Concept explainers

Cost Flows through Accounts

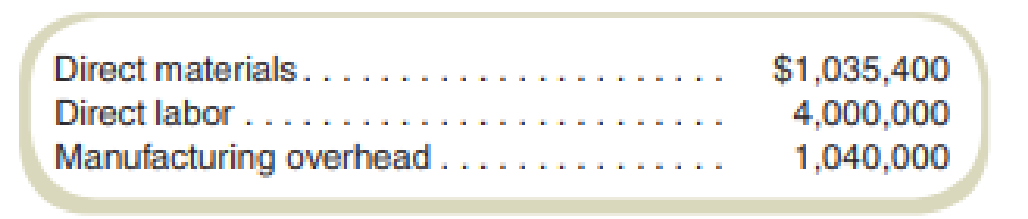

Brighton Services repairs locomotive engines. It employs 100 full-time workers at $20 per hour. Despite operating at capacity, last year’s performance was a great disappointment to the managers. In total, 10 jobs were accepted and completed, incurring the following total costs:

Of the $1,040,000 manufacturing

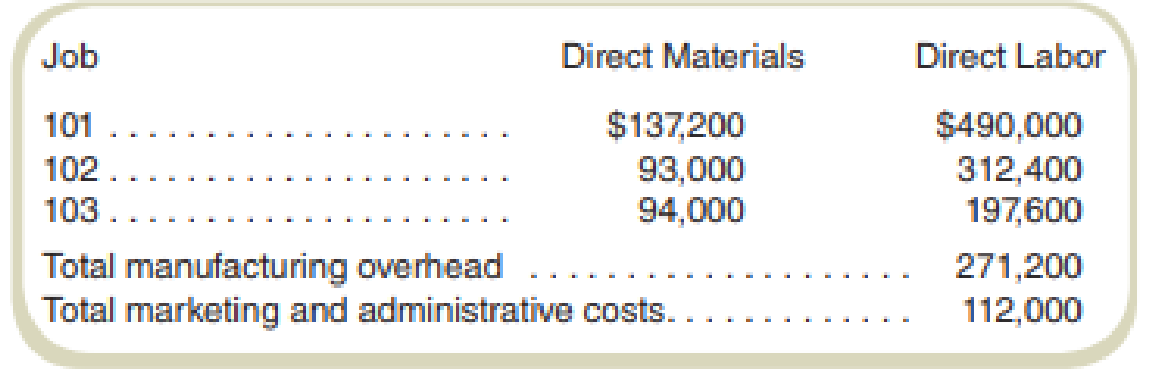

This year, Brighton Services expects to operate at the same activity level as last year, and overhead costs and the wage rate are not expected to change. For the first quarter of this year, Brighton Services completed two jobs and was beginning the third (Job 103). The costs incurred follow:

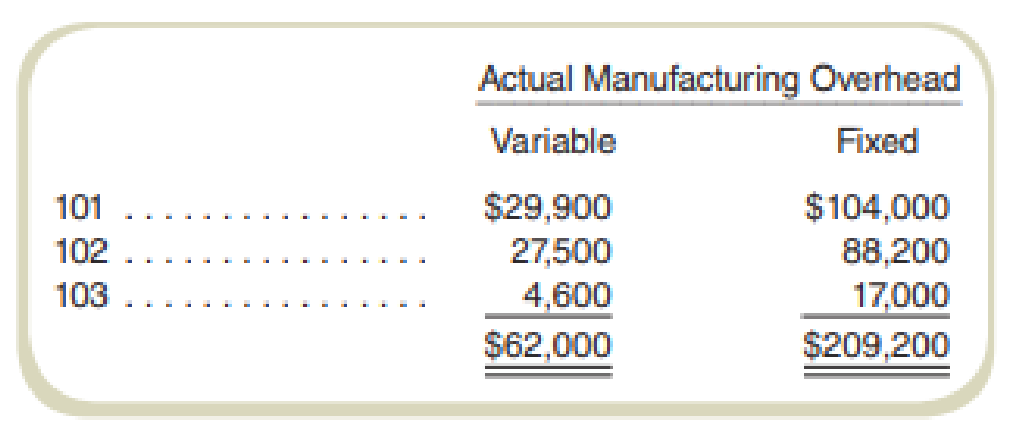

You are a consultant associated with Lodi Consultants, which Brighton Services has asked for help. Lodi’s senior partner has examined Brighton Services’s accounts and has decided to divide actual factory overhead by job into fixed and variable portions as follows:

In the first quarter of this year, 40 percent of marketing and administrative cost was variable and 60 percent was fixed. You are told that Jobs 101 and 102 were sold for $850,000 and $550,000, respectively. All over- or underapplied overhead for the quarter is written off to Cost of Goods Sold.

Required

- a. Present in T-accounts the actual

manufacturing cost flows for the three jobs in the first quarter of this year. - b. Using last year’s overhead costs and direct labor-hours as this year’s estimate, calculate predetermined overhead rates per direct labor-hour for variable and fixed overhead.

- c. Present in T-accounts the normal manufacturing cost flows for the three jobs in the first quarter of this year. Use the overhead rates derived in requirement (b).

- d. Prepare income statements for the first quarter of this year under the following costing systems:

- (1) Actual.

- (2) Normal.

a.

Compute in T-accounts: the actual manufacturing cost flows for the three jobs in the first quarter of this year.

Explanation of Solution

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

T-account of materials inventory:

| Materials inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 137,200 | |||||

| $ 93,000 | |||||

| $ 94,000 | |||||

Table: (1)

T-account of wages payable:

| Wages payable | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 490,000 | |||||

| $ 312,400 | |||||

| $ 197,600 | |||||

Table: (2)

T-account of variable manufacturing overhead:

| Variable manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 62,000 | $ 29,900 | ||||

| $ 27,500 | |||||

| $ 4,600 | |||||

Table: (3)

T-account of fixed manufacturing overhead:

| Fixed manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 209,200 | $ 104,000 | ||||

| $ 88,200 | |||||

| $ 17,000 | |||||

Table: (4)

T-account of work-in-process inventory:

| Work-in-process inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 324,200 | $ 761,100 | ||||

| $ 1,000,000 | $ 521,100 | ||||

| $ 62,000 | |||||

| $ 209,200 | |||||

Table: (5)

T-account of finished goods inventory:

| Finished goods inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 761,100 | |||||

| $ 521,100 | $ 1,282,200 | ||||

Table: (6)

T-account of the cost of goods sold:

| Cost of goods sold | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 1,282,200 | |||||

Table: (7)

b.

Calculate predetermined overhead rates per direct labor-hour for variable and fixed overhead by using last year’s overhead costs and direct labor-hours.

Explanation of Solution

Predetermined overhead rate: The predetermined overhead rate is the rate computed for applying manufacturing overheads to the work-in-process inventory. This rate can be computed by dividing the total amount of manufacturing overheads by the base of allocation. The formula for calculating the predetermined overhead rate is:

Compute the predetermined variable overhead rate:

Compute the predetermined fixed overhead rate:

Working note 1:

Compute the total direct labor-hours:

Working note 2:

Compute the variable manufacturing overhead:

Working note 3:

Compute the fixed manufacturing overhead:

c.

Present in T-accounts the normal manufacturing cost flows for the three jobs in the first quarter of this year by using the overhead rates derived as per the previous part.

Explanation of Solution

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

T-account of materials inventory:

| Materials inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 137,200 | |||||

| $ 93,000 | |||||

| $ 94,000 | |||||

Table: (8)

T-account of wages payable:

| Wages payable | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 490,000 | |||||

| $ 312,400 | |||||

| $ 197,600 | |||||

Table: (9)

T-account of variable manufacturing overhead:

| Variable manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 62,000 | $ 38,220 | ||||

| $ 16,000 | $ 24,367 | ||||

| $ 15,413 | |||||

Table: (10)

T-account of fixed manufacturing overhead:

| Fixed manufacturing overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 182,000 | $ 89,180 | ||||

| $ 56,857 | |||||

| $ 35,963 | |||||

| $ 27,200 | |||||

Table: (11)

T-account of work-in-process inventory:

| Work-in-process inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 324,200 | $ 754,600 | ||||

| $ 1,000,000 | $ 486,624 | ||||

| $ 78,000 | |||||

| $ 182,000 | |||||

Table: (12)

T-account of finished goods inventory:

| Finished goods inventory | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 754,600 | |||||

| $ 486,624 | $ 1,241,224 | ||||

Table: (13)

T-account of the cost of goods sold:

| Cost of goods sold | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 1,241,224 | |||||

Table: (14)

T-account of under-or over-applied overhead

| Under-or over-applied overhead | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| $ 27,200 | $ 16,000 | ||||

Table: (15)

d.

