Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 9, Problem 21E

Income statement indicating

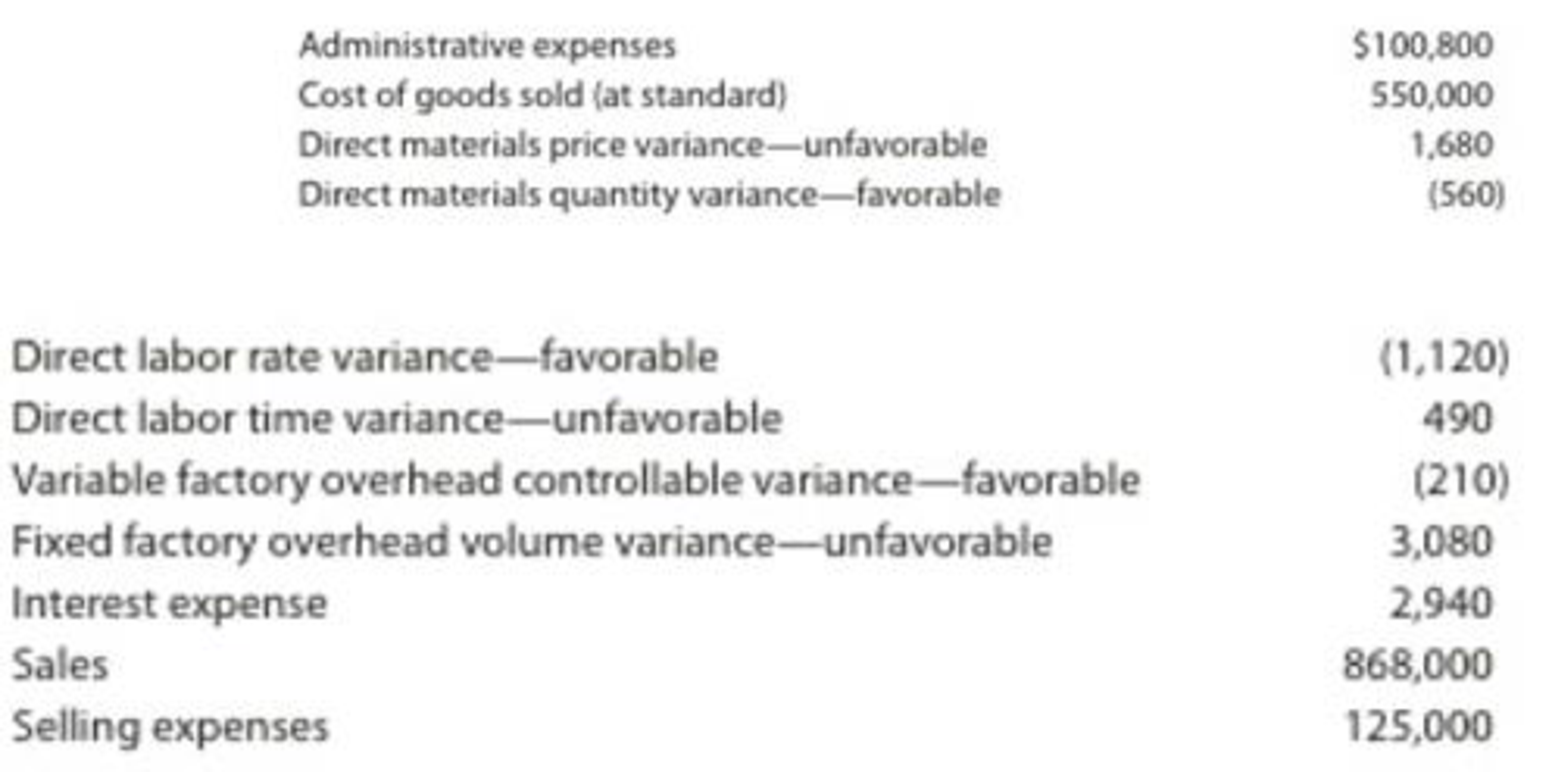

The following data were taken from the records of Griggs Company for December:

Prepare an income statement for presentation to management.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Managerial Accounting

Ch. 9 - What are the basic objectives in the use of...Ch. 9 - What is meant by reporting by the principle of...Ch. 9 - What are the two variances between the actual cost...Ch. 9 - The materials cost variance report for Nickols...Ch. 9 - A. What are the two variances between the actual...Ch. 9 - Prob. 6DQCh. 9 - Would the use of standards be appropriate in a...Ch. 9 - A. Describe the two variances between the actual...Ch. 9 - At the end of the period, the factory overhead...Ch. 9 - If variances are recorded in the accounts at the...

Ch. 9 - Direct materials variances Bellingham Company...Ch. 9 - Direct labor variances Bellingham Company produces...Ch. 9 - Factory overhead controllable variance Bellingham...Ch. 9 - Factory overhead volume variance Bellingham...Ch. 9 - Standard cost journal entries Bellingham Company...Ch. 9 - Prob. 6BECh. 9 - Crazy Delicious Inc. produces chocolate bars. The...Ch. 9 - Prob. 2ECh. 9 - Salisbury Bottle Company manufactures plastic...Ch. 9 - The following data relate to the direct materials...Ch. 9 - De Soto Inc. produces tablet computers. The...Ch. 9 - Standard direct materials cost per unit from...Ch. 9 - H.J. Heinz Company uses standards to control its...Ch. 9 - Direct labor variances The following data relate...Ch. 9 - Glacier Bicycle Company manufactures commuter...Ch. 9 - Ada Clothes Company produced 40,000 units during...Ch. 9 - Prob. 11ECh. 9 - Direct materials and direct labor variances At the...Ch. 9 - Flexible overhead budget Leno Manufacturing...Ch. 9 - Prob. 14ECh. 9 - Factory overhead cost variances The following data...Ch. 9 - Thomas Textiles Corporation began November with a...Ch. 9 - Prob. 17ECh. 9 - Factory overhead cost variance report Tannin...Ch. 9 - Prob. 19ECh. 9 - Prob. 20ECh. 9 - Income statement indicating standard cost...Ch. 9 - Prob. 22ECh. 9 - Prob. 23ECh. 9 - Rosenberry Company computed the following revenue...Ch. 9 - Lowell Manufacturing Inc. has a normal selling...Ch. 9 - Shasta Fixture Company manufactures faucets in a...Ch. 9 - Flexible budgeting and variance analysis I Love My...Ch. 9 - Direct materials, direct labor, and factory...Ch. 9 - Factory overhead cost variance report Tiger...Ch. 9 - CodeHead Software Inc. does software development....Ch. 9 - Direct materials and direct labor variance...Ch. 9 - Flexible budgeting and variance analysis Im Really...Ch. 9 - Direct materials, direct labor, and factory...Ch. 9 - Factory overhead cost variance report Feeling...Ch. 9 - Prob. 5PBCh. 9 - Prob. 1COMPCh. 9 - Advent Software uses standards to manage the cost...Ch. 9 - Prob. 2MADCh. 9 - Prob. 3MADCh. 9 - Prob. 4MADCh. 9 - Ethics in action Dash Riprock is a cost analyst...Ch. 9 - Variance interpretation Vanadium Audio Inc. is a...Ch. 9 - MinnOil performs oil changes and other minor...Ch. 9 - Marten Company has a cost-benefit policy to...Ch. 9 - Prob. 3CMACh. 9 - JoyT Company manufactures Maxi Dolls for sale in...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Using variance analysis and interpretation Last year, Endicott Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Endicotts trial balance?arrow_forwardStandard direct materials cost per unit from variance data The following data relating to direct materials cost for October of the current year are taken from the records of Good Clean Fun Inc., a manufacturer of organic toys: Determine the standard direct materials cost per unit of finished product, assuming that there was no inventory of work in process at either the beginning or the end of the month.arrow_forward(Appendix) Calculating factory overhead: three variances Using the data given in E8-17, calculate the following overhead variances: a. Spending variance. b. Production-volume variance. c. Efficiency variance. d. Was the factory overhead under- or overapplied? By what amount? In all problems involving variances, use F and U to indicate favorable and unfavorable variances, respectively.arrow_forward

- Using variance analysis and interpretation Last year, Wrigley Corp. adopted a standard cost system. Labor standards were set on the basis of time studies and prevailing wage rates. Materials standards were determined from materials specifications and the prices then in effect. On June 30, the end of the current fiscal year, a partial trial balance revealed the following: Standards set at the beginning of the year have remained unchanged. All inventories are priced at standard cost. What conclusions can be drawn from each of the four variances shown in Wrigleys trial balance?arrow_forwardDickinsen Company gathered the following data for December: a.Compute the revenue price variance. b.Compute the revenue volume variance. c.Compute the total revenue variance.arrow_forwardAnker Company had the data below for its most recent year, ended December 31: Required: Prepare a performance report that shows the variances on an item-by-item basis.arrow_forward

- (Appendix 10A) Which of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials, Work in Process, Finished Goods, and Cost of Goods Sold. d. They are reported on the balance sheet at the end of the year. e. All of these.arrow_forwardMarten Company has a cost-benefit policy to investigate any variance that is greater than 1,000 or 10% of budget, whichever is larger. Actual results for the previous month indicate the following: The company should investigate: a. neither the materials variance nor the labor variance. b. the materials variance only. c. the labor variance only. d. both the materials variance and the labor variance.arrow_forwardCalculation of materials and labor variances Fritz Corp. manufactures and sells a single product. The company uses a standard cost system. The standard cost per unit of product follows: The charges to the manufacturing department for November, when 5,000 units were produced, follow: The Purchasing department normally buys about the same quantity as is used in production during a month. In November, 5,500 lb were purchased at a price of $2.90 per pound. Required: Calculate the following from standard costs for the data given, using the formulas on pages 421–422 and 424: Materials quantity variance. Materials purchase price variance (at time of purchase). Labor efficiency variance. Labor rate variance. Give some reasons as to why both the materials quantity variance and labor efficiency variance might be unfavorable.arrow_forward

- Which of the following is true concerning labor variances that are not material in amount? a. They are closed to Cost of Goods Sold. b. They are prorated among Work in Process, Finished Goods, and Cost of Goods Sold. c. They are prorated among Materials, Work in Process, Finished Goods, and Cost of Goods Sold. d. They are reported as part of Overall Variance on the balance sheet at the end of the year.arrow_forwardMaterials and labor variances Fausto Fabricators Inc. uses a standard cost system to account for its single product. The standards established for the product include the following: The following operating data came from the records for the month: In process, beginning inventory, none. In process, ending inventory, 800 units, 80% complete as to labor; material is issued at the beginning of processing. Completed during the month, 5,600 units. Materials issued to production were 51,680 lb @ .55 per pound. Direct labor was 384,000 for 40,000 hours worked. Required: Calculate the following variances, using the diagram format in Figure 8-4. 1. Materials price. 2. Materials quantity. 3. Net materials variance. 4. Labor rate. 5. Labor efficiency. 6. Net labor variance. (Hint: Before determining the standard quantity for materials and labor, you must first compute the equivalent units of production for materials and labor.)arrow_forwardDirect materials and direct labor variance analysis Lenni Clothing Co. manufactures clothing in a small manufacturing facility. Manufacturing has 25 employees. Each employee presently provides 40 hours of productive labor per week. Information about a production week is as follows: Instructions Determine (A) the standard cost per unit for direct materials and direct labor; (B) the price variance, quantity variance, and total direct materials cost variance; and (C) the rate variance, time variance, and total direct labor cost variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

What is Risk Management? | Risk Management process; Author: Educationleaves;https://www.youtube.com/watch?v=IP-E75FGFkU;License: Standard youtube license