Concept explainers

Smith, Inc.

Rachel Robertson wishes to use mean-per-unit sampling to evaluate the reasonableness of the book value of the accounts receivable of Smith, Inc. Smith has 10,000 receivable accounts with a total book value of $1,500,000. Robertson estimates the population’s standard deviation to be equal to $25. After examining the overall audit plan, the auditors believe that the account’s tolerable misstatement is $60,000, and that a risk of incorrect rejection of 5 percent and a risk of incorrect acceptance of 10 percent are appropriate.

Required:

- a. Calculate the required

sample size . - b. Assuming the following results:

Book value of items in sample = $149

Average audited value of items in sample = $146

Standard deviation of sample = $28

use the mean-per-unit method to:

- (1) Calculate the point estimate of the account’s audited value.

- (2) Calculate the projected misstatement for the population.

- (3) Calculate the adjusted allowance for sampling risk.

- (4) State the auditors’ conclusion in this situation (accept or reject).

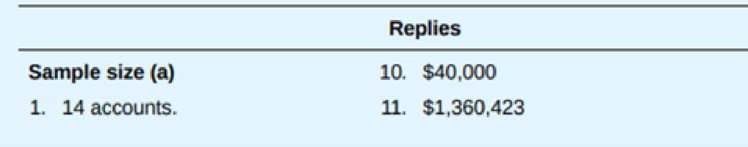

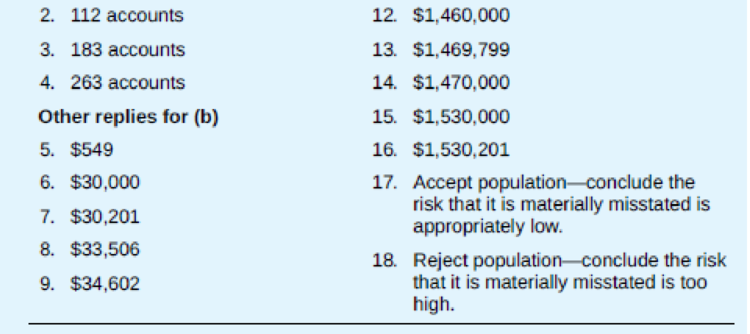

Use the following replies for the above questions—replies may be used once, more than once, or not at all. In all cases, select the reply closest to your answer.

Want to see the full answer?

Check out a sample textbook solution

Chapter 9 Solutions

Connect Access Card for Principles of Auditing & Other Assurance Services

- The auditors of Landi Corporation wish to use a structured approach to nonstatistical sampling to evaluate the reasonableness of the accounts receivable. Landi has 15,000 receivable accounts with a total book value of $2,500,000. The auditors have assessed the combined level of inherent and control risk at a moderate level and believe that their other substantive procedures are so limited as to require a “maximum” risk assessment. After considering the overall audit plan, the auditors believe that the test’s tolerable misstatement is $57,500. Use figure below to determine the reliability factor. Please calculate the sample size. Risk That Other Substantive Procedures Will Fail to Detect a Material Misstatement Combined Assessment of Inherent and Control Risk Maximum Moderate Low Maximum 3.0 2.3 1.9 Slightly below Maximum 2.7 2.0 1.6 Moderate 2.3 1.6 1.2 Low 1.9 1.2 1.0arrow_forwardA scrap metal dealer claims that tye mean of its cash sales in no more than $80, although an Internal revenue service agent believes that the dealer is being dishonest. Observing a sample of 20 cash customers the agent finds the mean cash sales to be $91 with a standard deviation of $21. Assuming the popUlation is distributed Approximately normally, and using the 0.05 level of significance , will the agents suspicion be confirmed?arrow_forwardAn audit firm is conducting the audit of Diaz Construction Company for the fiscal year ended October 31. Rebecca Smith, the partner in charge of the audit, decides that MUS is the appropriate sampling technique to use in order to audit Diaz’s inventory account. The balance in the inventory at October 31 was $4,250,000. Rebecca has established the following: risk of incorrect acceptance = 5% (i.e., the desired confidence level of 95%), tolerable misstatement = $212,500, and expected misstatement = $63,750. Calculate the sample size and sampling interval using Table 8-5 in the textbook (round your interval answer to the nearest whole number).arrow_forward

- In an MUS sample with a sampling interval of $5,000, an auditor discovered that aselected accounts receivable with a recorded amount of $10,000 had an audit valueof $8,000. If this is the only error discovered by the auditor, the projected error ofthe sample would be(1) $1,000. (3) $4,000.(2) $2,000. (4) $5,000.arrow_forwardCarson Allister is performing a PPS application in the audit of Bird Company’s accounts receivable. Based on the acceptable level of the risk of incorrect acceptance of 5 percent and a tolerable misstatement of $120,000, Allister has calculated a sample size of 75 items and a sampling interval of $25,000. After examining the sample items, the following misstatements were identified: (Use Exhibit F.A.2.) Item Recorded Balance Audited Value 1 $35,000 $28,000 2 10,000 8,000 3 6,000 3,000 Required: Calculate the upper limit on misstatements for Bird Company’s accounts receivable.arrow_forward. The true proportion of accounts receivable with some kind of error is 8 percent for Moby Group. If an auditor randomly samples 100 accounts receivable, a) is it acceptable to use the normal approximation to estimate the probability that fewer than two will contain errors? Explain your reasoning. b) what is the mean and standard deviation of errors? c) assume the auditor takes a sample of 150, what is the probability that less than 5 will contain errors?arrow_forward

- A CPA company is conducting the audit of Finch Hardware Company for the year ended December 31. The senior-in-charge of the audit plans to use MUS to audit Finch’s inventory account. The balance at December 31 was $9,000,000, tolerable misstatement is $360,000, expected misstatement is $90,000, and the risk of incorrect acceptance is 5%. Compute the required MUS sample size and sampling interval using Table 8-5 in the textbook (round your interval answer to the nearest whole number).arrow_forwardBaily Cox, an audit manager, judged that the test of controls of the company’s 50,000 purchase transactions should be based on a tolerable rate of deviation of 6 percent, a risk of overreliance of 5 percent, and an expected population deviation rate of 3 percent. Using AICPAsample size tables, Cox determined that the appropriate sample size in this situation would bea. 49.b. 78.c. 132.d. 195arrow_forwardThe auditor conducted test of details of transaction and audit client's revenue using sampling. There are 100 sales transactions made by the company. Overall of the 100 transactions, according to auditor’s professional judgment, materiality is set at 5% or 5 transactions. The auditor took a sample of 20 transactions, and it turns out that of the 20 transactions examined, there were 2 misstatement found. Based on the results of the sampling inspection, the auditor concluded that there was 2 out of 20 means 10%, and judge this finding as material misstatement. When in fact, overall of the 100 transactions there were only that 2 transactions occurred irregularities or errors that accidentally that two were chosen on 20 random sampling. What we called the risk involved in this case example? Explain your answer specifically!arrow_forward

- Evaluating a Sampling Application. Tom Barton, an assistant accountant with a local CPAfirm, recently graduated from Other University. He studied statistical sampling for auditing in college and wants to impress his employers with his knowledge of modern auditingmethods.Barton decided to select a random sample of payroll checks for the test of controls usinga tolerable rate of deviation of 5 percent and an acceptable risk of overreliance of 5 percent. The senior accountant told Barton that 2 percent of the checks audited last year hadone or more errors in the calculation of net pay. He decided to audit 100 random checks.Because supervisory personnel had paychecks with higher amounts than production workers, he selected 60 of the supervisor checks and 40 checks of the others. He was very carefulto see that the selections of 60 from the April payroll register and 40 from the August payrollregister were random.The audit of this sample yielded two deviations, exactly the 2 percent rate…arrow_forwardHattab auditing Co. was conducting the audit of Metro market for the fiscal year ended December 31. The auditor decides that MUS is the appropriate sampling technique to use in order to audit Metros’ inventory account. The balance in the inventory at December 31 was $3,000,000. The auditor has established the following: the desired confidence level of 90%, tolerable misstatement $270,500, and expected misstatement $65,500. Requirement: 1- Calculate the sample size and sampling interval. 2- The staff accountant performed the audit procedures listed in the invent+ory audit program for each sample item. Using the sample size computed in requirement (1), calculate the upper limit on misstatement based on the following misstatements. Error Number Book Value Audit Value 1 6,000 $ 1,000 $ 2 24,000 $ 39,000 $ 3 55,000 $ 57,000 $arrow_forwardA component of an account balance has a recorded balance of $10,000 and an audited valueof $8,000. By using monetary unit sampling, if the sampling interval is $20,000, the projected misstatement would bea. $2,000.b. $4,000.c. $5,000.d. $10,000.arrow_forward

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning