be $45,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,500 more units per year. Currently, the selling price per unit is $18 and the cost per unit is $5.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub