Assigning Costs: Missing Data

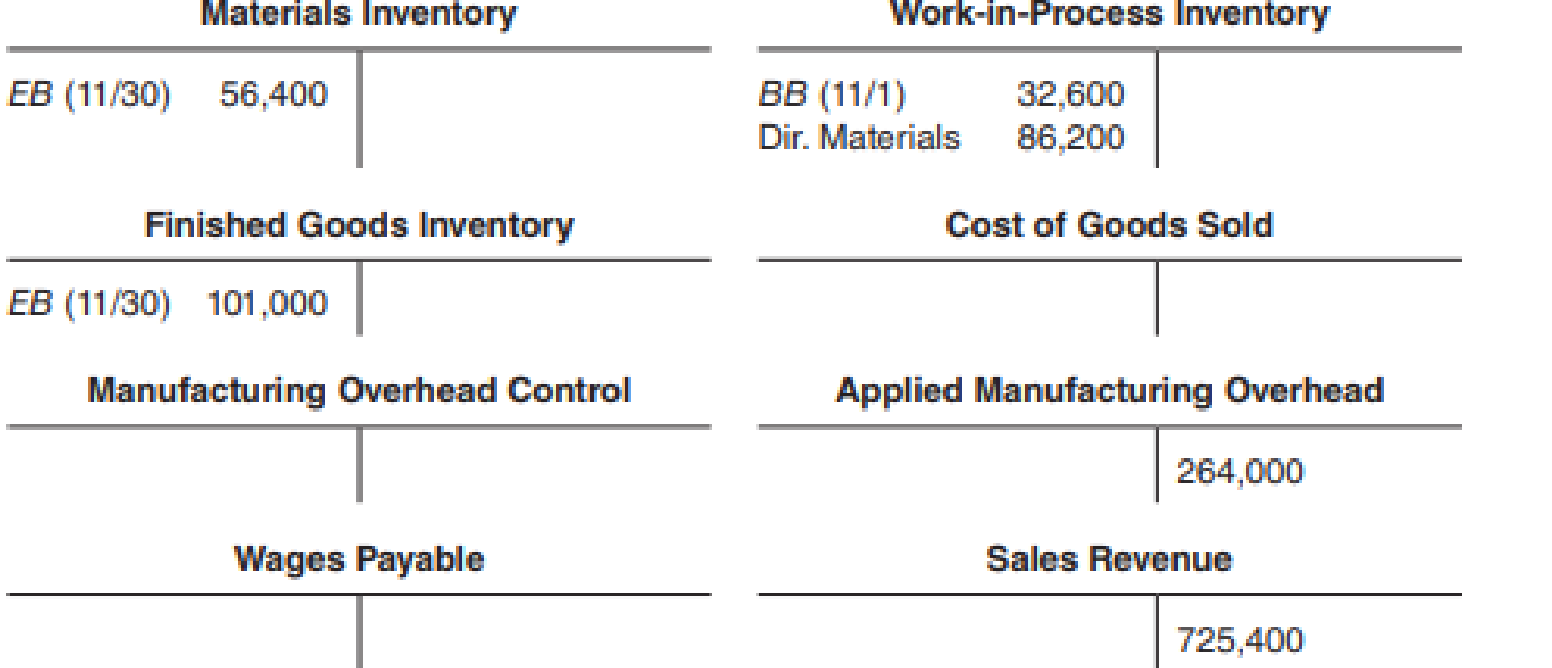

The following T-accounts represent November activity:

Additional Data

- Materials of $113,600 were purchased during the month, and the balance in the Materials Inventory account increased by $11,000.

Overhead is applied at the rate of 150 percent of direct labor cost.- Sales are billed at 180 percent of cost of goods sold before the over- or underapplied overhead is prorated.

- The balance in the Finished Goods Inventory account decreased by $28,600 during the month before any proration of under- or overapplied overhead.

- Total credits to the Wages Payable account amounted to $202,000 for direct and indirect labor.

- Factory

depreciation totaled $48,200. - Overhead was underapplied by $25,080. Overhead other than indirect labor, indirect materials, and depreciation was $198,480, which required payment in cash. Underapplied overhead is to be allocated.

- The company has decided to allocate 25 percent of underapplied overhead to Work-in-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation.

Required

Complete the T-accounts.

Complete the T-accounts given in the question.

Explanation of Solution

The T-accounts with complete information:

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

Journal entries (job costing): The journal entries are prepared in order to record the day to day transactions of the entity. The journal entries in job costing are prepared by starting from the materials inventory. The balances are then transferred to work-in-process inventory and after that to finished goods inventory.

T-account of materials inventory:

| Materials inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| BB | $ 45,500 | $ 86,200 | ||||

| Purchases | $ 113,600 | $ 16,400 (1) | ||||

| EB | $ 56,400 | |||||

Table: (1)

T-account of work-in-process inventory:

| Work-in-process inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| BB | $ 32,600 | $ 374,400 (5) | ||||

| Direct materials | $ 86,200 | |||||

| Direct labor | $ 176,000 (2) | |||||

| Overhead applied | $ 264,000 | |||||

| Balance | $ 184,400 (6) | |||||

| Proration | $ 6,270 (8) | |||||

| Balance | $ 190,670 | |||||

Table: (2)

T-account of finished goods inventory:

| Finished goods inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| Balance | $ 129,600 (4) | |||||

| Overhead applied | $ 374,400 (5) | $ 403,000 (3) | ||||

| EB | $ 101,000 | |||||

| Proration | $ 3,762 (9) | |||||

| Balance | $ 104,762 | |||||

Table: (3)

T-account of the cost of goods sold:

| Cost of goods sold | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| Finished goods inventory | $ 403,000 (3) | |||||

| Proration | $ 15,048 (10) | |||||

Table: (4)

T-account of manufacturing overhead control:

| Manufacturing overhead control | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 16,400 (1) | ||||||

| $ 26,000 (7) | ||||||

| $ 48,200 | ||||||

| $ 198,480 | $ 289,080 | |||||

Table: (5)

T-account of applied overhead control:

| Applied overhead control | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 264,000 | $ 264,000 | |||||

Table: (6)

T-account of wages payable:

| Wages payable | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 176,000 (2) | ||||||

| $ 26,000 (7) | ||||||

Table: (7)

T-account of sales revenue:

| Sales revenue | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 725,400 | ||||||

Table: (8)

Working note 1:

Amount of $86,200 has been taken from the direct materials used.

Compute the unaccounted balance:

Working note 2:

Overheads applied are 150% of direct labor cost.

Compute the direct labor costs:

Assume X to be direct labor costs.

Working note 3:

Compute the cost of goods sold:

Assume X to be the cost of goods sold.

Working note 4:

Compute the beginning balance of finished goods:

Working note 5:

Compute the cost of goods manufactured:

Working note 6:

Compute the work-in-process ending balance:

Working note 7:

Compute the indirect labor:

Working note 8:

Compute the proration of work-in-process:

Working note 9:

Compute the proration of finished goods:

Working note 10:

Compute the proration of the cost of goods sold:

Want to see more full solutions like this?

Chapter 7 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Statement of cost of goods manufactured; income statement; balance sheet The adjusted trial balance for Rochester Electronics, Inc. on November 30, the end of its first month of operation, is as follows: The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were 33,000. c. Direct labor cost was 18,500. d. Factory overhead costs were as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of November. 2. Prepare an income statement for the month of November. (Hint: Check to be sure that your figure for Cost of Goods Sold equals the amount given in the trial balance.) 3. Prepare a balance sheet as of November 30. (Hint: Do not forget Retained Earnings.)arrow_forwardBaldwin Printing Company uses a job order cost system and applies overhead based on machine hours. A total of 150,000 machine hours have been budgeted for the year. During the year, an order for 1,000 units was completed and incurred the following: The accountant computed the inventory cost of this order to be 4.30 per unit. The annual budgeted overhead in dollars was: a. 577,500. b. 600,000. c. 645,000. d. 660,000.arrow_forwardDuring the month, a company with no departmentalization incurred costs of 45,000 for materials, 36,000 for labor, and 22,500 for factory overhead. There were no units in process at the beginning or at the end of the month, and 20,000 units were completed. Determine the unit cost for the month for materials, labor, factory overhead, and the total unit cost. (Round unit costs to three decimal places.)arrow_forward

- OReilly Manufacturing Co.s cost of goods sold for the month ended July 31 was 345,000. The ending work in process inventory was 90% of the beginning work in process inventory. Factory overhead was 50% of the direct labor cost. No indirect materials were used during the period. Other information pertaining to OReillys inventories and production for July is as follows: Required: 1. Prepare a statement of cost of goods manufactured for the month of July. (Hint: Set up a statement of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Start by using cost of goods sold to solve for the cost of goods manufactured.) 2. Prepare a schedule to compute the prime cost incurred during July. 3. Prepare a schedule to compute the conversion cost charged to Work in Process during July.arrow_forwardDuring August, Skyler Company worked on three jobs. Data relating to these three jobs follow: Overhead is assigned on the basis of direct labor hours at a rate of 2.30 per direct labor hour. During August, Jobs 39 and 40 were completed and transferred to Finished Goods Inventory. Job 40 was sold by the end of the month. Job 41 was the only unfinished job at the end of the month. Required: 1. Calculate the per-unit cost of Jobs 39 and 40. (Round unit costs to nearest cent.) 2. Compute the ending balance in the work-in-process inventory account. 3. Prepare the journal entries reflecting the completion of Jobs 39 and 40 and the sale of Job 40. The selling price is 140 percent of cost.arrow_forwardApplying factory overhead Bergan Company estimates that total factory overhead costs will be 620,000 for the year. Direct labor hours are estimated to be 80,000. For Bergan Company, (A) determine the predetermined factory overhead rate using direct labor hours as the activity base, (B) determine the amount of factory overhead applied to Jobs 200 and 305 in May using the data on direct labor hours from BE 16-2, and (C) prepare the journal entry to apply factory overhead to both jobs in May according to the predetermined overhead rate.arrow_forward

- Abbey Products Company is studying the results of applying factory overhead to production. The following data have been used: estimated factory overhead, 60,000; estimated materials costs, 50,000; estimated direct labor costs, 60,000; estimated direct labor hours, 10,000; estimated machine hours, 20,000; work in process at the beginning of the month, none. The actual factory overhead incurred for November was 80,000, and the production statistics on November 30 are as follows: Required: 1. Compute the predetermined rate, based on the following: a. Direct labor cost b. Direct labor hours c. Machine hours 2. Using each of the methods, compute the estimated total cost of each job at the end of the month. 3. Determine the under-or overapplied factory overhead, in total, at the end of the month under each of the methods. 4. Which method would you recommend? Why?arrow_forwardTotal Pops data show the following information: New machinery will be added in April. This machine will reduce the labor required per unit and increase the labor rate for those employees qualified to operate the machinery. Finished goods inventory is required to be 20% of the next months requirements. Direct material requires 2 pounds per unit at a cost of $3 per pound. The ending inventory required for direct materials is 15% of the next months needs. In January, the beginning inventory is 3,000 units of finished goods and 4,470 pounds of material. Prepare a production budget, direct materials budget, and direct labor budget for the first quarter of the year.arrow_forwardEstimated income statements, using absorption and variable costing Prior to the first month of operations ending October 31, Marshall Inc. estimated the following operating results: The company is evaluating a proposal to manufacture 50,000 units instead of 40,000 units, thus creating an ending inventory of 10,000 units. Manufacturing the additional units will not change sales, unit variable factory overhead costs, total fixed factory overhead cost, or total selling and administrative expenses. a. Prepare an estimated income statement, comparing operating results if 40,000 and 50,000 units are manufactured in (1) the absorption costing format and (2) the variable costing format. b. What is the reason for the difference in operating income reported for the two levels of production by the absorption costing income statement?arrow_forward

- At the end of the first year of operations, 21,500 units remained in the finished goods inventory. The unit manufacturing costs during the year were as follows: Determine the cost of the finished goods inventory reported on the balance sheet under (a) the absorption costing concept and (b) the variable costing concept.arrow_forwardComacho Chemical Co. recorded costs for the month of 18,900 for materials, 44,100 for labor, and 26,250 for factory overhead. There was no beginning work in process, 8,000 units were finished, and 3,000 units were in process at the end of the period, two-thirds completed. Compute the months unit cost for each element of manufacturing cost and the total per unit cost. (Round unit costs to three decimal places.)arrow_forwardCost flow relationships The following information is available for the first month of operations of Bahadir Company, a manufacturer of mechanical pencils: Using the information given, determine the following missing amounts: A. Cost of goods sold B. Finished goods inventory at the end of the month C. Direct materials cost D. Direct labor cost E. Work in process inventory at the end of the montharrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,