Prepare the income statement for the first quarter of this year using actual and normal systems.

Explanation of Solution

Normal system of costing: Under normal costing, the cost of a job is determined by using the actual direct material, and the labor cost by adding overhead applied using a predetermined rate and an actual allocation base.

Actual system of costing: The cost of a job is determined by using the actual direct material, and the labor cost by adding overhead applied using an actual overhead rate and an actual allocation base under actual costing.

Income statement using actual system:

| Particulars | Amount |

| Sales Revenue | $ 1,400,000 |

| Less: Cost of goods sold | ($ 1,282,200) |

| Gross margin | $ 117,800 |

| Less: (Under-) Over applied overhead | $ 0 |

| Marketing and administrative costs | ($ 112,000) |

| Operating profit (loss) | $ 5,800 |

Income statement using normal system:

| Particulars | Normal |

| Sales Revenue | $ 1,400,000 |

| Less: Cost of goods sold | ($ 1,241,224) |

| Gross margin | $ 158,776 |

| Less: (Under-) Over applied overhead | $ 11,200 |

| Marketing and administrative costs | ($ 112,000) |

| Operating profit (loss) | $ 35,576 |

Want to see more full solutions like this?

Chapter 7 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Bolger and Co. manufactures large gaskets for the turbine industry. Bolgers per-unit sales price and variable costs for the current year are as follows: Bolgers total fixed costs aggregate to 360,000. Bolgers labor agreement is expiring at the end of the year, and management is concerned about the effects of a new labor agreement on its break-even point in units. The controller performed a sensitivity analysis to ascertain the estimated effect of a 10-per-unit direct labor increase and a 10,000 reduction in fixed costs. Based on these data, the break-even point would: a. decrease by 1,000 units. b. decrease by 125 units. c. increase by 375 units. d. increase by 500 units.arrow_forwardPatterson Corporation expects to incur 70,000 of factory overhead and 60,000 of general and administrative costs next year. Direct labor costs at 5 per hour are expected to total 50,000. If factory overhead is to be applied per direct labor hour, how much overhead will be applied to a job incurring 20 hours of direct labor? a. 120 b. 260 c. 28 d. 140arrow_forwardPocono Cement Forms expects $900,000 in overhead during the next year. It does not know whether it should apply overhead on the basis of its anticipated direct labor hours of 60,000 or its expected machine hours of 30,000. Determine the product cost under each predetermined allocation rate if the last job incurred $1,550 in direct material cost, 90 direct labor hours, and 75 machine hours. Wages are paid at $16 per hour.arrow_forward

- Cost Classification, Income Statement Gateway Construction Company, run by Jack Gateway, employs 25 to 30 people as subcontractors for laying gas, water, and sewage pipelines. Most of Gateways work comes from contracts with city and state agencies in Nebraska. The companys sales volume averages 3 million, and profits vary between 0 and 10% of sales. Sales and profits have been somewhat below average for the past 3 years due to a recession and intense competition. Because of this competition, Jack constantly reviews the prices that other companies bid for jobs. When a bid is lost, he analyzes the reasons for the differences between his bid and that of his competitors and uses this information to increase the competitiveness of future bids. Jack believes that Gateways current accounting system is deficient. Currently, all expenses are simply deducted from revenues to arrive at operating income. No effort is made to distinguish among the costs of laying pipe, obtaining contracts, and administering the company. Yet all bids are based on the costs of laying pipe. With these thoughts in mind, Jack looked more carefully at the income statement for the previous year (see below). First, he noted that jobs were priced on the basis of equipment hours, with an average price of 165 per equipment hour. However, when it came to classifying and assigning costs, he needed some help. One thing that really puzzled him was how to classify his own 114,000 salary. About half of his time was spent in bidding and securing contracts, and the other half was spent in general administrative matters. Required: 1. Classify the costs in the income statement as (1) costs of laying pipe (production costs), (2) costs of securing contracts (selling costs), or (3) costs of general administration. For production costs, identify direct materials, direct labor, and overhead costs. The company never has significant work in process (most jobs are started and completed within a day). 2. Assume that a significant driver is equipment hours. Identify the expenses that would likely be traced to jobs using this driver. Explain why you feel these costs are traceable using equipment hours. What is the cost per equipment hour for these traceable costs?arrow_forwardNatur-Gro, Inc., manufactures composters. Based on past experience, Natur-Gro has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 264,000 + 1.42X, where X equals number of composters. Last year, Natur-Gro produced 30,000 composters. Actual overhead costs for the year were as expected. Total overhead for per unit was a. 1.42 b. 8.80 c. 11.63 d. 10.22arrow_forwardSmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = 543,000 + 1.34X, where X equals number of smokers. Last year, SmokeCity produced 20,000 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? 2. What is the total overhead cost incurred by SmokeCity last year? 3. What is the total fixed overhead cost incurred by SmokeCity last year? 4. What is the total variable overhead cost incurred by SmokeCity last year? 5. What is the overhead cost per unit produced? 6. What is the fixed overhead cost per unit? 7. What is the variable overhead cost per unit? 8. Recalculate Requirements 5, 6, and 7 for the following levels of production: (a) 19,500 units and (b) 21,600 units. (Round your answers to the nearest cent.) Explain this outcome.arrow_forward

- Handbrain Inc. is considering a change to activity-based product costing. The company produces two products, cell phones and tablet PCs, in a single production department. The production department is estimated to require 2,000 direct labor hours. The total indirect labor is budgeted to be 200,000. Time records from indirect labor employees revealed that they spent 30% of their time setting up production runs and 70% of their time supporting actual production. The following information about cell phones and tablet PCs was determined from the corporate records: a. Determine the indirect labor cost per unit allocated to cell phones and tablet PCs under a single plantwide factory overhead rate system using the direct labor hours as the allocation base. b. Determine the budgeted activity costs and activity rates for the indirect labor under activity-based costing. Assume two activitiesone for setup and the other for production support. c. Determine the activity cost per unit for indirect labor allocated to each product under activity-based costing. d. Why are the per-unit allocated costs in (a) different from the per-unit activity cost assigned to the products in (c)?arrow_forwardCarr Company provides human resource consulting services to small- and medium-sized companies. Last year, Carr provided services to 700 clients. Total fixed costs were $159.000 with total variable costs of $87x500. Based on this information, complete this chart:arrow_forwardPattison Products, Inc., began operations in October and manufactured 40,000 units during the month with the following unit costs: Fixed overhead per unit = 280,000/40,000 units produced = 7. Total fixed factory overhead is 280,000 per month. During October, 38,400 units were sold at a price of 24, and fixed marketing and administrative expenses were 130,500. Required: 1. Calculate the cost of each unit using absorption costing. 2. How many units remain in ending inventory? What is the cost of ending inventory using absorption costing? 3. Prepare an absorption-costing income statement for Pattison Products, Inc., for the month of October. 4. What if November production was 40,000 units, costs were stable, and sales were 41,000 units? What is the cost of ending inventory? What is operating income for November?arrow_forward

- Last year, Orsen Company produced 25,000 juicers and sold 26,500 juicers for 60 each. The actual variable unit cost is as follows: Fixed overhead was 320,000. Fixed selling expenses consisted of advertising copayments totaling 110,000. Fixed administrative expenses were 236,000. There were no beginning and ending work-in-process inventories. Beginning finished goods inventory was 148,000 for 4,000 juicers. The value of ending inventory reported on the financial statements was a. 55,500 b. 92,500 c. 66,500 d. 39,900arrow_forwardIdentify cost graphs The following cost graphs illustrate various types of cost behavior: For each of the following costs, identify the cost graph that best illustrates its cost behavior as the number of units produced increases: A. Total direct materials cost B. Electricity costs of 1,000 per month plus 0.10 per kilowatt-hour C. Per-unit cost of straight-line depreciation on factory equipment D. Salary of quality control supervisor, 20,000 per month E. Per-unit direct labor costarrow_forwardEvent Forms expects $120,000 in overhead during the next year. It doesn't know whether it should apply overhead on the basis of its anticipated direct labor hours of 6,000 or its expected machine hours of 5,000. What would be the product cost under each predetermined allocation rate if the last job incurred $3,500 in direct material cost, 55 direct labor hours, and 55 machine hours? Wages are paid at $17 per hour.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning