Concept explainers

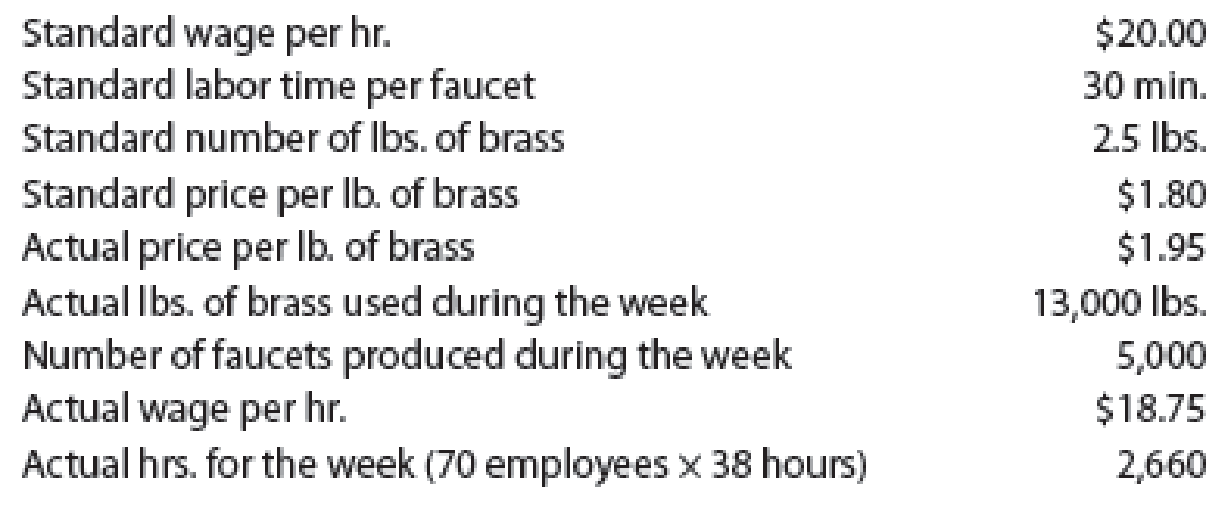

Shasta Fixture Company manufactures faucets in a small manufacturing facility. The faucets are made from brass. Manufacturing has 70 employees. Each employee presently provides 38 hours of labor per week. Information about a production week is as follows:

Instructions

Determine (a) the

Compute the following:

- a. The standard cost per unit for direct materials, and direct labor.

- b. The direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance, and

- c. The direct labor rate variance, direct labor time variance, and total direct labor cost variance.

Explanation of Solution

Direct material variances:

The difference between the actual material cost per unit and the standard material cost per unit for the direct material purchased is known as direct material cost variance. The direct material variance can be classified as follows:

- v Direct materials price variance.

- v Direct materials quantity variance.

Direct labor variances:

The difference between the actual labor cost in the production and the standard labor cost for actual production is known as direct labor cost variance. The direct labor variance can be classified as follows:

- v Labor rate variance.

- v Labor time variance.

- a. Compute the standard cost per unit for direct materials, and direct labor.

| Particulars | Standard materials and labor cost per faucet |

| Direct materials (1) | $4.50 |

| Direct labor (2) | $10.00 |

| $14.50 |

Table (1)

Therefore, the standard cost per unit for direct materials, and direct labor is $14.50.

Working note (1):

Compute the amount of direct materials:

Working note (2):

Compute the amount of direct labor:

- b. Compute the direct materials price variance, the direct materials quantity variance, and the total direct materials cost variance

- Ø Ascertain the direct materials price variance.

Hence, the direct materials price variance is $1,950, and it is an unfavorable variance, since the actual price is more than the standard price.

- Ø Ascertain the direct materials quantity.

Working note (3):

Compute the standard quantity:

Hence, the quantity variance is $900, and it is an Unfavorable variance. Since the actual quantity is more than the standard quantity.

- Ø Ascertain the total direct materials cost variance.

Hence, the total direct materials cost variance is $2,850, and it is an unfavorable variance, since both the direct materials price variance and the direct materials quantity variance are unfavorable.

- c. Compute the direct labor rate variance, direct labor time variance, and total direct labor cost variance:

- Ø Ascertain the direct labor rate variance.

Working note (4):

Compute the actual labor hours:

The direct labor rate variance is $(3,325) and it is a favorable variance, since the actual rate per hour is lesser than the standard rate per hour.

- Ø Ascertain the direct labor time variance.

Working note (5):

Compute the standard direct labor hours:

The direct labor time variance is $3,200 and it is an unfavorable variance, since the actual direct labor hour is more than the standard direct labor hour.

- Ø Ascertain the total direct labor cost time variance.

The direct labor cost variance is $(125) and it is a favorable variance, since the direct labor rate variance is lesser than the direct labor time variance.

Want to see more full solutions like this?

Chapter 9 Solutions

Managerial Accounting

- At the beginning of the year, Lopez Company had the following standard cost sheet for one of its chemical products: Lopez computes its overhead rates using practical volume, which is 80,000 units. The actual results for the year are as follows: (a) Units produced: 79,600; (b) Direct labor: 158,900 hours at 18.10; (c) FOH: 831,000; and (d) VOH: 112,400. Required: 1. Compute the variable overhead spending and efficiency variances. 2. Compute the fixed overhead spending and volume variances.arrow_forwardUSD Inc. has established the following standard cost per unit: Although 10,000 units were budgeted, 12,000 units were produced. The Purchasing department bought 50,000 lb of materials at a cost of $237,500. Actual pounds of materials used were 46,000. Direct labor cost was $287,500 for 25,000 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forwardCarlo Lee Corp. has established the following standard cost per unit: Although 10,000 units were budgeted, only 8,800 units were produced. The purchasing department bought 55,000 lb of materials at a cost of $123,750. Actual pounds of materials used were 54,305. Direct labor cost was $186,550 for 18,200 hours worked. Required: Make journal entries to record the materials transactions, assuming that the materials price variance was recorded at the time of purchase. Make journal entries to record the labor variances.arrow_forward

- Jameson Company produces paper towels. The company has established the following direct materials and direct labor standards for one case of paper towels: During the first quarter of the year, Jameson produced 45,000 cases of paper towels. The company purchased and used 135,700 pounds of paper pulp at 0.38 per pound. Actual direct labor used was 91,000 hours at 12.10 per hour. Required: 1. Calculate the direct materials price and usage variances. 2. Calculate the direct labor rate and efficiency variances. 3. Prepare the journal entries for the direct materials and direct labor variances. 4. Describe how flexible budgeting variances relate to the direct materials and direct labor variances computed in Requirements 1 and 2.arrow_forwardDirect materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forwardFargo Co. manufactures products in batches of 100 units per batch. The company uses a standard cost system and prepares budgets that call for 500 of these batches per period. Budgeted fixed overhead is $60,000 per period. The standard costs per batch follow: During the period, 503 batches were manufactured, and the following costs were incurred: Required: Calculate the variances for materials, labor, and overhead. For overhead, use the two-variance method. (Hint: Please use the information given about the budgeted fixed overhead to compute the variable overhead rate.)arrow_forward

- Cost and production data for Binghamton Beverages Inc. are presented as follows: Required: Calculate net variances for materials, labor, and factory overhead. Calculate specific materials and labor variances by department, using the diagram format in Figure 8-4. Comment on the possible causes for each of the variances that you computed. Make all journal entries to record production costs in Work in Process and Finished Goods. Determine the balance of ending Work in Process in each department. Assume that 4,000 units were sold at $40 each. Calculate the gross margin based on standard cost. Calculate the gross margin based on actual cost. Why does the gross margin at actual cost differ from the gross margin at standard cost. As the plant controller, you present the variance report in Item 1 above to Paul Crooke, the plant manager. After reading it, Paul states: “If we present this performance report to corporate with that large unfavorable labor variance in Blending, nobody in the plant will receive a bonus. Those standard hours of 5,500 are way too tight for this production process. Fifty-eight hundred hours would be more reasonable, and that would result in a favorable labor efficiency variance that would more than offset the unfavorable labor rate variance. Please redo the variance calculations using 5,800 hours as the standard.” You object, but Paul ends the conversation with, “That is an order.” What standards of ethical professional practice would be violated if you adhered to Paul’s order? How would you attempt to resolve this ethical conflict?arrow_forwardSmith Industries uses a cost system that carries direct materials inventory at a standard cost. The controller has established these standards for the cost of one basket (unit): Smith Industries made 3,000 baskets in July and used 15,500 pounds of material to make these units. Smith Industries paid $39,370 for the 15,500 pounds of material. A. What was the direct materials price variance for July? B. What was the direct materials quantity variance for July? C. What is the total direct materials cost variance? D. If Smith Industries used 15,750 pounds to make the baskets, what would be the direct materials quantity variance?arrow_forwardBotella Company produces plastic bottles. The unit for costing purposes is a case of 18 bottles. The following standards for producing one case of bottles have been established: During December, 78,000 pounds of materials were purchased and used in production. There were 15,000 cases produced, with the following actual prime costs: Required: 1. Compute the materials variances. 2. Compute the labor variances. 3. CONCEPTUAL CONNECTION What are the advantages and disadvantages that can result from the use of a standard costing system?arrow_forward

- April Industries employs a standard costing system in the manufacturing of its sole product, a park bench. They purchased 60,000 feet of raw material for $300,000, and it takes S feet of raw materials to produce one park bench. In August, the company produced 10,000 park benches. The standard cost for material output was $100,000, and there was an unfavorable direct materials quantity variance of $6,000. A. What is April Industries standard price for one unit of material? B. What was the total number of units of material used to produce the August output? C. What was the direct materials price variance for August?arrow_forwardCase made 24,500 units during June, using 32,000 direct labor hours. They expected to use 31,450 hours per the standard cost card. Their employees were paid $15.75 per hour for the month of June. The standard cost card uses $15.50 as the standard hourly rate. A. Compute the direct labor rate and time variances for the month of June, and also calculate the total direct labor variance. B. If the standard rate per hour was $16.00, what would change?arrow_forwardThe standard specifications for an electric motor manufactured by XYZ Electric Co. follow: Factory overhead rates are based on a normal 70% capacity and use the following flexible budget: The actual production was 2,500 motors, and factory overhead costs totaled $29,750. Required: Calculate the factory overhead variances using the two-variance method and the diagram format.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning